【Joe’s華爾街脈動】就業成長與關稅考驗投資者決心

股市在經濟不確定性加劇下盤整;歷史性的五月強勢帶來希望

Joe 盧, CFA 2025年6月4日 美東時間

重點摘要

- 投資者評估私部門就業成長顯著放緩、ISM服務業採購經理人指數(PMI)萎縮,以及鋼鋁關稅提高的實施與對美中貿易談判的謹慎評論。

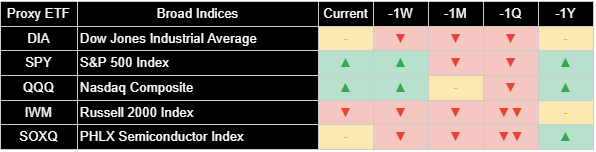

- 整體市場指數表現分歧,標普500指數近乎持平,那斯達克指數趨勢大致持穩,不過道瓊工業平均指數和費城半導體指數的量化指標顯示,本週已從負面改善至中性。

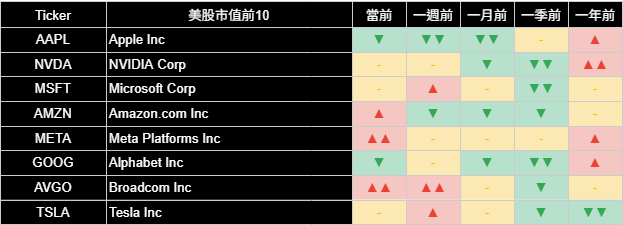

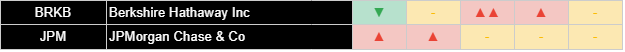

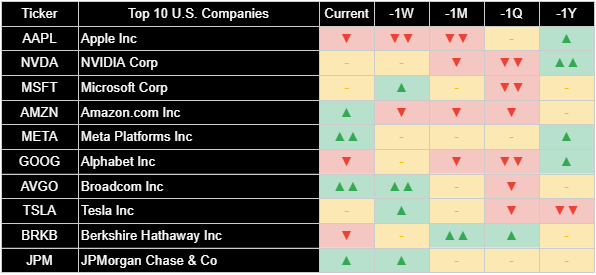

- 美國頂尖企業表現分歧;Meta (Meta Platforms Inc.)和博通(Broadcom Inc.)的指標展現顯著強勢且正向趨勢得到鞏固,而蘋果(Apple Inc.)持續其負面趨勢,微軟(Microsoft Corp.)的趨勢則降溫至中性。

