【Joe’s華爾街脈動】周報:科技股財報亮眼,非美國市場在持續的關稅波動中表現分歧

美國消費者具韌性、通膨趨緩帶來支撐,但全球貿易前景仍是漲勢能否持續的關鍵

Joe 盧, CFA 2025年5月30日 美東時間

一周重點摘要

- 美國股市在假期縮短的一週內反彈,標普500指數上漲+1.12%,受惠於強勁的科技股財報和具韌性的消費者,儘管貿易關稅的法院裁決和持續的美中貿易談判狀況,為市場注入波動。

- 儘管貿易限制和新的出口管制公告的陰影依然存在,大型科技股,尤其是輝達(NVIDIA)(+2.53%),繳出亮眼的業績,確認了對AI投資的承諾,並推動那斯達克指數上漲+0.99%。

- 美國關鍵通膨數據(核心PCE)四月份年增率趨緩至+2.5%,為2021年以來最低的年度增幅,且消費者信心顯著改善;然而聯準會會議紀錄顯示,與貿易政策不確定性相關的通膨上行風險依然存在。

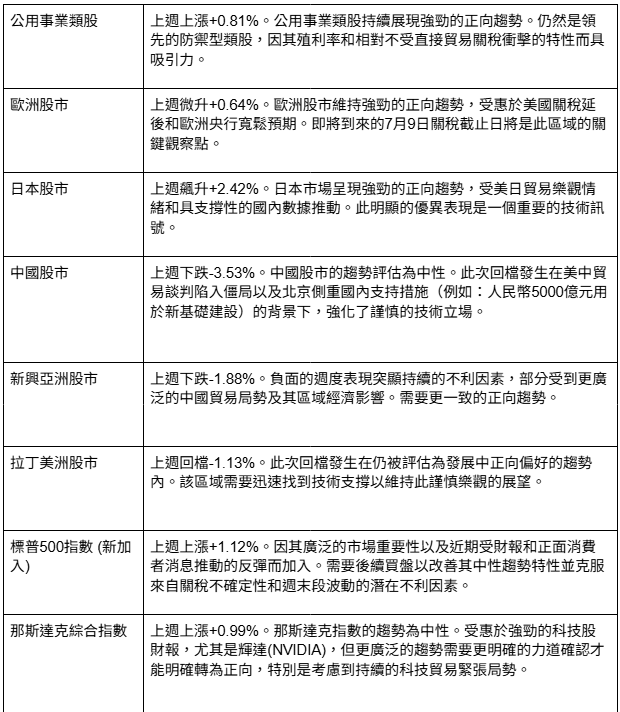

- 已開發國際(EAFE)市場呈現顯著分歧:日本(EWJ +2.42%)因美日貿易樂觀情緒和具支撐性的國內數據而反彈,而歐洲股市(VGK +0.64%)則因美國關稅延後和歐洲央行降息預期而溫和上漲,與中國股市(MCHI -3.53%)的回檔形成對比。

- 對潛在經濟狀況的評估指向一些持續的不利因素;儘管近期的市場強勢令人鼓舞,特別是標普500指數五月份上漲+6.28%,但在關稅不確定性持續形塑全球市場情緒之際,保持警惕至關重要。

