【Joe’s華爾街脈動】市場在經濟數據與貿易休兵中找到安慰;趨勢反轉能否持續?

關稅緊張局勢緩解、通膨降溫,股市大漲;關鍵數據即將公布

Joe Lu, CFA 2025年5月16日 美東時間

一周市場觀點

美國股市上周強勢反彈,標普500指數上漲+5.16%,那斯達克綜合指數則飆升+6.80%。主要漲幅來自本周初美中宣布關鍵性的90天貿易休兵協議。根據協議,美國將多數中國進口商品的關稅降至30%(先前高達145%),中國則將多數美國商品的關稅降至10%。這項具重大意義的降溫措施,顯著緩解了市場對貿易戰升級的恐懼。同時,美國放寬AI晶片貿易限制的報導推動那斯達克指數的漲幅,相較於4月8日的低點,上漲逾20%,技術上代表進入牛市。儘管這波強勁反彈已使標普500指數重回2025年正報酬區間,我們的底層分析仍顯示,美股指數更廣泛的負面技術趨勢尚未完全扭轉,仍需進一步確認。

我們焦點列表中的主要美國企業表現普遍強勁,由科技股和成長型股票領漲。輝達(NVIDIA)上周大漲+15.36%,直接受惠於圍繞AI晶片貿易的正面情緒。其他大型科技股如特斯拉(+22.88%)、亞馬遜(+7.03%)、Meta Platforms(+7.08%)、微軟(+3.67%)和博通(+10.03%)亦顯著上揚,反映投資者重燃對科技股的熱情。

我們對潛在經濟狀況的評估肯定貿易休兵在減輕眼前的經濟衰退壓力方面,發揮了正面的影響。儘管指標持續指向美國經濟正處於晚期循環(投資存續期間和企業獲利展望負面,通膨壓力正面),但朝向更易管理的平均關稅率發展,符合我們的基本情境預期,並避免了更具破壞性的結果。此趨勢亦獲得四月份通膨數據的佐證:總體CPI月增0.2%(年增2.3%,為2021年2月以來最小增幅),核心CPI年增率維持在2.8%,而PPI則意外下降。若此物價壓力趨緩的態勢得以延續,將有助於美國聯準會目前按兵不動的立場,並可能在勞動市場走弱時,為下半年的寬鬆政策預留空間。儘管正向的貿易消息可能開始提振市場情緒,但堅韌的「硬數據」(三月份激增後,四月份零售銷售相對穩定,初請領失業金人數健康)與極度疲弱的「軟數據」(五月份消費者信心創2022年6月以來最低)之間的落差,仍然是當前局勢的關鍵特徵。

上周美國各類股表現普遍正面,由周期性與科技導向型類股領漲。資訊科技類股上漲+7.81%,非必需消費品類股上漲+8.06%,工業類股上漲+5.72%,顯示風險偏好顯著改善。即使是防禦型類股,亦有所表現,例如公用事業類股(+2.60%)和必需消費品類股(+0.85%),但相較之下,漲幅落後於對經濟較為敏感的類股。芝加哥期權交易所波動率指數(VIX)連續第七周下跌,反映投資者對短期波動的預期顯著降低。

國際股市亦受惠於全球市場情緒的改善。歐洲股市上漲+2.31%,日本股市上漲+0.92%。中國股市亦上揚(+1.81%),可能受到其國內信貸數據逐步改善的支撐,這或代表當地可能進一步放寬政策。其他資產類別則反映了風險偏好的情緒:受正面貿易消息影響,公債價格下跌,殖利率隨之上揚(短期公債-0.06%,20年以上公債避險部位+1.76%)。WTI原油價格(透過USO追蹤)上漲+3.81%。然而,黃金顯著回檔,本周下跌-3.41%,為年初以來的漲勢,畫下一個值得注意的休止符。比特幣則上漲+2.74%。