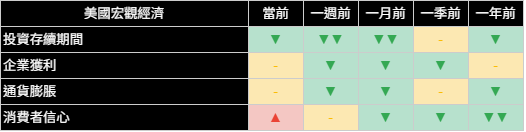

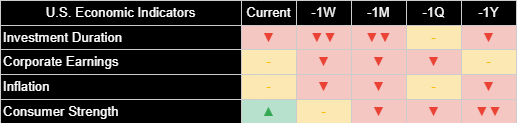

- 美國潛在經濟情緒顯示,企業獲利和投資存續期間展望謹慎改善至中性,儘管通膨預期有所波動,消費者信心則維持穩定。

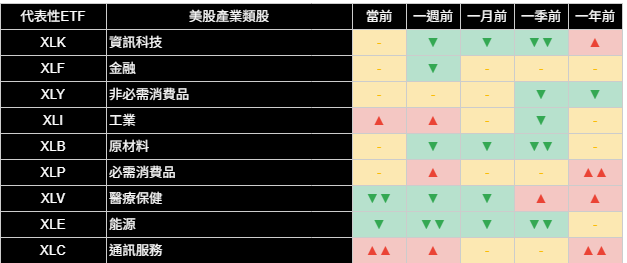

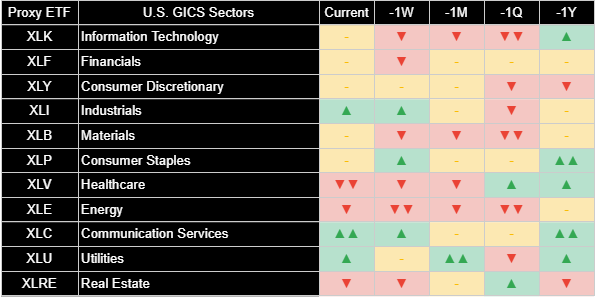

- 美國各類股表現好壞參半,通訊服務類股顯著走強,醫療保健類股則持續疲弱,而資訊科技類股和金融類股等關鍵類股的趨勢則穩定至中性。

- 國際市場普遍樂觀,歐洲、英國和日本指標趨勢強勁,而印度市場則維持負面,新興歐洲市場的展望亦有所惡化。

- 黃金價格上漲,經濟不確定性提升了其避險吸引力,而石油和比特幣則小幅下跌,公債價格上漲。

市場概覽

美股週三收盤變動不大,投資者消化美國私部門就業成長顯著放緩的消息。五月份ADP私部門公布的就業報告顯示僅增加3.7萬個工作機會,遠低於預期的13萬,並創下自2023年3月以來最小的月度增幅。這樣疲弱的勞動數據,加上五月份ISM服務業採購經理人指數(PMI)低於預期降至49.9,顯示服務業停滯不前,並導致公債殖利率下滑。十年期公債殖利率收在約4.36%,而標普500指數收盤近乎持平,那斯達克指數則小幅上漲。

勞動市場數據仍是本週的關注焦點。儘管ADP報告顯示,在政策和經濟環境不確定的情況下,企業可能採取更謹慎的徵才策略,但昨日的職位空缺暨勞工流動調查(JOLTS)報告顯示,四月份職位空缺數增至740萬個。此一上升趨勢表明潛在的勞動力需求依健康,儘管隨著經濟成長可能放緩,預期勞動市場狀況將會趨緩。貿易緊張局勢再度浮現,川普總統將鋼鋁關稅提高一倍至50%的措施已正式生效。同時,他也針對與中國國家主席習近平達成貿易協議的困難性作出評論。

儘管當日市場訊號錯綜,但歷史市場表現提供了一些鼓舞。標普500指數五月份超過6%的強勁漲幅,是自1980年以來第二佳的五月報酬率,歷史上一直是未來報酬的正向指標。自1980年以來的分析顯示,在如此強勁的五月之後,該年剩餘時間多半能維持正報酬,且隨後12個月的報酬在所有觀察案例中均為正值。雖然過去的表現不代表未來結果,但此歷史先例顯示近期股市的上漲動能可能持續。歐洲市場在歐洲央行即將做出利率決策前走高,亞洲市場亦上漲。

整體市場指數

美國整體市場指數週三大致持平,市場消化疲弱的勞動數據。我們的TrendFolios®量化指標顯示,標普500指數和那斯DA克綜合指數的趨勢維持正向。道瓊工業平均指數和費城半導體指數則維持中性趨勢,較一週前的負面有所改善,而羅素2000指數則維持負面。

目前市場正在權衡多項相互矛盾的訊號:就業成長放緩和服務業PMI走弱讓投資人趨於謹慎,但關鍵指數仍維持長期的正向趨勢。這種觀望態度突顯了週五非農就業報告的重要性,投資者期望該報告能釐清勞動市場的健康狀況及其對聯準會政策的潛在影響,尤其是在持續的貿易不確定性背景下。

美國十大企業

在美國龍頭企業中,Meta (Meta Platforms Inc.)表現突出,其指標趨勢顯著增強至強勁正向。博通(Broadcom Inc.)亦上漲,維持強勁的正向趨勢。亞馬遜(Amazon.com Inc.)的趨勢反轉為正向。相反地,特斯拉(Tesla Inc.)雖大幅下跌,但其趨勢仍維持在中性。蘋果(Apple Inc.)持續其負面趨勢,而微軟(Microsoft Corp.)的指標趨勢則從正向降溫至中性。

市場出現分歧反應,實則反映出投資人更具判斷力的操作思維,企業特定發展動態會與總體經濟擔憂一同被權衡。Meta (Meta Platforms Inc.)和博通(Broadcom Inc.)等公司的強勁動能與其他公司的謹慎態度形成對比,尤其是在就業成長放緩和貿易對話重啟的背景下,投資者正在解讀諸如蘋果(Apple Inc.)遭分析師降評等消息。

