【Joe’s華爾街脈動】貿易緊張局勢加劇與關稅威脅下,股市仍上漲

投資者應對加劇的美中摩擦與利率不確定性,焦點轉向關鍵就業數據及聯準會訊號

Joe 盧, CFA 2025年6月2日 美東時間

重點摘要

- 美股收高,展現韌性,投資者大致消除了因美中貿易緊張局勢升級和新關稅聲明引發的初期擔憂,惟經濟訊號仍顯複雜。

- 主要大型股指數,特別是那斯達克綜合指數,自早盤低點回升並收於正值,即便小型股和半導體指數持續疲弱且趨勢評估為負面。

- 美國頂尖企業的表現各異,Meta (Meta Platforms Inc.)等公司實現強勁上漲且趨勢有所改善,而Alphabet (Alphabet Inc.)和特斯拉(Tesla Inc.)等其他公司則面臨不利因素且趨勢轉為負面。

- 經濟評估指出通貨膨脹壓力上升,以及對企業獲利和投資存續期間的持續擔憂,這使得關鍵勞動數據發布前的展望更趨複雜。

- 類股趨勢呈現分歧,通訊服務和公用事業類股表現強勁,而醫療保健和能源類股則維持深度負面展望,反映在廣泛不確定性下投資者的選擇性情緒。

- 國際市場展現局部強勁的正面動能,尤其在歐洲、英國和日本,儘管美國貿易摩擦再起,對全球經濟成長構成潛在風險。

- 黃金等避險資產上漲,原油因地緣政治擔憂而飆升,比特幣則暫停近期漲勢;美國公債價格下跌,殖利率隨之上升。

市場概覽

美股週一收高,儘管早盤受貿易緊張局勢升級而承壓,但整體仍展現韌性。主要指數回升,反應投資者大致已消除對美國新關稅威脅及美中摩擦加劇的擔憂。此番反彈顯示市場對關稅言論已逐漸適應,或「逢低買入」的情緒持續存在。

本週焦點轉向即將公布的美國就業數據與聯準會主席鮑爾的談話。聯準會理事華勒針對關稅可能帶動通膨的評論,以及聯準會可能「看穿」暫時性效應的觀點,凸顯了內部政策的辯論。儘管近期的通膨數據溫和,但關稅效應仍具不確定,尤其在第二季標普500指數成分股獲利預期下調幅度高於平均的情況。

週一公布的ISM製造業指數顯示持續萎縮,進口大幅下降,與擴張性的標普全球採購經理人指數(S&P Global PMI)形成對比。在貿易戰風險評估下,美元走弱,黃金則上漲。儘管有外交斡旋,貿易前景依然不明朗,不過目前市場對關稅消息的敏感度較低。

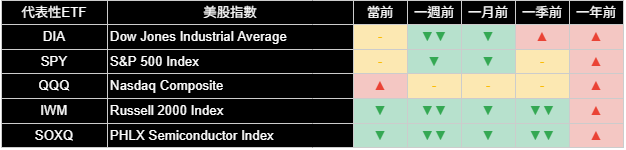

整體市場指數

美國整體市場指數從早盤因貿易緊張引發的賣壓中回升,大多收高。那斯達克綜合指數領漲(+0.79%),其趨勢改善至正向。標普500指數上漲(+0.56%),其中性趨勢較上週有所改善。道瓊工業平均指數上揚(+0.20%),但其趨勢轉弱至中性。相較之下,羅素2000指数和費城半導體指數的趨勢則維持或轉為負面,顯示潛在的脆弱性。

此種韌性,尤其在那斯達克市場,意味著投資者可能低估了關稅的短期衝擊,轉而著眼於大型科技股。然而,小型股和半導體類股的負面趨勢則透露出集中的疲弱現象。在關鍵就業數據和聯準會訊息即將發布之際,市場能否維持當前的韌性,將是觀察後續走勢的關鍵。

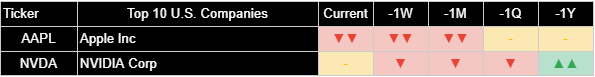

美國十大企業

美國龍頭企業表現分歧。Meta (Meta Platforms Inc.)上漲(+3.62%),其趨勢改善至非常正向。博通(Broadcom Inc.)上揚(+2.74%),其趨勢亦較上週改善。相反地,Alphabet (Alphabet Inc.)下跌(-1.58%),其趨勢轉為負面。特斯拉(Tesla Inc.)因歐洲銷售困境下跌(-1.09%),其趨勢由正向轉為中性,而輝達(NVIDIA Corp.)則下跌(-0.67%),趨勢轉弱至中性。這凸顯了投資者的選擇性偏好。