一周重點摘要

- 由於美中關稅休兵及通膨數據趨緩,顯著提振投資者情緒,故美國股市上周大漲(標普500指數+5.16%),為近六周內來的第四次收紅。。

- 優於預期的通膨報告(四月CPI年增+2.3%,PPI意外下降)進一步舒緩市場的擔憂,並支持聯準會今年稍晚可能彈性降息的觀點。

- 我們對經濟狀況的評估仍指向經濟周期晚期循環階段,但貿易緊張局勢的降溫,降低了當前最壞情況的衰退風險,儘管消費者信心等「軟數據」依然處於歷史低檔。

- 焦點列表新增眾多項目,包括印度股市、美國主要指數以及科技股,反映本周行情反彈幅度廣泛,風險偏好同步回升。

本周焦點

從我的分析角度來看,航太與國防(A&D)產業持續值得投資者重點關注。這個廣泛的產業包含了商用航空、中藥國防承包,以及快速發展的太空探索領域的企業。典型的航太與國防產業特點在於漫長的產品開發和銷售周期、持續投入大量的研發,以及高度依賴全球政府機構和大型企業高度依賴採購。該產業的發展軌跡通常受到當前地緣政治氣候、技術創新發展以及更廣泛的全球經濟趨勢所影響。在此領域中,某些投資方法旨在提供不同公司規模的廣泛產業參與度,這可以為投資者提供對該產業更為分散的曝險。

當前航太與國防產業的重要性,牢牢紮根於持續且複雜的全球安全局勢,這為全球國防能力的強勁需求提供了支撐。我們的專有指標顯示,許多關鍵產業參與者擁有大量且持續的訂單,顯示未來營收具有一定程度的可見度。與此同時,儘管面臨營運上的障礙和個別公司特定的問題,商用航太領域將受惠於機隊更新和客運量增加的長期結構性需求。該產業的基本面顯示,中期而言,在這些持久性需求驅動下,預期將有穩健的獲利成長。

展望未來,航太與國防產業展現具備卓越表現的潛力,並受到多項潛在催化因素的支撐。為因應地緣政治動態,全球對國防現代化的持續(甚至可能增加的)投資,提供了一個強勁的需求基礎。供應鏈中斷的緩解可能釋放更高的生產效率,並支持利潤率的改善。此外,先進航空系統、太空商業化,以及下一代推進技術等領域的重大創新,皆代表著可觀的長期成長機會。儘管該產業目前的市場估值反映了一定程度的樂觀情緒,但必須在其戰略重要性與未來成長前景的背景下進行評估。投資者需要考量的核心問題包括:當前國防支出軌跡的可持續性、商用航太生產正常化的進程,以及新興技術將如何重塑既有領導者和新進者之間的競爭格局。

