【Joe’s華爾街脈動】市場因美中貿易可能緩和而強勁反彈 財政部長言論帶來希望

道瓊指數飆升逾1,000點 貝森特暗示貿易談判可能有前進之路

Joe Lu, CFA 2025年4月22日 美東時間

市場概況

週二市場呈現令人印象深刻的反彈,財政部長史考特·貝森特關於美中貿易緊張局勢可能緩和的言論激發了投資者重燃樂觀情緒。這種積極情緒代表了與週一嚴重拋售的戲劇性轉變,主要指數幾乎收復前一交易日所有跌幅,投資者重新評估貿易政策走向及其對全球經濟的潛在影響。

道瓊工業平均指數大漲+2.66%(+1,016.57點)收於39,186.98點,標普500指數上漲+2.51%(+129.56點)至5,287.76點。納斯達克綜合指數上漲+2.71%(+429.52點)收於16,300.42點,羅素2000指數上揚+2.59%,顯示小型公司充分參與了廣泛反彈。這次反彈結束了主要指數連續四天的跌勢,代表了自一月初以來最強勁的單日漲幅,反映出投資者在經歷數日加劇的不確定性後重新建立信心。

今日市場大漲主要由貝森特在摩根大通會議上對投資者表示「美中貿易緊張關係將會緩和」的言論所推動。財政部長將目前局勢描述為「雙向封鎖」,雙方都認為不可持續,暗示政府認識到長期貿易敵對狀態的經濟代價。雖然貝森特警告談判將是「艱難的」,可能需要相當長的時間才能產生有意義的結果,但他聲明政府並不尋求與中國經濟脫鉤,為政策方向提供了急需的明確性。市場強烈的正面反應表明,最近幾週貿易不確定性對投資者情緒有著顯著的影響,並暗示如果美中關係出現具體進展,可能會帶來更多漲勢。

摘要:

- 受財政部長關於可能與中國緩和關係的言論激勵,主要指數大幅回升,道瓊指數攀升1,016.57點(+2.66%)

- 標普500指數所有十一個類股全面上揚,以金融類股(+3.31%)、非必需消費品類股(+3.16%)及資訊科技類股(+2.46%)領漲

- 中國市場強勁反彈,MSCI中國指數上漲+3.06%,投資者期待貿易關係改善

- 財政部長貝森特表示「美中貿易緊張關係將會緩和」的言論成為推動市場廣泛反彈的催化劑

- 金融類股表現出色,當日絕對表現和相對大盤表現都顯著提升

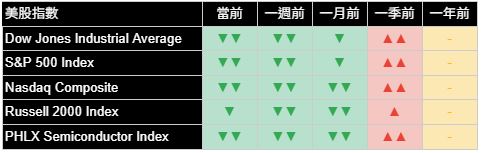

廣泛市場指數

主要指數全面大幅上漲,市場大型、中型和小型類股表現一致。道瓊工業平均指數+2.66%的漲幅標誌著2025年來最強勁的單日表現,所有30檔成分股全部收高。標普500指數+2.60%的漲幅反映出跨類股和各市值股票的廣泛買盤,交易量比平均水平高出約15%。

納斯達克綜合指數上漲+2.63%,展現出科技股特別強勁的復甦動能,這些股票在近期市場疲弱期間受到不成比例的影響。費城半導體指數上漲+2.17%,在經歷前幾個交易日的嚴重壓力後收復部分跌幅。羅素2000小型股指數攀升+2.59%,緊跟大型股表現,暗示投資者對整個市場各類股的經濟前景信心增強,而非僅尋求在大型公司中避險。