如此分歧的表現揭示了市場細微的變化;Meta (Meta Platforms Inc.)和亞馬遜(Amazon.com Inc.)(趨勢現為正向)的動能與蘋果(Apple Inc.)(趨勢非常負面)的謹慎形成對比。市場對人工智慧(AI)股的「逢低買入」傾向呈現選擇性。即將公布的財報,如博通(Broadcom),以及市場對總體經濟數據的反應,將考驗這些關鍵企業能否維持市場領導地位。

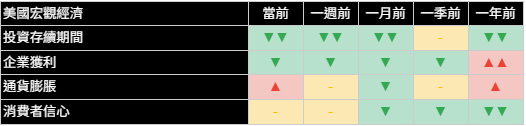

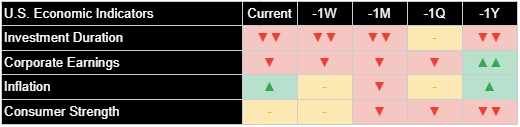

美國經濟指標

美國經濟因素的評估呈現謹慎和分歧。通貨膨脹前景從上週的中性轉為正向(上升),與市場對關稅可能推升通膨的擔憂一致。然而,市場對投資存續期間的看法仍非常負面,對企業獲利也維持負面,反映出投資者對經濟成長和獲利能力的持續憂慮。消費者信心則維持中性。

通貨膨脹預期上升,加上負面的企業獲利和投資存續期間看法,對市場構成挑戰。考量到聯準會內部辯論,由關稅推動的更強勁通膨可能使聯準會政策複雜化。即將公布的就業數據將考驗消費者信心,而製造業萎縮和進口下降則凸顯了更廣泛的經濟不利因素。

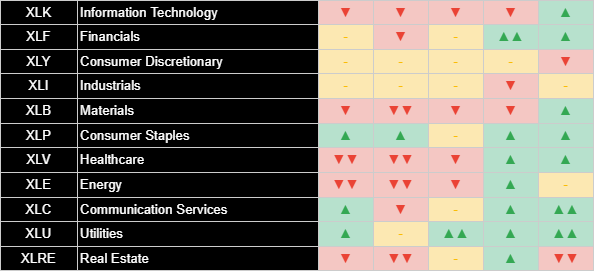

產業類股總覽

美國類股趨勢各異。通訊服務類股上漲(+0.49%),維持其改善後的正向趨勢。公用事業類股亦保持正向趨勢。相較之下,醫療保健類股的趨勢轉弱至非常負面,能源類股儘管其代表指數上漲(+1.31%),但仍維持非常負面。資訊科技類股雖上漲(+0.88%),但趨勢仍為負面。金融類股(+0.04%)則轉為中性,較一週前的負面有所改善。

防禦型的必需消費品和公用事業類股的正向趨勢顯示投資者態度謹慎。通訊服務類股的強勁表現與成長主題一致。然而,醫療保健、能源和資訊科技類股的極度負面趨勢則透露出更廣泛的擔憂。製造業數據好壞參半,加上貿易緊張局勢,為工業類股(趨勢中性)和原物料類股(趨勢仍為負面)增添不確定性。市場韌性究竟是全面性回穩,或僅由特定類股撐持,仍有待觀察。

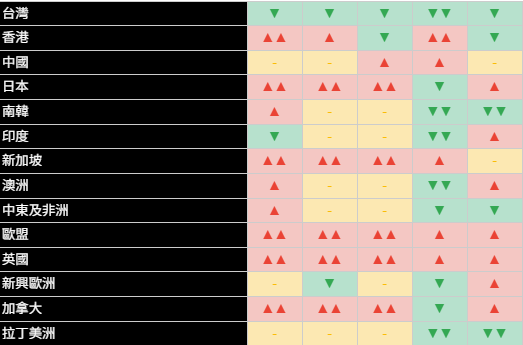

國際市場

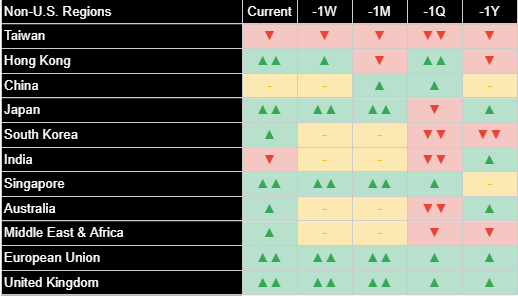

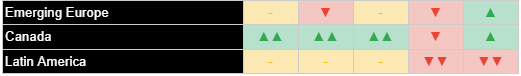

在全球貿易不確定性升溫之際,國際市場走勢呈現亦分歧。歐盟、英國和日本均維持非常正向的趨勢,顯示信心穩固。香港的趨勢亦維持非常正向,較上週增強。相反地,台灣則呈現持續的負面趨勢。印度儘管其代表指數單日上漲(+0.44%),但趨勢由中性轉為負面。中國則維持中性展望,而新興歐洲市場則從負面改善至中性。

