【Joe’s華爾街脈動】周報:關稅震盪撼動市場:不確定性籠罩市場,建議謹慎應對

貿易緊張局勢再起,拖累本週表現,市場焦點轉向未來經濟數據與聯準會評論

Joe 盧, CFA 2025年5月23日

一周重點摘要

- 由於美國總統就歐盟進口商品及蘋果(Apple) iPhone潛在關稅發表最新言論,在陣亡將士紀念日週末前夕引發投資者不安,美國股市本週收低,普遍回落。

- 在關稅言論發布後,科技股與成長型股票,特別是蘋果公司,立即面臨賣壓,凸顯市場對貿易政策轉變及其對企業獲利潛在影響的敏感性。

- 公用事業和必需消費品等防禦性類股,以及黃金等資產展現相對韌性,顯示市場普遍存在強烈的避險情緒。

- 公債殖利率與美元因關稅消息而下跌,反映市場對潛在經濟影響的擔憂,同時市場波動性有所上升。

- 接下來因假期縮短的交易週,將密切關注關鍵經濟數據的發布,包括GDP和PCE通膨數據,以及輝達(Nvidia)的財報和美國聯準會主席鮑爾預定談話中任何政策訊號。

一周市場觀點

美國股市上週在明顯的避險氛圍中收低,主要因為週末前川普總統突然宣布,威脅將對非美國製造的蘋果(Apple) iPhone及自歐盟進口的商品課徵高額關稅。此消息在原本準備迎接長週末假期的市場中,掀起一陣不安情緒。標普500指數本週最終下跌-1.9%,道瓊工業指數則下跌-1.7%。以科技股為主的那斯達克綜合指數亦回檔-1.9%,而小型股羅素2000指數則出現更為顯著的跌幅,達-2.7%。這波由貿易焦慮所引發的賣壓衝擊了現行的上升趨勢,並導致市場波動性急遽上升,預示市場可能出現更劇烈的震盪。市場的即時反應突顯出投資者情緒對貿易政策依然高度敏感,相關議題再度成為市場焦點。

新一輪關稅言論對美國主要企業的影響尤為顯著。蘋果(Apple Inc.)股價受到顯著衝擊,本週下跌-7.6%,在週五針對性的關稅威脅發布後,盤前即出現急跌。其他主要科技股和成長股亦感受到壓力;輝達(NVIDIA Corp.)回檔-2.6%,亞馬遜(Amazon.com Inc.)下跌-2.0%,Meta Platforms (Meta Platforms Inc.)則下跌-2.6%。微軟(Microsoft Corp.)則錄得較為溫和的跌幅,為-0.7%。相較之下,Alphabet (Alphabet Inc.)則逆勢上漲+2.7%。其他重要企業,包括博通(Broadcom Inc.)(-1.7%)、特斯拉(Tesla Inc.)(-1.0%)、波克夏海瑟威(Berkshire Hathaway Inc.)(-0.8%)及摩根大通(JPMorgan Chase & Co.)(-2.5%),本週均收黑。此價格走勢顯示市場對風險進行了重新評估,特別是針對那些擁有龐大國際供應鏈或海外營收曝險的企業。

我們對基本經濟狀況的評估,在貿易緊張局勢重現的多重影響下,認為需要維持高度警覺。儘管第一季企業獲利普遍強勁,標普500指數成分股中多數公司業績超乎預期,但新關稅的前景可能會對未來的利潤率構成壓力,並抑制市場對2025年剩餘時間企業獲利成長的預期。在最新關稅消息出現前,市場一度認為經濟衰退風險正逐步下降,但貿易爭端若再度升級,將成為顯著的不確定因素,可能衝擊經濟成長。基於調查的經濟數據,如消費者信心和企業執行長信心指數,先前已透露出一些警訊,而新的關稅威脅可能加劇這些擔憂,即便在勞動市場等「硬數據」尚未顯示出相應疲軟的情況。

上週美國各類股的表現,明確地反映了市場轉向防禦性佈局的趨勢。公用事業類股(+0.1%)和必需消費品類股(+0.6%)是少數勉強錄得漲幅的類股,突顯其在不確定時期的吸引力。反之,對經濟成長和貿易關係較為敏感的類股則面臨阻力。資訊科技類股受到蘋果等主要成分股消息的直接衝擊,下跌-3.3%。能源類股大幅下挫-4.2%。金融類股下跌-2.4%,非必需消費品類股損失-2.3%,工業類股回吐-0.9%,原物料類股下跌-0.5%,醫療保健類股小幅走低-0.1%,通訊服務類股微幅下跌-0.9%,不動產類股則回檔-2.0%。此一格局強化了市場的審慎情緒,投資者似乎正在減少對被認為較易受到貿易干擾或經濟放緩影響的領域的曝險。

