【Joe’s華爾街脈動】川普暫停對等關稅90天,市場上演歷史性大反彈,債券波動加劇

華爾街經歷二戰後第三大漲幅,總統發布「買入」呼籲,多數國家獲得關稅減免

作者:Joe Lu,CFA 2025年4月9日美東時間

市場概況

由於川普總統宣布對大多數國家暫停實施其全面性「對等」關稅90天,讓美國股市週三上演驚人反彈,創造歷史上最戲劇性的交易日之一。這一驚人轉變發生在數天劇烈市場波動之後,釋放出一波買盤海嘯,使標普500指數創下二戰後第三大漲幅,並創下華爾街有史以來最龐大的交易量紀錄。

標普500指數暴漲+12.00%,收於5,456.90點,創下2008年以來最大單日漲幅。道瓊斯工業平均指數上漲+7.86%,大幅上揚2,962.86點,收於40,608.45點,創下2020年3月以來最大百分比漲幅。那斯達克綜合指數表現最為壯觀,飆升+10.50%,收於17,124.97點,創下2001年1月以來最大單日漲幅及歷史第二佳表現。小型股表現更勝一籌,羅素2000指數暴漲+18.67%,投資者爭相購買在近期拋售中受打擊最嚴重的股票。

在交易日早些時候,川普在Truth Social上鼓勵投資者,寫道:「保持冷靜!一切都會好起來的。美國將變得比以往任何時候都更強大、更好!」隨後他直接發布投資建議,寫道:「現在是買入的大好時機!!!DJT」,引發市場立即反應。川普媒體科技集團(股票代碼為DJT),在總統發表上述言論後股價上漲逾8%。在美國總統對於股市的評論發表之際,金融市場普遍擔憂關稅對經濟的影響。

「我已授權暫停90天,並在此期間將對等關稅大幅降低至10%,立即生效」川普發文。財政部長Scott Bessent後來澄清,除中國外,所有國家在談判期間將恢復到10%的基準關稅率。然而,隨著與北京的緊張關係顯著升級,川普宣布對中國商品的關稅將提高至125%,表明將繼續對全球第二大經濟體施壓。市場策略師指出,儘管為期90天的暫停消除了市場的重大壓力,但對暫停結束後可能發生的情況仍存在擔憂,特別是中國的關稅率現已達到三位數。

摘要:

- 川普宣布對多數國家(中國除外)暫停關稅90天,標普500指數大漲+12.00%,創下二戰後第三大漲幅

- 科技類股領漲,資訊科技類股飆升+13.48%,半導體股暴漲+18.67%

- 隨著市場穩定,川普在社交媒體上敦促投資者「保持冷靜!」,並宣布「現在是買入的大好時機!!!」

- 國債市場仍面臨壓力,30年期國債收益率創下2020年以來最大三日漲幅,引發對更廣泛金融系統壓力的擔憂

- 中國面臨升級至125%的關稅,引發對潛在貨幣貶值或國內刺激措施的擔憂

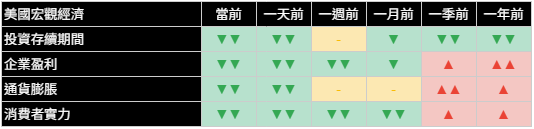

經濟指標

儘管今日市場呈現爆炸性反彈,經濟前景仍然複雜,關鍵前瞻性指標顯示出混合信號。投資期限在大多數時間框架內繼續呈現負面趨勢,表明儘管關稅暫停帶來短期緩解,投資者對長期增長前景持續擔憂。過去一週投資期限的惡化表明,儘管今日市場情緒亢奮,投資者對經濟增長軌跡仍保持謹慎。

通貨膨脹趨勢在大多數時間框架內仍然深度負面,反映市場對價格壓力的持續擔憂。隨著消費者物價指數報告即將於明日公布,通膨數據變得更加重要,交易者評估關稅引發的價格上漲是否可能迫使美國聯準會採取更積極的應對措施。週四上午公布的CPI預計將顯示3月份溫和上漲0.1%,若得到確認,可能為市場提供額外緩解。展望未來,這些經濟信號表明,隨著投資者消化關稅暫停的短期緩解,以及與中國貿易關係惡化的持續擔憂,波動性將持續。