一周市場觀點

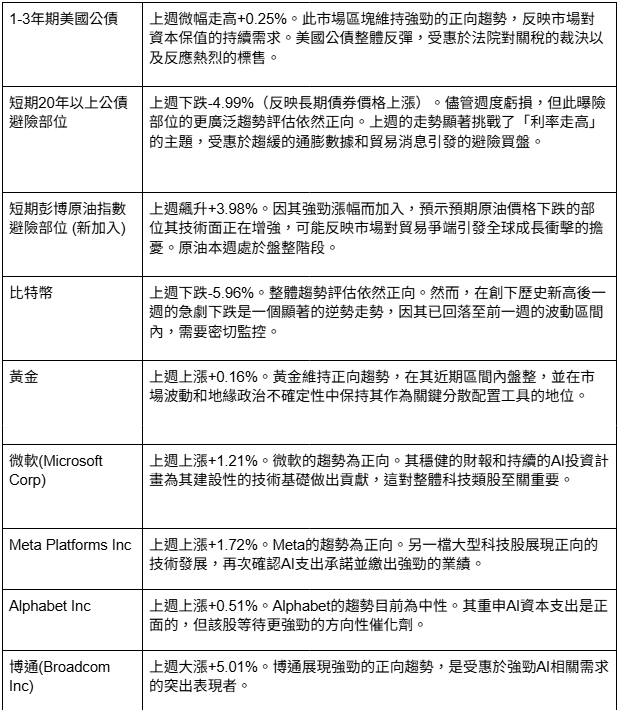

美國股市在波動且因假期縮短的一週內全面上漲,標普500指數(+1.12%)、那斯達克指數(+0.99%)和道瓊指數(+0.96%)均收紅。市場最初受惠於美國對歐盟新關稅的延後。然而,在一項不利於現行全球關稅的法院判決(該判決迅速被擱置)後,週中出現下跌。本週稍晚,財政部長Bessent關於美中貿易談判陷入僵局的言論,則略微打壓了市場情緒。儘管尾盤出現不確定因素,但整體而言,美國股市五月份仍錄得強勁漲幅(標普500指數當月上漲+6.28%,年初至今上漲+0.81%)。不過,技術指標顯示仍需保持謹慎。

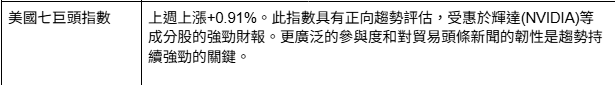

科技類股成為本週推升美股的主要動能,特別是AI領導者輝達(NVIDIA)(+2.53%)的強勁財報,突顯了市場對AI基礎建設需求持續強勁。微軟(Microsoft)(+1.21%)和Meta(+1.72%)亦上漲,而蘋果(Apple)(-0.61%)則表現落後。

四月份核心PCE通膨率(年增+2.5%)降至2021年以來最低水平,但仍高於美國聯準會2%的目標。最新聯準會會議紀錄顯示,通膨仍面臨上行風險,部分原因在於貿易政策的不確定性。五月份消費者信心有所改善,可能與貿易緊張局勢緩解有關,儘管通膨預期依然偏高。在關稅法院裁決和7年期公債標售反應熱烈後,公債殖利率有所下降。