美國經濟指標

最新的美國潛在經濟驅動因素評估顯示謹慎基調。儘管投資存續期間和企業獲利的展望略有改善,量化指標分別從更為負面或負面轉為中性,但對通貨膨脹的看法在短暫的正向評估後已轉為中性,顯示物價壓力預期波動。消費者信心的看法則穩定維持在中性。

這些細微的轉變顯示經濟正處於一個十字路口。儘管對企業獲利和投資存續期間的悲觀情緒有所緩和是具建設性的,但搖擺不定的通膨前景以及近期如ADP就業報告和ISM服務業PMI等疲弱數據,皆造成了不確定性。即將公布的就業數據對於判斷消費者韌性是否得以維持至關重要。

產業類股總覽

週三各類股活動好壞參半。通訊服務類股展現顯著強勢,指標趨勢強勁正向且持續改善。工業類股亦走強,其指標趨勢轉為正向。相較之下,醫療保健類股仍處於極度負面,而能源類股儘管單日下跌(-1.95%),在量化指標分析來看,其負面趨勢已從上週的非常疲弱狀態有所改善。資訊科技類股(+0.15%)、金融類股(-0.57%)和原物料類股(+0.38%)的趨勢均從負面穩定至中性。

投資者的部位配置反映在不明朗的經濟前景下採取細緻的策略。儘管如通訊服務類股等領域存在樂觀情緒,但醫療保健等類股的持續疲弱則顯示市場持續保持謹慎。數個主要類股趨勢穩定至中性是一項關鍵發展。

國際市場

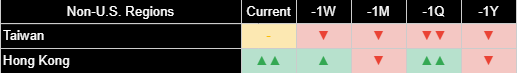

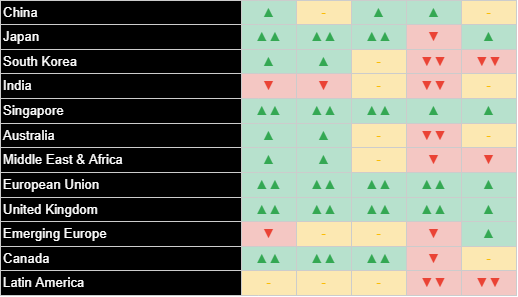

全球市場普遍呈現正向趨勢,歐盟、英國、日本和新加坡維持強勁的正向動能。中國亦保持正向趨勢,其市場代表指數當日上漲(+1.92%)。相較之下,印度市場持續呈現負面趨勢,新興歐洲市場的趨勢則轉為負面,顯示區域性擔憂加劇。拉丁美洲的趨勢則轉弱至中性。

許多已開發市場和主要亞洲市場的普遍強勢代表著,即便美國經濟訊號好壞參半,投資者仍在根據區域前景進行差異化佈局。即將到來的政策決策,如歐洲央行的決策,以及持續的貿易談判,尤其是關於中國的部分,將塑造國際市場情緒。

其他資產

隨著公債殖利率下滑,黃金價格上漲(+0.64%),其強勁正向趨勢得以延續。原油(-0.79%)和比特幣(-1.26%)雙雙下跌,但量化指標仍維持中性趨勢。在固定收益方面,由於經濟數據疲弱,公債價格上揚;例如,7-10年期美國公債價格上漲(+0.74%),其趨勢改善至中性。工業金屬(-0.11%)則維持負面趨勢。

較低的公債殖利率,係因應美國疲弱的經濟數據所致,為黃金和公債價格帶來明顯提振,強化了黃金的避險吸引力。原油和比特幣的中性態勢顯示這些市場目前處於盤整階段。投資者將持續關注通膨訊號及央行的應對措施,以指引在這些不同資產類別中的部位配置。

保持聯繫並分享見解:

若您覺得本文有幫助,請點讚支持。

- 歡迎將此電子報轉發給可能覺得有價值的同事和朋友。

- 訂閱即可直接在您的收件匣中收到此分析。

- 在社群媒體上關注我們以獲取更多更新。

本電子報僅供參考,不構成任何證券或資產類別的投資建議或買賣推薦。文中所表達的觀點為作者截至發布日期的觀點,如有變動,恕不另行通知。所呈現的資訊乃基於從相信可靠的來源所獲取的數據,但其準確性、完整性和及時性不作保證。過往表現並非未來結果的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其財務顧問。作者及相關實體可能持有本文所討論的資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Job Growth Slowdown & Tariff Titters Test Investor Resolve

Equity Markets Tread Water as Economic Uncertainties Mount; Historical May Strength Offers Hope

By Joe 盧, CFA As of June 4, 2025

EXECUTIVE SUMMARY

- U.S. equity markets closed little changed as investors assessed a significant slowdown in private-sector job growth and a contraction in the ISM Services PMI, alongside the implementation of increased steel and aluminum tariffs and cautious commentary on U.S.-China trade talks.

- Broad market indices showed mixed performance with the S&P 500 nearly flat and the Nasdaq posting modest gains, while trends generally held, though the Dow Jones Industrial Average and PHLX Semiconductor Index improved to neutral from negative over the week.

- Top U.S. companies exhibited divergent performance; Meta and Broadcom showed notable strength and positive trend reinforcement, while Apple continued its negative trend and Microsoft's trend cooled to neutral.

- Underlying U.S. economic sentiment shows cautious improvements in corporate earnings and investment duration outlooks to neutral, though inflation expectations fluctuated and consumer strength held steady.

- U.S. sectors displayed a mixed bag with Communication Services strengthening significantly, while Healthcare remained weak, and key sectors like Information Technology and Financials saw trends stabilize to neutral.

- International markets were largely positive with strong trends in Europe, the UK, and Japan, while India remained negative and Emerging Europe's outlook deteriorated.

- Gold prices advanced on lower Treasury yields as economic uncertainty boosted its safe-haven appeal, while oil and Bitcoin saw modest declines, and bond prices rose.

MARKET OVERVIEW

U.S. equity markets ended Wednesday with minimal changes as investors processed a notable slowdown in private-sector job growth. The May ADP private-payroll report revealed an increase of only 37,000 jobs, significantly below the anticipated 130,000 and marking the smallest monthly gain since March 2023. This soft labor data, coupled with a lower-than-expected ISM services PMI for May which fell to 49.9, signaled a stagnation in the services sector and contributed to a decline in bond yields. The 10-year Treasury yield settled around 4.36%, while the S&P 500 finished near the flatline and the Nasdaq saw a modest gain.

Labor market data remains a key focus this week. While the ADP report suggested firms might be adopting a more cautious hiring approach amidst an uncertain policy and economic environment, yesterday's JOLTS report showed a rise in job openings to 7.4 million in April. This uptick suggests underlying labor demand remains healthy, though an easing of labor market conditions is anticipated as economic growth potentially slows. Trade tensions also resurfaced as President Trump’s doubled tariffs on steel and aluminum to 50% took effect, and he commented on the difficulty of striking a trade deal with China's President Xi.

Despite the day's mixed signals, historical market performance offers some encouragement. The S&P 500's strong gain of over 6% in May, the second-best May return since 1980, has historically been a positive indicator for future returns. Analysis since 1980 shows that following such strong Mays, returns for the remainder of the year were positive in a majority of instances, and returns over the subsequent 12 months were positive in all observed cases. While past performance is not a guarantee, this historical precedent suggests the recent upward momentum in equities could persist. European markets traded higher ahead of the European Central Bank's upcoming interest-rate decision, while Asian markets also posted gains.

BROAD INDICES

U.S. broad equity indices were largely unchanged Wednesday as markets digested softer labor data. The S&P 500 Index saw a minimal change (-0.03%) and the Nasdaq Composite gained modestly (+0.28%), while the Dow Jones Industrial Average slipped (-0.25%). The PHLX Semiconductor Index, however, advanced (+1.51%). Trends for the S&P 500 and Nasdaq Composite remained positive. The Dow and Semiconductor index held neutral trends, an improvement from negative a week ago, while the Russell 2000 stayed negative.

