【Joe’s華爾街脈動】周報:技術性反彈面臨聯準會考驗,市場靜待政策明朗化

繼上週市場波動性上漲後,分歧與數據將影響市場趨勢

Joe Lu, CFA 2025年5月9日 美東時間

本新聞通訊僅供參考,不構成任何投資建議或買賣任何證券或資產類別的推薦。文中所表達的觀點為作者截至發布日期為止的觀點,並可能隨時更改,恕不另行通知。所呈現的資訊係基於從據信可靠來源獲得的數據,但其準確性、完整性和及時性不作保證。過往表現不代表未來結果。投資涉及風險,包括可能損失本金。讀者在做出任何投資決定前,應諮詢自己的財務顧問。作者及相關實體可能持有本文所討論資產或資產類別的部位。

一周市場觀點

美國股市上週設法上揚,標普500指數上漲+1.05%,那斯達克綜合指數則上漲+1.31%。儘管這些漲幅反映了市場在強勁的四月份就業報告推助下,部分消化了先前因關稅引發的波動,但它們仍發生在既有的負面技術趨勢框架內。我們仍認為,這些潛在的負面趨勢仍是主要的技術考量因素,並將受到下週將公布的關鍵經濟數據和美國聯準會溝通的嚴峻考驗。市場目前正處於一個轉捩點,必須果斷突破阻力以確認新的正向軌跡,否則先前的謹慎立場將重新確立。

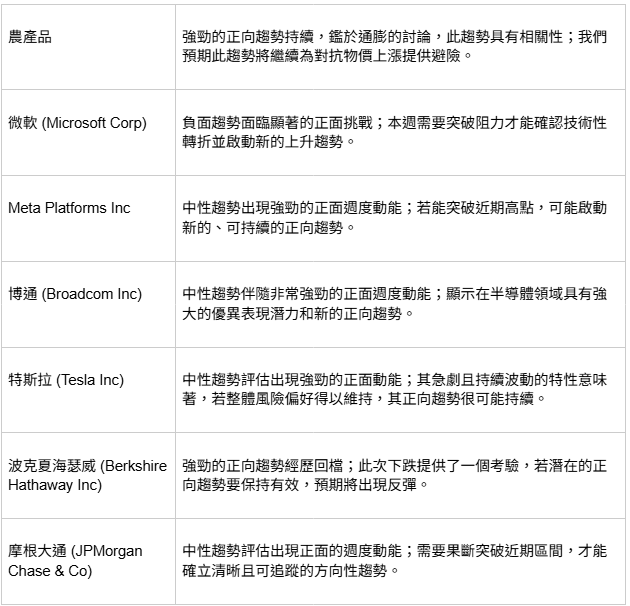

上週我們焦點列表中主要美國企業的表現,反映了這種選擇性的市場環境。微軟 (Microsoft Corp) (+3.13%) 和特斯拉 (Tesla Inc) (+6.32%) 等關鍵成長股的顯著漲幅表明,即使在普遍的不確定性中,特定機會依然存在。然而,持續的企業財報內容,日益受到關稅衝擊擔憂的影響,突顯了企業所面臨的不利因素,而明確的前瞻性指引對於個股趨勢能否確立信心至關重要。

我們對基本經濟狀況的評估顯示經濟循環週期已進入後期。極為負面的投資存續期間展望和負面的企業獲利預期,皆發出顯著的謹慎訊號。相較於正面的通膨壓力及中性的消費者信心,此格局強化了經濟正處於成長放緩伴隨持續通膨的艱難階段的點觀。我們預期,消費者支出模式(尤其是在任何因關稅引發的提前採購之後)以及關稅相關成本的實際轉嫁程度,將是未來幾個月影響經濟動能和市場趨勢的關鍵因素。

上週美國各類股的表現提供了重要訊號。公用事業 (+1.40%) 等防禦型類股的相對強勢,證實了投資者持續的謹慎態度。儘管資訊科技 (+2.16%) 和工業 (+2.95%) 類股錄得上漲,但它們能否確立相對於防禦型領域的持續領先地位,將是判斷持久的風險偏好轉變是否正在發生的關鍵指標。我們預期,真正的市場信心將透過果斷且廣泛地轉動至週期性類股來展現,而此現象尚未持續出現。