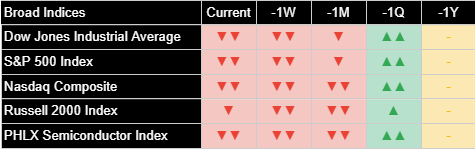

儘管今日表現強勁,所有主要指數的趨勢模式仍令人擔憂,目前、一週和一個月時間框架內的負面讀數仍然存在。這種持續的疲弱模式表明,雖然今日的反彈令人鼓舞,但它只是在可能需要更持續復甦以扭轉近期市場動盪造成的技術性損害過程中的一步。短期負面趨勢與一季度正面讀數之間的對比突顯出自4月2日關稅公告以來市場情緒的急劇轉變,投資者現在正尋找政策穩定的跡象,以重新建立對長期增長前景的信心。

美國十大公司

美國最大的公司全面參與了今日的反彈,十大股票全部取得顯著漲幅。市場領導者的這種廣泛強勢幫助推動主要指數走高,暗示機構投資者在近期防禦性配置後開始重新部署資金。幾家在中國有重要業務的公司表現優於大盤,反映出對潛在貿易解決方案的樂觀情緒重新湧現。

市場領導者中表現最強的是蘋果(+3.41%)、特斯拉(+4.60%)和Meta平台(+3.22%),都明顯優於大盤。亞馬遜(+3.50%)和Alphabet(+2.57%)也大幅上漲。十大公司中相對表現較弱的是微軟(+2.14%)和輝達(+2.04%),但兩者仍有意義的上漲。跨產業和商業模式的強勁表現暗示對更廣泛增長前景的信心重新增強,而非由特定類股催化劑驅動今日的市場行動。

檢視趨勢模式,儘管今日有所上漲,大多數大型公司在目前、一週和一個月時間框架內仍顯示負面趨勢,反映出近期市場下跌造成的顯著技術性損害。值得注意的是,波克夏海瑟威表現出更具建設性的模式,顯示當前讀數正面,並在較長期視圖中呈現出強勢。這種差異突顯了波克夏多元化業務模式和大量現金儲備在市場不確定時期的價值,這些特性在近期波動中越來越受到投資者重視。

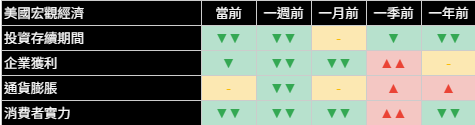

經濟指標

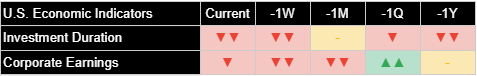

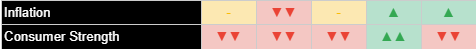

經濟指標呈現混合表現,一些指標在近期惡化後開始穩定。投資期限在各時間框架內仍面臨挑戰,但今日市場行動顯示期限偏好有早期改善跡象。這個潛在的轉折點可能標誌著對長期經濟增長前景更感舒適的開始,儘管對這種轉變持久性的不確定性仍然相當大。

公司獲利指標在單日內時間框架表現出正面走勢,反映近期穩健的獲利報告,或許表明市場對貿易緊張局勢對獲利影響的擔憂可能有些過度。一季度角度保持正面,強調了近期政策不確定性出現前,普遍健康的企業環境。消費者信心在多數時間框架內顯示持續疲弱,暗示儘管今日市場樂觀,但對貿易動態如何影響家庭支出模式的持續擔憂。

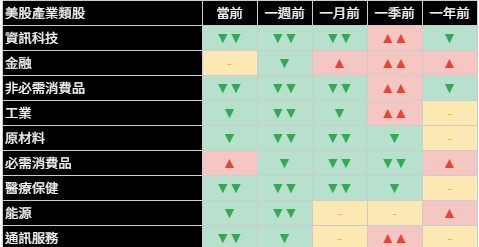

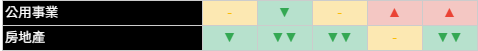

類股概況

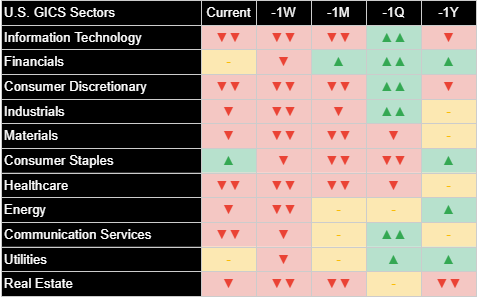

週二的交易中,標普500指數所有十一個類股均呈現正面表現,但漲幅差異顯著。金融類股領漲,上升+3.31%,可能受益於殖利率曲線陡峭化和市場活動增加帶來的交易收入預期提升。非必需消費品(+3.16%)和資訊科技(+2.46%)也表現強勁,反映出對消費支出和科技需求的樂觀情緒重新湧現。