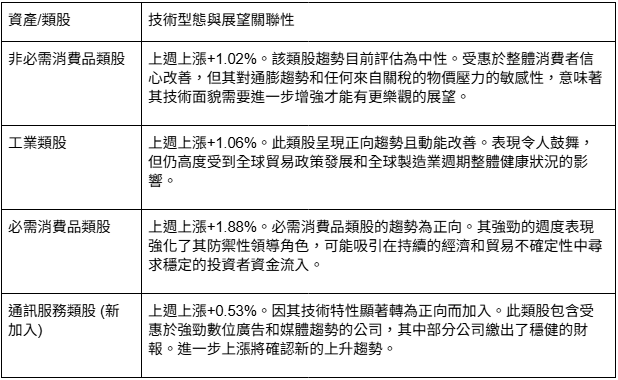

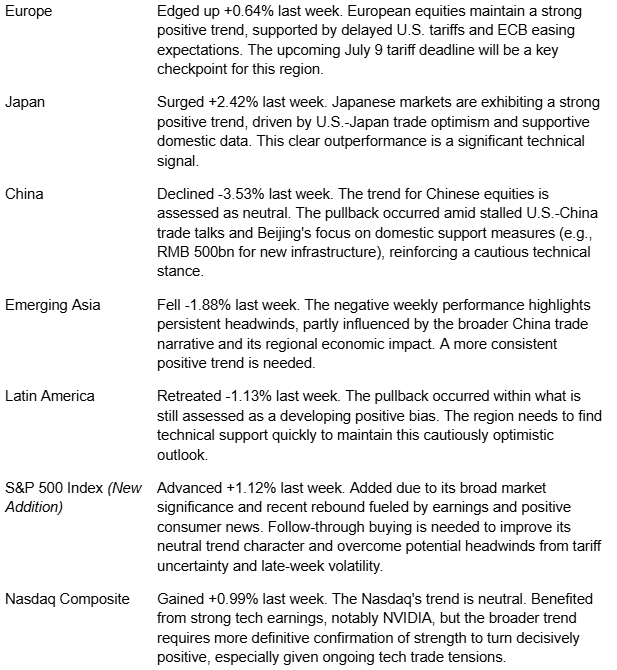

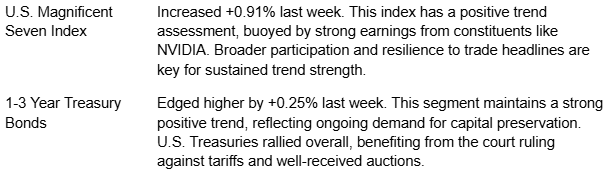

類股表現分歧。科技股、公用事業(+0.81%)和必需消費品(+1.88%)表現相對強勢,而能源類股(-0.24%)則下跌。此種分歧反映出在企業財報、消費者數據和持續的貿易不確定性之間尋求平衡的複雜市場環境。

國際股市表現各異。歐洲股市上揚,受惠於美國關稅延後以及對歐洲央行降息預期升溫。日本市場因對美日潛在貿易協議的樂觀情緒而反彈。相較之下,在美中貿易談判陷入僵局以及中國國內側重刺激措施的背景下,中國市場則出現回檔。

本週焦點

MSCI歐洲、澳洲及遠東(EAFE)指數是廣受認可且極具重要性的基準,常用於衡量北美以外已開發股市的表現。「EAFE」代表歐洲、澳大拉西亞(Austalasia)及遠東地區,涵蓋英國、日本、德國、法國、瑞士和澳洲等21個已開發國家,但特別排除了美國和加拿大。其旨在代表這些國際市場的大型和中型股部分,捕捉各成分國約85%的自由流通調整後市值。因此,MSCI EAFE指數是機構投資者和基金經理衡量其國際已開發市場股票投資組合回報,以及理解這些重要經濟體廣泛趨勢的重要工具。

我的分析明確指出,MSCI EAFE指數(美元計價)值得策略性超配考量。這項判斷基於多項具吸引力的因素:EAFE市場相較於美國股市存在顯著的估值折價(本益比為15.18倍),同時提供較高的股息殖利率(3.05%),既提供了價值緩衝,也帶來了穩健的收益流。更關鍵的是,資本流動結構正發生的實質性變化——包括美國政策驅動的分散配置、德國吸引投資的財政刺激,以及日本因利率轉變而出現的資產回流——目前正有利於此區域。這些趨勢,在美國政府可能傾向弱勢美元以提振出口的背景下,可能進一步放大,創造一個有利於匯率波動美化以美元計價回報的成熟環境。對投資者而言,這提供了一個及時的機會,以獲取經風險調整後更高的回報、有效分散美國股市集中風險的顯著效益,以及資本增值與收益的強效組合,這些都受到全球資本配置實質性轉變的驅動,而此轉變似乎被市場低估了。

儘管EAFE主要國家內部的地緣政治風險、匯率波動和經濟複雜性不容忽視,但就當前的投資格局來看,這些因素已充分反映在資產價格中。對投資者而言,策略上的當務之急是跳脫近期美國市場的主導地位,並認識到全球股市領導地位的週期性。MSCI EAFE指數憑藉其獨特的產業曝險(尤其是金融和工業類股)以及對價值和收益因子的內在傾向,提供了差異化的回報來源,這對於強化投資組合的穩定性至關重要。審慎考量對EAFE的配置不僅僅是一種戰術調整,更是一種策略性舉措,旨在提升長期投資組合的韌性,並從這個受基本價值和這些不斷演變的總體經濟順風驅動、有望復甦的全球市場區塊中獲取超額報酬。

