【Joe’s華爾街脈動】市場處於十字路口:科技股受挫,地緣政治風險逼近

隨著關鍵成長引擎步履蹣跚且避險情緒升溫,投資者面臨市場領導地位和經濟韌性的嚴峻考驗

Joe 盧, CFA 2025年6月20日 美東時間

重點摘要

- 在地緣政治緊張局勢和國內經濟放緩跡象的推動下,市場正出現明確的避險轉向。

- 隨著小型股和關鍵的資訊科技類股趨勢明確轉為負面,市場的基礎正在崩裂。

- 市場領導地位已經瓦解,Alphabet等關鍵成長引擎的趨勢嚴重惡化。

- 企業獲利前景已然轉弱,與美國消費者持續的韌性形成鮮明對比。

- 國際市場正普遍失去動能,數個主要區域的正向趨勢出現逆轉。

- 隨著資金輪動至黃金和原油等傳統避險資產,市場明顯出現向優質資產避險的趨勢。

市場概覽

本週全球市場在高度謹慎的氛圍中收盤,投資者持續消化來自地緣政治、經濟數據和央行政策間的矛盾訊號。不確定性成為市場的主導基調,源於川普總統決定延後美國是否介入以伊衝突的談判時程。這項為期兩週的延遲雖暫時緩解了局勢升溫的風險,但地緣政治依然是市場的焦點,促使資金流向特定的避險資產,並對整體股市指數構成壓力。當日的類股表現反映了此種動態,能源和必需消費品類股上漲,而對景氣循環較為敏感的通訊服務和原物料類股則領跌。

國際市場方面則缺乏明確方向。歐洲市場設法收高,但背景是消費者信心意外走弱,反應潛在經濟脆弱性。亞洲市場方面,中國央行維持其關鍵貸款利率不變,雖符合市場預期,卻未激起市場興趣。一個值得注意的發展是美元兌其主要貿易夥伴貨幣走貶,此舉通常會支撐風險性資產,但在當前環境下卻未能奏效。大宗商品方面,由於以色列和伊朗之間的空襲持續,引發市場對供應可能嚴重中斷的擔憂,原油價格隨之上漲。

美國國內方面,經濟前景更趨黯淡。美國經濟評議會的領先經濟指標(LEI)再次下滑,主要受到消費者預期轉弱和新增製造業訂單減少的拖累。儘管該委員會表示並未預測經濟將陷入衰退,但數據明確指向2025年經濟成長軌跡正在放緩。這與債券市場的走勢一致,隨著投資者預期美國聯準會將採取更為寬鬆的政策,殖利率隨之下滑。聯準會自身的預測持續暗示今年將有兩次降息,而理事華勒的評論更指出最早可能在7月份降息,進一步鞏固了市場對利率走低的預期,為投資者製造了交錯的複雜影響,需審慎應對。

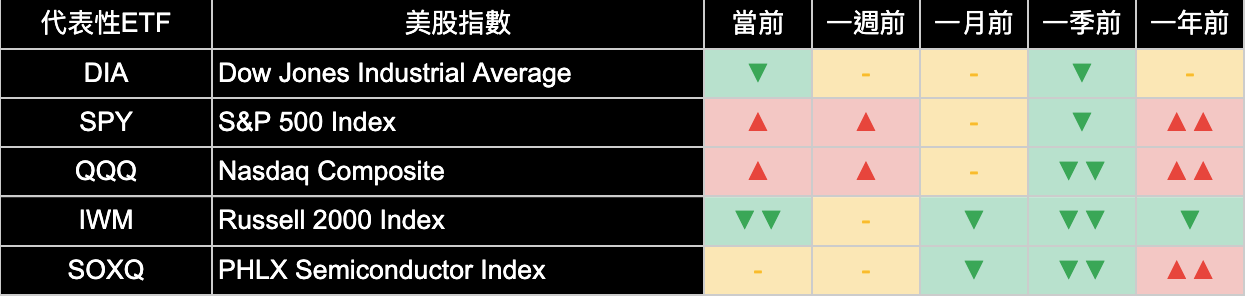

整體市場指數

美國市場出現關鍵性裂痕。小型股羅素2000指數的潛在趨勢急劇惡化,跌入明顯的負面區間,這是個明確的避險訊號。這些規模較小、對經濟敏感的公司日益疲弱,與大型股標普500指數仍然維持正向的趨勢形成鮮明對比。

