標普500指數創下2023年以來最佳單週表現,投資者撤離美國資產導致黃金創下歷史新高

Joe Lu,CFA 2025年4月11日 美東時間

市場概況

美國股市週五反彈,在全球貿易和投資流動的基本擔憂加深的情況下,歷史性波動的一週仍以積極的態勢收盤。標普500指數上漲+1.81%至5,363.36點,而道瓊斯工業平均指數上漲+1.56%至40,212.71點,上漲619.05點。科技股為主的納斯達克綜合指數表現更佳,上漲+2.06%至16,724.46點。這些漲幅為市場歷史上最動盪的一週之一畫上句點,儘管貿易緊張局勢持續,標普500指數仍創下自2023年11月以來最佳單週表現。

波士頓聯邦儲備銀行行長蘇珊·柯林斯的評論支持了當日的漲幅,她表示如有需要,央行「絕對會準備好」幫助穩定市場,儘管她指出市場目前仍「運作良好」。這一保證為投資者提供了許多人視為潛在的「聯準會保護」,幫助緩解了一些市場焦慮。摩根大通CEO傑米·戴蒙強化了這一預期,表示他預計市場變動可能促使聯準會介入。

儘管本週出現戲劇性的波動,三大平均指數均出現顯著的漲幅。標普500指數在一週內上漲+5.7%,道瓊斯指數上漲近+5%,而納斯達克指數飆升+7.3%,創下自2022年以來最佳表現。標普500指數的單週內超過10%的交易範圍堪比疫情最嚴重時期的價格波動。市場策略師將市場走勢描述為「雲霄飛車」,他們指出,儘管近期技術面有所進展,但不確定性和風險仍然居高不下。

摘要:

- 美國市場週五反彈,儘管貿易局勢持續緊張,標普500指數仍上漲+1.81%,創下2023年以來最佳單週表現

- 最新調查顯示,儘管川普暫緩關稅,81%的投資者計劃維持或減少其美國資產曝險

- 黃金飆升至3,200美元以上的歷史新高,創下自2020年以來最佳單週表現,反映投資者對美國資產信心動搖

- 美元指數跌破100關鍵水平,而國債收益率繼續攀升,顯示外國投資者可能正在撤離

- 美國聯準會官員表示,如果市場狀況惡化,準備進行干預,但目前認為市場「運行良好」

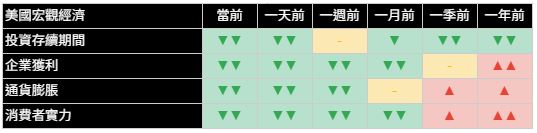

經濟指標

經濟基本面在多項指標上繼續惡化,聯準會官員現在公開下調經濟預測,以應對貿易緊張局勢。紐約聯邦儲備銀行行長約翰·威廉姆斯大幅削減了對美國經濟的展望,預測今年的GDP增長將放緩至「略低於1%」,而通膨率將上升至3.5%至4%之間。他還預測,由於移民減少和貿易不確定性,失業率將上升至5%。這些估計數字與聯準會3月份預測的1.7%成長率和2.8%通膨率相比,大幅調降。

今日發布的消費者信心數據支持了這一悲觀觀點,密歇根大學調查顯示消費者信心跌至2022年6月以來的最低水平。更為令人擔憂的是通膨預期的飆升,一年期通膨預期值從3月的4.9%大幅躍升至6.7%——這是自1981年以來的最高水平。五年期通膨預期值上升至4.4%,為1991年以來最高,表明關稅擔憂正在成為長期預期中的重要因素。這一消費者情緒的急劇下滑表明,即使在周三關稅政策調整前,消費者已經感到不安。

明尼阿波利斯聯邦儲備銀行(Minneapolis Fed)行長尼爾·卡什卡里Neel Kashkari 強調了這一轉變,指出「世界各地的投資者過去視美國為最佳投資地點」,但最近的市場走勢表明「美國不再是世界上最具吸引力的投資地點」。

