【Joe’s華爾街脈動】美國貿易法院阻止關稅與輝達財報提振市場;經濟訊號好壞參半

法院裁決使關稅失效,引發股市反彈;惟整體經濟前景與貿易政策路徑仍不明朗

Joe 盧, CFA 2025年5月29日 美東時間

重點摘要

美國貿易法院裁決部分關稅無效,加上輝達(NVIDIA)財報強勁,推動股市上揚。然而,白宮即將提出上訴,為未來貿易政策投下不確定性。

- 標普500指數的評估轉為正向,儘管在小型股等領域仍需謹慎。

- 輝達(NVIDIA)和博通(Broadcom Inc)展現強勢,儘管在潛在有利的關稅發展下,蘋果(Apple Inc.)的負面評估依然存在。

- 經濟訊號好壞參半:第一季GDP數據略微下修,初請領失業金人數連續第三週上升,同時對通膨的擔憂持續。

- 類股表現各異:金融類股展望改善至中性,醫療保健類股的負面評估有所緩和。相反地,通訊服務類股的展望則緩和至中性。

- 國際市場方面,香港市場評估顯著增強。然而,中國市場展望降溫至中性,與數個維持強勁正向評估的已開發市場形成對比。

- 受經濟數據疲弱影響,黃金和美國公債價格因殖利率下降而升值。原油和比特幣價格則下跌,顯示各資產類別反應不一。

市場概況

美國國際貿易法院裁定,包括對全球徵收的10%基線關稅和特定對中關稅在內的關鍵關稅無效,加上輝達(NVIDIA)強勁的財報(尤其來自其遊戲部門),共同推動市場初步上揚。此司法行動為不斷升級的貿易緊張局勢帶來了喘息機會,儘管政府的上訴為此增添了不確定因素。輝達(NVIDIA)的正面績效,受到美國對中國出口管制影響而略受抑制。

整體經濟前景呈現好壞參半的景象。美國第一季實質GDP年化成長率下修至-0.2%,歸因於進口增加和政府支出減少。初請領失業金人數連續第三週上升,至24萬人,超出預期,顯示勞動市場可能趨緩,儘管整體狀況依然大致穩健。由於投資者評估其對即將到來的美國聯準會貨幣政策的影響,此系列數據導致債券殖利率下降,10年期美國公債殖利率收在4.44%因。

國際市場反應各異,亞洲股市的上漲與歐洲股市的溫和下跌形成對比。美元出現貶值。原油價格在OPEC+可能增產的揣測下回檔。關稅裁決使進行中的貿易談判更趨複雜,市場參與者將密切關注後續的貿易發展和關鍵通膨指標,例如個人消費支出(PCE)物價指數,以尋求方向指引。

主要市場指數

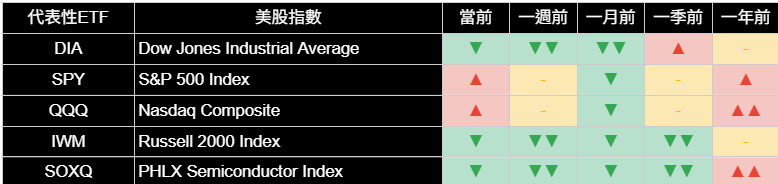

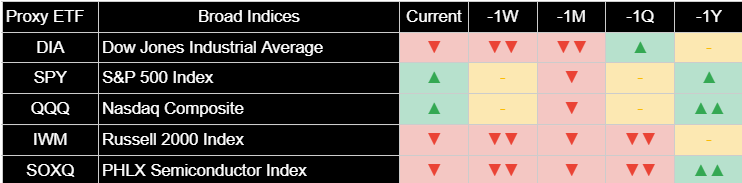

主要美股指數錄得上漲,標普500指數上揚+0.4%,那斯達克綜合指數上漲+0.2%,受惠於關稅發展和輝達(NVIDIA)的財報。道瓊工業平均指數(+0.3%)、羅素2000指數(+0.3%)和費城半導體指數(+0.5%)亦收高。值得注意的是,標普500指數的評估從先前的中性立場改善至正向,那斯達克綜合指數則維持其正向評估。然而,道瓊工業平均指數、羅素2000指數和費城半導體指數則持續反映負面評估。

