儘管川普實施關稅政策,聯準會理事暗示降息選項仍存在,股市收高

Joe Lu, CFA 2025年4月14日 美東時間

市場概況

由於投資者評估川普總統關稅政策的最新發展,週一股市有所回升。受益於政府意外宣布豁免智慧型手機、電腦和半導體晶片的對等關稅新措施,科技股上漲,帶動整體市場在經歷一波震盪交易後股市收高。

道瓊斯工業平均指數上漲+0.87%(+312.08點),收於40,524.79點,標普500指數上升+0.79%,收於5,405.97點。以科技股為主的納斯達克指數上漲+0.64%,收盤於16,831.48點。三大指數在盤中交易過程中均出現顯著的波動,一度轉為負值交易,最終仍收高。芝加哥期權交易所波動指數(VIX),也被稱作「華爾街的恐慌指標」,較上週的極端值下降超過6點,表明市場焦慮有所緩解。

週五晚間意外宣布的關稅豁免為科技股提供了急需的催化劑,蘋果上漲+2.21%,戴爾躍升近4%。然而,川普總統和商務部長盧特尼克(Howard Lutnick) 隨後的聲明暗示這些豁免可能不是永久性的,這削弱了市場反彈力道。根據川普在Truth Social上的貼文,這些產品「仍受現有20%芬太尼關稅約束,只是被移至不同關稅『類別』」,為本已複雜的局勢增添了新的不確定性。

在一項關鍵發展中,美國聯準會理事沃勒(Christopher Waller)表示,川普關稅導致的通膨可能是「暫時性的」,表明儘管面臨潛在的價格壓力,降息仍在考慮之中。「我已經能聽到有人抗議這肯定是個錯誤,尤其考慮到2021和2022年發生的事。但僅僅因為一次沒有成功,並不意味著你永遠不應該再這樣思考」,沃勒在聖路易斯的演講中如此說道,回應對重蹈先前政策錯誤的擔憂。

要點摘要:

- 美國聯準會理事沃勒表示關稅引起的通膨可能是「暫時性的」,暗示降息仍在考慮範圍內

- 儘管波動劇烈,市場收高,科技股受惠於智慧型手機和半導體關稅豁免而上漲

- 道瓊斯工業平均指數上漲+0.78%,標普500指數上升+0.79%,納斯達克指數上漲+0.64%,交易過程充滿波動

- 蘋果股價飆升+2.21%領漲科技股,戴爾在豁免消息刺激下大漲近4%

- 必需消費類股是4月份唯一呈現正向表現的標普500類股,反映市場不確定性下的防禦性布局

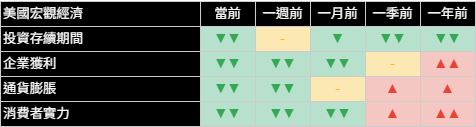

經濟指標

經濟指標顯示持續惡化,投資週期在所有時間框架上都呈現顯著弱勢。投資週期的下滑表明市場參與者越來越傾向於短期投資,反映了對長期經濟前景的高度不確定性。這種模式通常出現在投資者預期未來可能出現經濟挑戰的時期。

企業獲利亦顯示出令人擔憂的模式,在大多數時間框架上持續呈現負面讀數。這表明獲利前景正在惡化,可能受到關稅將透過增加投入成本,壓縮利潤的擔憂所影響。這些負面訊號在多個時間段的一致性表明這不僅僅是暫時性現象,而是可能影響未來幾季企業績效表現的發展趨勢。

美國十大公司

美國大型企業週一表現參差不齊,科技公司普遍表現較好。蘋果領漲科技類股,大幅上升+2.21%,直接反映對其供應鏈有利的關稅豁免措施。因為投資者重新評估科技業曝險,Alphabet(谷歌母公司)表現也不錯,上漲+1.23%。

相反,幾家頂級公司經歷了明顯下跌。Meta Platforms(前身為Facebook)在十大公司中跌幅最大,下跌-2.22%。亞馬遜跟隨下跌-1.48%,博通下降-1.97%。這些混合的結果突顯了今日反彈的選擇性,市場參與者仔細地評估每家公司面臨的關稅風險,而非全面推高整個市場。

