【Joe’s華爾街脈動】以伊衝突引發全球市場拋售,油價飆升

在關鍵的聯準會會議前,原油價格飆漲加劇通膨憂慮,投資者紛紛逃離風險性資產,轉向黃金和美元

Joe 盧, CFA 2025/06/13 美東時間

重點摘要

- 以色列對伊朗的攻擊引爆地緣政治緊張局勢,導致全球市場急劇拋售,投資者紛紛逃向避險資產。

- 美國所有主要指數均告下跌,道瓊工業平均指數動能減弱,廣泛的避險情緒蓋過了近期的市場樂觀趨勢。

- 大型成長股領跌,儘管能源類股因原油價格飆漲而上揚,反映出受衝突驅動的明顯分歧。

- 消費者信心的前景已然轉弱,引發市場對經濟在面臨新的地緣政治和通膨壓力下能否保持韌性的質疑。

- 油價的突升使經濟前景更加複雜,適逢美國聯準會即將召開政策會議,新的通膨壓力浮現,對其決策構成重大挑戰。

- 國際市場同步下跌,黃金和美元等經典避險資產則上漲,顯示典型的避險趨勢再度啟動。

市場概覽

地緣政治震撼波及全球金融市場,以色列對伊朗的攻擊引發了典型的避險潮,促使原油價格飆漲,投資者紛紛湧向美元和黃金。此一突如其來的局勢升級已完全攫取了華爾街的注意力,蓋過了近期美國通膨數據疲弱所帶來的樂觀情緒。油價飆升如今對下週即將召開會議的美國聯準會構成了重大挑戰,使其決策變得更加複雜。在能源價格推動下,通膨繼續升溫的風險升高,也讓近期市場的反彈行情陷入不確定性,整體市場氛圍轉趨脆弱。

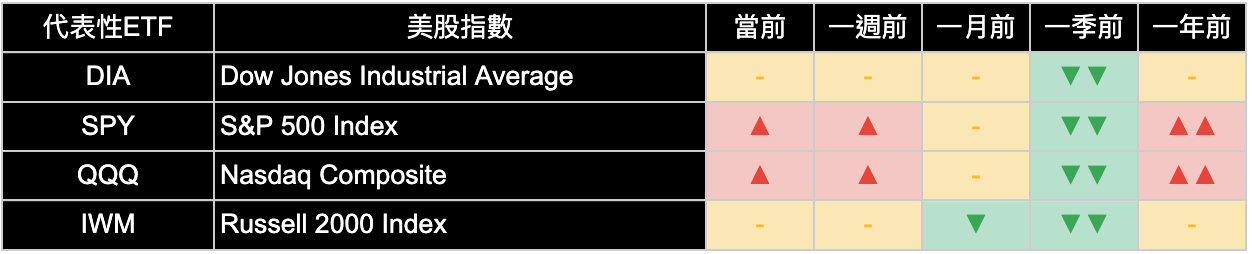

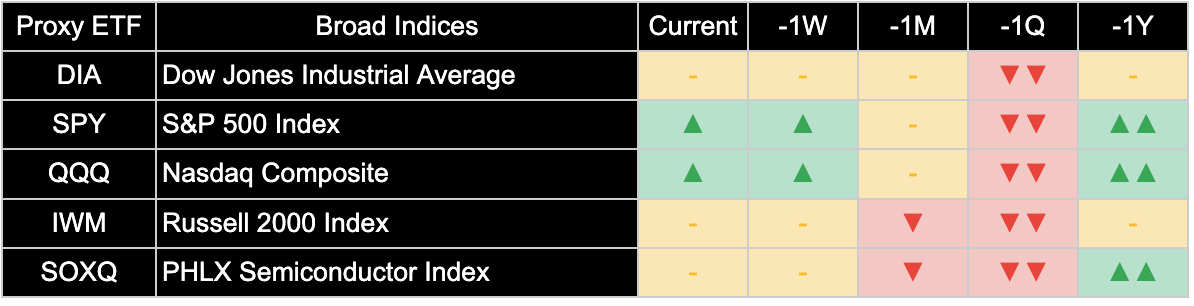

整體市場指數

避險情緒席捲美國各大指數,道瓊工業平均指數(-1.78%)和小型股羅素2000指數(-1.83%)領跌。我們對道瓊指數趨勢的評估已惡化至中性,證實了市場對週期性交易的信心正在減弱。儘管標普500指數和那斯達克綜合指數仍維持長期的正向趨勢,但此次廣泛拋售引發了一個關鍵疑問:這究竟是短暫的反應,還是由地緣政治風險和新一波通膨憂慮所引發的持續性波動的開端?

