【Joe’s華爾街脈動】市場脈動:應對關稅動盪與財政斷層

貿易疑慮與赤字擔憂考驗市場韌性,投資者謹慎情緒升高

Joe Lu, CFA 截至2025年5月20日

重點摘要

市場疲態漸增;貿易、通膨、財政擔憂刺激美股指數回檔,考驗樂觀情緒。

- 儘管近期趨勢有所改善,美國股市因持續的關稅風險而回檔。

- 美國領先企業走弱;關稅和消費者擔憂蓋過個別優勢。

- 反覆無常的貿易政策和財政疑慮主導市場情緒;通膨上升,企業獲利趨穩。

- 美國各類股表現好壞參半;儘管金融、公用事業類股趨勢正向,貿易政策衝擊帶來挑戰。

- 國際股市維持相對強勢,可能受美國關稅影響。

- 財政擔憂導致公債殖利率上升;加密貨幣受監管消息提振上漲,大宗商品表現分歧。

市場概況

市場動態顯示出疲態,美股指數在貿易、通膨,以及財政不確定性的籠罩下回檔,正面企業消息的提振效果相當有限。當前的謹慎氛圍可被形容為「缺乏明確方向的樂觀情緒」。一個關鍵主題是美國股市相對於國際市場的落後表現,主要與關稅相關。近期的關稅「暫緩」是否真正改變了充滿挑戰的貿易格局,或者僅僅是暫時的策略性手段,以及美國股市的落後究竟屬於暫時現象,還是結構性問題,投資者現在都必須審慎評估。

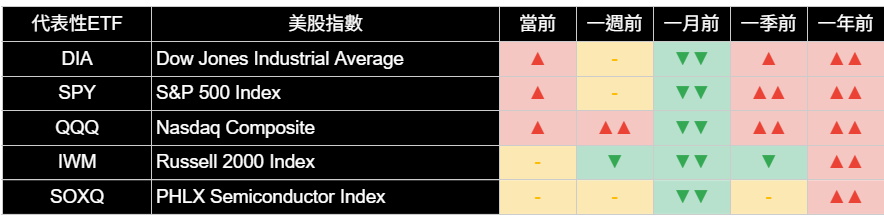

主要市場指數

美國股市從近期高點回檔,標普500指數(-0.34%)中止了其連續六天的漲勢。道瓊工業平均指數(-0.25%)和那斯達克綜合指數(-0.33%)亦下跌,而羅素2000指數(+0.05%)則微幅收高。主要大型股指數的正向趨勢評估大致與昨日持平,惟那斯達克指數的動能似乎較一週前的強勁正向態勢有所趨緩。此種猶豫反映出市場逐漸認識到潛在風險依然存在,特別是圍繞貿易政策及其經濟後果的風險。關鍵問題在於,標普500指數近期暫停下修獲利預期,究竟是真正的穩定訊號,還是「極其嚴苛」關稅的持續衝擊真正顯現前的短暫平靜。

美國前十大公司

「七巨頭」普遍表現疲弱,反映整體市場的風險偏好。蘋果(Apple)(-0.92%)的負面趨勢持續,而Alphabet(-1.54%)的負面趨勢則加劇。微軟(Microsoft)(-0.15%)維持其強勁的正向趨勢,特斯拉(Tesla)(+0.51%)在執行長馬斯克承諾續任執行長五年後上漲。輝達(NVIDIA)(-0.88%)揭露美國禁止向中國銷售H20晶片可能造成150億美元的銷售衝擊,突顯了地緣政治科技限制的實際成本。這些領先企業面臨的關鍵問題是它們是否有能力應對「先開槍,後瞄準,再準備」的關稅政策。個別企業的優勢能否持續克服揮之不去的總體經濟不確定性,以及可能影響美國長期創新的基礎研究潛在破壞性削減?

