【Joe’s華爾街脈動】市場因貿易談判展開而攀升;通膨數據逼近成關鍵考驗

股市正面動能增強,但在投資者權衡地緣政治發展與僵固性通膨及強韌消費等複雜經濟背景下,領導族群依然狹隘

Joe 盧, CFA 2025年6月9日 美東時間

重點摘要

- 全球市場聚焦關鍵一週,美中貿易談判於倫敦展開,而即將公布的美國通膨數據和公債標售,將考驗上週強勁就業報告所引發的漲勢。

- 美國主要指數呈現擴大的正面動能,但領導族群仍集中於大型股,小型股和半導體類股則落後於此波漲勢。

- 大型股之間表現分歧,微軟(Microsoft)等個股趨勢持續強勁,而蘋果(Apple)和特斯拉(Tesla)在公司特定挑戰下面臨動能減弱。

- 強韌的消費者持續支撐經濟,但對通膨的重新正向評估,為美國聯準會和長天期資產創造了具挑戰性的環境。

- 資金正輪動至工業和原物料等週期性類股,而必需消費品等防禦型領域的動能則正在消退。

- 國際市場展現強勢,歐洲仍為領導者,中國市場趨勢轉為正向,儘管拉丁美洲的疲軟突顯了採取選擇性全球佈局的必要性。

- 比特幣和原油上漲,反映市場普遍尋求報酬,而黃金的正向趨勢則顯示投資者對通膨的持續擔憂。

市場概覽

市場本週以審慎樂觀的基調展開,延續上週五強勁反彈的氣勢。主要焦點轉向倫敦,美中貿易代表正在當地舉行會談,為全球風險偏好定下關鍵基調。在此背景下,本週將公布一系列具高度市場影響力的經濟數據,這些數據很可能決定市場的下一步走向。

近期市場的強勁表現,緊隨出乎意料強勁的5月份就業報告。該報告已有效地打消了市場對美國聯準會短期內降息的預期。這使得10年期美國公債殖利率堅守在4.5%以上,並使本週即將公布的5月份通膨數據更受矚目。該數據結果以及主要的公債標售,將是對債券市場穩定性的關鍵考驗。與此同時,投資者正密切關注國會山的預算協商,其中圍繞債務上限的討論增添了另一層政策驅動的不確定性。

企業方面,蘋果(Apple)的全球開發者大會(WWDC)於今日開幕,投資者高度關注該公司期待已久的人工智慧(AI)策略。儘管總體經濟數據看起來強勁,但勞動市場的景象正變得更加複雜。數家主要企業近期宣布裁員;同時,前幾個月就業成長數據的向下修正,顯示潛在的降溫趨勢,為原本強韌的經濟論述增添了一絲警示。

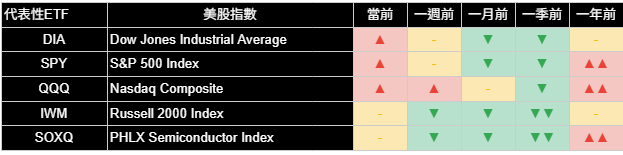

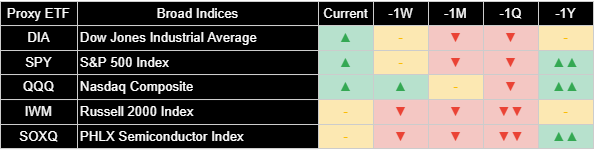

整體市場指數

在市場對美中貿易談判的抱持期待之際,美國主要指數本週開局穩健。那斯達克綜合指數(+0.15%)和標普500指數(+0.09%)小幅上漲,延續了上週強勁就業報告帶來的動能。我們的分析顯示,標普500指数和道瓊工業平均指數的趨勢在過去一週均已轉為正向,儘管那斯達克指數仍是最強勁且最一致的領漲者。相較之下,以羅素2000指数(+0.69%)衡量的小型股雖然單日漲幅較大,但其潛在趨勢在經歷一段疲弱後才剛穩定至中性。

