【Joe’s華爾街脈動】美中關稅休兵點燃創紀錄漲勢,但警報完全解除了嗎?

美中緊張降溫,點燃強勁反彈;科技類股強勢回歸

Joe Lu, CFA 2025年5月12日 美東時間

市場概況

美國股市週一經歷了關鍵性的一日行情,主要指數飆升至兩個多月來的最高水平,此前美中宣布大幅(儘管是暫時性地)調降雙邊關稅。這項具里程碑意義的協議為談判代表們確立了一個為期90天的窗口,以期達成更全面的貿易協議。在此暫緩期間,美國對多數中國進口商品的關稅將從145%大幅削減至30%,而中國則將對美國商品的關稅從125%相應調降至10%的基準水平。如此大幅度的緊張降溫出乎市場意料,並為一直以來應對貿易戰陰霾不斷升級的市場帶來了立即且深遠的寬慰。我們預期未來幾週財政部長Scott Bessent將與其中國代表進行進一步磋商,這對於形塑長期前景至關重要。

市場反應明確看漲。標普500指數飆升+3.30%,果斷收復自三月初以來的高點,並完全抹去了自「解放日」關稅宣布以來的跌幅。道瓊工業平均指數上漲+2.86%,而以科技股為主的那斯達克綜合指數則領漲,飆升+4.07%。以羅素2000指數為代表的小型股亦大漲,漲幅達+3.52%。關稅削減的幅度顯然超出華爾街預期,注入了強勁的樂觀情緒。市場目前反映貿易衝突短期內急劇升溫的可能性已大幅下降,並將此解讀為關稅確實可能作為一種強而有力的談判手段,而非長期固定政策的落實。

此波反彈在大型科技巨擘股中尤為強勁,這些公司先前不成比例地受到貿易戰憂慮的影響。AI晶片領導者輝達 (NVIDIA) (+5.44%)、亞馬遜 (Amazon) (+8.07%)、蘋果 (Apple) (+6.18%) 和特斯拉 (Tesla) (+6.75%) 均錄得可觀漲幅。正面情緒亦蔓延至其他對貿易敏感的類股,汽車股在對未來潛在關稅緩解的預期下亦反彈。儘管市場的立即反應對許多人而言是「夢幻情境」,燃起了對成長正常化和衰退風險降低的希望,但仍有必要保持一定程度的策略性謹慎。這只是一次重大降溫,而非最終的和平條約。美國對中國商品保留的30%關稅仍然相當可觀,而對其他多數國家商品10%的基線關稅在可預見的未來似乎也仍將持續。隨著為期90天的暫緩期將於七月初到期,以及其他眾多國際貿易談判仍在進行中,市場再度出現波動的可能性依然存在。儘管如此,此次暫緩為企業提供了調整和規劃的關鍵窗口,這無疑是一個正面的發展。為今日政策局勢再添一層面的是,川普總統亦簽署了一項旨在降低美國藥價的行政命令。

重點摘要

美股週一急劇飆升,因美中達成里程碑式協議,暫時大幅削減雙邊關稅,釋放大量投資者樂觀情緒,預示貿易戰壓力可能顯著減輕:標普500指數 (+3.30%),道瓊工業平均指數 (+2.86%),那斯達克綜合指數 (+4.07%)。

- 為期90天的關稅暫緩期,將美國對多數中國進口商品的關稅從145%降至30%,中國對美國商品的關稅則從125%降至10%的基準水平,此舉果斷超出預期,提振了廣泛的市場信心。