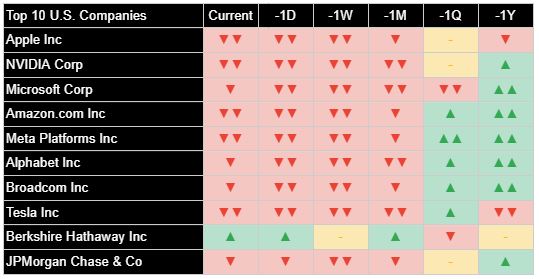

美國十大公司

週五,美國最大的幾間公司多數表現積極,10家最大公司中有8家股價上漲。科技巨頭蘋果公司領漲,大幅上漲+4.06%至198.15美元,儘管市場擔憂其受到中國關稅的影響,本週漲幅仍達+5.4%。另一方面,據報導,隨著中國對美國進口產品提高關稅,特斯拉已從其中國網站上移除了美國製造的Model S和Model X車型的「訂購」按鈕,凸顯了貿易戰升級對業務的直接影響。

摩根大通(JPMorgan Chase)銀行表現同樣出色,上漲+4.00%,季度營收達460.1億美元,超過分析師預期的441.1億美元。雖然該銀行巨頭的股票交易員在第一季度創下創紀錄的收入,但其CEO對美國經濟前景持謹慎態度,警告仍存在相當大的動盪。其他主要銀行表現好壞參半,富國銀行(Wells Fargo)淨利息收入未達預期,因為疲軟的貸款需求影響了該銀行的最大收入來源,而摩根士丹利(Morgan Stanley’s)的股票交易員第一季度收入超過了分析師的預測。

十大公司中表現最強的是博通,飆升+5.59%,本週累計漲幅達+24.37%。輝達在「七大科技巨頭」股票中表現最佳,儘管週五的漲幅較為溫和,僅上漲+2.5%,但本週股價仍上漲+17%。少數下跌的公司包括Meta Platforms下跌-0.50%,以及特斯拉下跌-0.06%,因為特斯拉將美國製造的汽車撤出中國市場,並在美國推出更便宜的Cybertruck車款,以適應新的貿易局勢。

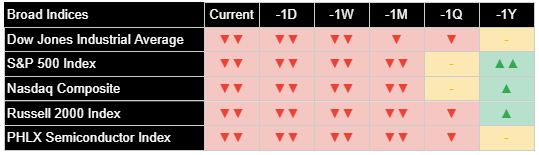

廣泛市場指數

更廣泛的市場各主要指數表現一致,所有基準指數當日均上漲。納斯達克綜合指數領漲+2.06%,其次是標普500指數上漲+1.81%,道瓊斯工業平均指數上漲+1.56%。這些漲幅促成了顯著的單週漲幅,標普500指數的單週漲幅+5.7%,為2023年11月以來表現最佳。納斯達克指數本週上漲+7.3%,創下2022年11月以來最強勁的單週表現,而道瓊斯指數在五天內上漲近+5%。

小型股表現特別強勁,羅素2000指數週五上漲+2.41%,本週漲幅接近+11%。這一表現尤為引人注目,因為小型公司通常國際多元化程度較低,可能面臨貿易中斷的更大挑戰。然而,小型股可能受益於市場認為它們相比一些大型跨國公司,對中國直接貿易的曝險較小。

雖然市場反彈令人印象深刻,但許多策略師仍保持謹慎。因為能見度有限,情緒似乎是市場主要驅動因素。關稅暫緩提高了對談判解決途徑的希望,表明政府正關注市場,但投資者現在正在觀望其中一些貿易協議的具體內容。一些市場觀察家認為市場可能已經觸底,但在大幅反彈後,風險回報比可能不是特別吸引人,尤其是在中美貿易戰愈演愈烈的情況下。