類股表現與大型股之間的分歧突顯出市場漲勢雖有擴大,但仍由大型股主導。整體來看,儘管市場正面動能正在增強,但小型股的滯後以及半導體指數的中性立場顯示投資者仍持謹慎態度。本週關鍵在於貿易談判的正面結果和可控的通膨數據,這將決定市場能否迎來來更廣泛、更具包容性的上漲,抑或領導族群將持續狹隘。

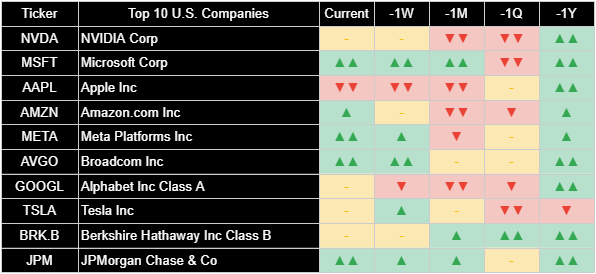

美國十大企業

在市場最具影響力的公司中,由於公司特定消息吸引了投資者的注意力,其表現好壞參半。特斯拉(Tesla)(+4.55%)在上週經歷艱難後出現顯著反彈,儘管我們的分析顯示其潛在趨勢在過去一週從正向急劇惡化至負面。相反地,蘋果(Apple)(-1.21%)在其全球開發者大會前下跌,投資者正熱切期待其AI策略的消息。微軟(Microsoft)(+0.50%)小幅上漲,其潛在趨勢依然非常強勁,證實了其市場支柱的地位。

這突顯了大型股之間持續的分歧。儘管像微軟(Microsoft)和摩根大通(JPMorgan Chase)這樣的基礎型股票展現出強勁、堅定不移的正面動能,但其他如蘋果(Apple)和特斯拉(Tesla)等公司則面臨重大的公司特定障礙,導致其趨勢減弱或轉為負面。對投資者而言,這強調了超越整體市場標籤、根據各公司自身優勢進行評估的重要性,尤其是在AI競爭和策略轉向等主題成為焦點之際。

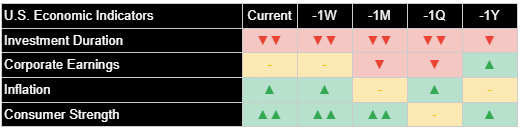

美國經濟指標

我們對潛在經濟驅動因素的評估呈現出一幅錯綜複雜的景象,有助於理解當前市場出現多重分歧的背景。消費者信心的前景仍然非常樂觀且穩定,這與上週強勁的就業報告一致,並有助於解釋市場的韌性。然而,我們對通膨的看法已轉回正向,顯示在市場等待本週官方消費者物價指數(CPI)數據之際,對物價壓力的擔憂再起。這與長天期投資持續負面的展望形成對比,可能反映了利率長期維持高檔的影響。

這種強勁消費與通膨隱患再起的相組合,為美國聯準會增添難度。這強化了市場關於短期內不太可能降息的論述,對企業獲利構成更大壓力,以證明當前股票估值的合理性。對投資者而言,關鍵問題是,即使通膨持續僵固且借貸成本居高不下,消費者信心能否繼續推動經濟向前發展。

產業類股總覽

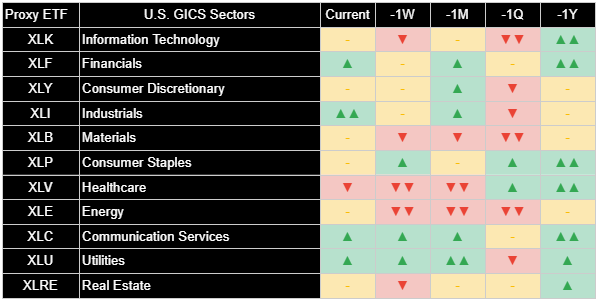

本週開局之際,類股表現各異,其中週期性產業展現相對強勢。非必需消費品類股(+0.80%)和原物料類股(+0.67%)錄得當日部分最大漲幅,似乎反映了與貿易談判展開相關的樂觀情緒。我們的分析顯示,工業類股的趨勢在過去一週已顯著增強至非常正向的評估。相較之下,先前領漲的必需消費品類股趨勢已從正向轉弱至中性,而資訊科技類股(+0.49%)在經歷一段疲弱後,其趨勢亦趨於穩定。