美國十大公司

隨著投資者紛紛回流湧入在近期經濟低迷時期遭逢重挫的科技股,市場最大的幾間公司出現了爆炸性成長。由於投資者對可能嚴重影響其全球供應鏈和生產成本的關稅威脅減少做出反應,特斯拉引領了強勁反彈,飆升+22.69%。在出現驚人漲幅之際,之前關於特斯拉估值的評論在新市場條件下被重新評估。

輝達延續其顯著波動性,在前幾個交易日遭受重大損失,暴漲+18.72%。因供應鏈中斷和進口成本上升的威脅對大多數國家暫時緩解,蘋果股價上漲+15.33%,Meta Platforms股價躍升+14.76%,博通暴漲+18.66%。而交易者重新評估關稅暫停對其全球業務的影響,微軟上漲+10.13%,亞馬遜跳漲+11.98%。這些漲幅的幅度反映了在經濟低迷期間的嚴重超賣狀況,也反映出大多數國家在90天暫停期間回到10%基準關稅率的緩解。

波克夏海瑟威(Berkshire Hathaway)表現較為溫和,上漲+5.84%,反映其更多元化和防禦性的投資組合定位。摩根大通上漲+8.06%,因市場預期美國聯準會將干預債券市場。這些市場領導者的表現差異突顯了修訂關稅政策的潛在長期影響,那些對中國直接暴露較少的公司表現更佳,因為投資者正在消化對中國商品徵收125%關稅率的影響。這些公司的每日變化讀數中的顯著變動表明市場情緒出現重大轉折點,可能對今日顯著反彈之外產生持久影響。

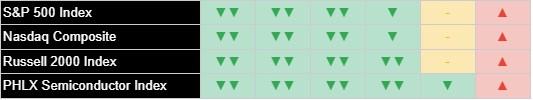

廣泛市場指數

美國股市指數週三經歷了歷史性漲幅,在近期拋售中遭受最深損失的領域,漲幅最為戲劇性。科技股為主的那斯達克綜合指數飆升+10.50%,而標普500指數暴漲+12.00%。道瓊斯工業指數包含更多在全球貿易佔有重要地位的跨國公司,該指數上漲+7.86%,相較於增長導向指數,顯示出強勁但相對更為溫和的漲幅。

由羅素2000指數代表的小型股表現最為壯觀,驚人上漲+18.67%,反映出它們此前嚴重超賣的狀況,以及相較於大型跨國公司,其相對於國際貿易衝突的隔離性。費城半導體指數跳漲+8.50%,在下跌期間因其複雜的全球供應鏈和對亞洲的高度依賴而受到特別打擊後,強勁反彈。

這些指數的趨勢模式顯示,儘管今日反彈,當前期間仍持續呈現負面讀數,突顯出這一顯著反彈發生在更廣泛市場疲弱的背景下。這表明投資者對於這次反彈是否代表市場動態的可持續轉變,或僅是在持續擔憂貿易政策、通貨膨脹和債券市場不穩定的背景下的短期緩解反彈仍持謹慎態度。大多數指數的每日變化讀數顯示中性至略微正面變化,表明雖然今日走勢在幅度上具有歷史性,但可能更多代表緩解性反彈,而非市場信念的根本轉變。

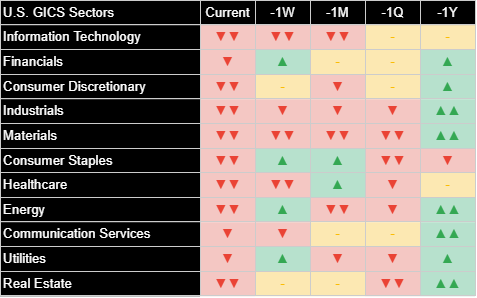

類股概況

在今日歷史性反彈中,標普500的全部十一個類股均大幅上漲,其中受關稅擔憂影響最大的領域漲幅最為顯著。數個類股在其一日變化讀數中顯示特別值得注意的改善,表明市場領導地位和投資者情緒的潛在轉變。

標普500資訊科技類股領漲,飆升+13.48%,投資者紛紛回流成長股。金融類股顯示令人印象最深刻的一日變化改善之一,表明隨著投資者重新評估美國聯準會可能干預債券市場的可能性,銀行和金融服務公司的情緒發生重大轉變。標普500非必需消費品類股緊隨其後,跳漲+10.89%,反映出對廣泛關稅影響消費者支出的擔憂減輕。