國際股市上週表現迥異,歐洲股市 (+1.98%) 和日本股市 (+1.18%) 持續展現正向趨勢特性,表明若美國市場不確定性持續,它們或可提供更穩定的回報潛力。中國股市 (+3.22%) 上週表現強勁,但必須克服其整體的負面趨勢。關鍵的跨資產訊號需要密切監控:美元指數走強 (+0.33%),若此趨勢持續,將對國際市場回報和大宗商品價格構成壓力。WTI原油(透過USO追蹤)相對於其負面趨勢的表現 (+3.24%),以及黃金的上漲 (+3.15%) 和比特幣的反彈 (+6.75%),本週將受到全球風險偏好和通膨預期轉變的考驗。

一周重點摘要

- 繼上週小幅上漲(標普500指數 +1.05%)後,美國股市本週將面臨關鍵考驗,近期的反彈行情能否克服普遍的負面技術趨勢,抑或在即將公布的關鍵經濟數據和美國聯準會評論下確認其持續性,將見分曉。

- 上週債券市場的強勁表現顯示市場對投資存續期間的情緒發生轉變;本週的聯邦公開市場委員會(FOMC)會議對於確認或挑戰市場目前對政策路徑的解讀至關重要。

- 上週觀察到的顯著跨資產分歧——特別是美元走強(+0.33%)伴隨股市的正向表現,以及大宗商品(WTI原油 +3.24%,黃金 +3.15%)走勢迥異——表明市場存在潛在複雜性,需要仔細釐清以確立明確的方向性偏好。

- 本週我們的焦點列表調整,包括新增資訊科技類股和標普500指數等,反映了技術性考驗在即的領域,而移除印度股市和原油避險部位則突顯了趨勢清晰度的轉變。

- 展望未來,我們預期即將公布的通膨(CPI)和零售銷售數據,加上聯準會明確的政策訊號,將對形塑市場趨勢以及判斷上週暫時的風險偏好行為能否獲得可持續的動能具有決定性作用。

本週焦點

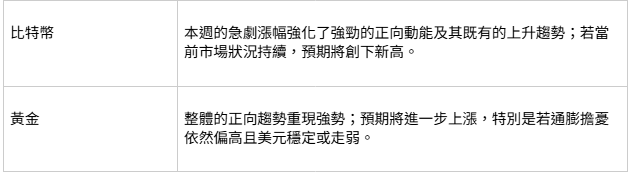

本週,我們的焦點集中在黃金和比特幣,因為在持續的關稅衝擊和全球尋求美元替代方案的背景下,它們的技術型態為市場對美國聯準會潛在的流動性操作提供了重要洞見。即使沒有明確的降息,任何市場對為抵禦衰退訊號而採取的「隱形量化寬鬆」的解讀,都可能助長通膨預期。這樣的環境幾乎肯定有利於黃金等傳統通膨避險工具以及比特幣等替代價值儲存工具,從而強化其既有或新興的正向趨勢。

從我們的角度來看,黃金(上週上漲+3.15%)已重現強勢,守穩於關鍵支撐之上,並與其整體的正向趨勢一致。我們預期,果斷突破近期阻力將確認此既有上升趨勢的持續,特別是在地緣政治緊張局勢提供支撐背景,且據稱主權實體持續將儲備多元化的情況下。比特幣(上週反彈+6.75%)已展現強勁的重新向上動能,果斷推升其價格並確認其強勁的正向趨勢。我們預測,若能在強勁交易量的配合下持續突破近期高點,將顯示其上升趨勢的強力延續,既反映了在有利流動性環境下對風險資產的偏好,也體現了其作為非主權價值儲存工具的吸引力。

展望未來,黃金和比特幣既有的正向趨勢預計將持續,並對本週即將公布的通膨數據以及市場對美國聯準會政策訊號的解讀高度敏感。若經濟數據和聯準會的評論強化了對持續通膨壓力伴隨寬鬆流動性背景的預期,這兩種資產都處於有利地位,可望延續技術性強勢。儘管任何出乎意料的鷹派訊號都可能帶來短期波動,但黃金和比特幣的潛在技術面和主題性支撐表明,其正向趨勢很可能持續。因此,黃金維持其上升軌跡以及比特幣創下新高,是我們預期觀察的關鍵技術確認。