此輪動顯示投資者可能正在為一個更受週期性因素驅動的市場階段進行佈局,偏好對經濟成長和貿易消息敏感的工業和原物料等類股。必需消費品等防禦型領域動能的停滯支持了此一看法。投資者應關注此輪動是否持續,因為這將意味著市場信心已超越近幾個月來以狹隘、成長股為主的領導格局,而擴展至更廣泛的層面。

國際市場

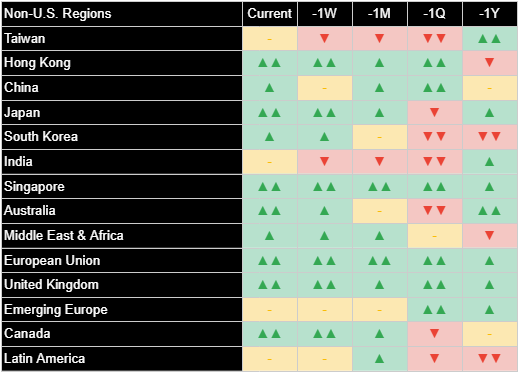

國際市場呈現明顯的區域分歧,亞洲市場表現尤為強勁。以中國為重點的資產(+1.09%)表現強勁,我們的分析指出中國的潛在趨勢現已轉為正向,儘管有報導稱出口成長放緩,但仍顯示動能正在增強。在已開發市場,歐盟和英國維持非常強勁且穩定的正向趨勢,位居全球表現最佳之列。相較之下,拉丁美洲(-0.39%)則表現落後,其趨勢在昨日從正向惡化至中性。

歐盟、英國的強勢以及中國目前增強的動能顯示,全球經濟成長預期正在改善,為美國以外的市場提供了具吸引力的機會。然而,拉丁美洲趨勢的動搖提醒我們,新興市場的表現並非整齊劃一,且可能迅速轉變。這強化了一個觀點,即投資者或可從具地理選擇性的方法中受益,專注於具有清晰且持續正面動能的區域。

其他資產

在其他資產類別中,比特幣(+4.24%)錄得強勁漲幅,在據報更為有利的監管和政治環境下,延續了近期的上漲趨勢。原油(+0.94%)亦在全球經濟成長樂觀情緒的推動下上漲,而黃金(+0.47%)則小幅上揚。我們的分析顯示,儘管不如前期那樣明確,黃金仍維持正向趨勢。與此同時,短期和中期美國公債的趨勢仍然負面,反映了週五強勁就業數據後殖利率上升帶來的壓力。

比特幣等風險性資產與黃金和原油等傳統通膨避險工具同步走強,顯示投資者心態複雜。這表明市場在各類資產中尋求報酬,但同時也對在政府持續赤字的情況下,通膨和貨幣穩定性存有揮之不去的擔憂。對投資組合而言,這突顯了在傳統相關性可能發生轉變,且資產正對週期性和結構性等多重驅動因素做出反應的環境中,進行操作所面臨的挑戰。

保持聯繫並分享見解:

若您覺得本文有幫助,請點讚支持。

- 歡迎將此電子報轉發給可能覺得有價值的同事和朋友。

- 訂閱即可直接在您的收件匣中收到此分析。

- 在社群媒體上關注我們以獲取更多更新。

本電子報僅供參考,不構成任何證券或資產類別的投資建議或買賣推薦。文中所表達的觀點為作者截至發布日期的觀點,如有變動,恕不另行通知。所呈現的資訊乃基於從相信可靠的來源所獲取的數據,但其準確性、完整性和及時性不作保證。過往表現並非未來結果的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其財務顧問。作者及相關實體可能持有本文所討論的資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Climb as Trade Talks Begin; Inflation Data Looms as Key Test

Positive momentum builds in stocks, but leadership remains narrow as investors weigh geopolitical developments against a complex economic backdrop of sticky inflation and a resilient consumer.