- 此波反彈的廣度與力道,尤其是在科技巨擘股的表現,指向近期市場特性出現急劇且普遍的改善;我們預期此正向轉變的後續走勢將受到密切關注。

- 儘管此次休兵是極其正面的發展,可能重新設定成長預期,但在七月期限前,未來之路仍需應對剩餘的關稅複雜性及眾多其他國際談判;這是一次緊張降溫,而非最終解決方案。

- 我們預期即將公布的通膨數據(CPI、PPI)和零售銷售數據,對於判斷此次關稅緩解能否轉化為持續的經濟動能和進一步的市場正向趨勢至關重要。

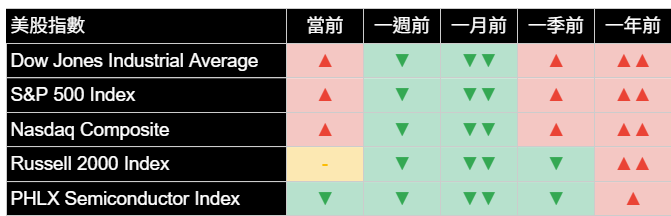

主要市場指數

受美中關稅調降的提振,主要市場指數週一全面大漲,強勁突破近期的盤整格局。標普500指數飆升+3.30%,道瓊工業平均指數躍升+2.86%,那斯達克綜合指數飆漲+4.07%。代表小型股的羅素2000指數亦急劇反彈,上漲+3.52%。此次全面性的強勁上漲,預示著投資者情緒發生顯著且正向的轉變,因對貿易戰加劇的恐懼已大幅消退。我們預期此新浮現的樂觀情緒將受到後續經濟數據的考驗。

費城半導體指數在此波反彈中表現強勁,當日大漲+7.08%。此優異表現表明,關稅消息為這個對經濟敏感且全球互聯的產業帶來了尤為顯著的寬慰,該產業先前已顯現壓力跡象。

從分析角度來看,今日的強勁反彈代表所有主要指數的近期市場特性出現急劇且正向的轉折。我們的分析顯示顯著改善,標普500、道瓊工業平均指數和那斯達克綜合指數的狀況目前在近期看來均屬有利。羅素2000指數的特性已改善至中性。此波普遍性的正向發展值得關注,我們將觀察未來幾個交易日能否出現持續的跟進走勢,以確認先前中期負面評估是否已出現更為持久的逆轉,並有望迎來新的上升趨勢。

美國前十大公司

美國大型企業週一表現普遍強勁且異常亮眼,這些全球性巨擘直接受惠于美中貿易緊張局勢的實質性降溫。全數「七巨頭」股票均錄得驚人漲幅,突顯了它們對全球供應鏈和國際市場情緒的槓桿效應。

觀察個股當日表現:亞馬遜 (Amazon.com Inc) 飆升+8.07%。Meta Platforms Inc 大漲+7.92%。特斯拉 (Tesla Inc) 上漲+6.75%。蘋果 (Apple Inc) 上漲+6.18%。輝達 (NVIDIA Corp) 上揚+5.44%。Alphabet Inc A股 (Alphabet Inc Class A) 上漲+3.74%。微軟 (Microsoft Corp) 上漲+2.40%。博通 (Broadcom Inc) 上漲+6.43%。摩根大通 (JPMorgan Chase & Co) 參與此波普遍反彈,上漲+2.75%。波克夏海瑟威B股 (Berkshire Hathaway Inc Class B) 亦上漲+0.11%。

從底層分析面來看,今日急漲的正向價格走勢已顯著改善多家領先企業的近期市場特性。我們的分析指出,微軟 (Microsoft Corp)、亞馬遜 (Amazon.com Inc)、Meta Platforms Inc、博通 (Broadcom Inc) 和特斯拉 (Tesla Inc) 的狀況目前在近期看來均屬有利。蘋果 (Apple Inc) 和Alphabet Inc A股 (Alphabet Inc Class A) 的狀況則從極為不利改善至中度不利,而輝達 (NVIDIA Corp) 儘管當日漲幅強勁,仍處於中度不利狀態。摩根大通 (JPMorgan Chase & Co) 維持其有利評估,波克夏海瑟威B股 (Berkshire Hathaway Inc Class B) 則維持中性。我們預期,持續的正面市場情緒可能進一步改善這些讀數,儘管部分個股仍需更多證據才能預示從近期的疲弱中完全出現分析性的轉折。