標普500通信服務類股上漲+8.84%,且單日Delta也出現正值,表明媒體和電信公司的動能增強。同樣,標普500公用事業類股,雖然漲幅較為溫和,上漲+3.94%,也顯示出正面的變化轉變,表明儘管風險偏好情緒普遍存在,一些投資者正在採取防禦性定位。由於對於商品的相關擔憂有所緩解,標普500原材料類股上漲+8.74%,標普500能源類股攀升+7.74%。

類股間出色但不均勻表現反映了投資者對暫時性的關稅暫停的緩解。金融、通信服務和公用事業的正面一日變化轉變表明,如果市場穩定持續,值得關注的新興類股輪動動態。同時,儘管絕對表現強勁,大多數其他類股持續呈現負面變化讀數,突顯出投資者在評估今日反彈是否標誌著可持續趨勢變化或僅是在持續政策不確定性中的緩解反彈時,市場中的謹慎基調。

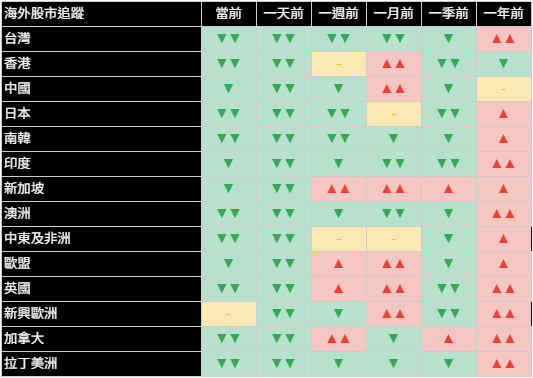

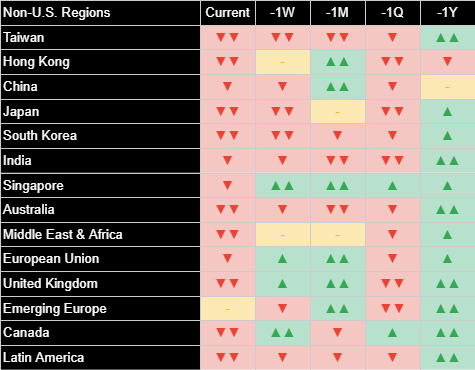

國際市場

全球市場與美國反彈同步強勁上漲,但隨著投資者評估川普差別關稅方式的影響,各地區漲幅不均。歐洲市場表現強勁,MSCI歐洲指數上漲+7.44%,因該地區受益於90天關稅暫停並恢復到10%基準稅率。日本市場也呈現正面反應,MSCI日本指數攀升+7.61%,反映出對與美國貿易緊張局勢緩解的欣慰。

儘管被排除在關稅暫停之外,中國市場的漲幅較為溫和,MSCI中國指數上漲+6.28%,因投資者已經將重大的貿易挑戰因素納入計價。新興市場整體表現優於大盤,MSCI亞洲新興市場指數上漲+7.57%,MSCI拉丁美洲指數上漲+6.65%,許多發展中經濟體受益於全球貿易中斷威脅的減少。

國際市場的趨勢模式繼續在大多數地區顯示以負面為主的讀數,特別是在當前和近期期間,表明今日反彈發生在更廣泛全球市場疲弱的背景下。這一模式突顯了國際市場復甦的潛在脆弱性,特別是考慮到專門針對中國的關稅升級至125%。中國、印度、新加坡和歐盟的正面一日變化讀數表明,如果更積極的情緒持續,可能會出現潛在的新興強勢領域,但美中貿易關係的長期影響對全球市場仍是重大關切。

其他資產

跨資產表現顯示出風險偏好情緒,但債券市場穩定性仍存擔憂,儘管股市反彈,國債收益率持續急劇上升。30年期收益率經歷了2020年以來最大的三日攀升,上升近40個基點,引發對潛在更廣泛金融系統中斷的擔憂。

即使在今日股市反彈中,債券價格持續承壓,突顯出對固定收益市場潛在不穩定性的擔憂加劇。市場觀察者指出,股市飆升與債券價格下跌之間的這種不尋常分歧,加劇了對美國聯準會可能干預國債市場以穩定的猜測。30年期國債收益率當日上升7.2個基點至4.786%,在三個交易日內總計跳升近40個基點,創下2020年3月以來最大漲幅。

