【Joe’s華爾街脈動】市場在短暫早盤反彈後急轉直下,美中貿易戰升級雙方互祭報復性關稅威脅

美國海關午夜開始徵收新關稅,股市反彈崩潰

Joe 盧俊廷,CFA 2025年4月8日

市場概況

美國市場週二出現歷史性反轉,早盤反彈以驚人方式崩潰,導致標普500指數出現至少自1978年以來最大盤中逆轉。原本看似緩解性反彈迅速轉為連續第四個交易日的跌勢,因投資者無法擺脫對全球兩大經濟體之間升級貿易戰的擔憂。市場劇烈震盪之際,美國海關準備在午夜開始對來自86個國家的進口商品徵收新關稅。

主要指數在反彈嘗試失敗後收盤深陷紅區,標普500指數下跌-1.80%,道瓊斯工業平均指數下挫-0.81%,那斯達克綜合指數下跌-1.57%。小型股延續下行趨勢,羅素2000指數暴跌-3.47%,反映市場對其易受貿易中斷影響的擔憂加劇。費城半導體指數下挫-2.63%,突顯科技類股對全球供應鏈和國際市場的敏感度。盤中的戲劇性逆轉凸顯市場對迅速升級的貿易緊張局勢極度緊張。

華盛頓與北京之間的對峙在中國上週對所有美國商品加徵34%額外關稅後顯著升級。川普總統以最後通牒回應:"如果明天中午12:00前不取消該關稅,我們將在已實施的關稅基礎上再加徵50%關稅,"這將使總關稅率達到驚人的104%。中國商務部立即聲明"堅決反對"這一威脅,誓言"戰鬥到底",並在官方聲明中將川普的升級行動描述為"錯誤和勒索"。

市場策略師們現正辯論中國對可能超過100%的關稅將如何回應,可能引發"急性通縮力量"(通過貨幣貶值)或"顯著的通膨力量"(通過國內刺激措施),無論哪種方式都將對全球經濟產生影響。這種不確定性,加上財政部長Scott Bessent表示與約70個國家的關稅談判可能持續到6月的言論,進一步使原本希望能夠快速解決問題的投資者感到不安。在眾多國家爭相尋求全面關稅政策的豁免的同時,台灣也宣布將由行政院副院長鄭麗君率團赴美,尋求降低擬議中的32%關稅並增加貿易合作。

摘要:

- 全球市場跌勢延續,中國對所有美國商品宣布34%報復性關稅,川普總統隨即威脅加徵50%額外關稅

- 台灣股市跌破19,000點,創2024年2月以來新低,因美國32%關稅疑慮持續

- 科技類股遭受重創,資訊科技下跌-2.00%,半導體指數下滑-2.63%

- 防禦性類股相對表現較佳,投資者尋求避險以應對日益加劇的經濟不確定性

- 台灣將派高級代表團赴美進行關稅削減談判,製造業表達深切憂慮

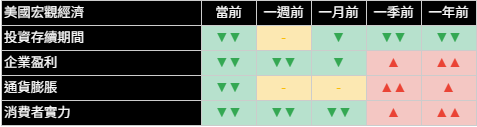

經濟指標

隨著貿易緊張局勢加劇,經濟前景進一步惡化,多項前瞻性指標顯示令人擔憂的疲弱,市場正在努力應對關稅戰可能帶來的深遠影響。關於中國可能如何回應美國關稅的迫切問題使經濟學家意見分歧,一些人示警中國貨幣可能貶值,進而引發全球急性通縮壓力,而其他人則預計重大國內刺激措施可能對世界經濟產生通膨效應。投資期限在所有時間框架內持續呈現負面趨勢,表明市場對經濟增長前景和利率走勢持續悲觀。

企業獲利趨勢仍然深度負面,特別是在當前讀數中,反映市場預期在即將到來的第一季度財報季之前,企業將面臨重大利潤壓力和具挑戰性的商業環境。這與關稅將如何影響多個類股企業獲利能力的日益擔憂相符。製造業似乎特別脆弱,據產業代表表示,許多台灣製造商擔憂32%的美國關稅可能成為其業務的"致命一擊"。