類股概況

週五市場反彈中出現明顯的類股轉動,原材料類股領漲+2.97%,其次是資訊科技上漲+2.03%和能源上漲+2.48%。這一轉動模式反映了能源領域的潛在機會,因為川普總統正推動貿易夥伴購買更多美國能源,以減少貿易順差並可能避免更高關稅。財政部長貝森特 (Scott Bessent) 特別強調了日本、韓國和台灣可能投資阿拉斯加旗艦液化天然氣項目的可能性,作為縮小貿易逆差並避免更高關稅的方式。

表現最弱的類股是房地產,僅上漲+1.00%,其次是通訊服務上漲+0.85%和非必需消費品上漲+0.97%。鑑於市場擔心關稅導致進口價格上升可能對消費者產生潛在影響,非必需消費品的表現相對溫和。整體而言,本週科技、工業和金融類股領漲,因為投資者消化了「雲霄飛車式」的關稅政策公告。

分析長期趨勢,大多數類股在多個時間範圍內都表現出持續疲軟。能源和原材料類股表現出最令人擔憂的模式,在季度和年度期間持續負面趨勢。這些類股面臨全球貿易中斷和經濟增長預期降低的特殊挑戰。公用事業類股表現出最強勁的長期表現模式,與投資者在更廣泛的經濟不確定性中尋求防禦性定位相一致。這種類股轉動模式表明,儘管今日股市普遍上漲,投資者仍保持高度謹慎。

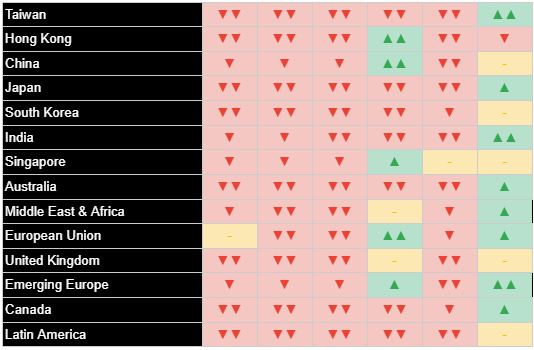

國際市場

全球市場表現好壞參半,新興亞洲市場以+3.93%的漲幅成為表現最佳的市場。儘管與美國的貿易緊張局勢升級,中國仍上漲+3.54%,可能反映了市場猜測,極端關稅水平最終將迫使談判而非持續升級。然而,川普-習近平會面的前景似乎越來越渺茫,據與李強總理會面的專家表示,中國表示「絕不會被強迫到談判桌前」。

歐洲市場表現同樣良好,在歐盟宣布其貿易代表將於週日前往華盛頓後,該地區上漲+2.68%。這一行動緊隨川普要求歐盟購買3500億美元的美國能源以消除其與美國的貿易順差,否則將面臨20%的關稅稅率,突顯了政府將能源出口與貿易談判聯繫起來的策略。

已開發市場和新興市場之間的差異依然明顯,新興市場在多個時間框架內普遍表現出較弱的趨勢模式。MLIV Pulse調查強化了這一趨勢,顯示投資者正尋求避開美國資產,轉而青睞歐洲和其他發達市場,超過四分之一的受訪者表示,他們正在減少對美國資產的投資,其程度超過總統公布全球關稅之前的預期。

其他資產

跨資產表現顯示全球投資模式發生了巨大變化,黃金成為美國資產信心減弱的主要受益者。黃金飆升+1.91%至3,200美元以上的歷史新高,創下自2020年以來最佳單週表現。貴金屬的上漲顯示對美國資產的偏好發生了變化,美國的信心明顯動搖,投資者正尋求多元化。黃金年初至今已上漲約24%。

相比之下,國債價格繼續下跌,10年期國債價格下跌-0.56%,收益率飆升至4.497%。這比週一3.87%的低點大幅上升66個基點,創下自2021年11月以來收益率最大的單週漲幅之一。30年期國債收益率創下自1982年以來最大的單週漲幅。市場分析師表示,在國債穩定並開始正常運行之前,風險資產將繼續面臨困境。債券市場的崩潰使國債作為世界避險資產的地位受到質疑,因為國債本週與股市一起下滑,促使投資者轉向其他資產。