受到週末前關稅消息衝擊,國際市場與其他資產類別也對本週的市況發展做出反應。先前表現強勢的歐洲股市(其追蹤代表指數本週上漲+1.4%),在美國威脅課徵50%關稅後,面臨新的不利因素。日本股市上漲+1.0%。據報導,在新的寬鬆措施的幫助下,中國市場小幅收紅(+0.4%)。黃金是此波避險情緒中顯著的受益者,因投資者尋求避風港而大漲+4.0%。比特幣亦上漲+5.4%。原油價格上揚+0.6%。在固定收益市場,關稅消息促使資金流向優質資產,公債殖利率隨之下滑;1-3年期美國公債上漲+0.1%。美元兌主要國際貨幣亦貶值。此種高度不確定性反映在旨在從標普500指數疲弱中獲益的工具(放空標普500指數的工具)上,其本週上漲+4.1%;而那些旨在從長期公債殖利率上升中獲利的工具(放空20年期以上美國公債的工具)本週亦上漲+3.5%,儘管殖利率在週五有所回落。這些市場動態凸顯了市場因應地緣政治與貿易情勢發展,而迅速進行風險重新定價的現象。

本週焦點

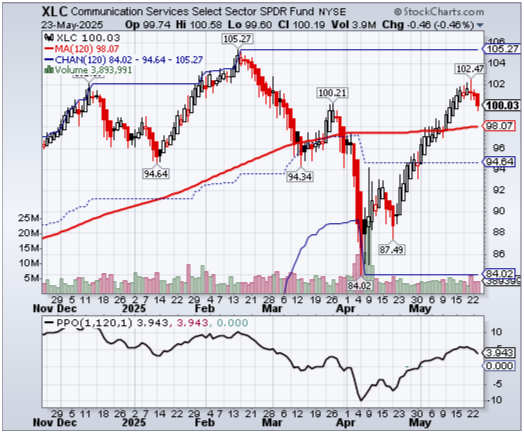

儘管本週自焦點列表中移除,但通訊服務類股仍是一個引人注目的投資概念。整體而言,它提供了一種明智的方式,來投資於我們所熟悉的科技和媒體巨擘的成長,但由於這些公司往往能產生大量實際現金,因此其走勢可能更為穩健。對投資者而言,這意味著有機會參與令人振奮的創新,同時受益於成熟企業的財務實力。

那麼,為何此類股具有吸引力?許多這類公司都非常擅長將其廣受歡迎的服務——例如線上搜尋、社群媒體、串流娛樂和行動通訊服務——轉化為可觀的利潤。與某些需要在廠房和設備上持續投入巨額資金的科技領域不同,許多通訊服務業的領導者是透過其品牌、用戶網絡和訂閱模式來創造價值。對您而言,這代表這些企業通常擁有強勁且可靠的現金流入。這些現金可以再投資於開發新產品、拓展市場規模,或是回饋給股東,進而推動資產的穩定增長。

此外,該產業中的頂尖企業通常非常有效率地運用資金來創造更多營收。它們積極投入於新概念的研發、軟體開發以及強化品牌——這些雖然是無形資產,卻極具價值。當這些「無形」投資被妥善管理時,它們往往就能轉化為真實且可持續的利潤。對投資者而言,這一點很重要,因為它顯示這些公司並非僅僅依賴市場炒作,而是真正在打造長期價值,這正是推動股價長期增值的核心動能。

簡而言之,投資通訊服務類股讓您能夠參與科技和媒體的未來。然而,由於許多這類公司是提供必要或廣受歡迎服務的成熟領導者,並且擅長創造現金,相較於投資更具投機性的科技企業,這可能是在您的投資組合中實現長期成長的更穩定方式。