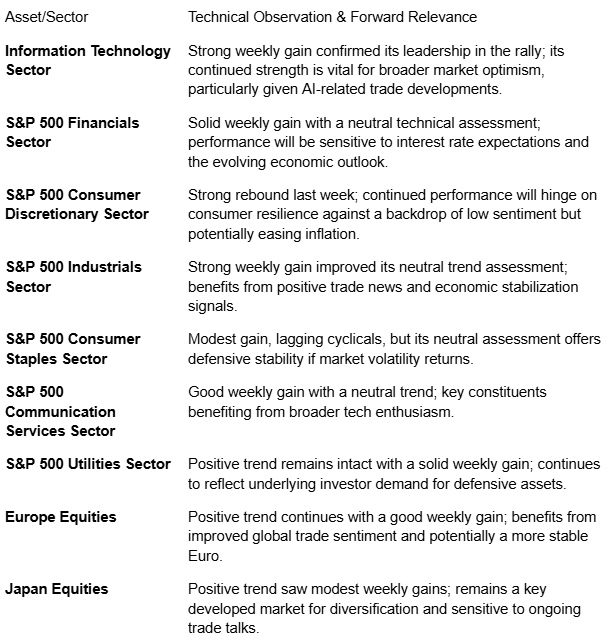

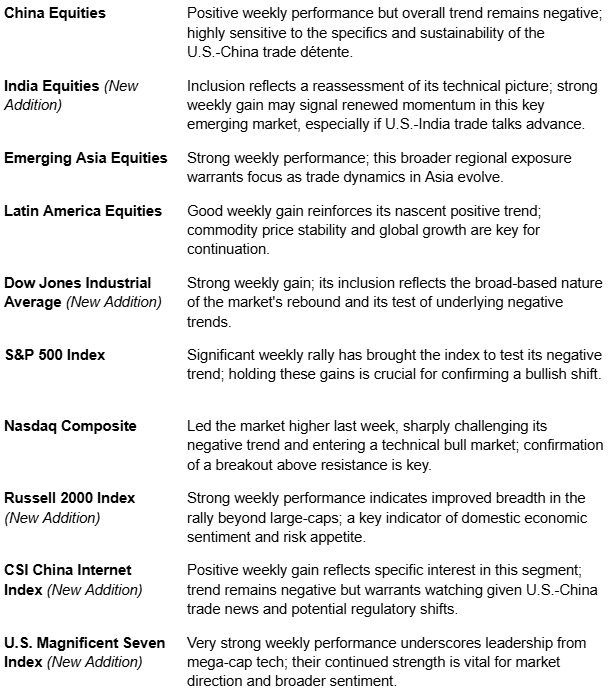

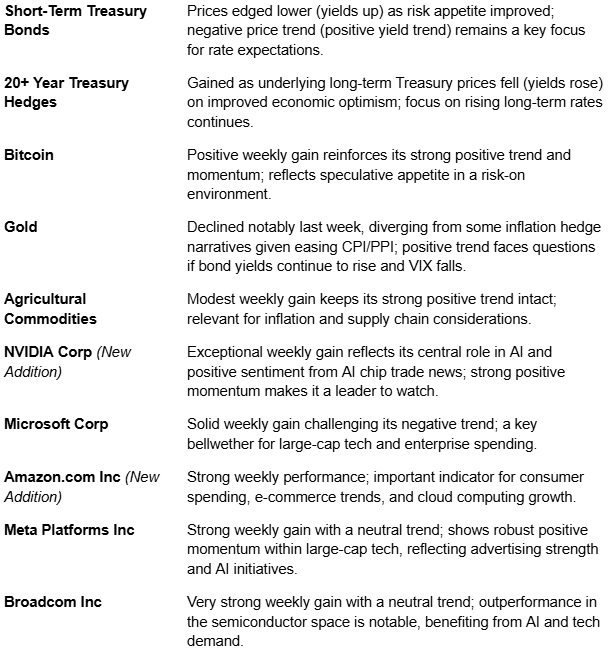

焦點列表重點

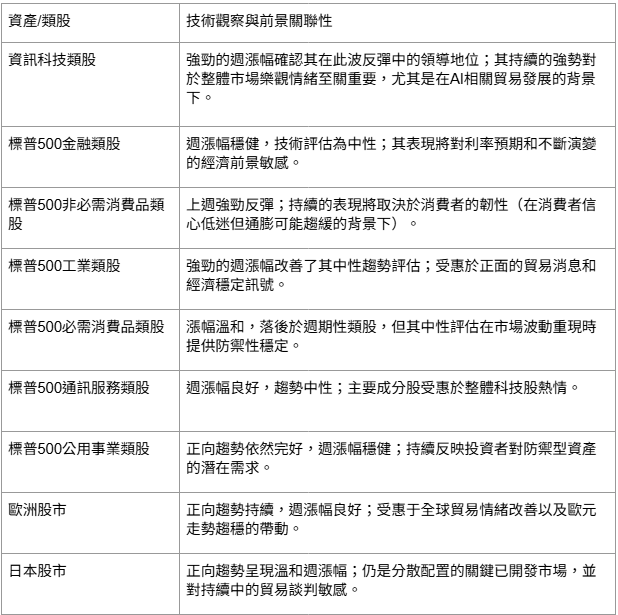

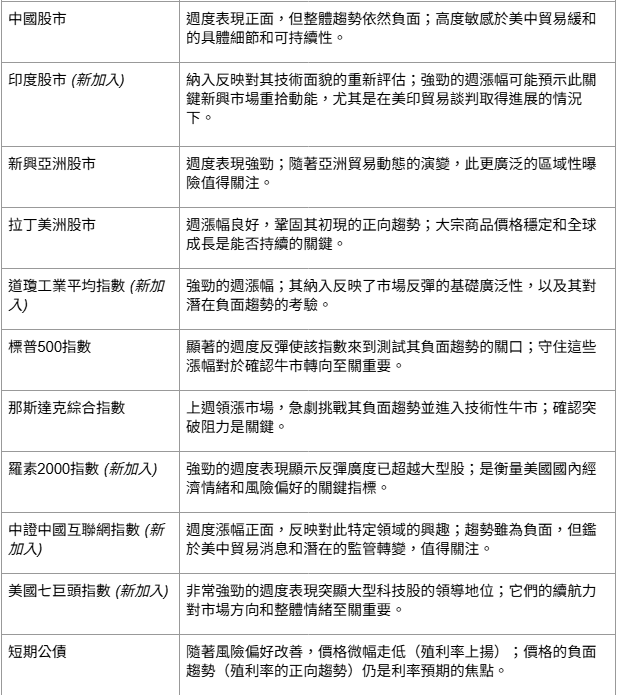

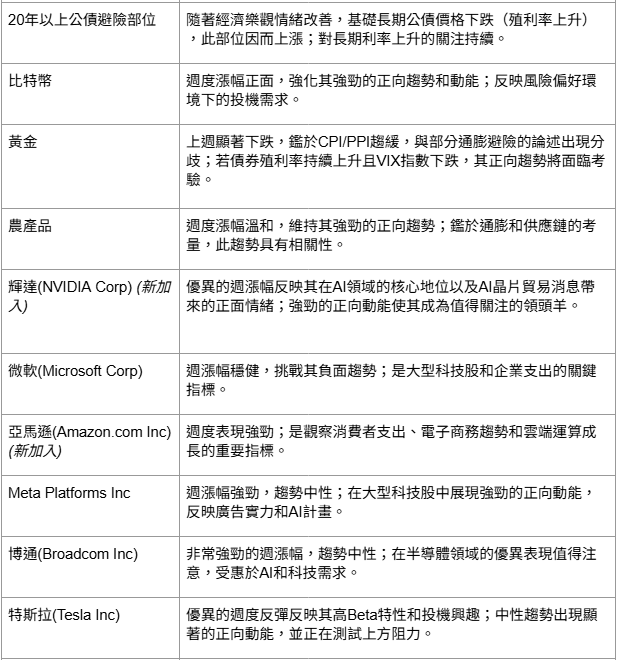