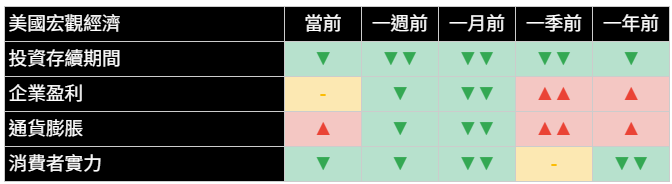

經濟指標

今日市場局勢幾乎完全受到美中關稅調降消息主導,此一事件勢必將產生深遠的經濟影響。此次緊張局勢的降溫本身即構成一項明確且正面的經濟訊號,預料有助於緩解成本壓力、提振商業信心,並降低全球成長預測面臨的下行風險。美國聯準會理事Adriana Kugler的評論強調,較高的關稅通常會帶來負面的供給衝擊,這突顯了此次休兵可能提供的經濟寬慰。市場目前將密切關注通膨軌跡和企業投資意願的轉變。此外,由於美國四月份的關稅收入達到創紀錄的163億美元,目前預期此數字將會放緩。

我們對經濟指標的評估反映出,今日市場衍生的情緒出現急劇的正面轉變。這表明對即時經濟災難的恐懼已顯著降低。受市場情緒改善以及家庭關稅負擔有望減輕的推動,消費者信心展望顯著改善,目前呈現正向。企業獲利展望亦轉為正向,顯示市場預期獲利環境將更為有利。通膨讀數維持中性,意味著儘管關稅引發的即時物價壓力勢將減緩,但潛在的通膨動態仍需密切關注,尤其是在本週即將公布關鍵的CPI和PPI報告之際。我們預期,隨著市場持續消化本次貿易休兵的全面影響,這些指標仍將持續演變調整。

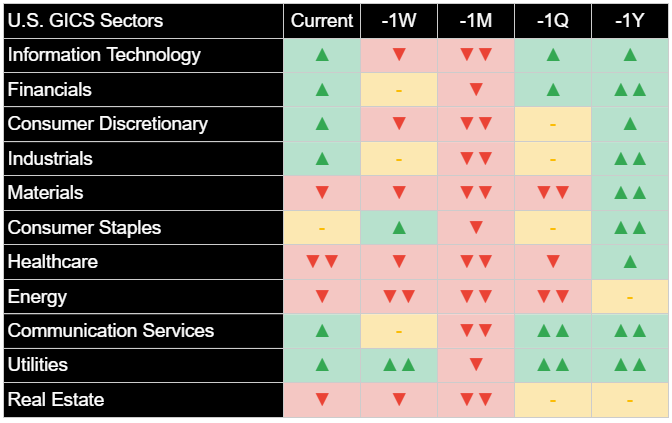

類股概況

標普500指數各類股週一表現普遍強勁且異常亮眼,所有十一個類股均顯著漲幅,因美中關稅休兵點燃了基礎廣泛的市場反彈。在本輪反彈中,通常對國際貿易關係和全球成長前景較為敏感的週期性和成長導向型類股漲勢尤為突出。

資訊科技類股 (+4.73%) 和非必需消費品類股 (+4.97%) 表現突出,直接受惠於貿易戰憂慮的消散以及其大型成分股的強勁反彈。通訊服務類股 (+2.08%)、工業類股 (+3.08%) 和原物料類股 (+2.32%) 亦錄得非常強勁的漲幅,反映出對全球經濟活動的樂觀情緒重燃。金融類股 (+2.03%) 穩健上揚。即使是傳統的防禦型類股也強勁參與此波風險偏好浪潮:房地產類股 (+1.08%)、必需消費品類股 (+0.15%) 和醫療保健類股 (+2.47%) 均上漲。能源類股 (+2.61%) 亦隨油價上漲而走高。唯一的例外是公用事業類股 (-0.60%),錄得溫和跌幅,這在風險偏好急劇飆升、防禦性殖利率相對吸引力減弱時較為常見。