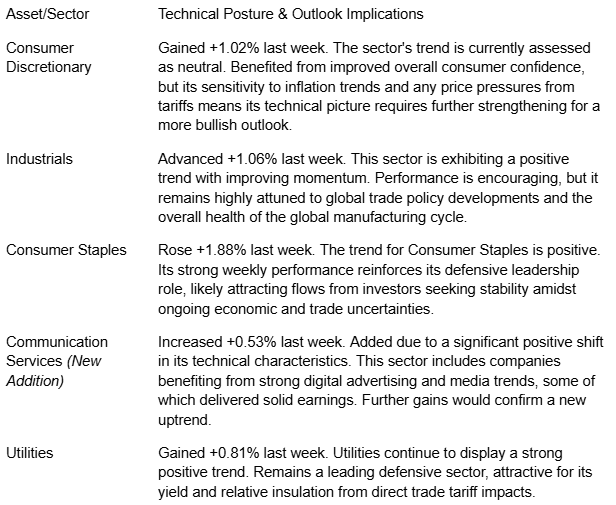

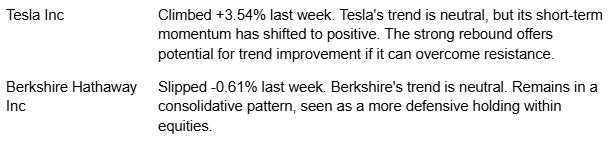

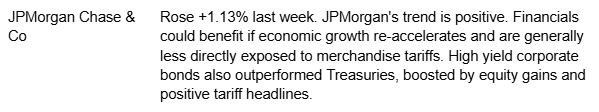

焦點列表重點

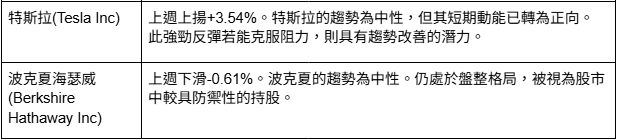

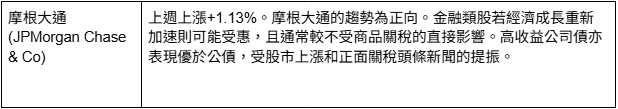

焦點列表調整

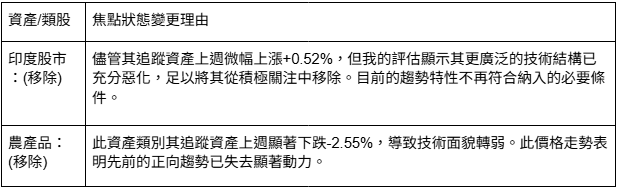

本週移除資產

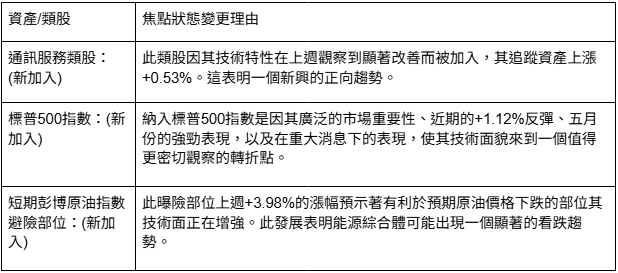

本週新增資產

展望未來

未來一周,市場將繼續關注企業基本面(尤其是美國科技業)與全球貿易政策持續不確定性之間的相互作用。儘管標普500指數在5月份強勁上漲6.28%,核心個人消費支出(PCE)通膨率放緩(4月份同比增長2.5%)和消費者信心回升等正向的經濟訊號也為市場提供了支撐,但「關稅針鋒相對」仍然是一個高度不確定因素。隨著關稅談判期限的臨近,例如,歐盟進口關稅期限延至7月9日,以及中美90天談判的期限至8月12日,這些期限的到來,都可能進一步加劇市場波動。

更多經濟數據的發布,包括對製造業和服務業的更多洞察,將受到密切關注,以了解其對聯準會政策前景的影響。儘管聯準會會議紀錄顯示,目前對貿易導致的通膨風險持謹慎態度,但任何通膨放緩或經濟復甦的進一步跡象,都可能影響市場對利率的預期。上週美國公債殖利率下跌,部分原因是貿易政策波動和強勁的拍賣需求,其趨勢將繼續成為影響整體市場情緒的關鍵因素。