消費者強度在所有時間框架內繼續呈現令人擔憂的疲弱,負面的變化讀數表明勢頭惡化。這表明消費者支出和信心可能回落,進一步壓縮企業獲利,尤其是面向消費者的類股。隨著關稅威脅提高各種進口商品價格,消費者購買力可能面臨額外限制,為零售商和消費品公司創造了充滿挑戰的環境。展望未來,這些經濟信號表明,隨著貿易衝突加劇,全球經濟增長將面臨重大阻力。

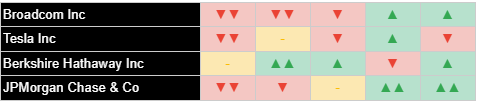

美國十大公司

市場最大公司面臨重大壓力,科技巨頭因投資者對供應鏈中斷和全球增長的擔憂而首當其衝。蘋果在大型科技股中領跌,暴跌-4.98%,因投資者擔憂對其全球供應鏈的潛在影響,該供應鏈嚴重依賴中國和台灣的製造業。特斯拉也遭遇重大損失,下跌-4.90%,反映市場對關稅影響其生產成本和獲取關鍵材料能力的擔憂。

在前十大公司中,博通和摩根大通是僅有的正面表現者,分別上漲+1.23%和+1.13%。博通的相對韌性表明一些投資者可能正在尋求具有更強定價能力和多元化收入來源的公司,而摩根大通的上漲可能反映投資者在主要銀行即將發布財報前的布局。

這些頂級公司的更廣泛趨勢模式顯示,在當前和最近時期,大多數公司均呈現一致負面讀數,只有波克夏海瑟威 (Berkshire Hathaway)在近期展示中性至正面趨勢。輝達和微軟儘管其歷史紀錄表現強勁,也遭遇重大損失,分別下跌-1.37%和-0.92%,儘管它們歷來表現強勁。亞馬遜下跌-2.62%,加劇了對消費者支出和全球供應鏈的擔憂。市場領導者之間的這種表現差異反映了投資者針對不斷升級的貿易緊張局勢採取的選擇性和謹慎策略,那些被認為對中國和國際供應鏈暴露較少的公司表現相對較好。

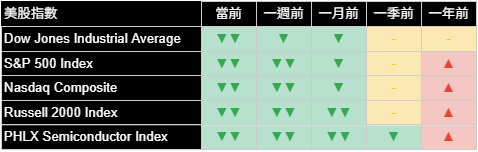

廣泛市場指數

美國市場指數週二延續跌勢,風險規避情緒明顯蔓延於各市值和風格。科技股權重的那斯達克綜合指數下跌-1.57%,而標普500指數下跌-1.80%。包含更多具有全球貿易重大影響的跨國公司的道瓊斯工業平均指數下跌-0.81%,相較其他指數表現出相對韌性。

由羅素2000指數代表的小型股遭受最陡峭跌幅,下跌-3.47%,反映其在經濟中斷面前的脆弱性,以及更專注於國內市場使其特別容易受到美國經濟放緩的影響。費城半導體指數下跌-2.63%,在半導體公司依賴的複雜全球供應鏈可能中斷的擔憂下,繼續其波動表現。

這些指數的趨勢模式在當前和最近期間均顯示一致負面讀數,過去一週負面信號的強度增加。這種負面動能的加速與不斷升級的貿易緊張相符,表明投資者對關稅的經濟影響仍高度擔憂。

類股概況

不斷升級的貿易緊張局勢引發各類股表現持續轉向保守,更具經濟敏感性的類股承受了拋售的主要壓力。標普500原材料類股領跌,大幅下挫-3.08%,反映對全球需求和供應鏈中斷的擔憂。標普500非必需消費品類股也面臨重大壓力,下跌-2.38%,因投資者擔心進口商品價格上漲對消費者支出的潛在影響。

標普500資訊科技類股下跌-2.00%,而標普500能源類股在更廣泛的全球增長擔憂下下跌-2.31%。標普500房地產類股下跌-2.51%,隨著投資者在潛在經濟放緩的背景下重新評估房地產價值,延續其疲弱模式。

更具防禦性的類股表現出相對韌性,標普500公用事業類股將跌幅限制在-0.41%,而標普500必需消費品類股下跌-1.55%,優於更廣泛市場,因投資者尋求提供必需品公司的相對安全性。這種防禦性輪動與典型的後期週期行為一致,此時投資者更加擔心經濟下滑,尋求具有更穩定現金流和更少週期性風險的類股。