大型企業間的表現模式反映了不同程度的潛在關稅影響。在中國有大量製造業務的公司,如蘋果,對關稅豁免的反應最為積極,而那些業務模式更加多元化或服務導向的公司,反應則較不明顯。這種選擇性反應突顯了投資者對關稅影響的細緻分析,而非先前交易中所見的廣泛市場悲觀情緒。

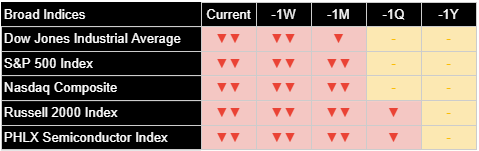

廣泛市場指數

主要市場指數全部收於正值區間,但表面下的強度卻不盡相同。道瓊斯工業平均指數在必需消費類股和蘋果的助力下,領漲+0.87%。標普500指數緊隨其後,上漲+0.79%,而納斯達克指數儘管以科技為主,但漲幅較為溫和,僅+0.64%。

代表小型類股的羅素2000指數的表現明顯落後,僅微漲+0.35%。這種相對弱勢反映了市場持續擔憂小型公司對經濟放緩、較高利率的脆弱性,以及吸收關稅帶來的成本提高的能力有限。費城半導體指數(SOX)上漲+1.18%,直接回應潛在的半導體豁免,但考慮到其永久性的不確定性,表現相對克制。

各指數的表現趨勢揭示了所有時間框架上的惡化,表明儘管今日反彈,市場弱勢仍然持續。這一模式表明市場仍處於充滿挑戰的階段,今日的漲幅可能代表暫時的鬆一口氣而非情緒的確定性轉變。長期來看,持續的負面讀數突顯了對高關稅環境下,市場對經濟增長和企業獲利能力的持續擔憂。

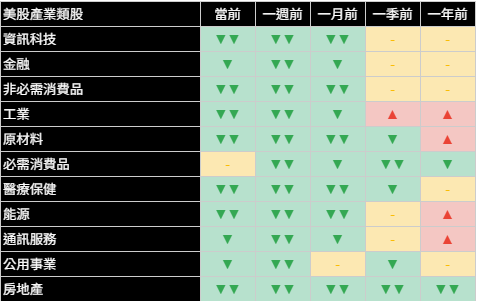

類股概況

必需消費品類股以+1.71%的漲幅成為週一表現最佳的類股,其後是房地產+2.07%和公用事業+1.80%。這種通常與經濟不確定性相關的防禦性類股領先,表明投資者儘管今日整體市場走強,仍保持謹慎。必需消費類股現為4月份唯一呈現正向表現的標普500類股,顯示市場在近期波動中對穩定、防禦性業務的偏好。

原物料(+1.20%)、醫療保健(+1.22%)和金融(+1.03%)也表現強勁,超越大盤。相比之下,能源(+0.35%)、非必需消費品(+0.29%)和資訊科技(+0.71%)表現落後,儘管後者受益於關稅豁免。這種混合的類股表現表明選擇性布局而非廣泛的風險偏好。

類股表現模式反映大多數類股持續惡化,特別是在經濟敏感領域,如原物料和能源。這些循環性類股的負面讀數幅度,表明市場對經濟增長的擔憂加劇。今日交易中明顯的防禦性布局,與這種經濟擔憂模式一致,投資者偏好那些傳統上在增長較慢和不確定性較高時期表現較好的類股。

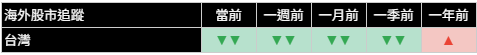

國際市場

全球市場呈現與美國市場類似的疲弱模式,大多數地區普遍呈現負面趨勢。亞洲市場表現出特別令人擔憂的模式,台灣、香港、中國、日本和南韓在最近時間框架中全部呈現持續負面讀數。亞洲主要經濟體這種普遍的疲弱趨勢表明,區域經濟的擔憂不僅限於美中貿易緊張局勢。

歐洲市場呈現更為混合的局面。雖然大多數歐洲地區當前讀數為負,但英國和歐盟表現出一些歷史性的強勢,表明其比亞洲同行具有更大的韌性。然而,這些相對優勢的領域仍然有限,尚未轉化為廣泛的區域性優異表現。