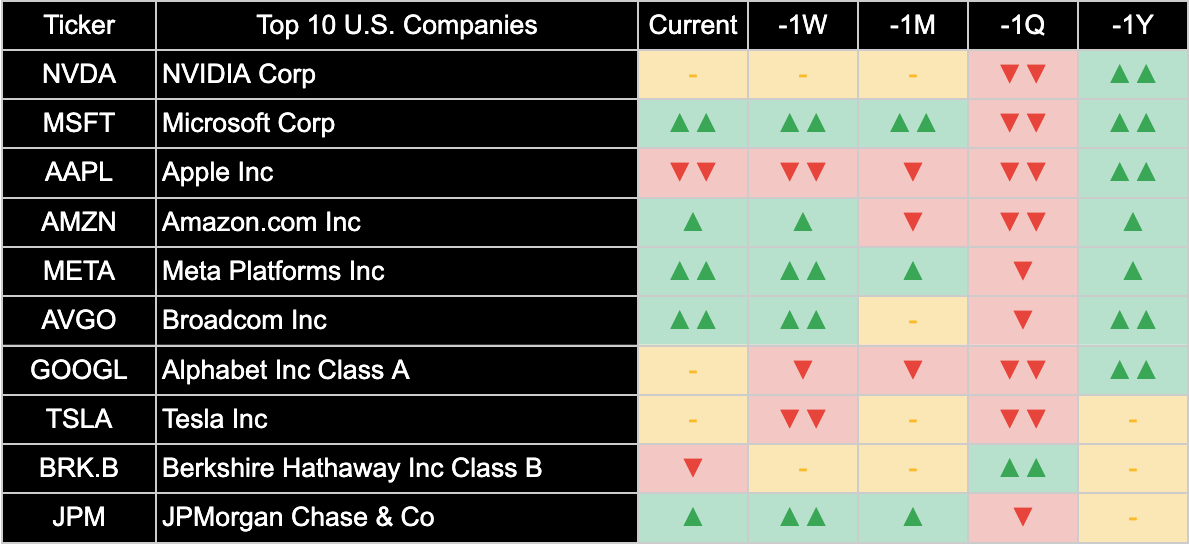

美國十大企業

在大型股中,避險趨勢清晰可見,博通(Broadcom)(-2.88%)和輝達(NVIDIA Corp)(-2.09%)等個股出現顯著跌幅,因投資者紛紛減碼高估值成長股的曝險部位。摩根大通(JPMorgan Chase & Co)(-1.23%)的下跌伴隨著其潛在趨勢的惡化,突顯了地緣政治憂慮如何衝擊主要的週期性領導股。這種對市場領導者的急劇轉向,突顯了資金轉向資本保值的趨勢。若緊張局勢持續升級,近期強勢股的韌性將面臨考驗。