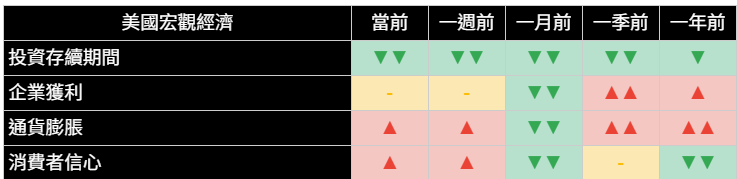

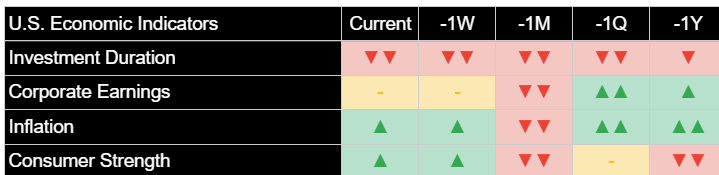

經濟指標

經濟前景依然不明朗,主因在於美國貿易政策反覆無常,以及對美國財政可持續性疑慮再起。今日對通膨壓力的評估加劇,而企業獲利展望則持穩於中性——相較於一個月前的悲觀態勢已顯著改善。對消費者信心的正向看法亦維持穩定。然而,對長期固定收益投資的情緒依然極度悲觀,可能受到長期公債殖利率上升的影響。這種「先開槍,後瞄準,再準備」的關稅實施方式,加劇了不確定性,使通膨局勢和美國聯準會政策更趨複雜。對投資者而言,關鍵問題在於當貿易政策如此難以預測時,應如何為資產定價。

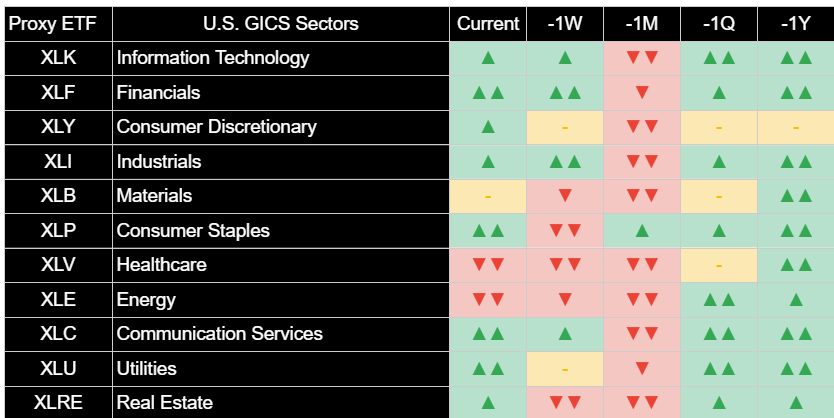

類股概況

在市場普遍謹慎和持續的關稅擔憂下,類股表現分歧。資訊科技類股(-0.38%)的正向趨勢得以維持。金融類股(-0.54%)和非必需消費品類股(-0.52%)亦維持正向趨勢。必需消費品類股(+0.35%)展現強勁的正向趨勢,與上週負面的評估形成鮮明對比。相反地,醫療保健類股(+0.25%)仍深陷極度負面的趨勢,能源類股(-0.92%)的負面趨勢則顯著加劇。美國GICS各類股面臨的核心挑戰是貿易政策對投入成本和需求面的廣泛衝擊。投資者必須辨別哪些類股具備韌性和定價能力,以駕馭此充滿挑戰的環境。