從技術角度來看,美國股市能否鞏固近期漲幅並建立更廣泛的支撐基礎至關重要。儘管受輝達等公司強勁業績和人工智慧支出再度增加的推動,科技股一直是關鍵驅動力,但可持續的反彈往往需要更廣泛的參與。EAFE市場的表現,尤其是歐洲(受歐洲央行支撐,但面臨當地經濟考驗)和日本(受特定貿易樂觀情緒提振)的分化路徑,也將成為衡量全球風險偏好的重要指標。。

投資者可能已經有些「關稅議題疲乏」,但貿易角力影響企業獲利和經濟成長的可能性仍然存在。儘管一些展望表明,從長期來看,「關稅高峰和恐慌高峰可能已經過去」,但短期內市場走勢可能仍將波動。TrendFolios®趨勢追蹤策略強調了保持警覺的重要性。儘管市場已出現復甦跡象,但公用事業等類股的防禦性領導地位仍持續,加上成長走勢,顯示投資者仍處於微妙的立場。未來一週的關鍵問題在於,強勁獲利和消費者數據所帶來的正向動力,能否繼續抵消全球貿易不確定性及潛在經濟擔憂所帶來的阻力。

保持聯繫並分享洞見:

若您覺得本文有幫助,請點讚支持。

- 歡迎將此新聞通訊轉發給可能覺得有價值的同事和朋友。

- 訂閱即可直接在您的信箱中接收此分析。

- 在社群媒體上追蹤我們以獲取更多更新。

本新聞通訊僅供參考,不構成任何投資建議或買賣任何證券或資產類別的推薦。文中所表達的觀點為作者截至發布日期為止的觀點,並可能隨時更改,恕不另行通知。所呈現的資訊係基於從據信可靠來源獲得的數據,但其準確性、完整性和及時性不作保證。過往表現不代表未來結果。投資涉及風險,包括可能損失本金。讀者在做出任何投資決定前,應諮詢自己的財務顧問。作者及相關實體可能持有本文所討論資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Tech Earnings Shine, Non-U.S. Markets Diverge Amid Persistent Tariff Volatility

Resilient U.S. Consumer and Moderating Inflation Offer Support, But Global Trade Picture Remains Key to Sustained Advance

Joe Lu, CFA May 30, 2025

EXECUTIVE SUMMARY

- U.S. equity markets rebounded in a holiday-shortened week, with the S&P 500 gaining +1.12%, driven by strong tech earnings and a resilient consumer, though trade policy headlines, including court rulings on tariffs and ongoing U.S.-China trade talk status, injected volatility.

- Mega-cap technology, notably NVIDIA (+2.53%), delivered robust results, affirming commitment to AI investment and fueling Nasdaq's +0.99% gain, despite the overhang of trade restrictions and new export control announcements.

- Key U.S. inflation data (core PCE) eased to +2.5% year-over-year in April, its slowest annual pace since 2021, and consumer confidence saw a sharp improvement; yet Fed minutes revealed ongoing concerns about upside inflation risks tied to trade policy uncertainty.

- Developed international (EAFE) markets showed notable divergence: Japan (EWJ +2.42%) rallied on U.S.-Japan trade optimism and supportive domestic data, while European equities (VGK +0.64%) gained modestly on delayed U.S. tariffs and ECB rate cut hopes, contrasting with a pullback in China (MCHI -3.53%).

- My assessment of underlying economic conditions points to some persistent headwinds; while recent market strength is encouraging, particularly the S&P 500's +6.28% gain in May, vigilance is crucial as tariff uncertainties continue to shape global market sentiment.

MARKET PERSPECTIVE

U.S. stocks experienced gains across the board during a volatile, holiday-shortened week, with the S&P 500 (+1.12%), Nasdaq (+0.99%), and Dow (+0.96%) all finishing in positive territory. The market was initially buoyed by a postponement of new U.S.-EU tariffs. However, an intraweek dip occurred following a court decision against existing global tariffs, which was quickly put on hold. Later in the week, sentiment was somewhat dampened by Treasury Secretary Bessent's remarks concerning stalled U.S.-China trade negotiations. Despite this late-week uncertainty, U.S. equities registered strong gains for May overall (S&P 500 +6.28% for the month, +0.81% year-to-date), although technical indicators suggest ongoing caution.