歐洲、英國、日本、加拿大等已開發市場以及香港的強勁正向趨勢,顯示其可能受到獨特的區域驅動因素或分散投資策略的影響。然而,美國與中國,甚至可能與歐盟之間再起的貿易緊張局勢,恐為全球帶來不利因素。美元走弱或可為新興市場提供短暫支撐,但貿易局勢對全球經濟成長仍具關鍵影響。印度的負面轉向和台灣的謹慎態勢值得持續關注。

其他資產

其他資產反映了貿易緊張局勢引發的避險情緒,推升了避險資產價格。黃金在此需求下上漲(+2.66%),其正向趨勢增強。原油因地緣政治擔憂而飆升(+3.57%),儘管其潛在趨勢非常負面。比特幣小幅回檔(-0.17%),但仍維持正向趨勢。1-3年期美國公債(-0.41%)及20年期以上美國公債(-1.30%)的代表指數下跌,殖利率隨之上升。工業金屬上漲(+1.58%),其趨勢為中性。

黃金的反彈突顯了對貿易戰和通膨的擔憂。原油價格的飆升加劇了對通膨的擔憂。鑑於比特幣近期的漲勢,其停頓似乎很正常。國債價格下跌顯示債券市場正在對通膨預期和聯準會可能採取的行動做出反應。

保持聯繫並分享見解:

若您覺得本文有幫助,請點讚支持。

- 歡迎將此電子報轉發給可能覺得有價值的同事和朋友。

- 訂閱即可直接在您的收件匣中收到此分析。

- 在社群媒體上關注我們以獲取更多更新。

本電子報僅供參考,不構成任何證券或資產類別的投資建議或買賣推薦。文中所表達的觀點為作者截至發布日期的觀點,如有變動,恕不另行通知。所呈現的資訊乃基於從相信可靠的來源所獲取的數據,但其準確性、完整性和及時性不作保證。過往表現並非未來結果的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其財務顧問。作者及相關實體可能持有本文所討論的資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Equities Rise Despite Flaring Trade Tensions and Tariff Threats

Investors Navigate Heightened U.S.-China Friction and Rate Uncertainty, Shifting Focus to Key Jobs Data and Fed Signals.

By Joe 盧, CFA As of June 2, 2025

EXECUTIVE SUMMARY

- U.S. equity markets closed higher, demonstrating resilience as investors largely shrugged off early concerns stemming from escalating U.S.-China trade tensions and new tariff pronouncements, though underlying economic signals remain mixed.

- Major broad stock indices, particularly the Nasdaq Composite, recovered from morning lows to finish in positive territory, even as small-caps and semiconductor indices continued to show weakness and negative trend assessments.

- Performance among top U.S. companies was varied, with strong gains and positive trend improvements for names like Meta Platforms Inc., while others like Alphabet Inc. and Tesla Inc. faced headwinds and negative trend shifts.

- Economic assessments pointed to rising inflationary pressures and persistent concerns regarding corporate earnings and investment duration, complicating the outlook ahead of key labor data releases.

- Sector trends were diverse, with Communication Services and Utilities showing strength, while Healthcare and Energy maintained deeply negative outlooks, reflecting selective investor sentiment amid broader uncertainties.

- International markets showed pockets of robust positive momentum, particularly in Europe, the UK, and Japan, though renewed U.S. trade frictions pose a potential risk to global growth.

- Safe-haven assets like Gold rallied, and Crude Oil surged on geopolitical concerns, while Bitcoin paused its recent advance; U.S. Treasury bond prices fell as yields rose.

MARKET OVERVIEW

U.S. equity markets closed higher Monday, resilient despite early pressure from escalating trade tensions. Major indices recovered as investors largely shrugged off concerns over new U.S. tariff threats and heightened U.S.-China friction. This rebound suggests acclimatization to tariff rhetoric or persistent "buy the dip" sentiment.

Investor focus shifts to a critical week of U.S. jobs data and Fed Chairman Powell's remarks. Fed Governor Waller's comments on tariffs' inflationary impact versus the Fed potentially "looking through" temporary effects highlight an internal policy debate. While recent inflation data was benign, tariff impacts are uncertain, especially as Q2 S&P 500 earnings estimates see larger-than-average cuts.

Monday's ISM Manufacturing Index showed continued contraction, with imports falling sharply, contrasting an expansionary S&P Global PMI. The U.S. dollar weakened amid trade-war risk assessment, and gold rose. Despite diplomatic overtures, the trade outlook remains uncertain, though markets currently show less sensitivity to tariff news.