這種分歧,突顯市場在對特定催化劑作出反應的同時,仍潛藏謹慎情緒,尤其是在經濟數據好壞參半(包括初請領失業金人數上升)的環境下,小型股等對經濟敏感的市場類股更是如此。投資者將關注指標性指數,評估此波重新轉為正向的走勢能否更廣泛地擴散並持續,或者當前的經濟不確定性是否導致市場表現持續分化。

美國前十大公司

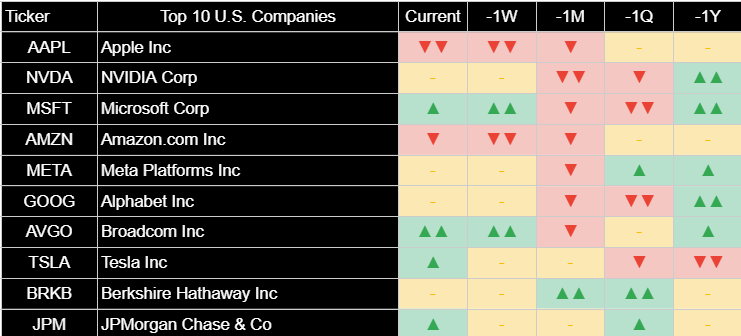

輝達(NVIDIA)(+3.2%)股價因財報強勁而反彈,儘管其整體評估仍為中性。博通(Broadcom Inc)(+1.1%)上揚,維持其強勁的正向評估。蘋果(Apple Inc)(-0.2%)下跌,即使在潛在有利的關稅消息下,其評估依然明顯為負。微軟(Microsoft Corp)(+0.3%)、特斯拉(Tesla Inc)(+0.4%)和摩根大通(JPMorgan Chase & Co)(+0.3%)均錄得上漲,皆維持正向評估。亞馬遜(Amazon.com Inc)(+0.5%)亦上漲,儘管其評估持續為負。Meta Platforms Inc(+0.2%)、Alphabet Inc(-0.3%)和波克夏海瑟威(Berkshire Hathaway Inc)(+0.6%)股價波動溫和,其評估則維持中性。

這些領先企業的表現突顯了個別公司動態和整體市場主題的共同影響。儘管輝達(NVIDIA)、博通(Broadcom Inc)、微軟(Microsoft Corp)、特斯拉(Tesla Inc)和摩根大通(JPMorgan Chase & Co)顯示出部分領域的韌性,但蘋果(Apple Inc)持續的負面評估是一個關鍵的觀察點。投資者需要考量這些強勢領域能否提振整體市場情緒,或者公司特定問題和經濟不確定性是否會導致績效持續分歧。

美國經濟指標

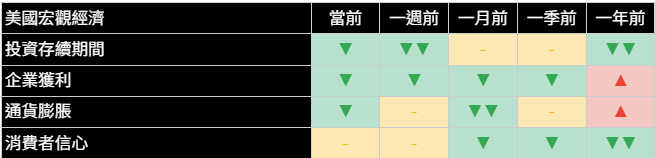

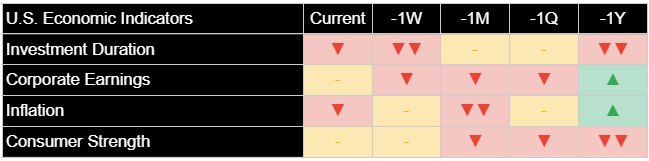

美國經濟前景持續呈現多面向。企業獲利(中性)、通膨(負面)和消費者信心(中性)的評估均持穩。值得注意的是,對投資存續期間的看法雖然仍為負面,但相較於先前更為顯著的負面評估略有改善,顯示擔憂情緒略微減輕。這些觀察發生在經濟數據好壞參半的背景下,包括第一季GDP下修至-0.2%的衰退,以及初請領失業金人數連續第三週上升至24萬人。

對通膨持續的負面評估,加上初請領失業金人數上升,描繪了一幅複雜的經濟情景。儘管投資存續期間展望的溫和改善帶來了一絲初步的樂觀情緒,但整體經濟訊號仍需審慎考量。此類發展無疑引發對美國聯準會未來政策路徑的疑問,因為勞動市場數據趨緩伴隨持續的通膨擔憂,可能引發對適當貨幣政策反應的不同解讀,從而提高了即將公布的PCE通膨數據的重要性。