商品市場表現強勁,WTI原油價格上漲+6.69%,因關稅暫停公告後需求前景改善。黃金價格上漲+3.70%,在電子交易中延續近期強勢,金屬市場對政策環境變化做出反應。美元指數小幅上漲+0.14%。加密貨幣市場加入更廣泛反彈,比特幣上漲+7.43%。這些跨資產趨勢揭示了一個複雜的市場環境,關稅減少的短期緩解與債券市場穩定性和與中國長期貿易關係的更深層結構性擔憂形成對比。

展望未來,市場參與者將密切關注週四的消費者物價指數報告,這可能對美國聯準會政策預期產生重大影響。CPI報告在一定程度上被貿易戰動態所掩蓋,但預計將顯示3月份溫和上漲。隨著債券市場波動達到極端水平,對美國聯準會可能採取干預措施以穩定國債市場的猜測日益增加。此外,投資者將評估對中國徵收125%關稅的影響,這可能引發重大貨幣貶值或國內刺激措施,帶來全球經濟連鎖效應。由於90天關稅暫停僅提供暫時緩解,隨著參與者應對這一快速變化的情況,市場可能會繼續經歷劇烈波動。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為美籍台灣人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Stage Historic Rally as Trump Pauses Tariffs for 90 Days, Bond Volatility Intensifies

Wall Street Experiences Third-Largest Post-WWII Gain Amid Presidential "Buy" Call and Tariff Relief for Most Nations

By Joseph Lu, CFA April 9, 2025 ET

MARKET OVERVIEW

U.S. markets staged a breathtaking rally on Wednesday in one of the most dramatic trading sessions in history, as President Donald Trump announced a 90-day pause on his sweeping "reciprocal" tariffs for most countries. The stunning reversal, which followed days of intense market volatility, unleashed a tsunami of buying that led to the third-largest post-World War II gain for the S&P 500 and the heaviest trading volume ever recorded on Wall Street.

The S&P 500 Index skyrocketed +12.00%, closing at 5,456.90 for its biggest one-day advance since 2008. The Dow Jones Industrial Average surged +7.86%, gaining an astounding 2,962.86 points to 40,608.45, marking its largest percentage gain since March 2020. The Nasdaq Composite experienced the most spectacular move, soaring +10.50% to end at 17,124.97, recording its largest one-day jump since January 2001 and second-best day ever. Small-cap stocks outperformed even these remarkable gains, with the Russell 2000 Index exploding +18.67% as investors rushed to buy stocks that had been most severely punished during the recent sell-off.

Early in the trading day, Trump took to Truth Social to encourage investors, writing "BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!" He followed this with a direct investment recommendation, posting "THIS IS A GREAT TIME TO BUY!!! DJT," causing an immediate market reaction. Trump Media & Technology Group, which trades under the ticker "DJT," jumped over 8% following the president's post. The presidential stock commentary came amid broader financial market concerns about the economic impact of tariffs.

"I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately," Trump posted. Treasury Secretary Scott Bessent later clarified that all countries except China would revert to the 10% baseline tariff rate during the negotiation period. However, in a significant escalation of tensions with Beijing, Trump announced that tariffs on Chinese goods would increase to 125%, signaling continued pressure on the world's second-largest economy. Market strategists noted that while the 90-day pause provided relief by removing a significant market overhang, concerns remained about what might happen when the pause concludes, particularly with China's tariff rate now in triple digits.

Executive Summary:

- S&P 500 surged +12.00% in third-largest post-WWII gain as Trump announces 90-day pause on tariffs for most countries, excluding China

- Technology sector led the massive rebound with Information Technology jumping +13.48% and semiconductor stocks surging +18.67%

- Trump urged investors to "BE COOL!" and declared "THIS IS A GREAT TIME TO BUY!!!" on social media as markets stabilized

- Treasury market remains under pressure as 30-year yield posts biggest three-day climb since 2020 amid concerns of broader financial system stress

- China faces escalated 125% tariff rate, raising concerns about potential currency devaluation or domestic stimulus measures

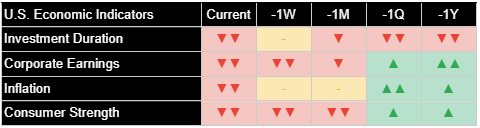

ECONOMIC INDICATORS

The economic outlook remains complex despite today's explosive market rally, with key forward-looking measures showing mixed signals. Investment duration continued to display negative trends across most timeframes, indicating persistent concerns about long-term growth prospects despite the short-term relief from the tariff pause. The deterioration in investment duration over the past week suggests investors remain cautious about economic growth trajectories despite today's euphoric market action.