防禦型類股相對落後但仍有意義的上漲,其中必需消費品(+1.42%)和房地產(+1.83%)漲幅最小。這種表現模式代表了對週一交易的反轉,當時防禦型類股在更廣泛的市場疲弱中展現出相對韌性。能源類股上漲+2.55%,因全球經濟增長前景改善帶動油價反彈,而通信服務上漲+2.61%,受益於對廣告和媒體支出預期的改善。

儘管今日有所上漲,大多數類股在目前、一週和一個月時間框架內的趨勢模式仍普遍呈現負面。然而,必需消費品在多個時間框架中展現出更具建設性的模式,從一週和一個月的角度來看,可見正面走勢。防禦型類股的韌性與更廣泛市場的技術性挑戰之間的這種差異暗示,儘管今日出現反彈,投資者仍保持謹慎。接下來幾個交易日將對確定這次反彈是否代表可持續復甦的開始或僅僅是持續調整中的技術性反彈至關重要。

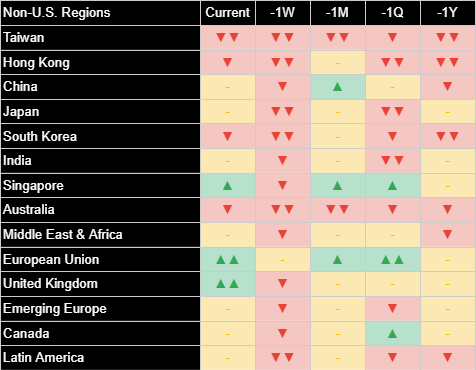

國際市場

週二全球市場展現出驚人的強勢,特別是那些最受美中貿易動態影響的地區漲幅尤為顯著。中國市場表現突出,MSCI中國指數上漲+3.06%,反映投資者對潛在貿易緩和的樂觀情緒。香港展現類似強勢,上漲+2.01%。這些處於貿易緊張局勢中心的市場的積極表現暗示投資者看到了在財政部長貝森特言論後改善關係的真實潛力。

歐洲市場展現廣泛強勢,歐盟指數上漲+2.06%,英國上漲+2.11%。這種積極表現暗示潛在貿易緩和的益處延伸至直接相關方之外,投資者預期在更少限制的貿易環境中全球增長前景將改善。日本上漲+1.99%,韓國上漲+1.04%,兩者都受益於對全球貿易流動的重要敞口和區域經濟狀況潛在改善。

新興市場表現出特別強勢,拉丁美洲大漲+2.91%,印度上漲+0.94%。這些強勁表現暗示投資者隨著風險偏好改善正在回歸高成長市場,雖然印度相對其他新興地區較為溫和的漲幅可能反映其對美中貿易動態的相對隔離位置。國際市場強勢的這種更廣泛模式強化了貿易政策發展代表真正的全球關切而非僅僅是美國和中國之間雙邊問題的敘述。

其他資產

跨資產市場顯示出投資者情緒的明顯轉變,傳統避險資產隨著風險偏好改善而回撤。黃金從前一交易日創下的紀錄高點下跌-1.42%,反映出在成長預期改善的環境下,對傳統避險資產的需求減少。比特幣上漲+4.75%,延續近期強勢,可能同時受益於風險情緒改善和其日益被認可的替代價值儲存角色。