The market is currently weighing conflicting signals: slowing job growth and a weaker services PMI suggest caution, yet key indices maintain positive longer-term trends. This indecision underscores the importance of Friday's nonfarm payrolls report, which investors hope will clarify the labor market's health and potential implications for Fed policy, especially amid ongoing trade uncertainties.

TOP 10 U.S. COMPANIES

Among leading U.S. companies, Meta Platforms Inc. stood out with a gain (+3.16%) as its trend strengthened significantly to strongly positive. Broadcom Inc. also rose (+1.65%), maintaining a robust positive trend. Amazon.com Inc. (+0.74%) saw its trend reverse to positive. Conversely, Tesla Inc. fell sharply (-3.55%) though its trend held at neutral. Apple Inc. (-0.22%) continued its negative trend, while Microsoft Corp. (+0.19%) saw its trend cool to neutral from positive.

The varied results point to a discerning market where company-specific developments are weighed against macroeconomic concerns. Strong momentum in names like Meta and Broadcom contrasts with caution surrounding others, particularly as investors parse news like Apple's analyst downgrade against a backdrop of slowing job growth and renewed trade dialogue.

U.S. ECONOMIC INDICATORS

The latest assessment of underlying U.S. economic drivers shows a cautious tone. While the outlook for Investment Duration and Corporate Earnings has improved slightly, moving from more negative or negative to neutral respectively, the view on Inflation has become neutral after a brief positive assessment, indicating fluctuating price pressure expectations. Consumer Strength perception remains steadily neutral.

These subtle shifts suggest an economy at a crossroads. While moderated pessimism on earnings and investment duration is constructive, the wavering inflation outlook and recent soft data like the ADP jobs report and ISM Services PMI create uncertainty. Upcoming employment data will be critical in assessing whether consumer resilience can be maintained.

SECTOR OVERVIEW

Sector activity was mixed on Wednesday. Communication Services showed notable strength with a strongly positive and improving trend. Industrials also firmed, with their trend turning positive. Conversely, Healthcare remained deeply negative, and Energy, despite a daily fall (-1.95%), saw its negative trend improve from very weak last week. Information Technology (+0.15%), Financials (-0.57%), and Materials (+0.38%) all saw their trends stabilize to neutral from negative.

Investor positioning reflects a nuanced approach to an uncertain economic environment. While there are pockets of optimism, such as in Communication Services, persistent weakness in sectors like Healthcare signals ongoing caution. The stabilization of several major sectors to a neutral trend is a key development, but the market will look to further economic data to confirm if this signals a broader, more resilient base.

INTERNATIONAL MARKETS

Global markets generally showed positive trends, with the European Union, United Kingdom, Japan, and Singapore maintaining strong positive momentum. China also held a positive trend, with its market proxy gaining (+1.92%) on the day. In contrast, India’s market continued to show a negative trend, and Emerging Europe’s trend shifted to negative, indicating increased regional concerns. Latin America's trend softened to neutral.

The prevailing strength in many developed and key Asian markets suggests investors are differentiating based on regional prospects, even as U.S. economic signals are mixed. Upcoming policy decisions, like that from the ECB, and ongoing trade discussions, particularly concerning China, will be pivotal in shaping international market sentiment.

OTHER ASSETS

Gold prices rose (+0.64%), extending a strongly positive trend as Treasury yields fell. Crude Oil (-0.79%) and Bitcoin (-1.26%) both declined while maintaining neutral trends. In fixed income, bond prices gained on the softer economic data; 7-10 Year Treasury Bonds, for example, saw prices rise (+0.74%) as its trend improved to neutral. Industrial Metals (-0.11%) remained in a negative trend.

Lower Treasury yields, reacting to weak U.S. economic data, provided a clear lift to Gold and bond prices, reinforcing Gold's safe-haven appeal. The neutral stances for Crude Oil and Bitcoin suggest these markets are currently in a consolidation phase. Investors will remain focused on inflation signals and central bank responses to guide positioning across these diverse asset classes.

Stay Connected & Share the Insights:

Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)