從分析角度來看,今日強勁且廣泛的反彈已推動多數類股的近期特性出現顯著的改善。我們的分析目前指出,資訊科技、金融、非必需消費品、工業和通訊服務類股的近期狀況有利。能源、原物料和房地產類股已從先前的不利評估改善至中性狀態。醫療保健類股的狀況已從極為不利改善至中度不利,必需消費品類股則維持中性。我們預期,此普遍性的改善若能持續,可能預示市場領漲力道和整體趨勢出現更持久的轉變。

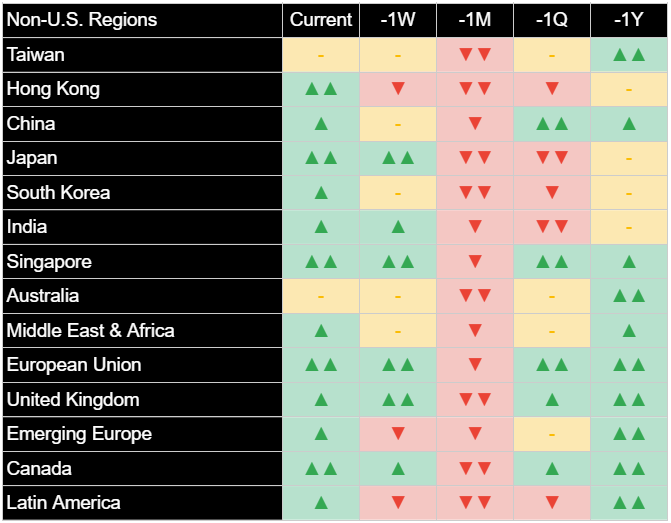

國際市場

國際市場週一飆升,反映出美中貿易衝突降溫對全球風險偏好的顯著提振。美元今日走強,上漲+1.41%,鑑於典型的「風險偏好」行為,此發展略顯反常,但可能反映了其他資本流動動態或休兵後對美國相對經濟實力的重新定價。

已開發市場強勁反彈:歐洲股市上漲+0.22%,日本股市躍升+1.10%。改善的全球貿易前景是推升行情的主要動力。我們的分析指出,這些地區正在維持或改善其本已存在的潛在正向特性,我們預期它們將持續受惠於更穩定的全球貿易環境。

儘管美元走強,新興市場亦在貿易緊張局勢緩和的帶動下普遍強勁上漲:新興亞洲市場上漲+2.71%,印度飆升+3.68%,拉丁美洲上漲+0.04%。中國股市飆漲+3.40%。新興市場此波廣泛且強勁的反彈突顯了全球投資情緒的舒緩,中國官方媒體將此協議視為北京立場的勝利。我們將持續關注新興市場的此波正向動能能否延續。

其他資產

週一其他資產類別的活動明確反映了美中關稅休兵所引發的強勁風險偏好情緒。股市與風險較高的大宗商品同步反彈,而黃金等傳統避險資產則承壓下挫。隨著避險需求蒸發,公債殖利率上揚(價格下跌)。

固定收益方面,隨著投資者積極從較安全的資產輪動撤出並預期未來成長可能轉強,美國公債價格全線下跌。短期公債價格下跌-0.18%,中期公債價格下跌-0.64%,長期公債價格下滑-0.93%。整體美國綜合債券價格亦下跌-0.33%。這標誌著對避險政府債券的需求顯著減少。我們預期債券殖利率將持續對不斷演變的成長和通膨預期保持敏感。

大宗商品表現好壞參半,但普遍反映了風險認知的轉變。WTI原油因全球成長擔憂緩解而上漲+1.49%。然而,黃金價格因其在明顯的風險偏好環境中避險吸引力顯著減弱而大跌-2.82%。基本金屬可能受惠於全球需求前景改善而上漲+1.42%。農產品微跌-0.11%。美元指數顯著走強,上漲+1.41%。在數位資產方面,比特幣價格下跌-1.33%;這個全球最大的加密貨幣盤中一度升破105,000美元,隨後回落,與傳統股市普遍風險偏好反彈走勢出現背離,後續表現值得關注。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。 Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。 Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

U.S.-China Tariff Truce Ignites Record Rally, But Is the All-Clear Sounded?