類股概況

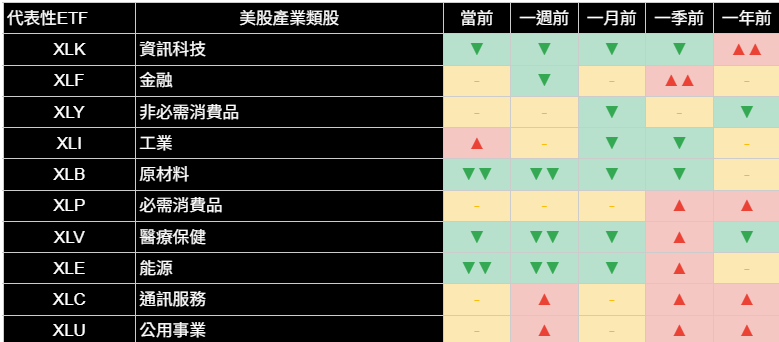

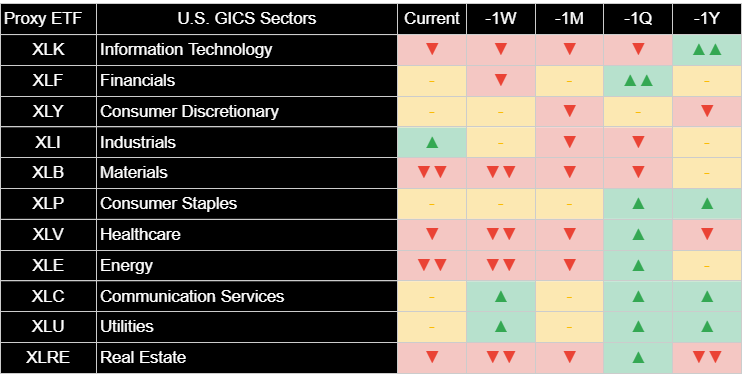

美國各類股表現各異。房地產類股(+0.9%)、能源類股(+0.8%)和醫療保健類股(+0.7%)領漲,而通訊服務類股(-0.8%)則錄得跌幅。在潛在評估方面,金融類股的展望從負面改善至中性,醫療保健類股的負面評估則變得較不顯著。相較之下,通訊服務類股的評估有所緩和,從正向轉為中性。資訊科技和工業等其他類股的評估則與前一日持平。關稅宣布和輝達(NVIDIA)的財報可能對觀察到的部分正面情緒有所貢獻。

金融和通訊服務類股展望的轉變,突顯了動態的市場格局。金融類股評估的改善可能歸因於經濟擔憂減輕或債券殖利率下降等因素。相反地,通訊服務類股評估的趨緩可能指向其他影響因素,或先前正向階段的結束。此種分歧的類股活動強調市場並非一致性地上揚,促使投資者思考當前的催化劑將產生廣泛、持久的影響,還是特定產業的驅動因素將持續主導。