新興市場普遍表現不佳,新興歐洲和拉丁美洲呈現特別疲弱的模式。這些負面讀數在各種經濟體中的廣泛性,表明全球性的經濟擔憂,而非特定區域問題。這種全球惡化模式與對貿易壁壘升級可能對經濟產生更廣泛影響的擔憂一致,並引發對關稅緊張持續加劇可能導致全球協調性放緩的質疑。

其他資產

各年期國債價格上漲,殖利率下降,20年期國債價格上漲+0.71%。這種債券市場強勢反映了對避險資產的需求持續存在,儘管今日股市上漲。7-10年期國債價格上升+0.80%,短期國債價格上漲+0.22%,導致殖利率曲線略微平坦化。這些變動表明儘管今日股市反彈,投資者對經濟增長前景仍持續擔憂。

債券市場的反應似乎與美國聯準會理事沃勒的重要評論一致,沃勒將關稅分解為兩種情境:一種是關稅維持較高水平較長時間,另一種是關稅被協商降低。沃勒表示,在任一情況下,降息可能都是適當的,他指出在較高關稅情境下降息將促進增長,或在協商降低關稅的情境下代表「好消息」的減輕。他將關稅通膨描述為「暫時性的」,這對市場具有重要的意義,表明即使關稅暫時推高通膨,美國聯準會也不一定會被迫降息。

大宗商品價格漲跌互現,黃金價格在近期強勁上漲後下跌-0.57%。原油價格微幅上漲+0.30%,在近期大幅下跌後趨於穩定,因石油輸出國組織(OPEC)直接引用川普關稅作為因素,下調了2025年需求成長預測。農產品價格略微下跌-0.11%,工業金屬價格下跌-0.28%。

貨幣市場顯示美元走弱,美元指數下跌-0.33%。儘管關稅的潛在通膨影響通常會支撐美元,但美元仍下跌。這種貨幣弱勢可能反映市場對美國聯準會降息的預期增加,特別是在美國聯準會理事沃勒評論關稅引起的通膨可能為「暫時性的」,且即使有較高關稅仍考慮降息之後。

跨資產表現表明,市場正在為潛在經濟放緩而非通膨擔憂進行布局,儘管今日整體股市上漲,債券的強勢和防禦性類股仍占主導地位。這一模式與關稅實施可能對經濟成長造成挑戰,而非主要通膨擔憂的敘述一致。

展望未來,市場將繼續權衡關稅政策的經濟影響與潛在貨幣政策反應。隨著美國聯準會官員現在直接評論關稅影響,投資者將密切關注政策發展和即將到來的獲利報告,尋找企業在這一不確定環境中韌性的線索。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Fed's Waller Calls Tariff Inflation "Transitory" as Markets Rally on Tech Exemptions

Stocks close higher as Fed Governor signals rate cuts remain on table despite Trump's tariff policies

Joe Lu, CFA April 14, 2025

MARKET OVERVIEW

Markets recovered some ground on Monday as investors assessed the latest developments in President Trump's tariff policies. Stocks finished higher after a volatile session, buoyed by a rally in technology names following the administration's surprise exemption of smartphones, computers, and semiconductors from recently announced reciprocal tariffs.

The Dow Jones Industrial Average climbed +0.87% (+312.08 points) to close at 40,524.79, while the S&P 500 advanced +0.79% to end at 5,405.97. The tech-heavy Nasdaq Composite added +0.64% to finish at 16,831.48. All three major indexes experienced significant intraday swings, at times trading in negative territory before settling into gains. The CBOE Volatility Index, Wall Street's "fear gauge," retreated more than 6 points, indicating reduced market anxiety compared to last week's extreme levels.

The unexpected tariff exemptions announced late Friday provided a much-needed catalyst for technology stocks, with Apple rising +2.21% and Dell jumping nearly 4%. However, the relief rally was tempered by subsequent statements from President Trump and Commerce Secretary Howard Lutnick suggesting the exemptions may not be permanent. According to Trump's Truth Social post, these products are "subject to the existing 20% Fentanyl Tariffs, and they are just moving to a different Tariff 'bucket,'" introducing a new layer of uncertainty to an already complex situation.