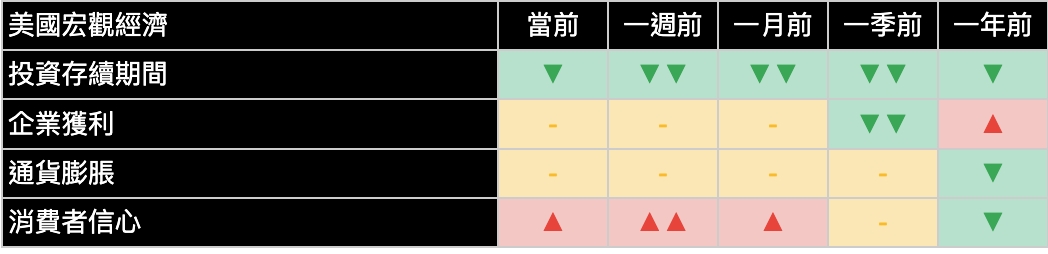

美國總體經濟

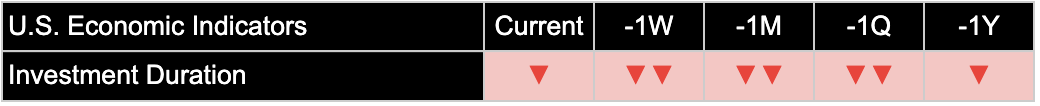

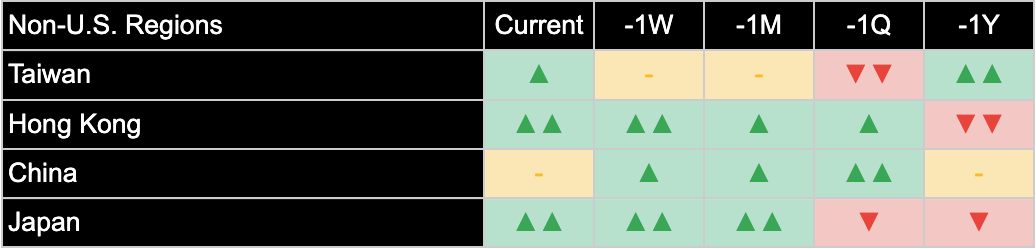

地緣政治突發衝突使整體經濟前景瞬間變得更加複雜。我們對消費者信心的評估已經轉弱,如果能源價格上漲將衝擊家庭預算,此一轉變可能會進一步惡化。此種動態為美國聯準會製造了艱難的緊張局面,因為油價飆漲引發的新的外部通膨衝擊,與近期指向經濟放緩的美國國內數據相悖。這對經濟能否承受持續的地緣政治不確定性提出了關鍵性的疑問。

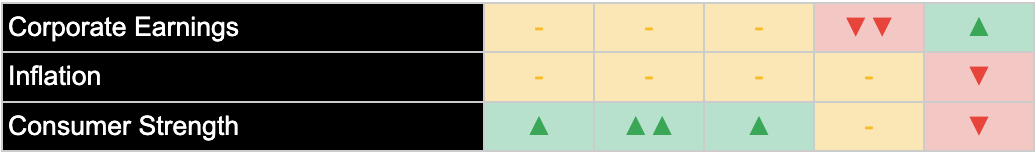

產業類股總覽

今日盤勢呈現明顯分歧,能源類股(+1.74%)在原油價格走高的帶動下大漲,而其他所有類股均告回落。此一走勢的幅度足以觸發該類股的看漲趨勢突破。相較之下,必需消費品和醫療保健等防禦型類股的下跌則非常顯著。這表明投資者不僅僅是在股票內部進行輪動,而是正在完全撤出此資產類別,這是一項看跌的訊號,也進一步引發了投資者對市場潛在實力的質疑。