美國國債價格相對穩定,殖利率曲線各段僅有溫和變動。20年期以上國債上漲+0.56%,7-10年期債券上漲+0.07%,1-3年期國債指數上漲+0.04%。固定收益市場的這種相對穩定性暗示投資者正謹慎評估潛在貿易緩和的影響,對利率預期的即時影響有限。殖利率曲線溫和陡峭化可能反映出略微改善的增長預期,與貨幣政策方向的持續不確定性相平衡。

美元指數隨著投資者重新評估經濟前景而略有走強,而商品複合體呈現廣泛強勢。原油上漲+1.09%,因全球增長擔憂緩和;工業金屬上漲+1.63%,因製造業預期改善;農產品上漲+1.31%,因全球貿易流動前景改善。各類商品類別的這種同步強勢暗示對成長前景的廣泛重新評估,而非類別特定因素驅動價格行動。

總結來說,今日市場走勢反映出投資者情緒因美中貿易緊張局勢可能緩和而顯著轉變。雖然財政部長貝森特的言論為反彈提供了重要催化劑,但他警告談判將是「艱難的」,暗示投資者應對有意義的貿易解決方案時間表保持現實預期。國內外市場的強烈正面反應凸顯出貿易不確定性對情緒的顯著影響,如果出現具體進展,則有進一步上漲的潛力。然而,多個時間框架中持續的負面趨勢模式暗示,雖然今日的反彈令人鼓舞,但它只是在可能需要更持續復甦以完全修復近期技術性損害過程中的一步。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Rebound Sharply on Potential US-China Trade De-escalation Following Treasury Secretary's Comments

Dow Surges Over 1,000 Points as Bessent Signals Possible Path Forward in Trade Negotiations

Joe Lu, CFA April 22, 2025

MARKET OVERVIEW

Markets staged an impressive rebound on Tuesday as comments from Treasury Secretary Scott Bessent regarding potential de-escalation in US-China trade tensions sparked renewed investor optimism. The positive sentiment represented a dramatic shift from Monday's steep selloff, with major indices reclaiming nearly all ground lost in the previous session as investors reassessed the trajectory of trade policy and its potential impact on the global economy.

The Dow Jones Industrial Average surged +2.66% (+1,016.57 points) to close at 39,186.98, while the S&P 500 jumped +2.51% (+129.56 points) to 5,287.76. The Nasdaq Composite gained +2.71% (+429.52 points) to end at 16,300.42, and the Russell 2000 advanced +2.59% as smaller companies participated fully in the broad-based rally. The rebound ended a four-day losing streak for the major indices and represented the strongest single-day gain since early January, reflecting renewed investor confidence after days of heightened uncertainty.

Today's market surge was primarily driven by Bessent's remarks to investors at a JPMorgan conference that "there will be a de-escalation" in trade tensions with China. The Treasury Secretary described the current situation as a "two-way embargo" that neither side views as sustainable, suggesting the administration recognizes the economic costs of prolonged trade hostilities. While Bessent cautioned that negotiations would be "a slog" and could take considerable time to produce meaningful results, his assertion that the administration does not seek economic decoupling from China provided much-needed clarity about policy direction. The market's strong positive reaction indicates how significantly trade uncertainty has weighed on investor sentiment in recent weeks and suggests potential for further gains if concrete progress materializes in US-China relations.

Executive Summary:

- Major indices staged impressive recovery with Dow Jones climbing 1,016.57 points (+2.66%) following Treasury Secretary's remarks about potential de-escalation with China

- All eleven S&P 500 segments posted gains, led by Financials (+3.31%), Consumer Discretionary (+3.16%), and Information Technology (+2.46%)

- Chinese markets surged in response, with MSCI China gaining +3.06% as investors anticipate improved trade relations

- Treasury Secretary Bessent's comments that "there will be a de-escalation" in US-China trade tensions served as catalyst for broad market recovery

- Financial segment showed significant strength with daily improvement both in absolute terms and relative to broader market

BROAD MARKET INDICES

Major indices recorded substantial gains across the board, with performance consistency throughout large, mid, and small-cap segments of the market. The Dow Jones Industrial Average's +2.66% advance marked its strongest single-day performance of 2025, with all 30 components closing in positive territory. The S&P 500's +2.60% gain reflected broad-based buying across segments and market capitalizations, with trading volumes approximately 15% above average levels.