大型股與小型股之間日益擴大的差距,顯示市場對美國經濟成長持久性的擔憂加劇。目前的關鍵問題是,市場狹隘的領導族群能否承受來自底層的侵蝕,或者小型股的下跌是否預示著更廣泛的市場修正。

美國十大企業

市場頂層的領導地位正在動搖。最值得關注的變化是Alphabet趨勢的急劇惡化,從中性轉為非常負面。雪上加霜的是,博通(Broadcom)的動能亦顯著減弱,顯示市場主要的成長引擎正出現問題。

此種領導地位的分裂——越來越少的股票負責推動市場回報——增加了集中度風險,並對整體市場漲勢的健康狀況提出了嚴重的質疑。投資者現在必須評估,是否會有新的、更持久的領導者出現。

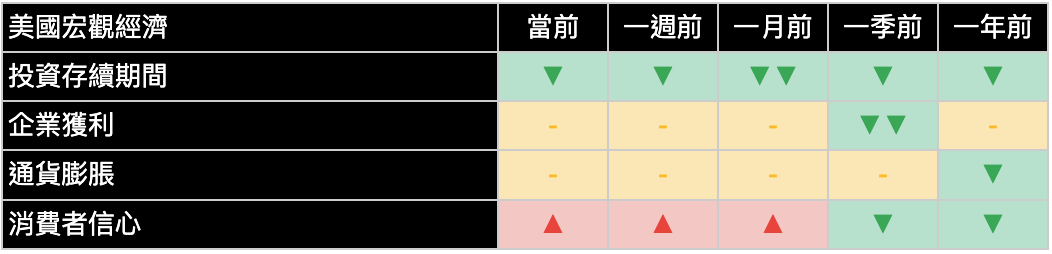

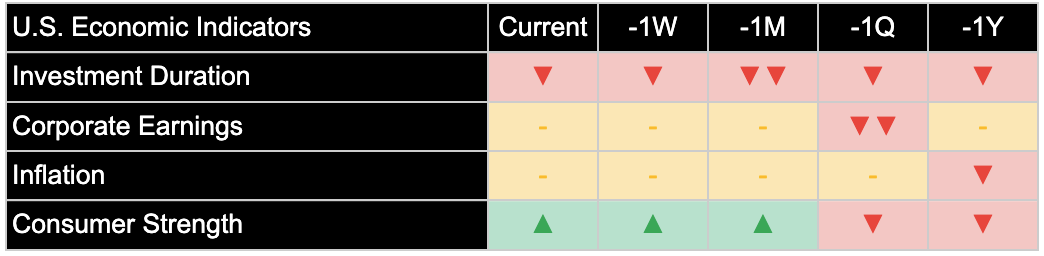

美國總體經濟

美國企業的獲利前景已明顯轉弱,這一變化與領先經濟指標連續下滑的趨勢相符。獲利能力的惡化,加上對較長投資期限持續審慎的訊號,顯示股市面臨的阻力正在增加。

此種商業前景轉弱的趨勢與美國消費者持續的韌性直接衝突。市場的核心矛盾在於,此種消費者實力能否繼續抵銷不斷下滑的商業狀況,此一動態對於形塑未來經濟路徑的發展至關重要。

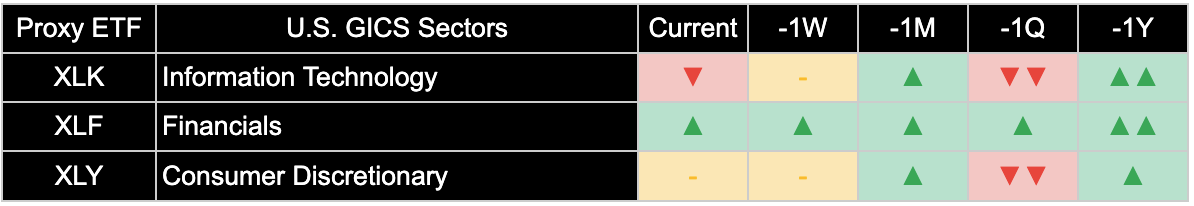

產業類股總覽

市場特性正出現明顯轉變。關鍵的資訊科技類股本週趨勢明確轉為負面,正證實了此點。與此同時,防禦型的必需消費品類股趨勢有所改善,能源類股則持續走強,顯示市場明確轉向避險。