Inflation trends remain deeply negative across most timeframes, reflecting persistent concerns about price pressures. With tomorrow's Consumer Price Index report looming, inflation data has taken on heightened significance as traders assess whether tariff-induced price increases might force a more aggressive Federal Reserve response. The CPI due Thursday morning is forecast to show a fairly tame 0.1% increase in March, which could provide additional relief to markets if confirmed. Looking ahead, these economic signals suggest continued volatility as investors digest both the short-term relief of the tariff pause and ongoing concerns about deteriorating trade relations with China.

TOP 10 U.S. COMPANIES

The market's largest companies experienced explosive gains as investors rushed back into technology stocks that had been severely punished in the recent downturn. Tesla led the spectacular rebound, soaring +22.69% as investors reacted to reduced tariff threats that would have significantly impacted its global supply chain and production costs. The automaker's dramatic surge came as previous commentary about Tesla's valuation was reassessed in light of the new market conditions.

NVIDIA continued its remarkable volatility, surging +18.72% after suffering significant losses in previous sessions. Apple surged +15.33%, Meta Platforms jumped +14.76%, and Broadcom rocketed +18.66%, as the threat of supply chain disruptions and higher import costs temporarily receded for most countries. Microsoft gained +10.13% and Amazon jumped +11.98% as traders reassessed the impact of the tariff pause on their global operations. The magnitude of these moves reflects both the severe oversold conditions that had developed during the downturn and the relief that most countries would return to the baseline 10% tariff rate during the 90-day pause.

Berkshire Hathaway showed more modest gains, rising +5.84%, reflecting its more diversified and defensive portfolio positioning. JPMorgan Chase advanced +8.06% amid growing expectations for Federal Reserve intervention in the bond market. The performance dispersion among these market leaders highlights the potential longer-term impacts of the revised tariff policy, with companies having less direct exposure to China faring better as investors digest the implications of the escalated 125% tariff rate on Chinese goods. The substantial one-day changes in delta readings for several of these companies indicate a major inflection point in market sentiment that could have lasting implications beyond today's remarkable rally.

BROAD MARKET INDICES

U.S. market indices experienced historic gains across the board on Wednesday, with the most dramatic advances seen in areas that had suffered the deepest losses during the recent sell-off. The technology-heavy Nasdaq Composite surged +10.50%, while the S&P 500 Index skyrocketed +12.00%. The Dow Jones Industrial Average, which contains more multinational companies with significant exposure to global trade, advanced +7.86%, showing strong but relatively more contained gains compared to growth-oriented indices.

Small-cap stocks, represented by the Russell 2000 Index, posted the most spectacular performance with an astounding +18.67% gain, reflecting both their severe prior oversold condition and their relative insulation from international trade conflicts compared to large multinational corporations. The Philadelphia Semiconductor Index jumped +8.50%, bouncing back strongly after being hit particularly hard during the downturn due to its complex global supply chains and heavy exposure to Asia.

The trend patterns across these indices show continued negative readings in current periods despite today's rally, underscoring that this remarkable advance occurs against a backdrop of broader market weakness. This suggests investors remain cautious about whether this rally represents a sustainable shift in market dynamics or merely a short-term relief rebound amid ongoing concerns about trade policy, inflation, and bond market instability. The daily delta readings show neutral to slightly positive changes for most indices, indicating that while today's move was historic in magnitude, it may represent more of a relief rally than a fundamental shift in market conviction.

SECTOR OVERVIEW

All eleven S&P 500 sectors posted substantial gains in today's historic rally, with the most significant advances in areas that had been most heavily impacted by tariff concerns. Several sectors showed particularly notable improvements in their one-day delta readings, signaling potential shifts in market leadership and investor sentiment.