國際市場

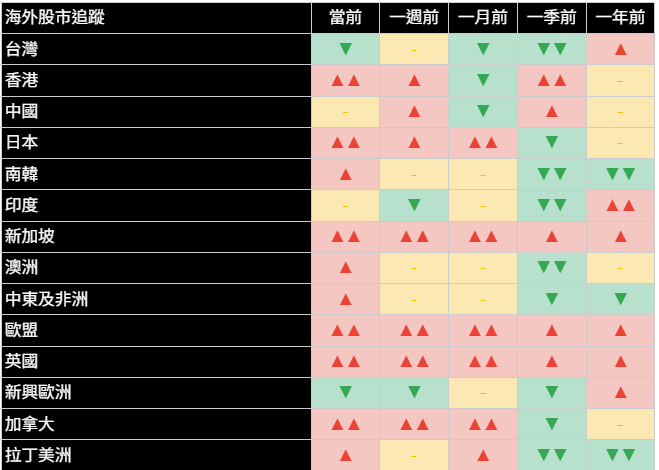

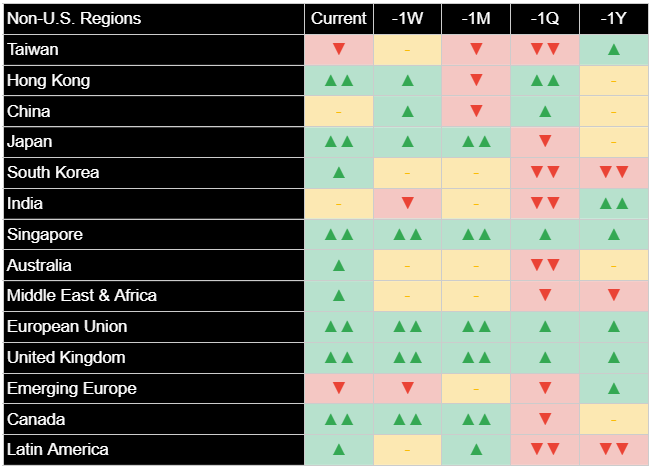

全球股市呈現好壞參半的景象,亞洲市場普遍上漲,與歐洲股市的微幅下跌形成對比。在市場評估方面,香港經歷了顯著的增強,展望轉為強勁正向。這使其與日本、新加坡、歐盟、英國和加拿大並列,這些市場均維持穩健的正向評估。南韓、澳洲以及中東與非洲地區則持續反映正向展望。相反地,台灣和新興歐洲則維持負面評估。中國市場評估降溫至中性,較一週前的正向立場有所轉變。印度的評估改善至中性,而拉丁美洲的評估則轉為正向。

此全球格局顯示數個已開發市場和香港的韌性,但在美國關稅發展的背景下,中國和台灣等關鍵亞洲經濟中心則釋放出一定程度的謹慎訊號。在全球成長考量和貿易政策模糊不清的情況下,正向動能的持久性是投資者面臨的一個適切問題,突顯了地理分散配置的潛在益處。

其他資產

其他資產類別表現各異。比特幣(-1.3%)下跌,而黃金(+0.6%)則升值。原油(-1.0%)價格下跌,受OPEC+可能增產的擔憂影響。各天期美國公債均錄得上漲,1-3年期公債上漲+0.1%,7-10年期公債上漲+0.4%,20年以上公債則上漲+0.9%;這些價格上漲與殖利率的下跌相對應。工業金屬(-0.3%)和農產品(-0.6%)價格亦下跌。這些資產的評估大致穩定:黃金持續展現強勁的正向評估。比特幣和短期公債的評估為中性。原油、長期公債和其他大宗商品類別則維持負面評估。

比特幣的下跌可能顯示其受到獨特影響因素的作用,與股市的部分樂觀情緒有所分歧。美國公債和黃金的升值表明投資者尋求感知上較安全的資產,這可能是對疲弱經濟數據和對美國聯準會政策揣測的反應。原油價格下跌主要歸因於供給面的考量。這些分歧的走勢突顯了總體經濟事件、資產特定基本面以及普遍風險情緒之間複雜的相互作用,強化了投資組合分散配置的重要性。

保持聯繫並分享洞見:

若您覺得本文有幫助,請點讚支持。

歡迎將此新聞通訊轉發給可能覺得有價值的同事和朋友。

訂閱即可直接在您的信箱中接收此分析。

在社群媒體上追蹤我們以獲取更多更新。

本新聞通訊僅供參考,不構成任何投資建議或買賣任何證券或資產類別的推薦。文中所表達的觀點為作者截至發布日期為止的觀點,並可能隨時更改,恕不另行通知。所呈現的資訊係基於從據信可靠來源獲得的數據,但其準確性、完整性和及時性不作保證。過往表現不代表未來結果。投資涉及風險,包括可能損失本金。讀者在做出任何投資決定前,應諮詢自己的財務顧問。作者及相關實體可能持有本文所討論資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

U.S. Trade Court Tariff Block & NVIDIA Earnings Boost Markets Amid Mixed Economic Signals

Court Ruling Invalidates Key Tariffs, Sparking Equity Rally, Though Broader Economic Picture and Trade Policy Path Remain Unclear

By Joe 盧, CFA As of May 29, 2025

EXECUTIVE SUMMARY

A U.S. trade court decision invalidating certain tariffs, coupled with robust earnings from NVIDIA, propelled equity markets higher. However, an impending administration appeal casts uncertainty over future trade policy.

- The S&P 500 Index saw its assessment turn positive, though caution is warranted in areas like small-capitalization stocks.