Robust earnings from the technology sector, particularly from AI leader NVIDIA (+2.53%), were a significant driver of market gains, underscoring strong demand for AI infrastructure. Microsoft (+1.21%) and Meta (+1.72%) also saw increases, while Apple (-0.61%) underperformed.

April's core PCE inflation rate (+2.5% year-over-year) fell to its lowest level since 2021 but remained above the Federal Reserve's 2% target. The minutes from the latest Fed meeting indicated persistent upside risks to inflation, partly due to uncertainties surrounding trade policy. Consumer confidence showed improvement in May, potentially linked to easing trade tensions, although inflation expectations remained elevated. Treasury yields declined following the tariff court ruling and a strong auction of 7-year notes.

Sector performance presented a mixed picture. Technology, Utilities (+0.81%), and Consumer Staples (+1.88%) displayed strength, while Energy (-0.24%) experienced a decline. This divergence reflects a complex market environment navigating a balance between corporate earnings, consumer data, and ongoing trade uncertainties.

International equity markets exhibited diverse performance. European equities advanced, supported by the delay in U.S. tariffs and growing expectations of an interest rate cut by the European Central Bank. Japanese markets rallied on optimism surrounding a potential U.S.-Japan trade agreement. In contrast, Chinese markets experienced a pullback amid stalled U.S.-China trade talks and a domestic focus on stimulus measures.

HIGHLIGHT OF THE WEEK

The MSCI EAFE Index is a widely recognized and crucial benchmark for investors looking to gauge the performance of developed equity markets outside of North America. "EAFE" stands for Europe, Australasia, and the Far East, encompassing 21 developed countries such as the United Kingdom, Japan, Germany, France, Switzerland, and Australia, while notably excluding the United States and Canada. It is designed to represent the large and mid-cap segments of these international markets, capturing approximately 85% of the free float-adjusted market capitalization in each constituent country. Consequently, the MSCI EAFE Index serves as a vital tool for institutional investors and fund managers to measure the returns of their international developed market equity portfolios and to understand broad trends across these significant economies.

My analysis strongly indicates that the MSCI EAFE Index warrants strategic overweight consideration. This conviction stems from an attractive confluence of factors: EAFE markets trade at a significant valuation discount to U.S. equities (P/E of 15.18x) while offering a superior dividend yield (3.05%), providing both a value cushion and a robust income stream. Critically, emerging capital flow dynamics—including U.S. policy-driven diversification, German fiscal stimulus drawing investment, and Japanese asset repatriation due to shifting interest rates—are now favoring this region. These trends, potentially amplified by a U.S. administration inclined towards a weaker dollar, create a ripe environment for currency movements to flatter USD-based returns. For investors, this presents a timely opportunity to capture enhanced risk-adjusted returns, meaningful diversification from concentrated U.S. equity risk, and a potent combination of capital appreciation and income, all driven by tangible shifts in global capital allocation that appear underappreciated by the broader market.

While geopolitical risks, currency volatility, and economic complexities within key EAFE nations are undeniable, the current investment landscape suggests these are adequately priced in. The strategic imperative for investors is to look beyond recent U.S. market dominance and recognize the cyclical nature of global equity leadership. The MSCI EAFE Index, with its distinct sector exposures (notably Financials and Industrials) and inherent factor tilts towards Value and Yield, provides a differentiated return stream crucial for robust portfolio construction. A carefully considered allocation to EAFE is not merely a tactical adjustment but a strategic move to enhance long-term portfolio resilience and capture alpha from a segment of the global market poised for a potential resurgence, driven by fundamental value and these evolving macroeconomic tailwinds.