作為市場主要引擎的科技類股出現逆轉,是一個關鍵的發展。與此同時轉向防禦型類股,顯示投資者正積極為一個不同的、更具挑戰性的環境重新佈局,引發了何種新的領導族群將會出現的問題。

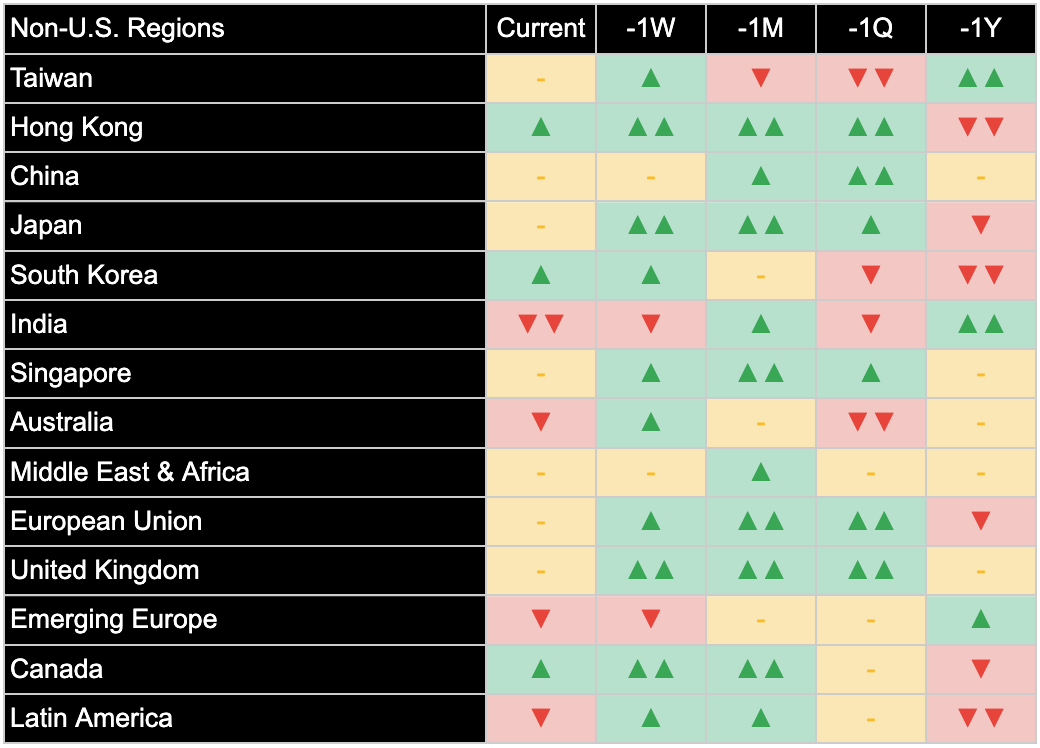

國際市場

全球股市正普遍喪失動能。包括歐洲和日本在內的主要已開發市場,先前的正向趨勢已消退轉為中性。澳洲和拉丁美洲的趨勢逆轉更為嚴重,已從正向明確轉為負面。

多個美國以外區域普遍出現的此種惡化,對全球經濟成長前景構成了重大的不利因素。隨著主要經濟體停滯不前,美國國內市場的韌性將受到考驗,迫使投資者質疑其能否繼續成為一個穩定的孤島。

其他資產

跨資產訊號明確反應典型的避險行為。在地緣政治緊張局勢升級的背景下,黃金和原油等避險資產的潛在正向趨勢依然穩固。相較之下,比特幣等對風險偏好敏感的資產則因資金逃向安全資產而下跌。

此種明顯的分歧——資金流入實物資產並流出投機性資產——是投資者進行防禦性重新佈局的典型特徵。這表明市場參與者正積極對沖地緣政治衝突和潛在的經濟放緩風險。

保持聯繫並分享見解:

- 若您覺得本文有幫助,請點讚支持。

- 歡迎將此電子報轉發給可能覺得有價值的同事和朋友。

- 訂閱即可直接在您的收件匣中收到此分析。

- 在社群媒體上關注我們以獲取更多更新。

本電子報僅供參考,不構成任何證券或資產類別的投資建議或買賣推薦。文中所表達的觀點為作者截至發布日期的觀點,如有變動,恕不另行通知。所呈現的資訊乃基於從相信可靠的來源所獲取的數據,但其準ecek性、完整性和及時性不作保證。過往表現並非未來結果的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其財務顧問。作者及相關實體可能持有本文所討論的資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Market at a Crossroads: Tech Stumbles as Geopolitical Risk Looms

With key growth engines faltering and risk aversion on the rise, investors face a critical test of market leadership and economic resilience.

By Joe 盧, CFA As of June 20, 2025

EXECUTIVE SUMMARY

- A definitive risk-off shift is underway, driven by geopolitical tensions and signs of a domestic economic slowdown.

- The market’s foundation is cracking as the trend for small-cap stocks and the pivotal Information Technology sector turns decisively negative.

- Market leadership has fractured, with critical growth engines like Alphabet showing severe trend deterioration.

- The outlook for corporate earnings has weakened, creating a sharp contrast with the ongoing resilience of the U.S. consumer.

- A synchronized loss of momentum is spreading across international markets, with several key regions seeing positive trends reverse.

- A clear flight to quality is evident as capital rotates into traditional safe havens like Gold and Crude Oil.

MARKET OVERVIEW

Global markets closed the week on a note of heightened caution as investors weighed conflicting signals from geopolitics, economic data, and central bank policy. The dominant theme was uncertainty, stemming from President Trump’s decision to extend negotiations regarding U.S. involvement in the Israel-Iran conflict. This two-week delay provided a temporary reprieve from immediate escalation but kept geopolitical risk at the forefront, fueling a flight to specific safe havens and pressuring broader equity indices lower. The day's sector performance reflected this dynamic, with Energy and Consumer Staples posting gains while more cyclically sensitive sectors like Communication Services and Materials led the decline.

The international picture offered little clarity. European markets managed to finish higher, but this occurred against a backdrop of unexpectedly weak consumer confidence, suggesting underlying fragility. In Asia, China's central bank held its key lending rate steady, a move that was widely anticipated but did little to spark investor enthusiasm. A notable development was the decline in the U.S. dollar against its major peers, a move that would typically support risk assets but failed to do so in the current environment. In commodities, Crude Oil rose as the continued air strikes between Israel and Iran stoked fears of significant supply disruptions.

Domestically, the economic outlook grew more clouded. The Conference Board's Leading Economic Index (LEI) fell again, driven by weaker consumer expectations and a drop in new manufacturing orders. While the board stated it does not forecast a recession, the data clearly points to a slowing growth trajectory for 2025. This aligns with movements in the bond market, where yields fell as investors priced in a more accommodative Federal Reserve. The Fed’s own projections continue to signal two rate cuts this year, and comments from Governor Waller suggesting a cut could come as soon as July further cemented expectations for lower rates, creating a complex cross-current for investors to navigate.

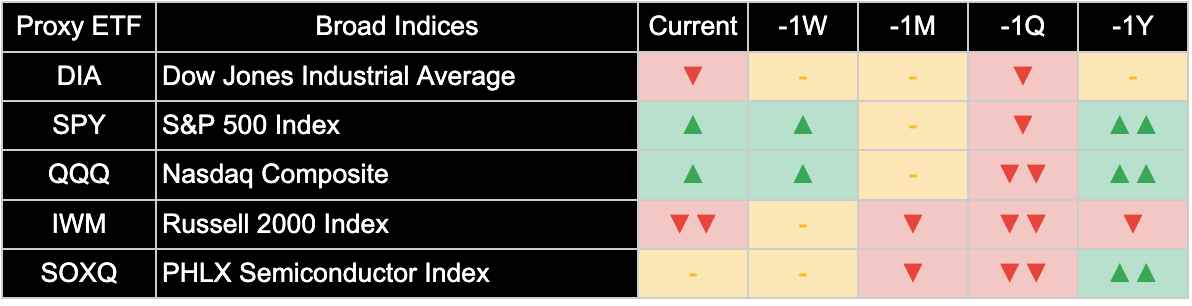

BROAD INDICES

A critical fracture has appeared in the U.S. market. The underlying trend for the small-cap Russell 2000 Index deteriorated sharply into strongly negative territory, a clear signal of risk aversion. This growing weakness in smaller, economically sensitive companies diverges significantly from the still-positive trend in the large-cap S&P 500.