The S&P 500 Information Technology sector led the charge, surging +13.48% as investors rushed back into growth stocks. The Financial sector showed one of the most impressive one-day delta improvements, indicating a significant shift in sentiment for banking and financial services companies as investors reassessed the potential for Federal Reserve intervention in bond markets. The Consumer Discretionary sector followed closely in performance, jumping +10.89%, reflecting reduced concerns about consumer spending impacts from broad-based tariffs.

The Communication Services sector gained +8.84% and also registered a positive one-day delta reading, suggesting strengthening momentum in media and telecommunications companies. Similarly, the Utilities sector, while gaining a more modest +3.94%, also showed a positive delta shift, indicating defensive positioning by some investors despite the broader risk-on sentiment. The S&P 500 Materials sector advanced +8.74%, and the S&P 500 Energy sector climbed +7.74% as commodity-related concerns eased.

The spectacular but uneven performance across sectors reflects investor relief about the temporary tariff pause. The positive one-day delta shifts in Financials, Communication Services, and Utilities suggest emerging sector rotation dynamics that bear watching if market stability continues. Meanwhile, the continued negative delta readings in most other sectors, despite strong absolute performance, highlights the cautious undertone in markets as investors assess whether today's rally marks a sustainable trend change or merely a relief rebound amid ongoing policy uncertainty.

INTERNATIONAL MARKETS

Global markets posted strong gains in synchrony with the U.S. rally, though the advances were uneven across regions as investors assessed the implications of Trump's differentiated tariff approach. European markets showed solid gains, with the MSCI Europe Index rising +7.44% as the region benefited from the 90-day tariff pause and return to the 10% baseline rate. Japanese markets also responded positively, with the MSCI Japan Index climbing +7.61%, reflecting relief about reduced trade tensions with the United States.

Chinese markets posted more modest gains despite being excluded from the tariff pause, with the MSCI China Index advancing +6.28% as investors had already priced in significant trade challenges. Emerging markets broadly outperformed, with the MSCI Emerging Asia Index rising +7.57% and the MSCI Latin America Index gaining +6.65%, as many developing economies benefited from the reduced threat of global trade disruptions.

The trend patterns for international markets continue to show predominantly negative readings across most regions, particularly in current and recent periods, suggesting that today's rally occurs against a backdrop of broader global market weakness. This pattern highlights the potential fragility of the international market recovery, especially given the escalation of tariffs specifically targeting China to 125%. Positive one-day delta readings for China, India, Singapore, and the European Union indicate potential emerging pockets of strength if the more positive sentiment persists, though the longer-term implications of the U.S.-China trade relationship remain a significant concern for global markets.

OTHER ASSETS

Cross-asset performance revealed significant risk-on sentiment amid concerns about bond market stability, as Treasury yields continued their sharp rise despite the equity market rally. The 30-year yield has experienced its largest three-day climb since 2020, rising nearly 40 basis points and fueling concerns about potential disruptions to the broader financial system.

The continued pressure on bond prices even amid today's equity rally highlights growing concerns about potential instability in fixed income markets. Market observers note that the unusual divergence between soaring stocks and falling bond prices has intensified speculation about potential Federal Reserve intervention to stabilize the Treasury market. The 30-year Treasury yield rose 7.2 basis points to 4.786% on the day, jumping by a total of almost 40 basis points over three sessions, the largest such rise since March 2020.

Commodity markets showed strength, with WTI crude oil prices rising +6.69% on improved demand outlook following the tariff pause announcement. Gold prices gained +3.70%, extending their recent strength into electronic trading as metals markets responded to the changing policy environment. The U.S. Dollar Index moved slightly higher with a +0.14% gain. The cryptocurrency market joined the broader rally, with Bitcoin advancing +7.43%. These cross-asset movements reveal a complex market environment where short-term relief about tariff reductions contrasts with deeper structural concerns about bond market stability and longer-term trade relations with China.

Looking ahead, market participants will be closely monitoring Thursday's Consumer Price Index report, which could significantly impact Federal Reserve policy expectations. The CPI report has been somewhat overshadowed by the trade war developments but is forecast to show a modest increase in March. With bond market volatility at extreme levels, there is growing speculation about potential Fed intervention to stabilize Treasury markets. Additionally, investors will be assessing the implications of the escalated 125% tariff rate on China, which could trigger either significant currency devaluation or domestic stimulus measures with global economic ripple effects. As the 90-day tariff pause provides only temporary relief, markets may continue to experience elevated volatility as participants navigate this rapidly evolving landscape.