美元指數大幅走弱,下跌-0.90%,自2022年4月以來首次跌破100關鍵水平。金融策略師表示,美國對世界其他地區的增長優勢已經消失,投資者越來越多地轉向歐洲和亞洲資產。一些市場觀察家將市場動盪描述為將美國特殊主義轉變為「美國否定論」,建議投資者在美國和中國緩和貿易戰且聯準會介入前,出售任何上漲股票。

在大宗商品空間,比特幣表現強勁,上漲+5.53%,原油價格上漲+1.75%,交易價格約為61美元/桶。跨資產類別的劇烈變化凸顯出市場仍然情緒激動,在未解決的貿易緊張局勢、收益不確定性和宏觀經濟逆風中仍在尋找立足點。雖然本週的漲幅令人鼓舞,但不應被視為明確的轉折點。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為美籍台灣人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Close Historic Week with Solid Gains Despite Trade War Escalation

S&P 500 Notches Best Week Since 2023 as Investor Exodus from U.S. Assets Sends Gold to Record Highs

Joe Lu, CFA April 11, 2025

MARKET OVERVIEW

U.S. equity markets rallied on Friday, closing a historically volatile week on a positive note even as underlying concerns about global trade and investment flows deepened. The S&P 500 Index advanced +1.81% to 5,363.36, while the Dow Jones Industrial Average rose +1.56% to 40,212.71, adding 619.05 points. The tech-heavy Nasdaq Composite outperformed with a gain of +2.06% to close at 16,724.46. These gains capped what has been one of the most tumultuous weeks in market history, with the S&P 500 posting its best weekly performance since November 2023 despite the ongoing trade tensions.

The day's gains were supported by comments from Boston Federal Reserve President Susan Collins indicating the central bank "would absolutely be prepared" to help stabilize markets if needed, though she noted markets are still "functioning well" for now. This reassurance provided what many investors saw as a potential "Fed put" that helped ease some market anxiety. JPMorgan CEO Jamie Dimon reinforced this expectation, saying he anticipates market movements that could prompt Fed intervention.

Despite the week's dramatic swings, the three major averages all notched substantial weekly gains. The S&P 500 jumped +5.7% for the week, the Dow gained nearly +5%, and the Nasdaq surged +7.3% for its best week since 2022. The S&P 500's more than 10% intra-week trading range rivals the sharp price swings seen during the depths of the pandemic. Market strategists have described the market action as a "roller coaster," noting that while there has been some recent technical progress, uncertainty and risks remain high.

Executive Summary:

- U.S. markets rebounded Friday, with S&P 500 gaining +1.81% to cap its best week since 2023 despite ongoing trade tensions

- Recent survey shows 81% of investors plan to keep or decrease U.S. asset exposure despite Trump's tariff pause

- Gold surged to all-time high above $3,200, posting best week since 2020 amid shaken investor confidence in U.S. assets

- Dollar index plunged below key 100 level while Treasury yields continued rising, signaling potential foreign investor exodus

- Fed officials ready to intervene if market conditions become disorderly, though currently see markets "functioning well"

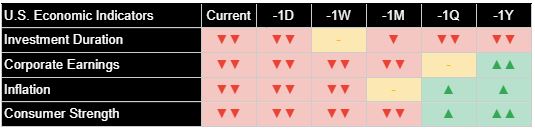

ECONOMIC INDICATORS

The economic backdrop continues to deteriorate across multiple measures, with Federal Reserve officials now openly lowering their economic forecasts in response to trade tensions. New York Fed President John Williams dramatically cut his outlook for the U.S. economy, predicting GDP growth will slow to "somewhat below 1%" this year while inflation rises to between 3.5% and 4%. He also projected unemployment will rise to 5% due to reduced immigration and trade uncertainties. These estimates represent significant downgrades from the Fed's March projections of 1.7% growth and 2.8% inflation.