趨勢模式顯示,在當前和最近期間,幾乎所有類股均呈現一致負面讀數。這種廣泛疲弱表明,隨著貿易緊張加劇和經濟不確定性增長,投資者在股票中看到的避險選擇甚少。

國際市場

全球市場繼續面臨重大壓力,亞洲市場因不斷升級的美中貿易戰而受到特別影響。中國市場同樣面臨重大壓力,MSCI中國指數下跌-1.70%,儘管這較週一的陡峭下跌後表現較好。日本市場表現出令人驚訝的韌性,MSCI日本指數在近期大幅下跌後上漲+0.54%。

新興市場整體表現欠佳,MSCI亞洲新興市場指數下跌-1.58%,MSCI拉丁美洲指數下跌-2.15%。歐洲市場同樣面臨困境,MSCI歐洲指數下跌-0.43%。

國際市場的趨勢模式在當前和最近期間顯示大多數地區普遍負面讀數,台灣考慮到其在全球科技供應鏈中的關鍵地位及其對美國和中國市場的重大暴露,顯示特別令人擔憂的趨勢。

其他資產

跨資產表現顯示顯著的風險規避,因投資者在不斷升級的貿易緊張局勢中重新評估投資組合。商品市場面臨重大壓力,WTI原油價格在潛在經濟放緩對全球需求的擔憂下暴跌-4.00%。工業金屬下跌-2.27%,反映類似的增長擔憂。農產品表現出更多韌性,將損失限制在-0.79%,但仍反映全球貿易流動的不確定性。

相比之下,避險資產表現出一些強度,黃金價格上漲+0.54%,因投資者尋求傳統的價值儲存。美元指數繼續吸引防禦性資金流入,儘管在近期強勁增長後略微回落-0.46%。在國債市場,價格全線走低。加密貨幣空間繼續面臨壓力,比特幣下跌-1.54%,延續其近期損失,因風險規避情緒蔓延至多樣化資產。

展望未來,市場參與者將密切關注週三的消費者物價指數報告,以獲取可能影響美聯儲政策的通貨膨脹趨勢的額外洞察。在關稅引起價格上漲的擔憂下,這一數據點具有額外的重要性。投資者還將關注貿易談判的發展,特別是台灣赴美高級代表團,這可能提供關於全面關稅政策潛在豁免或修改的訊號。隨著投資者在這一迅速發展的局勢中導航,波動性可能會保持高位。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為美籍台灣人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Make Sharp U-Turn after Brief Morning Rally, as U.S.-China Trade War Escalates with Retaliatory Tariff Threats

Stock Rally Collapses as U.S. Customs Begins Tariff Collections at Midnight

By Joseph Lu, CFA April 8, 2025

MARKET OVERVIEW

U.S. markets experienced a historic reversal on Tuesday as an early rally collapsed in spectacular fashion, resulting in the biggest intraday U-turn for the S&P 500 since at least 1978. What began as a relief bounce quickly turned into the fourth straight session of losses as investors remained unable to shake their concerns over the escalating trade war between the world's two largest economies. The market's whipsaw action came as U.S. Customs prepared to begin collecting new tariffs on imports from 86 countries at midnight.

The major indices closed deeply in the red after their failed rebound attempt, with the S&P 500 Index falling -1.80%, the Dow Jones Industrial Average dropping -0.81%, and the Nasdaq Composite declining -1.57%. Small-cap stocks continued their downward trajectory with the Russell 2000 Index plunging -3.47%, reflecting heightened concerns about their vulnerability to trade disruptions. The Philadelphia Semiconductor Index tumbled -2.63%, highlighting the tech sector's exposure to global supply chains and international markets. The dramatic intraday reversal underscored the market's extreme nervousness about the rapidly escalating trade tensions.

The standoff between Washington and Beijing intensified dramatically after China imposed an additional 34% tariff on all American goods last week. President Trump responded with an ultimatum: "If that tariff isn't removed by tomorrow at 12:00, we're putting a 50% tariff on above the tariffs that we put on," which would bring the total tariff rate to a staggering 104%. China's Commerce Ministry immediately declared it "resolutely opposes" the threat, vowing to "fight to the end" and characterizing Trump's escalation as "a mistake and blackmail" in an official statement.