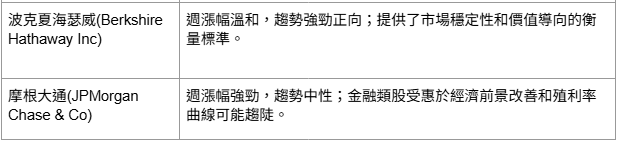

本周的焦點列表突顯了那些根據我們對上周市場活動的分析,展現出值得注意技術特性的資產。下表概述了這些關鍵領域:

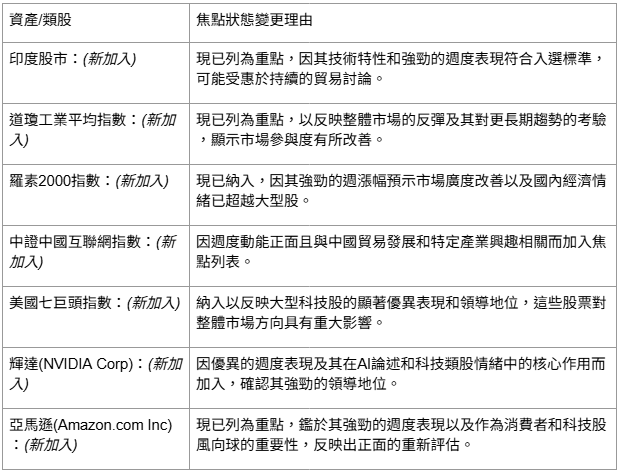

焦點列表調整

根據我們對不斷演變的技術訊號的評估,並比較重點資產(E欄中模型百分比 > 0者)與前一周的資產,本周焦點列表作出以下調整:

本周移除資產:

(5月9日的焦點列表中沒有資產(模型百分比 > 0)在5月16日的列表中模型百分比降至零。因此,本周沒有基於此特定標準的移除。)

本周新增資產:

展望未來

繼上周市場在建設性的貿易發展和趨緩的通膨數據中找到顯著安慰後,我們未來一周的焦點將轉向此正向動能能否延續,並開始明確扭轉主要美股指數潛在的負面技術趨勢。關稅方面,「政策高度不確定性」的緩解,特別是美中休兵,是一個重大的正面因素,可能為避免最壞的經濟衰退情境提供底部支撐。然而,正如我們更廣泛的經濟分析所示,經濟仍處於晚期循環,因此仍需保持警惕。我們預期市場將持續區分「硬」數據(上周CPI、PPI和穩定的初請領失業金人數均具支撐性)和「軟」的市場情緒數據(雖然疲弱,但若貿易樂觀情緒得以維持,則可能改善)。

本周即將公布的經濟數據,包括周一的領先經濟指標諮商會指數,以及本周稍晚的四月份成屋與新屋銷售數據,將是衡量經濟活動韌性的重要參考。儘管美國聯準會目前按兵不動,但任何來自官員的進一步評論都將受到分析,以判斷其在支持成長與確保通膨預期穩定之間平衡的評估是否有所轉變,尤其是在財政部長Bessent強調,需要在七月中旬前解決債務上限問題的背景下。同時,圍繞2017年減稅與就業法案屆期的相關討論也將開始佔據更重要的位置。

技術面來看,在上周的強勁反彈(標普500指數收復其「解放日」後的失土,那斯達克指數進入牛市)之後,主要美股指數正在測試關鍵阻力。若能在這些基準之上盤整,或進一步向上突破,將有利於確認底部支撐和潛在的新上升趨勢。我們將密切關注市場領漲力道是否能持續擴大至最初由科技股帶動的反彈。對目標導向的投資者而言,關鍵在於持續專注於多元化策略,運用再平衡使投資組合與長期目標保持一致,同時認知到與政策轉變相關的周期性波動仍應在預期之內。

歡迎將此分析分享給可能覺得有價值的人士。

若要持續接收我們針對美國經濟、股市和產業的深度分析與洞見,請訂閱我們的電子報。

本新聞通訊僅供參考,不構成任何投資建議或買賣任何證券或資產類別的推薦。文中所表達的觀點為作者截至發布日期為止的觀點,並可能隨時更改,恕不另行通知。所呈現的資訊係基於從據信可靠來源獲得的數據,但其準確性、完整性和及時性不作保證。過往表現不代表未來結果。投資涉及風險,包括可能損失本金。讀者在做出任何投資決定前,應諮詢自己的財務顧問。作者及相關實體可能持有本文所討論資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Find Comfort in Hard Data and Trade Truce; Will Trend Reversal Last?

Equities Surge as Tariff Tensions Ease and Inflation Cools; Key Economic Data on Tap

Joe Lu, CFA May 16, 2025

MARKET PERSPECTIVE

U.S. equity markets experienced a significant rally last week, with the S&P 500 Index advancing +5.16% and the Nasdaq Composite surging +6.80%. The bulk of these gains came early in the week following the pivotal announcement of a 90-day trade truce between the U.S. and China. This agreement saw the U.S. reduce its tariffs on most Chinese imports to 30% (down from as high as 145%) and China reduce its tariffs to 10% on most U.S. goods, a meaningful de-escalation that significantly eased market fears of an intensifying trade war. This news, coupled with reports of eased U.S. trade restrictions on AI chips, propelled the Nasdaq more than 20% above its April 8th low, technically entering a bull market. Despite this strong rebound, which has brought the S&P 500 back into positive territory for 2025, our underlying analysis suggests that broader negative technical trends for U.S. indices have not yet been fully reversed, requiring further confirmation.

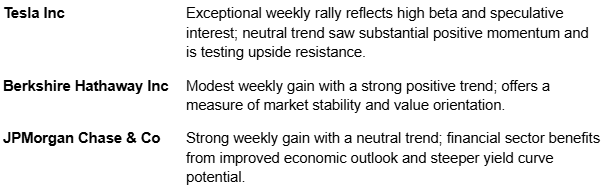

Performance among prominent U.S. companies on our Focus List was overwhelmingly positive, led by technology and growth names. NVIDIA gained an impressive +15.36% last week, directly benefiting from positive sentiment around AI chip trade. Other large-cap tech stocks like Tesla (+22.88%), Amazon.com (+7.03%), Meta Platforms (+7.08%), Microsoft (+3.67%), and Broadcom (+10.03%) also advanced significantly, reflecting renewed investor enthusiasm.