焦點列表重點

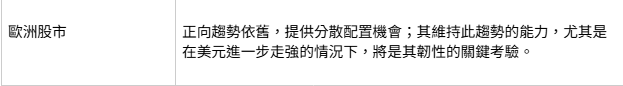

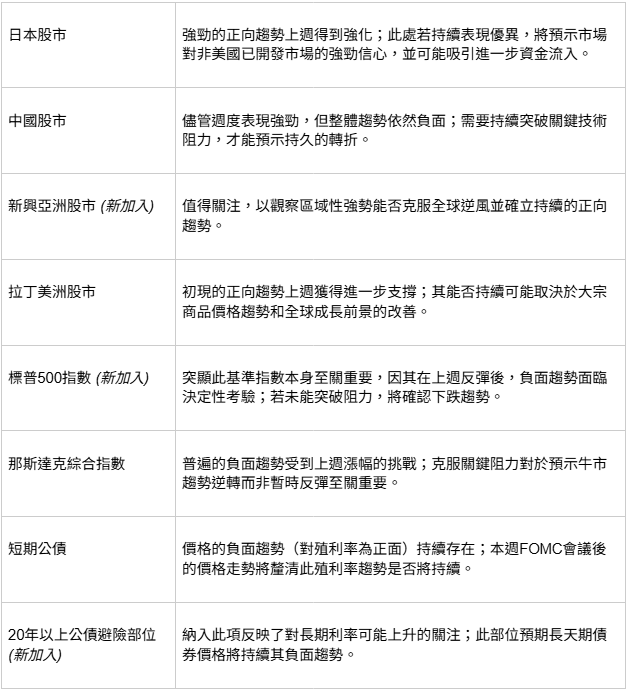

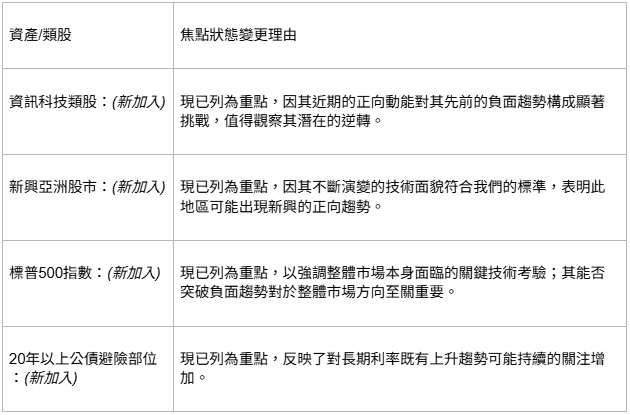

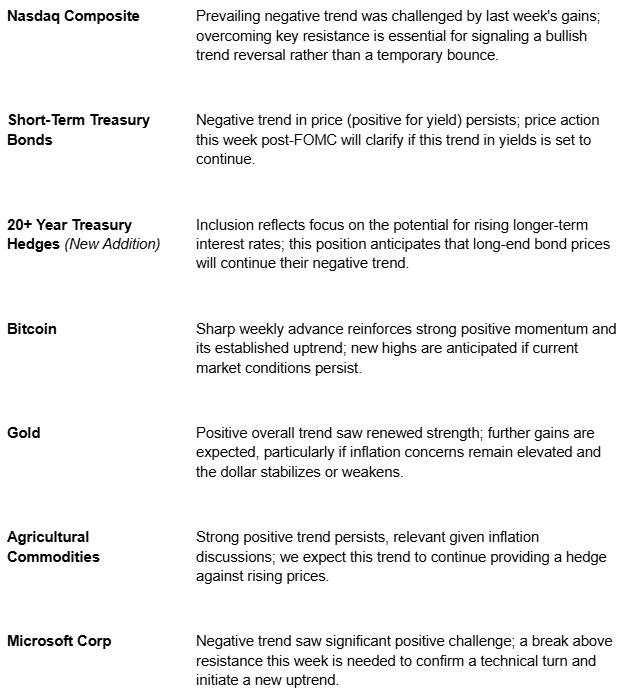

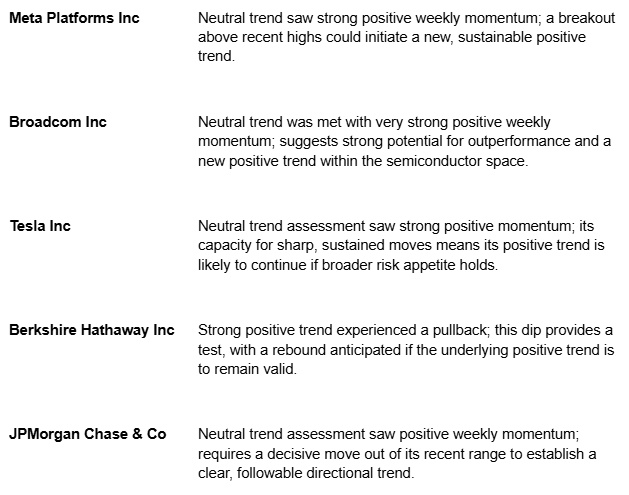

本週的焦點列表突顯了那些在上週的技術發展後,為近期前景設定了有趣情境的資產。下表概述了這些關鍵領域:

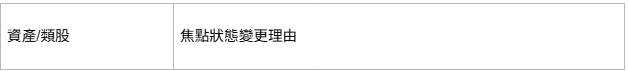

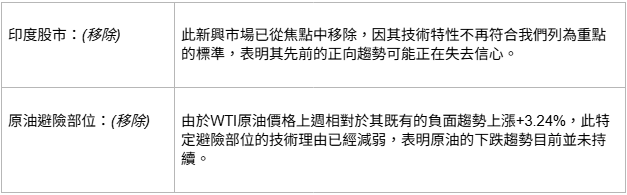

焦點列表調整

根據我們對不斷演變的技術訊號的評估,並比較重點資產(E欄中模型百分比 > 0者)與前一週的資產,本週焦點列表作出以下調整:

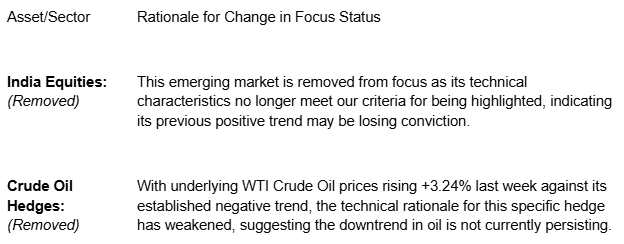

本週移除資產:

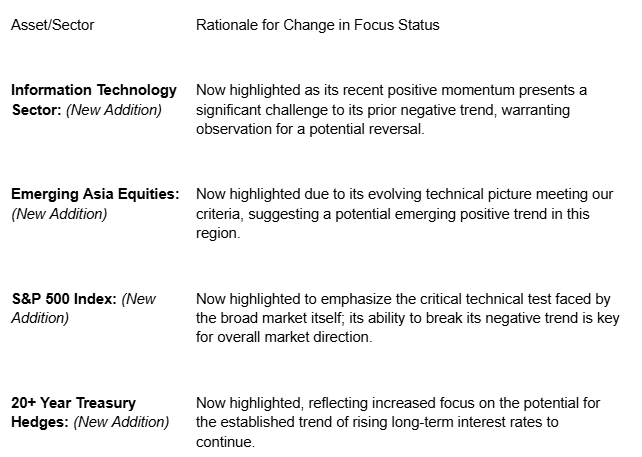

本週新增資產:

繼上週美國聯準會對關稅衝擊和成長擔憂的評論嚴重影響市場情緒後,我們未來一週的焦點將完全轉向美國貿易政策、即將公布的關鍵經濟數據以及聯準會不斷演變的反應之間的相互作用。我們預期,任何關於貿易的新發展或言論都將受到高度審視,特別是考慮到官方警告稱關稅可能加劇通膨並阻礙成長。「依賴數據」的聯準會將密切關注消費者韌性能否在謹慎的商業情緒下得以持續的跡象。

技術面上,主要美股指數仍處於既有的負面趨勢。上週的漲幅雖然顯著,但並未突破這些趨勢,更多的是對上方阻力的測試。本週的關鍵問題是,市場能否在此次反彈的基礎上建立可持續的正向趨勢,或者賣壓是否會重現,從而確認先前下跌趨勢的主導地位。持續的債務上限談判很可能成為一個日益重要的因素,隨著財政部長Bessent七月中旬的最後期限臨近,其可能為市場注入相當大的波動性。