Market strategists are now debating whether China's response to potential 100%+ tariffs could trigger either "an acutely deflationary force" through currency devaluation or "a significantly reflationary force" through domestic stimulus measures, with global economic implications either way. This uncertainty, coupled with Treasury Secretary Scott Bessent's comments that tariff negotiations with approximately 70 countries could extend until June, has further unsettled investors who were hoping for a quick resolution. Meanwhile, Taiwan has announced that Vice Premier Cheng Li-chiun will lead a delegation to the U.S. seeking to lower the proposed 32% levy and increase trade cooperation, as numerous countries scramble for exemptions from the sweeping tariff policy.

Executive Summary:

- Global markets extend losses as China announces 34% retaliatory tariff on all U.S. goods, prompting Trump to threaten additional 50% levies

- Taiwan stocks plummet below 19,000, hitting lowest level since February 2024 amid 32% U.S. tariff concerns

- Technology sector suffers significant losses with Information Technology down -2.00% and Semiconductor index falling -2.63%

- Defensive sectors outperform relatively as investors seek shelter from escalating economic uncertainty

- Taiwan sending high-level delegation to U.S. to negotiate tariff reductions as manufacturing sector expresses deep concerns

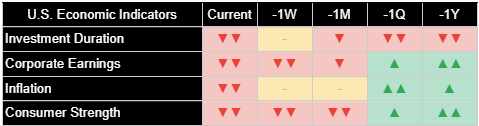

ECONOMIC INDICATORS

The economic outlook has deteriorated further amid the intensifying trade tensions, with multiple forward-looking measures showing concerning weakness and markets grappling with potentially profound implications of the tariff battle. The looming question of how China might respond to U.S. tariffs has economists divided, with some warning of a possible Chinese currency devaluation that could unleash acute deflationary pressures globally, while others anticipate significant domestic stimulus measures that might have reflationary effects on the world economy. Investment duration continues to display negative trends across all timeframes, indicating persistent pessimism about economic growth prospects and interest rate trajectories.

Corporate earnings trends remain deeply negative, particularly in current readings, reflecting market expectations for significant margin pressures and challenging business conditions ahead of the upcoming Q1 reporting season. This aligns with growing concerns about how tariffs will impact corporate profitability across multiple sectors. The manufacturing sector appears particularly vulnerable, with many Taiwanese manufacturers expressing fears that the 32% U.S. tariff could be "the nail in the coffin" for their businesses, according to industry representatives.

Consumer strength continues to show concerning weakness across all timeframes, with negative delta readings indicating deteriorating momentum. This suggests potential pullbacks in consumer spending and confidence that could further pressure corporate earnings, especially in consumer-facing sectors. As tariffs threaten to raise prices on a wide range of imported goods, consumer spending power may face additional constraints, creating a challenging environment for retailers and consumer goods companies. Looking ahead, these economic signals point to significant headwinds global economic growth as the trade conflict intensifies.

TOP 10 U.S. COMPANIES

The market's largest companies faced substantial pressure, with technology giants bearing the brunt of investor concerns about supply chain disruptions and global growth. Apple led the declines among mega-caps, plummeting -4.98% as investors worried about potential impacts to its global supply chain, which is heavily dependent on manufacturing in China and Taiwan. Tesla also saw significant losses, dropping -4.90%, reflecting concerns about tariff impacts on both its production costs and access to key materials.

Broadcom and JPMorgan Chase were the only positive performers among the top 10, rising +1.23% and +1.13% respectively. Broadcom's relative resilience suggests some investors may be seeking companies with stronger pricing power and diversified revenue streams, while JPMorgan's gain may reflect positioning ahead of upcoming earnings reports from major banks.

The broader trend pattern for these top companies reveals uniformly negative readings in current and recent periods for most names, with Berkshire Hathaway showing the only neutral to positive trend in the near term. NVIDIA and Microsoft also showed substantial losses, down -1.37% and -0.92% respectively, despite their historically strong performance. Amazon declined -2.62%, adding to concerns about consumer spending and global supply chains. This performance dispersion among market leaders reflects the selective and cautious approach investors are taking in response to the escalating trade tensions, with those companies perceived to have less exposure to China and international supply chains faring relatively better.