Our assessment of underlying economic conditions acknowledges the positive impact of the trade truce in reducing immediate recessionary pressures. While our indicators continue to point to a late-cycle U.S. economy (negative Investment Duration and Corporate Earnings outlooks, positive Inflation pressure), the move towards a more manageable average tariff rate aligns with our base-case scenario and avoids more damaging outcomes. This was complemented by favorable April inflation data: headline CPI rose a modest 0.2% month-over-month (2.3% YoY, the smallest since Feb 2021), core CPI held steady at 2.8% YoY, and PPI unexpectedly dropped. This moderation in price pressures, if sustained, supports the Federal Reserve's current on-hold stance and could provide room for policy easing later this year should the labor market soften. The ongoing divergence between resilient "hard data" (relatively steady retail sales in April after a March surge, healthy jobless claims) and extremely weak "soft data" (May consumer sentiment at its lowest since June 2022) remains a key feature of the landscape, though the positive trade news may begin to lift sentiment.

U.S. sector performance last week was broadly positive, with cyclical and technology-oriented sectors leading the charge. Information Technology gained +7.97%, Consumer Discretionary +8.06%, and Industrials +5.72%, indicating a significant improvement in risk appetite. Even defensive sectors participated, such as Utilities (+2.60%) and Consumer Staples (+0.85%), though they lagged the more economically sensitive groups. The Cboe Volatility Index (VIX) fell for the seventh consecutive week, reflecting significantly reduced investor expectations of short-term volatility.

International equity markets also benefited from the improved global sentiment. Europe Equities gained +2.31% and Japan Equities added +0.92%. China Equities (+1.81%) also advanced, likely supported by its domestic credit data showing gradual improvement, which might signal further policy easing there. Other asset classes reflected the risk-on mood: Treasury bond prices declined as yields rose on the positive trade news (Short-Term Treasuries -0.06%, 20+ Year Treasury Hedges +1.76%). WTI Crude Oil prices (via USO) rose +3.81%. Gold, however, retreated significantly, falling -3.41% for the week, a notable pause in its year-to-date rally. Bitcoin gained +2.74%.

EXECUTIVE SUMMARY

- U.S. equity markets surged last week (S&P 500 +5.16%), marking the fourth positive week in six, as a significant U.S.-China tariff truce and moderating inflation data dramatically improved investor sentiment.

- The announced 90-day tariff reduction (U.S. to 30%, China to 10%) and eased AI chip restrictions were key catalysts, driving the Nasdaq (+6.80%) into a technical bull market, up over 20% from its April low.

- Favorable inflation reports (April CPI +2.3% YoY, PPI unexpectedly dropping) further bolstered markets by easing concerns and supporting the view that the Fed may have flexibility for potential rate cuts later in the year.

- Our assessment of economic conditions still points to a late-cycle environment, but the de-escalation in trade tensions reduces immediate worst-case recessionary risks, though "soft data" like consumer sentiment remains historically weak.

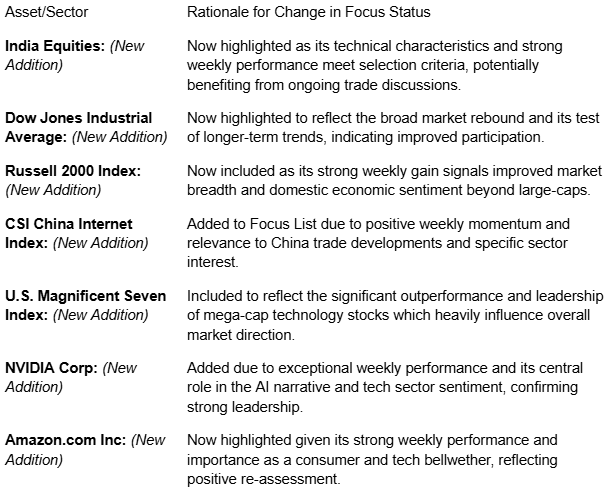

- The Focus List saw numerous additions, including India Equities and key U.S. indices and tech stocks, reflecting the week's broad-based rally and improved risk appetite.