本週焦點列表

焦點列表調整

本週移除

- 資訊科技類股 (移除): 此類股上週面臨顯著阻力,特別是在直接衝擊主要成分股的關稅聲明之後。這導致其技術型態惡化,因不再符合標準而移出焦點列表。

- 金融類股 (移除): 對於新一輪貿易緊張局勢可能對整體經濟造成的衝擊,以及潛在的市場波動性的擔憂,對金融類股構成壓力,導致其趨勢特性轉弱並因此被移除。

- 通訊服務類股 (移除): 在市場普遍疲弱和不確定性增加的背景下,此類股亦經歷回檔,使其技術型態不再符合我們的焦點標準。然而,這仍是一個可行的長期投資標的。

- 不動產類股 (移除): 對經濟前景和利率預期的敏感性(這兩者皆因關稅消息而變得更不確定)導致此類股趨勢下滑,因此予以移除。

- 道瓊工業指數 (移除): 作為一個對跨國企業有顯著曝險的廣泛市場指標,新一輪的貿易擔憂影響了其整體技術強度,導致其被移出焦點列表。

- 標普500指數 (移除): 與道瓊指數相似,由於關稅焦慮引發的廣泛賣壓,標普500指數的技術面轉弱,因此被移除。

- 羅素2000指數 (移除): 小型股通常對可能受貿易戰影響的國內經濟情緒較為敏感,其出現顯著下跌,導致此指數不再符合焦點標準。

- CSI China Internet Index中證海外中國互聯網指數 (移除): 儘管中國市場獲得部分支撐,但此特定指數仍受到複雜的地緣政治和貿易相關壓力影響,其技術趨勢目前不值得繼續關注。

- 輝達(NVIDIA Corp) (移除): 儘管即將公布財報,但該股隨著與貿易相關擔憂引發的整體科技股和半導體股拋售而回檔,使其短期技術面吸引力下降而被移出焦點。

- 亞馬遜(Amazon.com Inc) (移除): 作為一家擁有大量全球採購的企業,更廣泛貿易中斷的威脅可能導致其表現不佳和技術趨勢轉弱,因此被移除。

本週新增

Alphabet (Alphabet Inc) (新加入): Alphabet上週在重創的科技類股中展現相對強勢,成功錄得漲幅。此韌性及其技術特性的改善使其目前符合納入焦點的標準,後續值得關注其是否具備領漲潛力。

展望未來

在週五關稅聲明後,接下來因假期縮短的交易週將籠罩在高度不確定性中。市場方向可能在很大程度上受到這些貿易主題的後續發展,以及市場對其潛在經濟影響的整體評估所左右。根據我們的趨勢追蹤方法,目前建議保持謹慎,因為美國主要指數正在測試重要的支撐水平。若無法守穩,可能代表進一步的下行風險;反之,若出現明確反彈,才能確認主要的上升趨勢能夠消化這些新的衝擊。美國市場將於5月26日(週一)因陣亡將士紀念日休市。

投資者將密切關注美國聯準會主席鮑爾週日在普林斯頓大學畢業典禮上的致詞,儘管他不太可能發表重大的政策聲明。然而,任何有關經濟前景的評論都將受到仔細審視。本週的經濟數據方面,重點包括週四公布的第一季國內生產毛額(GDP)第二次估計值,該數據初值為年化調整後-0.3%。作為聯準會關鍵通膨指標的四月份個人消費支出(PCE)物價指數,將於週五公布,至關重要。週五上午公布的四月份新屋銷售數據呈現回落,此前成屋銷售數據亦令人失望。耐久財(durable goods)訂單和消費者信心指數則安排在週二公布。美國聯準會一直維持謹慎的「按兵不動」立場,近期的官方評論顯示其不願釋出即將降息的訊號,如果貿易緊張局勢顯現通膨性,或不利於經濟增長,這種情緒可能會更加惡化。

企業方面,本週市場將聚焦在人工智慧領導者輝達(Nvidia, NVDA)於週三下午公布的財報上。這份報告將成為科技類股乃至整體市場的焦點,至少在短期內可能蓋過貿易消息的影響。本週亦安排了數次公債標售,在近期一次20年期公債標售反應不佳後,市場將關注其需求狀況。鑑於市場重新聚焦於關稅問題,我們預期市場對頭條新聞的敏感度將維持在高點。經濟數據、聯準會評論以及地緣政治貿易發展之間的相互作用將決定市場趨勢。在對貿易前景及其對成長和通膨的影響尚未明朗前,採取防禦姿態仍屬於合理的策略。

保持聯繫並分享見解:

若您覺得本文有幫助,請點讚支持。

- 請將此電子報轉發給可能認為有價值的同事和朋友。

- 訂閱即可直接在您的收件匣中接收此分析。

- 在社群媒體上關注我們以獲取更多更新。

本電子報僅供參考之用,並不構成任何投資建議或買賣任何證券或資產類別的推薦。文中所述觀點為作者截至發布日期之意見,並可能隨時更改,恕不另行通知。所提供資訊乃基於從相信屬可靠來源獲取之數據,但其準確性、完整性及及時性不獲保證。過往表現並非未來業績的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其自身的財務顧問。作者及相關實體可能持有本文所討論之資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Tariff Tremors Shake Markets: Caution Advised as Uncertainty Looms Over Holiday Weekend

Renewed Trade Tensions Cap Weekly Performance, Shifting Focus to Economic Data and Fed Commentary Ahead

Joe 盧, CFA 2025/05/23

EXECUTIVE SUMMARY

- U.S. equity markets ended the week on a weaker note, broadly retreating as fresh presidential statements regarding potential tariffs on European Union imports and Apple's iPhones unsettled investors ahead of the Memorial Day weekend.

- Technology and growth stocks, particularly Apple, faced immediate selling pressure following the tariff remarks, highlighting the market's sensitivity to trade policy shifts and their potential impact on corporate profitability.

- Defensive sectors like Utilities and Consumer Staples, along with assets such as Gold, demonstrated relative resilience, indicative of a heightened risk-off sentiment prevailing in the market.

- Treasury yields and the U.S. dollar declined on the tariff news, reflecting concerns about potential economic repercussions, while market volatility saw an uptick.

- The upcoming holiday-shortened week will be closely watched for key economic releases, including GDP and PCE inflation data, alongside earnings from Nvidia and any policy signals from Federal Reserve Chairman Powell's scheduled remarks.

MARKET PERSPECTIVE

The U.S. equity landscape concluded last week with a distinct risk-off tone, largely triggered by new presidential announcements late in the week threatening significant tariffs on Apple's iPhones not made in the U.S. and on imports from the European Union. This news sent a ripple of concern through markets that were otherwise preparing for the long holiday weekend. The S&P 500 Index ultimately declined by -1.9% over the week, and the Dow Jones Industrial Average fell -1.7%. The technology-heavy Nasdaq Composite also saw a pullback of -1.9%, while the small-capitalization Russell 2000 Index experienced a more pronounced drop of -2.7%. This late-week selling pressure, fueled by trade anxieties, challenged prevailing uptrends and caused a spike in volatility, signaling potential for further choppiness. The immediate market reaction underscores how sensitive investor sentiment remains to trade policy, pushing it back to the forefront of market concerns.

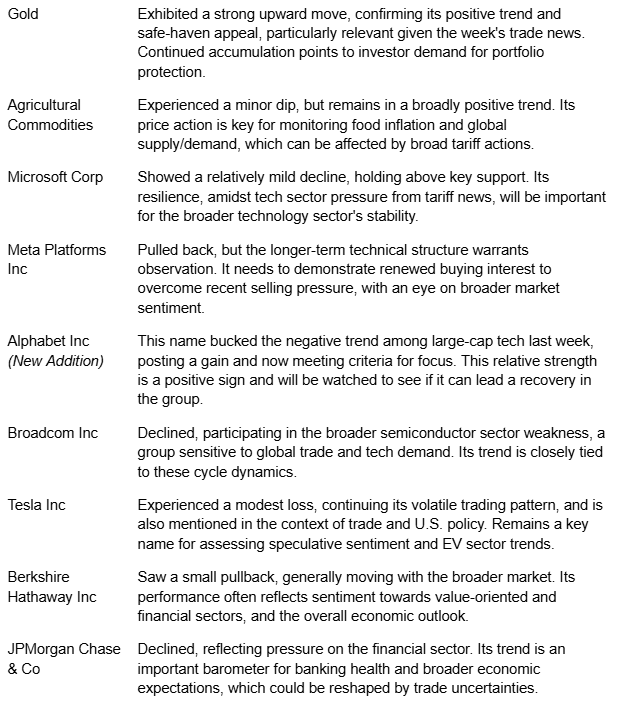

The impact of the renewed tariff rhetoric was particularly evident in key U.S. companies. Apple Inc. shares were notably affected, declining -7.6% for the week, with a sharp pre-market drop on Friday following the specific tariff threats. Other major technology and growth names also felt the pressure; NVIDIA Corp. pulled back by -2.6%, Amazon.com Inc. lost -2.0%, and Meta Platforms Inc. was down -2.6%. Microsoft Corp. registered a more modest decline of -0.7%. In contrast, Alphabet Inc. managed a gain of +2.7%. Other significant companies, including Broadcom Inc. (-1.7%), Tesla Inc. (-1.0%), Berkshire Hathaway Inc. (-0.8%), and JPMorgan Chase & Co. (-2.5%), all finished the week in negative territory. This price action suggests a reassessment of risk, especially for companies with significant international supply chains or revenue exposure.