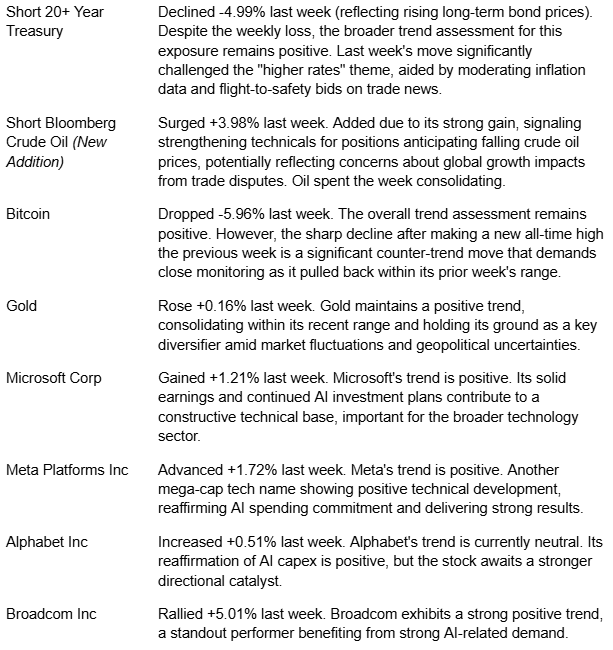

FOCUS LIST HIGHLIGHTS

FOCUS LIST ADJUSTMENTS

Assets Removed This Week

- India (Removed) - Despite a modest gain of +0.52% for its tracking asset last week, my assessment indicates its broader technical structure has deteriorated sufficiently to warrant its removal from active focus. The prevailing trend characteristics no longer meet the necessary conditions for inclusion.

- Agricultural Commodities (Removed) - This asset class experienced a notable decline of -2.55% for its tracking asset last week, contributing to a weakening technical profile. This price action suggests that the prior positive trend has lost significant impetus.

Assets Added This Week

- Communication Services (New Addition) - This sector has been added due to a significant improvement in its technical characteristics observed last week, including a +0.53% gain for its tracking asset. This suggests an emerging positive trend.

- S&P 500 Index (New Addition) - The S&P 500 Index is included as its broad market importance, recent +1.12% rebound, strong May performance, and navigation of significant news, has brought its technical picture to a juncture deserving more intensive observation.

- Short Bloomberg Crude Oil (New Addition) - The +3.98% advance for this exposure last week signals strengthening technicals for positions that benefit from falling crude oil prices. This development suggests a potentially significant bearish trend is emerging in the energy complex.

LOOKING AHEAD

The upcoming week will likely see continued focus on the interplay between corporate fundamentals, particularly in the U.S. technology sector, and the persistent uncertainty stemming from global trade policies. While the S&P 500 capped off a strong May with a gain of +6.28%, and positive economic signals like moderating core PCE inflation (+2.5% YoY for April) and rebounding consumer confidence offer support, the "tariff tit-for-tat" remains a significant wildcard. Key tariff deadlines, such as the July 9 date for EU import tariff decisions and the August 12 expiration of the 90-day negotiation window with China, will loom larger as they approach, potentially injecting further volatility.

Further economic data releases, including more insights into manufacturing and services sectors, will be scrutinized for their impact on the Federal Reserve's policy outlook. While the Fed minutes indicated ongoing caution about inflation risks tied to trade, any further signs of inflation moderation or economic resilience could influence market expectations for interest rates. U.S. Treasury yields fell last week partly due to trade policy volatility and strong auction demand, and their direction will continue to be a key factor for broader market sentiment.

From a technical standpoint, the ability of the U.S. equity market to consolidate its recent gains and build a broader base of support will be critical. While technology, fueled by strong earnings from companies like NVIDIA and reaffirmed AI spending, has been a key driver, sustainable rallies often require wider participation. The performance of EAFE markets, particularly the divergent paths of Europe (supported by ECB hopes but facing local economic tests) and Japan (buoyed by specific trade optimism), will also be important indicators of global risk appetite.

Investors may be experiencing some "tariff fatigue," yet the potential for trade disputes to impact corporate earnings and economic growth remains. While some outlooks suggest "peak tariff rates and peak fear are likely behind us" in the longer term, the near-term path is likely to remain choppy. My trend-following approach underscores the importance of vigilance. While the market has shown resilience, the persistence of defensive leadership in sectors like Utilities, alongside growth narratives, suggests a nuanced investor posture. The key question for the week ahead is whether the positive momentum from strong earnings and supportive consumer data can continue to counterbalance the headwinds from an uncertain global trade environment and underlying economic cautions.

Stay Connected & Share the Insights

Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)