HIGHLIGHT OF THE WEEK

From my analytical perspective, the Aerospace & Defense (A&D) sector continues to merit focused attention from investors. This broad industry encompasses firms involved in commercial aviation, vital defense contracting, and the rapidly evolving domain of space exploration. Characteristically, A&D is defined by protracted product development and sales cycles, substantial ongoing investment in research and development, and a significant reliance on procurement from governmental bodies and major corporations globally. The sector's trajectory is often shaped by the prevailing geopolitical climate, the pace of technological innovation, and broader global economic trends. Certain investment approaches within this space aim to provide broad industry participation across various company sizes, which can offer a more diversified exposure to the sector's underlying themes.

The current relevance of A&D is firmly anchored by a persistent and complex global security landscape, which underpins continued robust demand for defense capabilities worldwide. Our proprietary indicators point to substantial and sustained order books for many key industry players, suggesting a degree of forward revenue visibility. Simultaneously, the commercial aerospace segment, while navigating operational hurdles and discrete company-specific issues, stands to benefit from the long-term structural demand for fleet renewal and increasing passenger volumes. The industry's fundamentals suggest expectations for solid earnings growth over the medium term, reflecting these enduring demand drivers.

Looking ahead, the potential for the A&D sector to deliver noteworthy performance is supported by several potential catalysts. Continued, and possibly augmented, global investment in defense modernization in response to geopolitical dynamics provides a strong demand floor. An easing of supply chain disruptions could unlock enhanced production efficiencies and support margin improvement. Furthermore, significant innovation in fields such as advanced aerial systems, the commercialization of space, and next-generation propulsion technologies represent considerable long-term growth opportunities. While current market valuations for the sector reflect a degree of optimism, they must be assessed in the context of the industry's strategic importance and its future growth profile. Key questions for investors to consider include the durability of current defense spending trajectories, the cadence of commercial aerospace production normalization, and how emerging technologies will reshape the competitive landscape for both incumbent leaders and newer entrants.

FOCUS LIST HIGHLIGHTS

This week's Focus List highlights assets exhibiting noteworthy technical characteristics based on our analysis of last week's market action. The table below outlines these key areas:

FOCUS LIST ADJUSTMENTS

Based on our evaluation of evolving technical signals and comparing highlighted assets (those with Model % > 0 in Column E) with those from the prior week, the following adjustments are made to the Focus List this week:

Assets Removed This Week:

(There were no assets on the May 9th Focus List (Model % > 0) that had their Model % fall to zero on the May 16th list. Therefore, no removals based on this specific criterion this week.)

Assets Added This Week:

LOOKING AHEAD

Following a week where markets found significant comfort in constructive trade developments and moderating inflation data, our focus for the upcoming week shifts to whether this positive momentum can be sustained and begin to definitively reverse the underlying negative technical trends in major U.S. indices. The easing of "peak policy uncertainty" regarding tariffs, especially the U.S.-China truce, is a significant positive, likely supporting a base case away from worst-case recessionary scenarios. However, as our broader economic analysis suggests a late-cycle environment, vigilance is still required. We expect the market to continue differentiating between "hard" data (which was supportive last week with CPI, PPI, and steady jobless claims) and "soft" sentiment data (which has been weak but may improve if trade optimism holds).

Upcoming economic releases this week, including the Conference Board Leading Economic Index on Monday, and April Existing and New Home Sales data later in the week, will be important for gauging the resilience of economic activity. While the Federal Reserve is currently on hold, any further commentary from officials will be analyzed for shifts in their assessment of the balance between supporting growth and ensuring inflation expectations remain anchored, especially with Treasury Secretary Bessent highlighting the need to address the debt limit by mid-July. The ongoing discussions around the expiration of the 2017 Tax Cuts and Jobs Act will also begin to feature more prominently.

Technically, after last week's strong rally which saw the S&P 500 recover its post-"Liberation Day" losses and the Nasdaq enter a bull market, major U.S. indices are testing key resistance levels. A period of consolidation above these levels or further upside follow-through would be constructive for confirming a bottom and a potential new uptrend. We will be closely watching if market leadership continues to broaden beyond the initial tech-led rebound. The key for goal-oriented investors is to remain focused on a well-diversified strategy, using rebalancing to align portfolios with long-term objectives, while acknowledging that periodic volatility related to policy shifts should still be expected.

Consider sharing this analysis with others who might find it valuable.

To continue receiving our in-depth analysis and insights focused on the U.S. economy, stocks and sectors, please subscribe to our newsletter.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)