Our assessment of underlying economic conditions, now compounded by the re-emergence of trade tensions, calls for continued vigilance. While corporate earnings for the first quarter have generally been strong, with a high percentage of S&P 500 companies beating estimates, the prospect of new tariffs could weigh on future profit margins and temper expectations for earnings growth through the rest of 2025. Prior to the latest tariff news, there was a view that recession odds were moderating, but the potential for escalating trade disputes introduces a significant uncertainty that could impact growth. Softer survey-based economic data, such as consumer and CEO confidence, had already signaled some caution, and the new tariff threats could exacerbate these concerns, even if the "hard data," particularly from the labor market, has not yet shown commensurate weakness.

U.S. sector performance last week clearly reflected the shift towards defensive posturing. Utilities (+0.1%) and Consumer Staples (+0.6%) were among the few to eke out gains, underscoring their appeal in uncertain times. Conversely, sectors more sensitive to economic growth and trade relations faced headwinds. Information Technology was down -3.3%, directly impacted by the news affecting major constituents like Apple. Energy fell sharply by -4.2%. Financials declined -2.4%, Consumer Discretionary lost -2.3%, Industrials gave back -0.9%, Materials were down -0.5%, Healthcare edged lower by -0.1%, Communication Services dipped -0.9%, and Real Estate retreated -2.0%. This pattern reinforces a cautious market sentiment, with investors appearing to reduce exposure to areas perceived as more vulnerable to trade disruptions or an economic slowdown.

International markets and other asset classes reacted to the week's developments, particularly the late-week tariff news. European equities, which had been showing strength (+1.4% for their tracking proxy), faced new headwinds with the threat of 50% tariffs from the U.S. Japanese equities gained +1.0%. Chinese markets were modestly positive (+0.4%), reportedly aided by new easing measures. Gold was a notable beneficiary of the risk-off mood, rallying +4.0% as investors sought safe havens. Bitcoin also advanced +5.4%. Crude Oil prices were up +0.6%. In fixed income, the tariff news prompted a flight to quality, with Treasury yields falling; 1-3 Year Treasury Bonds gained +0.1%. The U.S. dollar also declined against major international currencies. The heightened uncertainty was reflected in instruments designed to benefit from S&P 500 weakness (Short S&P500), which gained +4.1%, and those structured to gain from rising longer-term Treasury yields (Short 20+ Year Treasury), which were up +3.5% over the week, though yields did fall on Friday. These movements highlight the market's quick repricing of risk in response to geopolitical and trade developments.

HIGHLIGHT OF THE WEEK

Even though it was removed from the focus list this week, the Communication Services sector presents a compelling investment idea. Bottom line, it offers a smart way to invest in the growth of familiar technology and media giants, but with a potentially steadier ride because these companies tend to generate a lot of actual cash. For investors, this means a chance to tap into exciting innovations while benefiting from the financial strength of established businesses.

So, why is this sector attractive? Many of these companies are excellent at turning their popular services—think online search, social media, streaming entertainment, and mobile phone services—into significant profits. Unlike some tech areas that require massive ongoing spending on factories and equipment, many Communication Services leaders build value through their brands, user networks, and subscription models. What this means for you is that these businesses often have strong, reliable cash coming in. This cash can be reinvested to create new, exciting products, expand their reach, or even be returned to shareholders, all of which can contribute to a growing investment.

Furthermore, the best companies in this sector are typically very efficient with how they spend money to make more money. They invest heavily in developing new ideas, software, and strengthening their brands—things you can't physically touch but are incredibly valuable. When these "invisible" investments are managed well, they translate into real, sustainable profits. For an investor, this is important because it shows these companies aren't just relying on hype; they are building real, long-term value, which is a key driver for stock price appreciation over time.