U.S.-China De-escalation Ignites Powerful Rally; Tech Sector Roars Back to Life

Joe Lu, CFA May 12, 2025

MARKET OVERVIEW

U.S. equity markets experienced a pivotal session on Monday, with major indices soaring to their highest levels in over two months following the announcement of a significant, albeit temporary, rollback in U.S.-China reciprocal tariffs. This landmark agreement establishes a 90-day window for negotiators to forge a more comprehensive trade deal. During this pause, U.S. duties on most Chinese imports will be dramatically cut from 145% to 30%, while China will reciprocally lower its tariffs on U.S. goods from 125% to a baseline 10%. Such a substantial de-escalation was unexpected and provided immediate, profound relief to markets that have been contending with the escalating specter of a trade war. We anticipate further discussions between Treasury Secretary Scott Bessent and his Chinese counterparts in the coming weeks, which will be crucial in shaping the longer-term outlook.

The market's response was unequivocally bullish. The S&P 500 Index soared +3.30%, decisively reclaiming levels not seen since early March and fully erasing the losses incurred since the "Liberation Day" tariff announcements. The Dow Jones Industrial Average gained +2.86%, while the technology-heavy Nasdaq Composite Index led the charge, rocketing up +4.07%. Small-capitalization stocks, represented by the Russell 2000 Index, also surged, gaining +3.52%. The magnitude of the tariff reductions clearly surprised Wall Street, injecting a strong dose of optimism. The market is now pricing in a reduced probability of an immediate, sharp escalation in trade conflicts, interpreting this as a sign that tariffs may indeed be serving as a potent negotiating tactic rather than a fixed long-term policy.

The rally was particularly potent in Big Tech megacap names, which had been disproportionately affected by trade war anxieties. AI chip leader NVIDIA (+5.44%), Amazon (+8.07%), Apple (+6.18%), and Tesla (+6.75%) all delivered substantial gains. The positive sentiment rippled through other trade-sensitive sectors, with auto stocks also rallying on expectations of potential future tariff relief. While the immediate market reaction reflects a "dream scenario" for many, fostering hopes of normalized growth and diminished recession risks, a degree of strategic caution remains warranted. This is a significant de-escalation, not a final peace treaty. The remaining 30% U.S. tariff on Chinese goods is still substantial, and the baseline 10% tariff on most other U.S. imports appears set to continue for the foreseeable future. With the 90-day pause expiring in early July and numerous other international trade negotiations ongoing, the potential for renewed market volatility persists. Nevertheless, this pause provides a crucial window for businesses to adapt and plan, a decidedly positive development. Adding another dimension to today's policy landscape, President Trump also signed an executive order aimed at reducing U.S. drug prices.

EXECUTIVE SUMMARY

U.S. equities surged dramatically Monday as a landmark U.S.-China agreement to temporarily slash reciprocal tariffs unleashed a wave of investor optimism, signaling a potential significant reduction in trade war pressures: S&P 500 Index (+3.30%), Dow Jones Industrial Average (+2.86%), Nasdaq Composite Index (+4.07%).

- The 90-day tariff pause, cutting U.S. duties on most Chinese imports from 145% to 30% and China's tariffs on U.S. goods from 125% to 10%, decisively exceeded expectations, fueling broad market confidence.

- The rally's breadth and strength, particularly in technology megacaps, point to a sharp, widespread improvement in near-term market character; we anticipate this positive shift will be closely watched for follow-through.

- While this truce is a profoundly positive development, potentially resetting growth expectations, the path ahead requires navigating remaining tariff complexities and numerous other international negotiations before the July deadline; this is a de-escalation, not a final resolution.

- We expect upcoming inflation data (CPI, PPI) and retail sales figures to be critical in determining if this tariff relief translates into sustained economic momentum and further positive market trends.