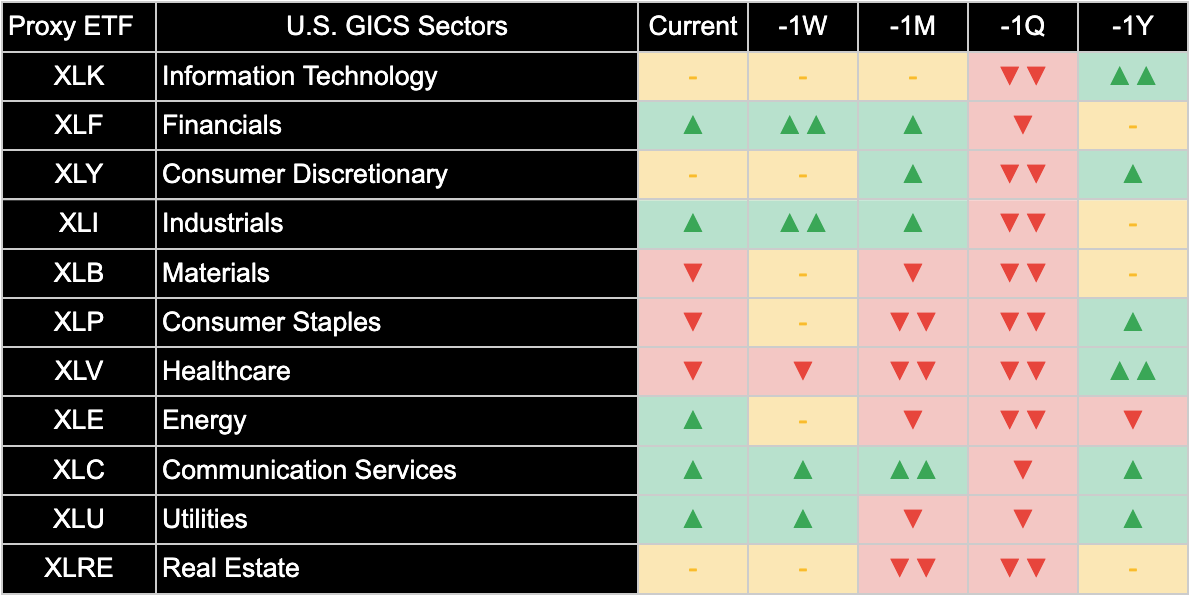

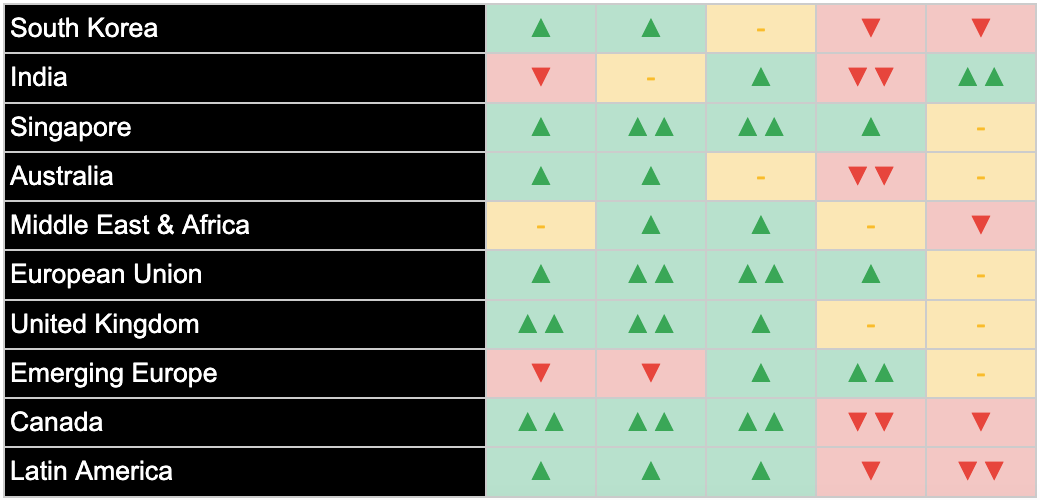

國際市場

避險情緒蔓延至全球市場,歐洲(-1.52%)和中國股市(-1.83%)均遭受重創,中東衝突蓋過了區域性的市場論述。此同步下滑已導致這些關鍵區域近期建立的正面動能消退。這對全球經濟成長前景構成了實質性的重挫,因為投資者現在必須權衡這究竟是暫時的干擾,還是可能導致剛開始萌芽的正向趨勢脫軌的根本性轉變。

其他資產

價格走勢描繪了一幅經典的避險景象,原油(+6.89%)和黃金(+1.31%)飆升,而比特幣(-1.58%)等風險較高的資產則下跌。然而,債券市場的反應卻不尋常。儘管市場瀰漫避險情緒,長天期美國公債價格卻下跌(-0.96%),推高了殖利率。此種分歧至關重要,因為它表明由油價飆漲引發的通膨憂慮目前是比傳統的債券避險需求擁有更強大的市場力量;這突顯了對停滯性通膨環境的擔憂加劇。

保持聯繫並分享見解:

- 若您覺得本文有幫助,請點讚支持。

- 歡迎將此電子報轉發給可能覺得有價值的同事和朋友。

- 訂閱即可直接在您的收件匣中收到此分析。

- 在社群媒體上關注我們以獲取更多更新。

本電子報僅供參考,不構成任何證券或資產類別的投資建議或買賣推薦。文中所表達的觀點為作者截至發布日期的觀點,如有變動,恕不另行通知。所呈現的資訊乃基於從相信可靠的來源所獲取的數據,但其準確性、完整性和及時性不作保證。過往表現並非未來結果的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其財務顧問。作者及相關實體可能持有本文所討論的資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Israel-Iran Strike Triggers Global Market Sell-Off, Spikes Oil

Investors flee risk assets for gold and the dollar as surging crude prices intensify inflation fears ahead of a pivotal Fed meeting.