In short, investing in the Communication Services sector allows you to participate in the future of technology and media. However, because many of these companies are established leaders providing essential or highly desired services and are skilled at generating cash, it can be a more stable way to achieve long-term growth in your portfolio compared to investing in more speculative tech ventures.

FOCUS LIST THIS WEEK

FOCUS LIST ADJUSTMENTS

Removed This Week

- Information Technology(Removed): The sector faced significant headwinds last week, particularly following tariff announcements that directly impact major constituents. This resulted in a deterioration of its technical posture, leading to its removal from focus as it no longer meets the criteria.

- Financials(Removed): Concerns about the broader economic impact of renewed trade tensions and potential market volatility weighed on the financial sector, leading to a weakening in its trend characteristics and its subsequent removal.

- Communication Services(Removed): This sector also experienced a pullback amidst the general market weakness and increased uncertainty, causing its technical profile to no longer align with our focus criteria. This remains a viable long term investment however.

- Real Estate(Removed): Sensitivity to economic outlook and interest rate expectations, both of which became more uncertain with the tariff news, contributed to a decline in this sector's trend, warranting its removal.

- Dow Jones Industrial Average(Removed): As a broad market gauge with significant exposure to multinational corporations, the renewed trade concerns impacted its overall technical strength, leading to its removal from the focus list.

- S&P 500 Index(Removed): Similar to the Dow, the S&P 500's technical picture weakened due to the broad-based selling pressure stemming from tariff anxieties, resulting in its removal.

- Russell 2000 Index(Removed): Small-capitalization stocks, often sensitive to domestic economic sentiment which can be affected by trade wars, saw a notable decline, leading to this index no longer meeting focus criteria.

- CSI China Internet Index(Removed): While Chinese markets saw some support, this specific segment remains subject to complex geopolitical and trade-related pressures, and its technical trend did not warrant continued focus at this time.

- NVIDIA Corp(Removed): Despite upcoming earnings, the stock pulled back with the broader tech and semiconductor sell-off related to trade concerns, causing its immediate technical picture to become less compelling for focus.

- Amazon.com Inc(Removed): As a company with significant global sourcing, the threat of broader trade disruptions likely contributed to its underperformance and a weakening of its technical trend, leading to its removal.

Added This Week

- Alphabet Inc(New Addition): Alphabet demonstrated relative strength within the hard-hit technology sector last week, managing to post a gain. This resilience and an improvement in its technical characteristics have led to its inclusion as it now meets the criteria for focus, making it important to watch for potential leadership.

LOOKING AHEAD

The upcoming holiday-shortened week is set against a backdrop of heightened uncertainty following Friday's tariff pronouncements. Market direction will likely be heavily influenced by any follow-through on these trade themes and the broader assessment of their potential economic impact. Our trend-following approach suggests caution, as key U.S. indices are testing important support levels. A failure to hold these could signal further downside, while a firm rebound would be needed to suggest the primary uptrend can absorb these new shocks. U.S. markets are closed on Monday, May 26th, for Memorial Day.

Investors will be closely watching Federal Reserve Chairman Jerome Powell's baccalaureate remarks at Princeton University on Sunday, although it's unlikely he will make significant policy statements. However, any commentary on the economic outlook will be scrutinized. The week's economic calendar features the second estimate of Q1 Gross Domestic Product (GDP) on Thursday, which initially came in at -0.3% annually adjusted. April's Personal Consumption Expenditures (PCE) price index, a key inflation gauge for the Fed, is due on Friday and will be critical. April New Home Sales data released Friday morning showed a retreat, following disappointing existing home sales figures. Durable goods orders and consumer confidence are also on tap Tuesday. The Federal Reserve has maintained a cautious "on hold" stance, and recent official commentary suggests reluctance to signal imminent rate cuts, a sentiment likely to be reinforced if trade tensions appear inflationary or detrimental to growth.

From the corporate side, the major event will be earnings from AI leader Nvidia (NVDA) on Wednesday afternoon. This report will be a significant focal point for the technology sector and the broader market, potentially overshadowing trade news, at least temporarily. Several Treasury auctions are also scheduled, and demand will be watched after a recent poorly received 20-year auction. Given the renewed focus on tariffs, we anticipate that market sensitivity to headlines will remain high. The interplay between economic data, Fed commentary, and geopolitical trade developments will dictate market trends. A defensive posture appears warranted until greater clarity emerges on the trade front and its implications for growth and inflation.

Stay Connected & Share the Insights:

Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)