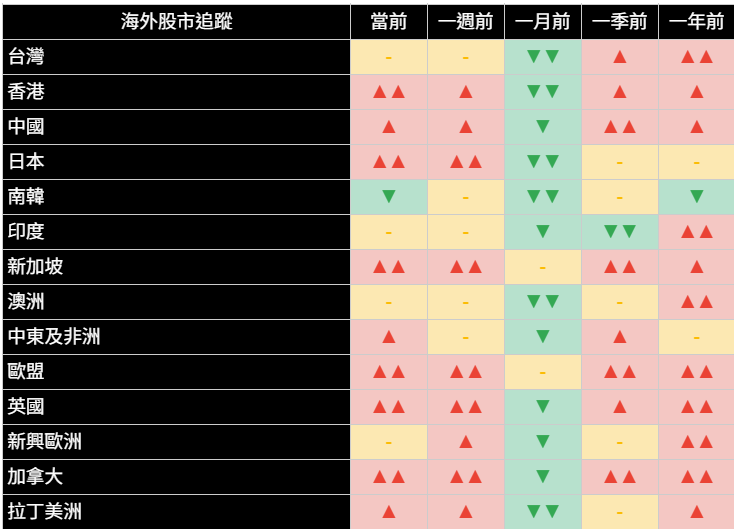

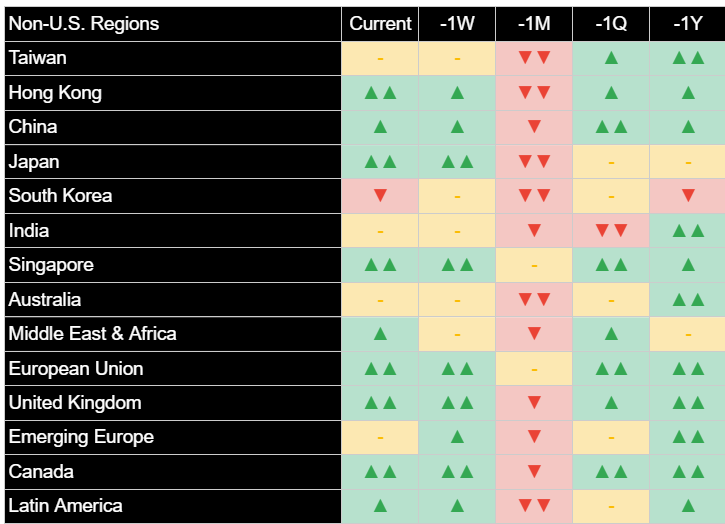

國際市場

2025年的一個顯著發展是,許多國際股票基金相對於美國同業持續表現突出,此趨勢被廣泛歸因於關稅對美國造成的集中衝擊。此種分歧值得投資者關注。今日,歐洲(+0.66%)和日本(+0.58%)維持強勁的正向趨勢。中國(+0.91%)在中國人民銀行放寬貨幣政策的背景下,維持穩定的正向趨勢,儘管美中緊張局勢仍是偏空因素。印度(-1.30%)的趨勢則趨緩至中性。部分觀點將美國市場的這種落後表現歸因於關稅「對美國消費者和美國企業徵稅」的具體反映,這可能強化了全球分散配置的理由,並促使市場更嚴格審視較不易受美國保護主義影響的非美國公司。

其他資產

美國公債殖利率,特別是長期公債殖利率,因市場對美國財政可持續性與政治僵局的高度擔憂而面臨上行壓力,穆迪近期下調美國信用評級正突顯了此點。今日,1-3年期美國公債(+0.01%)微幅上漲,而7-10年期(-0.13%)和20年以上(-0.72%)等長期債券則下跌。黃金(+1.86%)強勁上漲,維持其正向趨勢。比特幣(+1.53%)在正面的監管消息提振下持續上揚。投資者面臨的關鍵問題是,這些財政擔憂是否會使美國債務的風險溢價根深蒂固,從根本上改變利率格局。

保持聯繫,分享洞見:

若您覺得本文有幫助,請點讚支持。

- 歡迎將此新聞通訊轉發給可能覺得有價值的同事和朋友。

- 訂閱即可直接在您的信箱中接收此分析。

- 在社群媒體上追蹤我們以獲取更多更新。

本新聞通訊僅供參考,不構成任何投資建議或買賣任何證券或資產類別的推薦。文中所表達的觀點為作者截至發布日期為止的觀點,並可能隨時更改,恕不另行通知。所呈現的資訊係基於從據信可靠來源獲得的數據,但其準確性、完整性和及時性不作保證。過往表現不代表未來結果。投資涉及風險,包括可能損失本金。讀者在做出任何投資決定前,應諮詢自己的財務顧問。作者及相關實體可能持有本文所討論資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Market Pulse: Navigating Tariff Turbulence and Fiscal Fault Lines

Investor Caution Grows as Trade Doubts and Deficit Worries Test Market Resilience

By Joe Lu, CFA As of May 20, 2025

EXECUTIVE SUMMARY

Market fatigue grows; trade, inflation, fiscal worries spur U.S. index pullback, testing optimism.

- U.S. equities retreated on persistent tariff risks, despite some recent trend improvements.

- Leading U.S. firms weakened; tariff and consumer concerns overshadowed individual strengths.

- Erratic trade policy and fiscal doubts dominate sentiment; inflation rises, earnings stabilize.

- U.S. sectors mixed; trade policy impact challenges, though Financials, Utilities trend positive.

- International equities maintain relative strength, likely due to U.S. tariff impacts.

- Treasury yields rise on fiscal concerns; crypto gains on regulatory news, commodities mixed.

MARKET OVERVIEW

Market dynamics signal fatigue, with U.S. indices retracting amid trade, inflation, and fiscal uncertainties overshadowing positive company news. This cautious stance reflects "optimism without clarity." A key theme is U.S. equities lagging international markets, largely attributed to tariffs. Investors must now question if the recent tariff "pause" genuinely alters the challenging trade landscape or is merely a temporary tactical maneuver, and whether any U.S. equity lag is transient or structural.