This widening gap between large and small caps indicates mounting concern over the durability of domestic growth. The key question now is whether the market's narrow leadership can withstand this erosion from below, or if the downturn in small caps is a precursor to a broader correction.

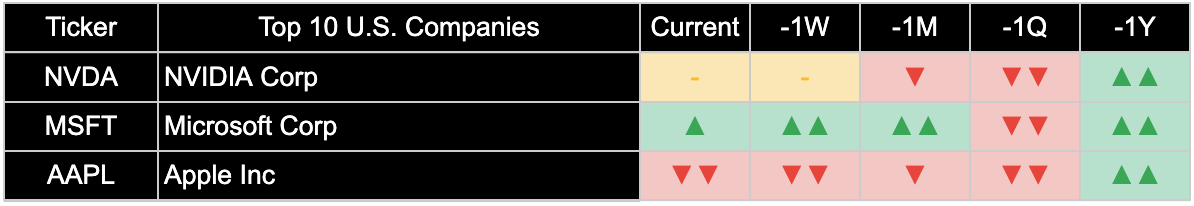

TOP 10 U.S. COMPANIES

Leadership at the top of the market is faltering. The most significant development was the severe deterioration in the trend for Alphabet, which shifted from neutral to strongly negative. This was compounded by a notable loss of momentum for Broadcom, indicating the market’s primary growth engines are sputtering.

This fracturing of leadership, where fewer stocks are responsible for driving returns, increases concentration risk and raises serious questions about the health of the overall market advance. Investors must now assess whether new, more durable leaders can emerge.

U.S. ECONOMIC INDICATORS

The outlook for corporate profitability has weakened, a significant change that aligns with declining leading economic indicators. This deterioration in the earnings outlook, combined with a persistently cautious signal for longer-term investment horizons, points to mounting headwinds for equity markets.

This weakening business outlook is in direct conflict with the continued resilience of the U.S. consumer. The central tension for the market is whether this consumer strength can continue to offset flagging business conditions, a dynamic that will be critical in shaping the economic path forward.

SECTOR OVERVIEW

A major shift in market character is underway, confirmed by the crucial Information Technology sector, whose trend turned decisively negative this week. This was accompanied by an improving trend in the defensive Consumer Staples sector and continued strength in Energy, signaling a clear rotation toward safety.

The reversal in Technology, the market’s primary engine, is a critical development. The concurrent turn toward defensive sectors suggests investors are actively repositioning for a different, more challenging environment, raising the question of what new leadership profile will emerge.

INTERNATIONAL MARKETS

A synchronized loss of momentum is sweeping across global equity markets. Key developed regions, including Europe and Japan, saw their prior positive trends evaporate into a neutral stance. The reversal was even more severe in Australia and Latin America, where trends flipped decisively from positive to negative.

This widespread deterioration across multiple non-U.S. regions presents a significant headwind for the global growth outlook. With major economic blocs stalling, the resilience of the domestic U.S. market will be tested, forcing investors to question whether it can remain an island of stability.

OTHER ASSETS

Cross-asset signals confirmed a classic risk-off shift. The underlying positive trends in safe havens like Gold and Crude Oil held firm amid rising geopolitical tension. In contrast, assets sensitive to risk appetite, such as Bitcoin, declined as capital fled to safety.

This clear divergence—with capital flowing into hard assets and out of speculative ones—is the hallmark of a defensive investor repositioning. It suggests market participants are actively hedging against both geopolitical conflict and a potential economic slowdown.

Stay Connected & Share the Insights:

- Like this article if you found it helpful.

- Forward this newsletter to colleagues and friends who might find it valuable.

- Subscribe to receive this analysis directly to your inbox.

- Follow us on social media for more updates.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)