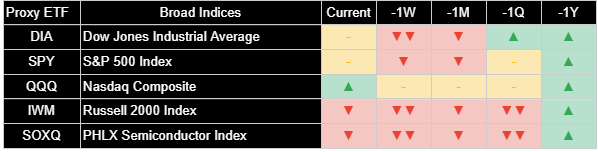

BROAD INDICES

U.S. broad market indices recovered from early trade-tension selling, closing mostly higher. The Nasdaq Composite led (+0.79%), its trend improving to positive. The S&P 500 Index gained (+0.56%), its neutral trend an improvement from last week. The Dow Jones Industrial Average added (+0.20%), though its trend weakened to neutral. However, Russell 2000 and PHLX Semiconductor Index trends remained or turned negative, suggesting underlying fragility.

This resilience, especially in the Nasdaq, implies investors might discount immediate tariff impacts, possibly eyeing large-cap tech. Yet, negative trends in small-caps and semiconductors signal concentrated weakness. Sustaining this broader market resilience is key as critical jobs data and Fed input loom.

TOP 10 U.S. COMPANIES

Leading U.S. companies showed mixed performance. Meta Platforms Inc. advanced (+3.62%), its trend improving to very positive. Broadcom Inc. gained (+2.74%), also improving its trend from last week. Conversely, Alphabet Inc. fell (-1.58%), its trend turning negative. Tesla Inc. declined (-1.09%) on European sales woes, its trend now neutral from positive, while NVIDIA Corp. lost (-0.67%), its trend weakening to neutral. This highlights selective investor appetite.

Such varied performance signals a nuanced landscape; momentum in Meta Platforms Inc. and Amazon.com Inc. (trend now positive) contrasts with caution for Apple Inc. (trend very negative). The "buy the dip" AI focus appears selective. Upcoming earnings, like Broadcom's, and reactions to macro data will test if these key firms can sustain market leadership.

U.S. ECONOMIC INDICATORS

U.S. economic factor assessments are cautious and mixed. The inflation outlook shifted to positive (rising), improving from last week's neutral, aligning with concerns that tariffs could boost inflation. However, Investment Duration views stayed very negative, and Corporate Earnings remained negative, signaling persistent growth and profitability worries. Consumer Strength held a neutral assessment.

This mix of rising inflation expectations with negative earnings and investment duration views creates a challenge. Stronger tariff-driven inflation could complicate Fed policy, given internal debate. Upcoming jobs data will test consumer strength, while contracting manufacturing and falling imports highlight broader economic headwinds.

SECTOR OVERVIEW

U.S. sector trends were varied. Communication Services, up (+0.49%), maintained its improved positive trend. Utilities also held a positive trend. In contrast, Healthcare's trend weakened to very negative, and Energy, though its proxy gained (+1.31%), stayed very negative. Information Technology, despite a (+0.88%) rise, remained negative. Financials (+0.04%) shifted to neutral, improving from negative a week ago.

Positive trends in defensive Consumer Staples and Utilities suggest investor caution. Communication Services' strength aligns with growth themes. However, deeply negative trends in Healthcare, Energy, and Information Technology signal broader concerns. Mixed manufacturing and trade tensions create uncertainty for Industrials (trend neutral) and Materials (trend still negative). The question remains if market resilience is broad or narrow.

INTERNATIONAL MARKETS

International markets showed diverse trends amidst global trade uncertainties. The European Union, United Kingdom, and Japan all maintained very positive trends, signaling sustained confidence. Hong Kong's trend also remained very positive, strengthening from last week. Conversely, Taiwan displayed a persistent negative trend. India's trend shifted to negative from neutral, despite a daily (+0.44%) gain for its proxy. China held a neutral outlook, while Emerging Europe improved to neutral from negative.

Strong positive trends in developed markets like Europe, the UK, Japan, and Canada, plus Hong Kong, suggest distinct regional drivers or diversification plays. However, renewed U.S. trade tensions with China and potentially the EU could create global headwinds. A weaker dollar may offer temporary relief to emerging markets, but the trade narrative's impact on global growth is paramount. India's negative shift and Taiwan's caution bear watching.

OTHER ASSETS

Other assets reflected risk-off sentiment from trade tensions, boosting safe havens. Gold gained (+2.66%) on this demand, its positive trend strengthening. Crude Oil surged (+3.57%) on geopolitical concerns, despite a very negative underlying trend. Bitcoin pulled back slightly (-0.17%) but kept a positive trend. Proxies for 1-3 Year Treasury Bonds (-0.41%) and 20+ Year Treasury Bonds (-1.30%) fell as yields rose. Industrial Metals gained (+1.58%), their trend neutral.

Gold's rally highlights nervousness about trade wars and inflation. Crude Oil's surge adds to these inflation concerns. Bitcoin's pause seems normal given its recent run, with interest remaining. Falling Treasury bond prices suggest the bond market is reacting to inflation expectations and potential Fed action.

Stay Connected & Share the Insights:

Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)