By Joe 盧, CFA As of June 9, 2025

EXECUTIVE SUMMARY

- Global markets are focused on a pivotal week as U.S.-China trade talks commence in London, with upcoming U.S. inflation data and Treasury auctions set to test the rally sparked by last week's strong jobs report.

- Major U.S. indices are showing broadening positive momentum, but leadership remains concentrated in large-caps as small-caps and semiconductors lag the advance.

- Performance among mega-cap stocks is diverging, with persistently strong trends in names like Microsoft contrasting with weakening momentum for Apple and Tesla amid company-specific challenges.

- A resilient consumer continues to support the economy, but a renewed positive assessment on inflation creates a challenging environment for the Federal Reserve and long-duration assets.

- A rotation into cyclical sectors like Industrials and Materials is underway, while momentum in defensive areas like Consumer Staples is fading.

- International markets show strength with Europe remaining a leader and China's trend turning positive, though weakness in Latin America highlights the need for a selective global approach.

- Bitcoin and Crude Oil advanced, reflecting a broad search for returns, while Gold's positive trend signals lingering investor concern over inflation.

MARKET OVERVIEW

Markets are kicking off a pivotal week with a cautiously optimistic tone, as stocks build on Friday's powerful rally. The primary focus shifts to London, where U.S. and Chinese trade representatives are meeting, setting a crucial tone for global risk appetite. This geopolitical maneuvering provides the immediate backdrop for a week packed with market-moving economic data that will likely determine the market’s next move.

The recent strength in the market comes on the heels of a surprisingly robust May jobs report, which has effectively pushed expectations for near-term Federal Reserve rate cuts off the table. This has kept the 10-year Treasury yield firm above 4.5% and places an even brighter spotlight on this week’s upcoming May inflation data. The results, along with major Treasury auctions, will be a key test for the bond market's stability. Simultaneously, investors are monitoring budget negotiations on Capitol Hill, where discussions around the debt ceiling add another layer of policy-driven uncertainty.

On the corporate front, Apple’s Worldwide Developers Conference begins today, with investors laser-focused on the company's long-awaited artificial intelligence strategy. While the headline economic data appears strong, the labor market landscape is becoming more complex. Recent announcements of job cuts from several major corporations and downward revisions to prior months' job growth suggest a potential cooling trend, adding a note of caution to an otherwise resilient economic narrative.

BROAD INDICES

The major U.S. indices started the week on a positive note, supported by anticipation surrounding U.S.-China trade talks. The Nasdaq Composite (+0.15%) and S&P 500 Index (+0.09%) saw modest gains, continuing the momentum from last week's strong jobs report. Our analysis shows the trend for both the S&P 500 and the Dow Jones Industrial Average has now turned positive over the last week, though the Nasdaq remains the strongest and most consistent leader. In contrast, small-caps, as measured by the Russell 2000 Index (+0.69%), saw a stronger daily gain, yet their underlying trend has only just stabilized to neutral after a period of weakness.

This divergence highlights a market that is gaining breadth but remains driven by large-cap leadership. While positive momentum is building across the board, the lag in small-caps and the neutral stance of the semiconductor index suggest investors are still cautious. The key question is whether positive outcomes from trade discussions and manageable inflation data this week can provide the catalyst needed for a broader, more inclusive market advance, or if leadership will remain narrow.

TOP 10 U.S. COMPANIES

Among the market's most influential companies, performance was mixed as company-specific stories captured investor attention. Tesla (+4.55%) saw a significant rebound after a difficult prior week, though our analysis shows its underlying trend sharply deteriorated from positive to negative over the past week. Conversely, Apple (-1.21%) declined ahead of its Worldwide Developers Conference, where investors are keenly awaiting news on its AI strategy. Microsoft (+0.50%) showed a modest gain, and its underlying trend remains exceptionally strong, confirming its status as a market pillar.