我們將密切監控本週的關鍵經濟數據發布,特別是週二的四月份消費者物價指數(CPI)和週四的四月份零售銷售數據。這些報告對於形塑通膨預期和評估真實的消費者力道至關重要,可能驗證或反駁停滯性通膨的擔憂。市場領漲力道也將是一個關鍵的風向球:若持續轉動至週期性類股,將代表投資者信心增強以及負面趨勢可能出現突破;反之,若市場重新偏好防禦型類股,則表明謹慎情緒持續且趨勢將延續。任何來自美國聯準會官員的進一步評論都將至關重要,因為我們試圖解讀貨幣政策的可能路徑。我們預期,關鍵跨資產分歧——例如強勢美元相對於國際股市表現,以及大宗商品價格相對於成長預期的走勢——的解決,將為未來市場方向和趨勢持續性提供重要線索。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。 Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。 Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Poised for Policy Clarity as Technical Rebound Faces Fed Test

Divergences and Data to Shape Market Trends Following Last Week's Volatile Gains

Joe Lu, CFA May 9, 2025

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

MARKET PERSPECTIVE

U.S. equity markets managed to advance last week, with the S&P 500 Index gaining +1.05% and the Nasdaq Composite adding +1.31%. While these gains reflect some absorption of earlier tariff-induced volatility, facilitated by a strong April jobs report, they occurred within the framework of established negative technical trends. We maintain that these underlying negative trends remain the dominant technical consideration and will be significantly tested by the crucial economic data and Federal Reserve communications scheduled for the upcoming week. The market is now at a juncture where it must either confirm a new positive trajectory by decisively breaking resistance or see the prior cautionary stance reasserted.

Performance among prominent U.S. companies on our Focus List last week was indicative of this selective environment. Notable gains in key growth names like Microsoft Corp (+3.13%) and Tesla Inc (+6.32%) suggest that specific opportunities persist even amidst broader uncertainty. However, the ongoing corporate earnings narrative, increasingly colored by concerns over tariff impacts, underscores the headwinds companies face, and clear forward guidance will be essential for individual stock trends to emerge with conviction.

Our assessment of underlying economic conditions points to a late-cycle environment. The strongly negative Investment Duration outlook and negative Corporate Earnings expectations signal significant caution. Juxtaposed with positive Inflation pressure and neutral Consumer Strength, this configuration reinforces the view that the economy is navigating the challenging phase of slowing growth alongside persistent inflation. We anticipate that consumer spending patterns, especially following any tariff-driven front-loading, and the actual pass-through of tariff-related costs will be critical factors influencing economic momentum and market trends in the coming months.

U.S. sector performance last week provided important signals. The relative strength of defensive sectors like Utilities (+1.40%) confirms ongoing investor caution. While Information Technology (+2.16%) and Industrials (+2.95%) posted gains, their ability to establish sustained leadership over defensive areas will be a key indicator of whether a durable risk-on shift is underway. We expect true market conviction to be revealed by a decisive and broad rotation into cyclical sectors, which has yet to materialize with persistence.

International equity markets showed varied results last week, with Europe Equities (+1.98%) and Japan Equities (+1.18%) continuing to exhibit positive trend characteristics, suggesting they may offer more stable return potential if U.S. market uncertainty continues. China Equities (+3.22%) had a strong week but must overcome its negative overall trend. Critical cross-asset signals require close monitoring: the U.S. Dollar Index strengthened (+0.33%), which, if persistent, will act as a headwind for international returns and commodity prices. The behavior of WTI Crude Oil (+3.24% via USO) against its negative trend, alongside Gold's gain (+3.15%) and Bitcoin's rally (+6.75%), will be tested by shifts in global risk appetite and inflation expectations this week.

EXECUTIVE SUMMARY

- Following last week's modest gains (S&P 500 +1.05%), U.S. equity markets are positioned for a critical test this week, where the recent rebound will either overcome prevailing negative technical trends or confirm their persistence against key upcoming economic data and Federal Reserve commentary.

- The bond market's strong performance last week indicated a shift in sentiment regarding investment duration; this week's FOMC meeting is set to be pivotal in affirming or challenging the market's current interpretation of the policy path.

- Significant cross-asset divergences observed last week—notably a stronger U.S. Dollar (+0.33%) alongside positive equity performance, and disparate moves in commodities (WTI Crude Oil +3.24%, Gold +3.15%)—signal underlying market complexities that require careful resolution to establish a clear directional bias.