The Nasdaq Composite's +2.63% rise demonstrated particularly strong recovery momentum in technology stocks, which had been disproportionately affected during recent market weakness. The Philadelphia Semiconductor Index advanced +2.17%, regaining some ground after experiencing severe pressure in previous sessions. The Russell 2000 small-cap index climbed +2.59%, closely tracking large-cap performance and suggesting investors are growing more confident about economic prospects across the entire market spectrum rather than seeking refuge solely in larger companies.

Despite today's strong performance, trend patterns across all major indices remain concerning, with negative readings still present across current, one-week, and one-month timeframes. This persistent pattern of weakness suggests that while today's rally is encouraging, it represents just one step in what may need to be a more sustained recovery to reverse the technical damage inflicted during the recent market turbulence. The contrast between short-term negative trends and positive one-quarter readings highlights the sudden shift in market sentiment that has occurred since the April 2nd tariff announcements, with investors now looking for signs of policy stability to regain confidence in longer-term growth prospects.

TOP 10 U.S. COMPANIES

The largest U.S. companies participated fully in today's rally, with all ten largest stocks posting significant gains. This broad strength among market leaders helped propel major indices higher and suggests institutional investors are beginning to redeploy capital after recent defensive positioning. Several companies with significant Chinese exposure outperformed the broader market, reflecting renewed optimism about potential trade resolution.

The strongest performers among market leaders were Apple (+3.41%), Tesla (+4.60%), and Meta Platforms (+3.22%), all significantly outperforming the broader market. Amazon (+3.50%) and Alphabet (+2.57%) also recorded substantial gains. The relative underperformers among the top ten were Microsoft (+2.14%) and NVIDIA (+2.04%), though both still posted meaningful advances. The strong performance across various sectors and business models suggests renewed confidence in the broader growth outlook rather than segment-specific catalysts driving today's market action.

Examining trend patterns, most of the largest companies continue to show negative trends across current, one-week, and one-month timeframes despite today's gains, reflecting the significant technical damage inflicted during the recent market downturn. Notably, Berkshire Hathaway stands out with more constructive patterns, showing positive current readings and strength visible in longer-term views. This divergence highlights the value of Berkshire's diversified business model and substantial cash reserves during uncertain market periods, characteristics that investors have increasingly valued amid recent volatility.

ECONOMIC INDICATORS

Economic measures showed mixed performance, with some indicators beginning to stabilize after recent deterioration. Investment duration remains challenged across various timeframes, though today's market action suggests some early signs of improvement in duration preferences. This potential inflection point could signal the beginning of greater comfort with longer-term economic growth prospects, though considerable uncertainty remains about the durability of this shift.

Corporate earnings measures have shown positive movement in the daily timeframe, reflecting recent solid earnings reports and perhaps indicating that market concerns about earnings impacts from trade tensions may have been somewhat overdone. The one-quarter view remains positive, underscoring the generally healthy corporate environment that existed before recent policy uncertainties emerged. Consumer strength shows persistent weakness across most timeframes, suggesting ongoing concern about how trade dynamics might affect household spending patterns despite today's market optimism.

SECTOR OVERVIEW

Tuesday's trading session saw positive performance across all eleven S&P 500 segments, with substantial divergence in the magnitude of gains. Financials led the advance with a gain of +3.31%, potentially benefiting from the steepening yield curve and expectations for improved trading revenue amid increased market activity. Consumer Discretionary (+3.16%) and Information Technology (+2.46%) also posted strong performances, reflecting renewed optimism about consumer spending and technology demand.