Consumer sentiment data released today supported this pessimistic view, with the University of Michigan survey showing sentiment tumbled to its lowest level since June 2022. More alarming was the surge in inflation expectations, with one-year expectations jumping to 6.7% from 4.9% in March—the highest level since 1981. Five-year inflation expectations rose to 4.4%, the highest since 1991, suggesting tariff concerns are becoming embedded in longer-term expectations. This dramatic plunge in consumer sentiment indicates consumers were already feeling queasy even before Wednesday's tariff policy shift.

Minneapolis Fed President Neel Kashkari highlighted this shift, noting that "investors around the world have viewed America as the best place to invest," but recent market movements suggest "America no longer is the most attractive place in the world to invest."

TOP 10 U.S. COMPANIES

The largest U.S. companies showed mostly positive performance on Friday, with 8 of the 10 largest companies posting gains. Technology giant Apple led the group with a significant advance of +4.06% to $198.15, putting the stock on pace for a weekly gain of +5.4% despite concerns about its exposure to the China tariffs. The company reportedly removed the "order" button from its China website for U.S.-built Model S and Model X vehicles as China raised tariffs on American imports, highlighting the immediate business impacts of the escalating trade war.

JPMorgan Chase also performed well, gaining +4.00% after reporting quarterly revenues of $46.01 billion, exceeding analyst expectations of $44.11 billion. While the banking giant's stock traders took in a record haul in the first quarter, its CEO struck a cautious tone about prospects for the U.S. economy, warning about considerable turbulence. Other major banks showed mixed results, with Wells Fargo missing estimates for net interest income as soft loan demand hurt the bank's largest revenue stream, while Morgan Stanley's stock-traders delivered first-quarter revenue that exceeded analyst predictions.

The day's strongest performer among the top 10 was Broadcom, which surged +5.59%, capping an extraordinary weekly gain of +24.37%. NVIDIA was the top performer among the "Magnificent Seven" stocks for the week, gaining +17% despite Friday's more modest +2.5% advance. Among the few decliners were Meta Platforms, which fell -0.50%, and Tesla, which edged lower by -0.06% as it pulled U.S.-made cars from the Chinese market and added a cheaper Cybertruck trim in the U.S. to adjust to the new trade realities.

BROAD MARKET INDICES

The broader market showed consistent performance across major indices, with all primary benchmarks posting gains for the day. The Nasdaq Composite led with a +2.06% advance, followed by the S&P 500 at +1.81% and the Dow Jones Industrial Average at +1.56%. These gains contributed to significant weekly advances, with the S&P 500 posting a +5.7% weekly gain, its best since November 2023. The Nasdaq rose +7.3% for the week, marking its strongest weekly performance since November 2022, while the Dow added nearly +5% over the five-day period.

Small-cap stocks showed particularly strong performance, with the Russell 2000 advancing +2.41% on Friday and posting a weekly gain of nearly +11%. This outperformance is notable given that smaller companies typically have less international diversification and might be expected to face greater challenges from trade disruptions. However, small-caps may be benefiting from perceptions that they have less exposure to direct China trade than some large multinational corporations.

While the market's rebound has been impressive, many strategists remain cautious. Sentiment appears to be the main market driver as there is little visibility. The tariff pause raised hopes for a path to negotiated resolutions and that the administration is paying attention to the markets, but investors are now waiting to see what some of these trade deals will look like. Some market observers believe there's a decent chance the bottom is in, but following the sharp rally off the lows, the risk-reward trade-off may not look particularly compelling, especially with the intensifying trade war with China.

SECTOR OVERVIEW

Friday's market rebound saw strong sector rotation, with Materials leading gains at +2.97%, followed by Information Technology at +2.03% and Energy at +2.48%. This rotation pattern reflected potential opportunities in the energy sector as President Trump pushed trade partners to buy more U.S. energy to reduce their trade surpluses and potentially avoid higher tariffs. Treasury Secretary Scott Bessent specifically highlighted the possibility of Japan, South Korea, and Taiwan investing in a flagship LNG project in Alaska as a way to narrow trade deficits and avoid higher tariff rates.