BROAD MARKET INDICES

U.S. market indices extended their losses on Tuesday, with risk aversion evident across market caps and styles. The technology-heavy Nasdaq Composite fell -1.57%, while the S&P 500 Index dropped -1.80%. The Dow Jones Industrial Average, which contains more multinational companies with significant exposure to global trade, declined -0.81%, showing relative resilience compared to other indices.

Small-cap stocks, represented by the Russell 2000 Index, suffered the steepest decline of -3.47%, reflecting their perceived vulnerability to economic disruptions and more domestic focus that makes them particularly susceptible to U.S. economic slowdowns. The Philadelphia Semiconductor Index fell -2.63%, continuing its volatile performance amid concerns about potential disruptions to the complex global supply chains that semiconductor companies rely on.

The trend patterns across these indices show uniformly negative readings in current and recent periods, with the intensity of negative signals increasing over the past week. This acceleration in negative momentum aligns with the escalating trade tensions and suggests investors remain highly concerned about the economic impact of tariffs.

SECTOR OVERVIEW

The escalating trade tensions triggered a continued defensive rotation in sector performance, with more economically sensitive sectors bearing the brunt of the sell-off. The S&P 500 Materials sector led declines with a steep drop of -3.08%, reflecting concerns about global demand and supply chain disruptions. The S&P 500 Consumer Discretionary sector also faced significant pressure, falling -2.38%, as investors worried about potential impacts on consumer spending due to higher prices for imported goods.

The S&P 500 Information Technology sector declined -2.00%, while the S&P 500 Energy sector fell -2.31% amid broader concerns about global growth. The S&P 500 Real Estate sector dropped -2.51%, continuing its pattern of weakness as investors reassess property valuations in light of potential economic slowdowns.

More defensive sectors showed relative resilience, with the S&P 500 Utilities sector limiting its decline to -0.41%, while the S&P 500 Consumer Staples sector fell -1.55%, outperforming the broader market as investors sought the relative safety of companies providing essential goods. This defensive rotation aligns with typical late-cycle behavior when investors become more concerned about economic downturns and seek sectors with more stable cash flows and less cyclical exposure.

The trend patterns show consistently negative readings across nearly all sectors in current and recent periods. This broad-based weakness suggests investors see few safe havens within equities as trade tensions escalate and economic uncertainty grows.

INTERNATIONAL MARKETS

Global markets continued to face significant pressure, with Asian markets particularly impacted by the escalating U.S.-China trade war. Chinese markets faced significant pressure, with the MSCI China Index falling -1.70%, though this represented a better performance than some regional peers following Monday's steep declines. Japanese markets showed surprising resilience, with the MSCI Japan Index gaining +0.54% after recent sharp losses.

Emerging markets broadly underperformed, with the MSCI Emerging Asia Index dropping -1.58% and the MSCI Latin America Index falling -2.15%. European markets also struggled, with the MSCI Europe Index declining -0.43%.

The trend patterns for international markets show broadly negative readings across most regions in current and recent periods, with Taiwan showing particularly concerning trends given its critical position in global technology supply chains and significant exposure to both U.S. and Chinese markets.

OTHER ASSETS

Cross-asset performance revealed significant risk aversion as investors reassessed portfolios amid escalating trade tensions. Commodity markets faced substantial pressure, with WTI crude oil prices plunging -4.00% on concerns about global demand in a potential economic slowdown. Industrial metals declined -2.27%, reflecting similar growth concerns. Agricultural commodities showed more resilience, limiting losses to -0.79%, though still reflecting uncertainty about global trade flows.

In contrast, safe-haven assets showed some strength, with gold prices rising +0.54% as investors sought traditional stores of value. The U.S. Dollar Index continued to attract defensive flows, though it pulled back slightly with a -0.46% move after recent strong gains. In the Treasury market, prices were mostly lower with Treasury prices down across the board. The cryptocurrency space continued to face pressure, with Bitcoin falling -1.54%, extending its recent losses as risk aversion spread across alternative assets.

Looking ahead, market participants will be closely watching Wednesday's consumer price index report for additional insights into inflation trends that could influence Federal Reserve policy. With concerns about tariff-induced price increases, this data point takes on added significance. Investors will also monitor developments in trade negotiations, particularly Taiwan's high-level delegation to the U.S., which could provide signals about potential exemptions or modifications to the sweeping tariff policy. Volatility is likely to remain elevated as investors navigate this rapidly evolving landscape.