- While NVIDIA and Broadcom Inc demonstrated strength, Apple Inc's negative assessment persisted despite the potentially favorable tariff developments.

- Mixed economic signals emerged: Q1 GDP figures were revised slightly lower, and jobless claims rose for a third consecutive week, while concerns about inflation persist.

- Sector performance varied: Financials saw an improved outlook to neutral, and Healthcare's negative assessment softened. Conversely, Communication Services' outlook moderated to neutral.

- Internationally, Hong Kong's market assessment strengthened notably. China's outlook, however, cooled to neutral, contrasting with several developed markets that maintained robustly positive assessments.

- Gold and Treasury bonds appreciated as yields declined on the softer economic data. Crude oil and Bitcoin experienced price decreases, illustrating diverse responses across asset classes.

MARKET OVERVIEW

The U.S. Court of International Trade's nullification of key tariffs, including a 10% global baseline and specific China duties, alongside NVIDIA's strong earnings, particularly from its gaming division, fueled an initial market upswing. This judicial action offered a reprieve from escalating trade tensions, though an administration appeal introduces an element of uncertainty. NVIDIA's positive results were somewhat tempered by cautious guidance regarding U.S. export controls impacting China.

The broader economic landscape presented a mixed view. Real U.S. GDP for Q1 was revised to a -0.2% annualized decline, attributed to increased imports and reduced government expenditures. A third consecutive weekly rise in initial jobless claims to 240,000, surpassing forecasts, suggests potential moderation in the labor market, even as overall conditions remain largely sound. This confluence of data led to a decrease in bond yields, with the 10-year Treasury yield settling at 4.44%, as investors assessed the implications for forthcoming Federal Reserve monetary policy.

International market reactions were varied, with gains in Asia contrasting with modest declines in Europe. The U.S. dollar experienced a depreciation. Crude oil prices retreated amid speculation of OPEC+ increasing supply. The tariff ruling complicates ongoing trade negotiations, and market participants will closely monitor subsequent trade developments and crucial inflation metrics, such as the Personal Consumption Expenditures (PCE) index, for directional clarity.

BROAD INDICES

Major U.S. stock indices recorded gains, with the S&P 500 Index advancing +0.4% and the Nasdaq Composite by +0.2%, driven by the tariff developments and NVIDIA's earnings. The Dow Jones Industrial Average (+0.3%), Russell 2000 Index (+0.3%), and PHLX Semiconductor Index (+0.5%) also closed higher. Significantly, the S&P 500 Index's assessment improved to positive from a previously neutral stance, and the Nasdaq Composite maintained its positive assessment. However, the Dow Jones Industrial Average, Russell 2000 Index, and PHLX Semiconductor Index continued to reflect negative assessments.

Such divergence underscores a market reacting to specific catalysts while harboring underlying caution, particularly for economically sensitive segments like small-capitalization stocks, amid an environment of mixed economic data including rising jobless claims. Investors will be watching to see if the renewed positive assessment for bellwether indices can extend more broadly, or if prevailing economic uncertainties will perpetuate a differentiated market performance.

TOP 10 U.S. COMPANIES

NVIDIA (+3.2%) shares rallied on strong earnings, though its overall assessment remains neutral. Broadcom Inc (+1.1%) advanced, sustaining its strongly positive assessment. Apple Inc (-0.2%) declined, with its assessment staying markedly negative even amidst potentially beneficial tariff news. Microsoft Corp (+0.3%), Tesla Inc (+0.4%), and JPMorgan Chase & Co (+0.3%) posted gains, all maintaining positive assessments. Amazon.com Inc (+0.5%) also rose, although its assessment continues to be negative. Meta Platforms Inc (+0.2%), Alphabet Inc (-0.3%), and Berkshire Hathaway Inc (+0.6%) experienced modest price changes, with their assessments holding at neutral.

The performance of these leading companies highlights both individual company dynamics and overarching market themes. While NVIDIA, Broadcom Inc, Microsoft Corp, Tesla Inc, and JPMorgan Chase & Co indicate areas of resilience, Apple Inc's enduring negative assessment is a key observation. Investors will need to consider whether these pockets of strength can buoy broader market sentiment or if company-specific issues and economic uncertainties will foster continued performance disparities.