In a pivotal development, Federal Reserve Governor Christopher Waller stated that inflation from Trump's tariffs will likely be "transitory," signaling that interest rate reductions remain under consideration despite potential price pressures. "I can hear the howls already that this must be a mistake given what happened in 2021 and 2022. But just because it didn't work out once does not mean you should never think that way again," Waller said in his St. Louis speech, addressing concerns about repeating previous policy errors.

Executive Summary:

- Fed Governor Waller indicated tariff-induced inflation would be "transitory," suggesting rate cuts remain on the table.

- Markets ended higher despite volatility as tech stocks rallied on tariff exemptions for smartphones and semiconductors

- Dow Jones added +0.78%, S&P 500 gained +0.79%, and Nasdaq rose +0.64% in choppy trading

- Apple shares jumped +2.21% leading tech gains, while Dell surged nearly 4% on the exemption news

- Consumer Staples was the only S&P 500 sector positive for April, reflecting defensive positioning amid uncertainty

ECONOMIC INDICATORS

Economic indicators showed continued deterioration, with investment duration exhibiting significant weakness across all timeframes. The decline in investment duration suggests that market participants are increasingly favoring shorter-term investments, reflecting heightened uncertainty about long-term economic prospects. This pattern typically emerges when investors anticipate potential economic challenges ahead.

Corporate earnings also showed concerning patterns, with persistent negative readings across most timeframes. This indicates deteriorating profitability expectations, likely influenced by fears that tariffs will compress margins by increasing input costs. The consistency of these negative signals across multiple time periods suggests this is not merely a temporary phenomenon but a developing trend that could impact corporate performance for several quarters.

TOP 10 U.S. COMPANIES

The largest U.S. companies showed mixed performance on Monday, with technology firms generally outperforming. Apple led the group with a significant gain of +2.21%, responding directly to the tariff exemptions that would benefit its supply chain. Alphabet (Google's parent company) also performed well, rising +1.23% as investors reassessed technology sector exposure.

Conversely, several top companies experienced notable declines. Meta Platforms (formerly Facebook) recorded the largest drop among the top 10, falling -2.22%. Amazon followed with a decline of -1.48%, while Broadcom dropped -1.97%. These mixed results highlight the selective nature of today's rally, with market participants carefully evaluating each company's exposure to tariff risks rather than bidding up the entire market.

The performance patterns among top companies reflect varying degrees of potential tariff impact. Companies with extensive manufacturing in China, like Apple, responded most positively to the exemptions, while those with more diverse or service-oriented business models showed less pronounced reactions. This selective response underscores investors' nuanced analysis of tariff implications rather than the broad market pessimism seen in previous sessions.

BROAD MARKET INDICES

Major market indices all finished in positive territory but showed varied strength beneath the surface. The Dow Jones Industrial Average led with a gain of +0.87%, helped by strength in its consumer staples components and Apple. The S&P 500 followed closely with a +0.79% advance, while the Nasdaq Composite, despite its technology concentration, recorded a more modest +0.64% increase.

Small-cap stocks, represented by the Russell 2000, significantly underperformed with a minimal gain of +0.35%. This relative weakness reflects continued concerns about small companies' vulnerability to economic slowdowns, higher interest rates, and limited ability to absorb increased costs from tariffs. The Philadelphia Semiconductor Index (SOX) rose +1.18%, responding directly to the potential semiconductor exemptions but showing some restraint given the uncertainty about their permanence.

The performance trend across indices reveals deterioration across all timeframes, indicating persistent market weakness despite today's bounce. This pattern suggests the market remains in a challenging phase, with today's gains potentially representing a relief rally rather than a definitive shift in sentiment. The continued negative readings across longer-term perspectives highlight ongoing concerns about economic growth and corporate profitability in a higher-tariff environment.