BROAD MARKET INDICES

Broad market indices posted exceptionally strong gains across the board on Monday, decisively breaking recent consolidation patterns on the back of the U.S.-China tariff rollback. The S&P 500 Index surged +3.30%, the Dow Jones Industrial Average jumped +2.86%, and the Nasdaq Composite Index soared +4.07%. The Russell 2000 Index, representing small-cap stocks, also rallied sharply, gaining +3.52%. This powerful, broad-based advance signals a significant and positive shift in investor sentiment as immediate fears of an escalating trade war have substantially receded. We anticipate this newfound optimism will be tested by upcoming economic data.

The PHLX Semiconductor Index participated robustly in the rally, gaining an impressive +7.08% on the day. This outperformance suggests that the tariff news provided particularly significant relief for this economically sensitive and globally interconnected sector, which had previously shown signs of stress.

From an analytical perspective, today's powerful rally represents a sharp and positive turn in the near-term market character across all major indices. Our analysis indicates a significant improvement, with conditions for the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite now appearing favorable in the near term. The Russell 2000 Index character has improved to neutral. This widespread positive development is noteworthy, and we look for sustained follow-through in the coming sessions to confirm a more durable reversal of prior negative medium-term assessments and potentially usher in a new upward trend.

TOP 10 U.S. COMPANIES

Performance among the largest U.S. companies was overwhelmingly positive and exceptionally strong on Monday, with these globally exposed titans directly benefiting from the material de-escalation in U.S.-China trade tensions. All of the "Magnificent Seven" stocks posted impressive gains, underscoring their leverage to global supply chains and international market sentiment.

Looking at individual stock performance for the day: Amazon.com Inc surged +8.07%. Meta Platforms Inc jumped +7.92%. Tesla Inc gained +6.75%. Apple Inc rose +6.18%. NVIDIA Corp advanced +5.44%. Alphabet Inc Class A climbed +3.74%. Microsoft Corp added +2.40%. Broadcom Inc gained +6.43%. JPMorgan Chase & Co participated in the broad rally, rising +2.75%. Berkshire Hathaway Inc Class B also gained +0.11%.

Interpreting the underlying analytical picture, the sharp positive price action today has led to notable improvements in the near-term market character for many of these leading companies. Our analysis indicates that conditions for Microsoft Corp, Amazon.com Inc, Meta Platforms Inc, Broadcom Inc, and Tesla Inc now appear favorable in the near term. For Apple Inc and Alphabet Inc Class A, conditions improved from pronouncedly unfavorable to moderately unfavorable, while NVIDIA Corp remained in a moderately unfavorable state despite its strong daily gain. JPMorgan Chase & Co maintained its favorable assessment, and Berkshire Hathaway Inc Class B stayed neutral. We anticipate that continued positive market sentiment could further improve these readings, though some names still require more evidence to signal a complete analytical turnaround from recent weakness.

ECONOMIC INDICATORS

Today's market narrative was overwhelmingly shaped by the U.S.-China tariff rollback, an event poised to have profound economic implications. The de-escalation itself acts as a significant, positive economic signal, potentially alleviating cost pressures, boosting business confidence, and mitigating downside risks to global growth forecasts. Federal Reserve Governor Adriana Kugler's comments, highlighting that steeper tariffs generally function as a negative supply shock, underscore the potential economic relief this truce may provide. The market will now keenly watch for shifts in inflation trajectories and business investment intentions. Furthermore, with U.S. customs duties hitting a record $16.3 billion in April, a moderation in this figure is now anticipated.

Our assessment of economic indicators reflected a sharp positive shift in market-derived sentiment today. The outlook for Consumer Strength improved markedly, now appearing positive, driven by the improved market sentiment and the prospect of a reduced tariff burden on households. The outlook for Corporate Earnings also turned positive, indicating expectations of a more favorable profitability environment. Inflation readings remained neutral, implying that while immediate tariff-induced price pressures are set to diminish, underlying inflation dynamics still require careful monitoring, especially with key CPI and PPI reports due this week. We expect these indicators to continue evolving as the market digests the full impact of the trade truce.