The weakest sector was Real Estate, which gained just +1.00%, followed by Communication Services at +0.85% and Consumer Discretionary at +0.97%. The relatively modest performance of Consumer Discretionary is particularly notable given concerns about potential consumer impacts from higher import prices due to tariffs. For the week as a whole, Technology, Industrials, and Financials led gains as investors processed the rollercoaster of tariff announcements.

Examining longer-term trends, most sectors show persistent weakness across multiple timeframes. Energy and Materials sectors demonstrate the most concerning patterns, with persistent negative trends over quarterly and annual periods. These sectors face particular challenges from global trade disruptions and reduced economic growth expectations. The Utilities sector shows the strongest long-term performance pattern, consistent with investors seeking defensive positioning amid the broader economic uncertainty. This sector rotation pattern suggests investors remain highly cautious despite today's broad gains.

INTERNATIONAL MARKETS

Global markets showed mixed performance, with emerging Asian markets standing out as the top performer with a gain of +3.93%. China advanced +3.54% despite the escalating trade tensions with the U.S., possibly reflecting speculation that extreme tariff levels will ultimately force negotiation rather than continued escalation. However, prospects for a Trump-Xi meeting appear increasingly remote, with China indicating it will not be coerced into coming to the negotiation table, according to experts meeting with Premier Li Qiang this week.

European markets also performed well, with the region gaining +2.68% after the European Union announced its trade representative would travel to Washington on Sunday. This follows Trump's demand that the EU buy $350 billion of American energy to erase its trade surplus with the U.S. or face a 20% tariff rate, highlighting the administration's strategy of linking energy exports to trade negotiations.

The divergence between developed and emerging markets remains pronounced, with emerging markets generally showing weaker trend patterns across multiple timeframes. The MLIV Pulse survey reinforces this trend, showing investors are looking to shun U.S. assets in favor of Europe and other developed markets, with more than a quarter of respondents saying they're curbing their investment in U.S. assets more than they had anticipated before the president unveiled global tariffs earlier this month.

OTHER ASSETS

Cross-asset performance revealed a dramatic shift in global investment patterns, with gold emerging as the primary beneficiary of waning confidence in U.S. assets. Gold surged +1.91% to a record high above $3,200 per ounce, capping its best week since 2020. The precious metal's rise signals a shift in appetite for U.S. assets, with confidence in the U.S. clearly shaken and investors looking to diversify. Gold has now gained approximately 24% year-to-date.

In stark contrast, Treasury prices continued their decline, with the 10-year Treasury price falling -0.56% as yields surged to 4.497%. This represents a massive 66 basis point increase since Monday's low of 3.87%, marking one of the biggest weekly yield spikes since November 2021. The 30-year Treasury yield saw its biggest weekly surge since 1982. Market analysts suggest that until Treasuries stabilize and start to behave normally, risk assets will struggle. The rout in bonds has cast doubt on Treasuries' status as the world's safe haven as they slid along with the stock market this week, sending investors into alternative assets.

The U.S. Dollar Index weakened dramatically, falling -0.90% to break below the psychologically important 100 level for the first time since April 2022. Financial strategists note that the U.S.'s growth advantage to the rest of the world has finally disappeared, with investors increasingly moving toward European and Asian assets. Some market observers have characterized the market upheaval as turning U.S. exceptionalism into "U.S. repudiation," suggesting investors sell any stock rallies until the U.S. and China de-escalate the trade war and the Fed steps in.

In the commodity space, Bitcoin showed strong performance with a +5.53% gain, while crude oil prices rose +1.75% to trade around $61 per barrel. The dramatic shifts across asset classes underscore that markets remain emotionally charged and still searching for footing amid unresolved trade tensions, earnings uncertainty, and macroeconomic headwinds. While this week's gains are encouraging, they shouldn't be mistaken for a clear turning point.