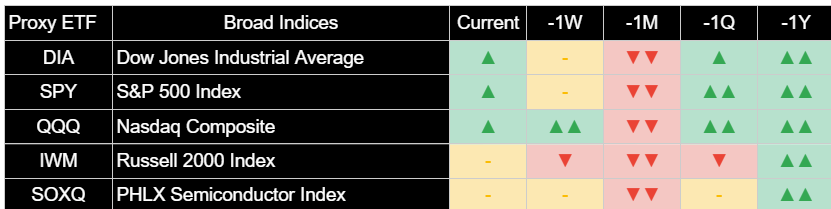

BROAD MARKET INDICES

U.S. equity markets retreated from recent highs, with the S&P 500 (-0.34%) snapping its six-day winning streak. The Dow Jones Industrial Average (-0.25%) and Nasdaq Composite (-0.33%) also declined, while the Russell 2000 (+0.05%) posted a marginal gain. Positive trend assessments for major large-cap indices generally held steady from yesterday, though the Nasdaq's momentum appeared to ease from its stronger positive stance a week ago. This market hesitation stems from a growing acknowledgment that underlying risks, particularly around trade policy and its economic ramifications, persist. The key question is whether the recent halt in S&P 500 earnings estimate cuts signals genuine stabilization or is merely a lull before the sustained impact of "extremely prohibitive" tariffs becomes clearer.

TOP 10 U.S. COMPANIES

The "Magnificent Seven" generally exhibited weakness, reflecting broader market risk appetite. Apple (-0.92%) saw its negative trend persist, while Alphabet's (-1.54%) intensified. Microsoft (-0.15%) maintained its strong positive trend, and Tesla (+0.51%) gained after CEO Musk’s commitment to remain CEO for five years. NVIDIA's (-0.88%) disclosure of a potential $15 billion sales impact from the U.S. ban on H20 chip sales to China highlights the tangible costs of geopolitical tech restrictions. The pivotal question for these leading firms is their capacity to navigate the "fire, aim, ready" tariff policy. Can individual strengths continue to overcome persistent macroeconomic uncertainty and potentially damaging cuts to basic research that might affect long-term U.S. innovation?

ECONOMIC INDICATORS

The economic outlook remains clouded, primarily by erratic U.S. trade policy and renewed U.S. fiscal sustainability concerns. Assessment of inflationary pressures intensified today, while the corporate earnings outlook held steady at neutral—a significant improvement from deep pessimism a month ago. The positive view on consumer strength also remained stable. However, sentiment towards longer-duration fixed income investments remains deeply pessimistic, likely influenced by rising long-term Treasury yields. The "fire, aim, ready" approach to tariff implementation injects profound uncertainty, complicating the inflation narrative and Federal Reserve policy. For investors, the critical question is how to price assets when trade policy is so unpredictable.

SECTOR OVERVIEW

Sector performance was mixed amidst broader market caution and ongoing tariff concerns. Information Technology (-0.38%) saw its positive trend hold. Financials (-0.54%) and Consumer Discretionary (-0.52%) also maintained positive trends. Consumer Staples (+0.35%) displayed a strong positive trend, a dramatic reversal from a deeply negative assessment last week. Conversely, Healthcare (+0.25%) remained mired in a very negative trend, and Energy (-0.92%) saw its negative trend intensify significantly. The overarching theme for U.S. GICS sectors is the pervasive impact of trade policy on input costs and demand. Investors must discern which sectors possess the resilience and pricing power to navigate this challenging environment.

INTERNATIONAL MARKETS

A significant development in 2025 is the continued notable outperformance of many international stock funds relative to their U.S. counterparts, a trend many attribute to the U.S.-centric impact of tariffs. This divergence warrants investor attention. Today, Europe (+0.66%) and Japan (+0.58%) maintained strong positive trends. China (+0.91%) held a stable positive trend as the PBOC eases monetary policy, though U.S.-China tensions remain a headwind. India (-1.30%) saw its trend ease to neutral. This U.S. lag, attributed by some to tariffs acting as a "tax on U.S. consumers and U.S. businesses," potentially strengthens the case for global diversification and scrutiny of non-U.S. companies less vulnerable to U.S. protectionism.

OTHER ASSETS

U.S. Treasury yields, particularly at the long end, face upward pressure from acute concerns over U.S. fiscal sustainability and political gridlock, highlighted by Moody's recent credit rating downgrade. Today, 1-3 Year Treasury Bonds (+0.01%) showed a slight gain, while longer-duration bonds like 7-10 Year (-0.13%) and 20+ Year (-0.72%) declined. Gold (+1.86%) posted a strong gain, maintaining its positive trend. Bitcoin (+1.53%) continued its advance, buoyed by positive regulatory news. The key question for investors is whether these fiscal concerns will entrench a higher risk premium in U.S. debt, fundamentally altering the interest rate landscape.

Stay Connected & Share the Insights:

Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)