SECTOR OVERVIEW

Sector performance within the S&P 500 was overwhelmingly positive and exceptionally strong on Monday, with all eleven sectors posting significant gains as the U.S.-China tariff truce ignited a broad-based market rally. Cyclical and growth-oriented sectors, which are typically more sensitive to international trade relations and global growth prospects, emphatically led the advance.

Information Technology (+4.73%) and Consumer Discretionary (+4.97%) were standout performers, directly benefiting from the dissipation of trade war anxieties and the powerful rally in their mega-cap constituents. Communication Services (+2.08%), Industrials (+3.08%), and Materials (+2.32%) also recorded very strong gains, reflecting renewed optimism for global economic activity. Financials (+2.03%) advanced solidly. Even traditionally defensive sectors participated strongly in the risk-on wave: Real Estate (+1.08%), Consumer Staples (+0.15%), and Healthcare (+2.47%) all moved higher. Energy (+2.61%) also gained as oil prices rose. The sole outlier was Utilities (-0.60%), which posted a modest loss, a common occurrence when risk appetite surges dramatically and the relative appeal of defensive yield diminishes.

From an analytical perspective, today's powerful and broad rally has driven significant positive shifts in the near-term character for most sectors. Our analysis now indicates favorable near-term conditions for Information Technology, Financials, Consumer Discretionary, Industrials, and Communication Services. Energy, Materials, and Real Estate have improved to a neutral state from previously unfavorable assessments. Healthcare's condition has improved from pronouncedly unfavorable to moderately unfavorable, and Consumer Staples remains neutral. We anticipate that this widespread improvement, if sustained, could signal a more durable shift in market leadership and overall trend.

INTERNATIONAL MARKETS

International markets surged on Monday, reflecting the significant boost to global risk appetite from the de-escalation in the U.S.-China trade conflict. The U.S. Dollar strengthened today, rising +1.41%, a somewhat counterintuitive development given the typical "risk-on" behavior but possibly reflecting other capital flow dynamics or a re-pricing of relative U.S. economic strength post-truce.

Developed markets rallied strongly: European equities gained +0.22% and Japanese equities jumped +1.10%. The improved global trade outlook was a primary catalyst. Our analysis indicates these regions are maintaining or improving their already positive underlying characteristics, and we expect them to continue benefiting from a more stable global trade environment.

Emerging markets also posted very strong gains, reacting positively to the easing trade tensions despite the stronger dollar: Emerging Markets Asia rose +2.71%, India surged +3.68%, and Latin America gained +0.04%. Chinese equities soared +3.40%. The broad and robust rally across emerging markets underscores the global relief, with Chinese state media framing the deal as a vindication of Beijing's stance. We will be watching to see if this positive momentum in emerging markets can be sustained.

OTHER ASSETS

Activity across other asset classes on Monday clearly reflected the strong risk-on sentiment triggered by the U.S.-China tariff truce. Equities and riskier commodities rallied, while traditional safe-haven assets like gold experienced significant selling pressure. Treasury yields rose (prices fell) as demand for safety evaporated.

In fixed income, U.S. Treasury prices declined across the curve as investors aggressively rotated out of safer assets and anticipated potentially stronger future growth. Short-term Treasury prices fell -0.18%, Intermediate Treasury prices dropped -0.64%, and Long-term Treasury prices slid -0.93%. Broad U.S. Aggregate Bond prices also decreased -0.33%. This marked a significant reduction in demand for safe-haven government debt. We expect bond yields to remain sensitive to evolving growth and inflation expectations.

Commodity performance was mixed but generally reflected the shifting risk perceptions. WTI Crude Oil gained +1.49% as global growth fears eased. However, Gold prices fell sharply by -2.82% as its safe-haven appeal diminished significantly in the pronounced risk-on environment. Base Metals rose +1.42%, likely on improved global demand prospects. Agricultural Commodities declined slightly by -0.11%. The US Dollar Index strengthened significantly, rising +1.41%. In digital assets, Bitcoin prices declined -1.33%; the world's largest cryptocurrency had touched a session high above $105,000 before retreating, showing a divergence from the broad risk-on rally in traditional equities that warrants observation.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)