The more defensive segments lagged somewhat but still posted meaningful gains, with Consumer Staples (+1.42%) and Real Estate (+1.83%) recording the smallest advances. This performance pattern represents a reversal from Monday's session, when defensive segments demonstrated relative resilience amid broader market weakness. Energy gained +2.55% as oil prices rebounded on improved global growth prospects, while Communication Services advanced +2.61% on renewed advertising and media spending expectations.

Segment trends continue to show broadly negative patterns across most segments in current, one-week, and one-month timeframes despite today's gains. However, Consumer Staples demonstrates more constructive patterns across multiple timeframes, with positive one-week and one-month views visible. This divergence between defensive segment resilience and the broader market's technical challenges suggests continued caution among investors despite today's rally. The next several trading sessions will be critical in determining whether this rebound represents the beginning of a sustainable recovery or merely a technical bounce within an ongoing correction.

INTERNATIONAL MARKETS

Global markets showed remarkable strength on Tuesday, with particularly impressive gains in regions most exposed to US-China trade dynamics. Chinese markets stood out with MSCI China advancing +3.06%, reflecting investor optimism about potential trade de-escalation. Hong Kong showed similar strength with a gain of +2.01%. These positive performances in markets at the epicenter of trade tensions suggest investors see genuine potential for improved relations following Treasury Secretary Bessent's comments.

European markets demonstrated broad strength, with the European Union index gaining +2.06% and the United Kingdom advancing +2.11%. This positive performance suggests the benefits of potential trade de-escalation extend beyond the directly involved parties, with investors anticipating improved global growth prospects in a less restrictive trade environment. Japan gained +1.99% and South Korea advanced +1.04%, both benefiting from their significant exposure to global trade flows and potential improvement in regional economic conditions.

Emerging markets showed particular strength, with Latin America surging +2.91% and India gaining +0.94%. These robust performances suggest investors are returning to higher-growth markets as risk appetite improves, though the relatively modest gain in India compared to other emerging regions may reflect its somewhat insulated position from US-China trade dynamics. This broader pattern of international market strength reinforces the narrative that trade policy developments represent a truly global concern rather than merely a bilateral issue between the United States and China.

OTHER ASSETS

The cross-asset landscape revealed a marked shift in investor sentiment, with traditional safe havens retreating as risk appetite improved. Gold declined -1.42% from its record high set in the previous session, reflecting reduced demand for traditional safe havens amid improved growth expectations. Bitcoin gained +4.75%, continuing its recent strength and potentially benefiting from both improved risk sentiment and its increasingly recognized role as an alternative store of value.

Treasury prices were relatively stable, with only modest movement across the curve. The 20+ year Treasury bond segment gained +0.56%, the 7-10 year segment rose +0.07%, and the 1-3 year Treasury segment increased +0.04%. This relative stability in fixed income markets suggests investors are cautiously assessing the implications of potential trade de-escalation, with limited immediate impact on interest rate expectations. The modest curve steepening likely reflects slightly improved growth expectations balanced against ongoing uncertainty about monetary policy direction.

The U.S. Dollar Index strengthened slightly as investors reassessed the economic outlook, while the commodity complex showed broad strength. Crude oil gained +1.09% as global growth concerns moderated, industrial metals advanced +1.63% on improved manufacturing expectations, and agricultural commodities rose +1.31% amid better sentiment about global trade flows. This synchronized strength across various commodity categories suggests a broad-based reassessment of growth prospects rather than segment-specific factors driving price action.

In summary, today's market movements reflect a significant shift in investor sentiment driven by potential de-escalation in US-China trade tensions. While Treasury Secretary Bessent's comments provided an important catalyst for the rally, his cautionary note that negotiations would be "a slog" suggests investors should maintain realistic expectations about the timeline for meaningful trade resolution. The strong positive reaction across both domestic and international markets underscores how significantly trade uncertainty has weighed on sentiment, with the potential for further gains if concrete progress materializes. However, the persistent negative trend patterns across multiple timeframes suggest today's rally, while encouraging, represents just one step in what may need to be a more sustained recovery to fully repair recent technical damage.