SECTOR OVERVIEW

Consumer Staples emerged as Monday's top-performing sector with a gain of +1.71%, followed closely by Real Estate at +2.07% and Utilities at +1.80%. This defensive sector leadership, typically associated with economic uncertainty, suggests investors remain cautious despite today's overall market strength. Consumer Staples is now the only S&P 500 sector positive for April, demonstrating the market's preference for stable, defensive businesses amid the recent volatility.

Materials (+1.20%), Healthcare (+1.22%), and Financials (+1.03%) also showed strength, outpacing the broader market. In contrast, Energy (+0.35%), Consumer Discretionary (+0.29%), and Information Technology (+0.71%) underperformed despite the latter benefiting from tariff exemptions. This mixed sector performance indicates selective positioning rather than broad-based risk appetite.

The sector performance patterns reflect continued deterioration across most sectors, particularly in economically sensitive areas like Materials and Energy. The magnitude of negative readings in these cyclical sectors suggests increased concerns about economic growth. The defensive positioning evident in today's trading aligns with this pattern of economic concern, with investors favoring sectors that traditionally outperform during periods of slower growth and higher uncertainty.

INTERNATIONAL MARKETS

Global markets showed similar patterns of weakness to U.S. markets, with negative trends prevalent across most regions. Asian markets displayed particularly troubling patterns, with Taiwan, Hong Kong, China, Japan, and South Korea all showing consistently negative readings across recent timeframes. This widespread weakness throughout Asia's major economies suggests regional economic concerns beyond just U.S.-China trade tensions.

European markets presented a more mixed picture. While most European regions showed negative current readings, the United Kingdom and European Union demonstrated some historical strength, suggesting greater resilience than their Asian counterparts. However, these pockets of relative strength remain limited and have not translated into broad regional outperformance.

Emerging markets generally underperformed, with Emerging Europe and Latin America showing particularly weak patterns. The widespread nature of these negative readings across diverse economies suggests global economic concerns rather than region-specific issues. This global deterioration pattern aligns with fears about broader economic impacts from escalating trade barriers and raises questions about the potential for coordinated global slowdown if tariff tensions continue to increase.

OTHER ASSETS

Treasury prices rose across maturities, with the yields falling and the 20-year Treasury price increasing +0.71% . This bond market strength reflects continued demand for safe-haven assets despite today's equity market gains. The 7-10 year Treasury price rose +0.80%, while short-term Treasury prices gained +0.22%, causing a modest flattening of the yield curve. These moves suggest continued investor concern about economic growth prospects despite today's equity bounce.

The bond market's reaction appears aligned with Fed Governor Waller's significant comments that broke down tariffs into two scenarios – one where they remain higher for longer, and another where they are negotiated lower. Waller indicated that rate cuts would likely be appropriate in either case, noting they would boost growth under the higher-tariff scenario or represent "good news" reductions under a negotiated lower-tariff outcome. His characterization of tariff inflation as "transitory" has significant market implications, suggesting the Fed won't necessarily be constrained from cutting rates even if tariffs temporarily push inflation higher.

Commodities presented a mixed picture, with Gold prices declining -0.57% after recent strong gains. Crude Oil prices rose marginally by +0.30%, stabilizing after substantial recent declines as OPEC lowered its demand growth forecast for 2025, citing Trump's tariffs as a direct factor. Agricultural commodities declined slightly, falling -0.11%, while Industrial Metals dropped -0.28%.

Currency markets showed the U.S. Dollar weakening, with the Dollar Index falling -0.33%. This decline came despite the potential inflationary impact of tariffs, which would typically support the dollar. The currency weakness may reflect growing market expectations for Federal Reserve rate cuts, particularly after Fed Governor Waller's comments that tariff-induced inflation would likely be "transitory" and that rate cuts remain on the table even with higher tariffs.

The cross-asset performance suggests markets are positioning for potential economic slowdown rather than inflation concerns, with bond strength and defensive equity sector leadership dominating despite today's overall equity market gains. This pattern aligns with the narrative of potential growth challenges from tariff implementation rather than primarily inflationary concerns.

Looking ahead, markets will continue weighing the economic impact of tariff policies against potential monetary policy responses. With Fed officials now commenting directly on tariff implications, investors will closely monitor both policy developments and upcoming earnings reports for clues about corporate resilience in this uncertain environment.