By Joe 盧, CFA As of: June 13, 2025

EXECUTIVE SUMMARY

- Geopolitical tensions erupted as an Israeli strike on Iran triggered a sharp global market sell-off, sending investors fleeing to safe-haven assets.

- All major U.S. indices declined, with momentum fading in the Dow Jones Industrial Average, as broad-based risk aversion overshadowed recent positive market trends.

- Megacap growth stocks led the retreat, though the Energy sector surged on soaring crude oil prices, reflecting a clear divergence driven by the conflict.

- The outlook for consumer strength has weakened, raising questions about the economy's resilience in the face of new geopolitical and inflationary pressures.

- The sudden spike in oil prices complicates the economic picture, introducing new inflation fears that challenge the Federal Reserve just ahead of its upcoming policy meeting.

- International markets fell in tandem, while classic safe havens like Gold and the U.S. dollar rallied, confirming a classic flight to safety.

MARKET OVERVIEW

Geopolitical shockwaves rocked global markets as an Israeli strike against Iran triggered a classic flight from risk, sending crude oil prices soaring and investors flocking to the U.S. dollar and gold. This abrupt escalation has seized Wall Street’s full attention, overshadowing recent optimism from softer U.S. inflation data. The surge in oil now presents a major complication for the Federal Reserve ahead of next week's meeting. The development creates a fragile market environment where the risk of sustained, energy-driven inflation puts the recent rally in jeopardy.

BROAD INDICES

Risk-off sentiment swept across U.S. indices, with the Dow Jones Industrial Average (-1.78%) and the small-cap Russell 2000 Index (-1.83%) leading the retreat. Our assessment of the Dow’s trend deteriorated to neutral, confirming a loss of conviction in the cyclical trade. While the S&P 500 and Nasdaq Composite still hold positive long-term trends, the broad-based selling raises a critical question: is this a short-lived reaction or the start of sustained volatility driven by geopolitical risk and new inflation fears?

TOP 10 U.S. COMPANIES

The flight from risk was clear among megacap stocks, with notable declines in Broadcom (-2.88%) and NVIDIA Corp (-2.09%) as investors shed exposure to high-valuation growth names. The decline in JPMorgan Chase & Co (-1.23%) was accompanied by a deterioration in its underlying trend, highlighting how geopolitical fears are hitting key cyclical leaders. This sharp pivot away from market leaders underscores a shift toward capital preservation, testing the resilience of recent winners if tensions remain elevated.

U.S. ECONOMIC INDICATORS

The economic landscape was abruptly complicated by the geopolitical flare-up. Our assessment of consumer strength has weakened, a shift that could be worsened if higher energy prices hit household budgets. This dynamic creates a difficult tension for the Federal Reserve, as the new, external inflationary shock from spiking oil counters the recent domestic data that had been pointing toward a slowing economy. This raises crucial questions about the economy's ability to absorb sustained geopolitical uncertainty.

SECTOR OVERVIEW

Today’s trading revealed a clear divergence, with the Energy sector (+1.74%) surging on higher crude prices while all others retreated. The move was significant enough to trigger a bullish trend breakout for the sector. In contrast, the decline in defensive sectors like Consumer Staples and Healthcare was highly significant. It suggests investors are not merely rotating within equities but are instead moving out of the asset class altogether, a bearish signal that raises questions about the market’s underlying strength.

INTERNATIONAL MARKETS

The risk-off wave was global, with European (-1.52%) and Chinese equities (-1.83%) suffering significant losses as the Middle East conflict overrode regional narratives. The synchronized downturn has caused the recently positive momentum in these key regions to fade. This represents a material setback for the global growth outlook, as investors must now weigh whether this is a temporary disruption or a fundamental shift that could derail the positive trends that were beginning to emerge.

OTHER ASSETS

Price action painted a classic risk-off picture as Crude Oil (+6.89%) and Gold (+1.31%) surged while riskier assets like Bitcoin (-1.58%) fell. However, the bond market's reaction was unusual. Longer-duration Treasury prices fell (-0.96%), pushing yields higher despite the risk-averse mood. This divergence is critical, as it suggests that inflation fears stoked by the oil spike are currently a more powerful market force than a traditional flight to safety in bonds, highlighting rising concerns of a stagflationary environment.

Stay Connected & Share the Insights:

- Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)