- Our Focus List adjustments this week, including additions like Information Technology and the S&P 500 Index, reflect areas where technical tests are imminent, while the removal of India Equities and Crude Oil Hedges underscores shifts in trend clarity.

- Looking ahead, we anticipate that upcoming inflation (CPI) and retail sales data, together with explicit Fed policy signals, will be decisive in shaping market trends and determining if last week's tentative risk-on behavior can gain sustainable traction.

HIGHLIGHT OF THE WEEK

This week, our highlight focuses on Gold and Bitcoin, as their technical postures offer significant insights into market reactions to perceived Federal Reserve liquidity operations amidst ongoing tariff impacts and a global search for U.S. dollar alternatives. Even without explicit rate cuts, any market perception of "stealth QE" to counteract recessionary signals is likely to fuel inflationary expectations. Such an environment will almost certainly benefit traditional inflation hedges like Gold and alternative stores of value like Bitcoin, reinforcing their existing or emerging positive trends.

From our perspective, Gold (which gained +3.15% last week) has shown renewed strength, holding above critical support and aligning with its positive overall trend. We anticipate that a decisive move through near-term resistance will confirm the continuation of this established uptrend, especially as geopolitical tensions provide a supportive backdrop and sovereign entities reportedly continue to diversify reserves. Bitcoin (which rallied +6.75% last week) has demonstrated strong renewed upward momentum, decisively pushing its price and confirming its strong positive trend. We expect a sustained breakout above recent highs, should it occur on robust volume, to signal a powerful continuation of its uptrend, reflecting both an appetite for risk assets in a supportive liquidity environment and its appeal as a non-sovereign store of value.

Looking ahead, the established positive trends in Gold and Bitcoin are expected to persist and will be highly sensitive to upcoming inflation data and the market's interpretation of Federal Reserve policy signals this week. Should economic data and Fed commentary reinforce expectations of sustained inflationary pressures combined with an accommodative liquidity backdrop, both assets are well-positioned for continued technical strength. While any unexpectedly hawkish signals could introduce short-term volatility, the underlying technical and thematic supports for Gold and Bitcoin suggest their positive trends are likely to endure. Therefore, Gold maintaining its upward trajectory and Bitcoin achieving new highs are key technical confirmations we anticipate.

FOCUS LIST HIGHLIGHTS

This week's Focus List highlights assets where last week's technical developments set up interesting scenarios for the near future. The table below outlines these key areas:

FOCUS LIST ADJUSTMENTS

Based on our evaluation of evolving technical signals and comparing highlighted assets (those with Model % > 0 in Column E) with those from the prior week, the following adjustments are made to the Focus List this week:

Assets Removed This Week:

Assets Added This Week:

LOOKING AHEAD

Following a week where Federal Reserve commentary on tariff impacts and growth concerns heavily influenced sentiment, our focus for the upcoming week shifts squarely to the interplay between U.S. trade policy, critical upcoming economic data, and the Fed's evolving reaction function. We anticipate that any new developments or rhetoric on trade will be highly scrutinized, particularly given official warnings that tariffs could stoke inflation and impede growth. The "data-dependent" Fed will be closely watching for signs of whether consumer resilience can be sustained against cautious business sentiment.

Technically, major U.S. indices remain in established negative trends. Last week's gains, while notable, did not break these trends and served more as a test of overhead resistance. The critical question for this week is whether markets can build on that rebound to forge a sustainable positive trend or if selling pressure will resume, confirming the dominance of the prior downtrends. The ongoing debt limit negotiations will likely become an increasingly significant factor, with the potential to inject considerable volatility as Treasury Secretary Bessent's mid-July deadline approaches.

We will be intensely monitoring this week's key economic releases, particularly Tuesday's April Consumer Price Index (CPI) and Thursday's April Retail Sales data. These reports will be pivotal in shaping inflation expectations and assessing true consumer strength, potentially validating or refuting stagflationary concerns. Market leadership will also be a key tell: a sustained rotation towards cyclical sectors would signal growing investor conviction and a potential break of negative trends, whereas a renewed preference for defensives would indicate persistent caution and trend continuation. Any further commentary from Federal Reserve officials will be paramount as we attempt to decipher the likely path of monetary policy. We expect the resolution of key cross-asset divergences—such as the strong Dollar versus international equity performance, and commodity price movements relative to growth expectations—to provide important clues regarding future market direction and trend persistence.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)