This highlights a continued bifurcation among mega-cap stocks. While foundational names like Microsoft and JPMorgan Chase display strong, unwavering positive momentum, others like Apple and Tesla face significant company-specific hurdles that are causing their trends to weaken or turn negative. For investors, this underscores the importance of looking beyond broad market labels and assessing each company on its own merits, especially as themes like AI competition and strategic pivots take center stage.

U.S. ECONOMIC INDICATORS

Our assessment of underlying economic drivers presents a complex picture that helps explain current market crosscurrents. The outlook for consumer strength remains exceptionally positive and stable, which aligns with last week's robust jobs report and helps explain the market's resilience. However, our view on inflation has shifted back to positive, indicating renewed concern about price pressures just as the market awaits this week's official Consumer Price Index data. This contrasts with a persistently negative outlook for long-duration investments, likely reflecting the impact of higher-for-longer interest rates.

This combination of strong consumption and resurgent inflation concerns creates a difficult backdrop for the Federal Reserve. It reinforces the market narrative that near-term rate cuts are unlikely, putting more pressure on corporate earnings to justify current equity valuations. The key question for investors is whether consumer strength can continue to propel the economy forward even if inflation remains sticky and borrowing costs stay elevated.

SECTOR OVERVIEW

Sector performance was varied at the start of a pivotal week, with cyclical areas showing notable strength. The Consumer Discretionary (+0.80%) and Materials (+0.67%) sectors posted some of the day's strongest gains, appearing to reflect optimism tied to the start of trade negotiations. Our analysis shows the Industrials sector has seen its trend strengthen significantly to a very positive assessment over the past week. In contrast, the trend for the previously leading Consumer Staples sector has faded from positive to neutral, while Information Technology (+0.49%) also saw its trend stabilize after a period of weakness.

The rotation suggests investors may be positioning for a more cyclically-driven market phase, favoring sectors like Industrials and Materials that are sensitive to economic growth and trade news. The stalling momentum in defensive areas like Consumer Staples supports this view. Investors should watch if this rotation persists, as it would signal a broadening of market confidence beyond the narrow, growth-focused leadership that has characterized recent months.

INTERNATIONAL MARKETS

International markets showed a distinct regional divergence, with notable strength in Asia. China-focused assets (+1.09%) were strong performers, and our analysis indicates China's underlying trend has now turned positive, signaling building momentum despite reports of slowing export growth. In developed markets, the European Union and the United Kingdom maintain a very strong and stable positive trend, ranking among the top global performers. In contrast, Latin America (-0.39%) lagged as its trend deteriorated from positive to neutral in the last day.

The strength in the European Union, the UK, and now building momentum in China suggests global growth expectations are improving, providing attractive opportunities outside the U.S. However, the faltering trend in Latin America is a reminder that emerging market performance is not monolithic and can shift rapidly. This reinforces the idea that investors may benefit from a geographically selective approach, focusing on regions with clear and persistent positive momentum.

OTHER ASSETS

In other asset classes, Bitcoin (+4.24%) posted a strong gain, continuing its recent upward trend amid what reports suggest is a more favorable regulatory and political environment. Crude Oil (+0.94%) also advanced on the back of global growth optimism, while Gold (+0.47%) saw a modest rise. Our analysis shows that Gold maintains a positive trend, though it is less decisive than in prior periods. Meanwhile, the trends for short and intermediate-term Treasury bonds remain negative, reflecting the pressure from higher yields following Friday's strong jobs data.

The simultaneous strength in risk-on assets like Bitcoin and traditional inflation hedges like Gold and Crude Oil points to a complex investor mindset. It suggests a search for returns across asset classes, but also lingering concerns about inflation and currency stability in the face of persistent government deficits. For portfolios, this highlights the challenge of navigating an environment where traditional correlations may be shifting, and assets are responding to a diverse mix of cyclical and structural drivers.

Stay Connected & Share the Insights:

Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)