U.S. ECONOMIC INDICATORS

The U.S. economic picture continues to be multifaceted. Assessments for corporate earnings (neutral), inflation (negative), and consumer strength (neutral) held steady. Notably, the view on investment duration, while still negative, showed a slight improvement from a previously more pronounced negative assessment, suggesting a marginal lessening of concerns. These observations come amid mixed economic releases, including a revision of Q1 GDP to a -0.2% decline and a third consecutive weekly increase in jobless claims to 240,000.

The enduring negative assessment regarding inflation, combined with rising jobless claims, paints a complex economic scenario. Although the modest improvement in the investment duration perspective offers a degree of tentative optimism, the overall economic signals call for careful consideration. Such developments invariably lead to questions regarding the future path of Federal Reserve policy, as moderating labor market data alongside persistent inflation concerns could elicit diverse interpretations of appropriate monetary responses, thereby heightening the significance of forthcoming PCE inflation figures.

SECTOR OVERVIEW

U.S. sector performance was varied. Real Estate (+0.9%), Energy (+0.8%), and Healthcare (+0.7%) led the advancers, whereas Communication Services (-0.8%) registered a decline. Regarding underlying assessments, Financials saw an improvement to a neutral outlook from negative, and Healthcare's negative assessment became less pronounced. In contrast, Communication Services experienced a moderation in its assessment, moving to neutral from positive. Assessments for other sectors, such as Information Technology and Industrials, remained unchanged from the prior day. The tariff announcement and NVIDIA's earnings report likely contributed to some of the positive sentiment observed.

The shifts in outlook for Financials and Communication Services underscore a dynamic market landscape. The improved assessment for Financials could be attributed to factors such as diminished economic concerns or the impact of falling bond yields. Conversely, the softening in Communication Services' assessment may point to alternative influences or the culmination of a previous positive phase. Such divergent sector activity emphasizes that the market is not advancing uniformly, prompting investors to consider whether current catalysts will exert a broad, lasting influence or if sector-specific drivers will remain predominant.

INTERNATIONAL MARKETS

Global equity markets presented a mixed picture, with general advances across Asia contrasting with slight declines in European bourses. In terms of market assessments, Hong Kong experienced a notable strengthening to a strongly positive outlook. This places it alongside Japan, Singapore, the European Union, the United Kingdom, and Canada, all of which maintained robustly positive assessments. South Korea, Australia, and the Middle East & Africa region continued to reflect positive outlooks. Conversely, Taiwan and Emerging Europe held negative assessments. China's market assessment tempered to neutral, a shift from its positive stance a week prior. India's assessment improved to neutral, while Latin America's turned positive.

This global pattern reveals resilience in several developed markets and Hong Kong, yet signals a degree of caution in key Asian economic centers like China and Taiwan, even with the backdrop of U.S. tariff developments. The durability of positive momentum in the face of global growth considerations and trade policy ambiguities is a pertinent question for investors, highlighting the potential benefits of geographic diversification.

OTHER ASSETS

Performance across other asset classes was varied. Bitcoin (-1.3%) declined, whereas Gold (+0.6%) appreciated. Crude Oil (-1.0%) prices decreased, influenced by concerns over potential OPEC+ supply increases. Treasury bonds across the curve registered gains, with 1-3 Year maturities up +0.1%, 7-10 Year maturities up +0.4%, and 20+ Year maturities up +0.9%; these price increases corresponded with a fall in yields. Industrial Metals (-0.3%) and Agricultural Commodities (-0.6%) also saw price declines. Assessments of these assets were largely stable: Gold continues to exhibit a strongly positive assessment. Bitcoin and shorter-term Treasuries are assessed as neutral. Crude Oil, long-term Treasuries, and other commodity categories maintain negative assessments.

The downturn in Bitcoin may indicate unique influencing factors, diverging from the partial optimism seen in equities. The appreciation in Treasury bonds and Gold suggests investor demand for perceived safer assets, likely a reaction to softer economic data and speculation regarding Federal Reserve policy. The fall in crude oil prices was primarily attributed to supply-side considerations. These divergent movements underscore the complex interaction of macroeconomic events, asset-specific fundamentals, and prevailing risk sentiment, reinforcing the importance of portfolio diversification.

Stay Connected & Share the Insights:

Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)