【Joe’s華爾街脈動】鮑爾暗示不急於降息以應對關稅擔憂,市場暴跌

Fed主席警告經濟面臨雙重威脅,股市大幅下滑

Joe Lu, CFA 2025年4月16日 美東時間

市場概況

美國市場週三遭受重大損失,因美國聯準會主席鮑爾表示,儘管對川普總統關稅政策的擔憂日益增加,央行不會急於降息。在鮑爾警告聯準會可能面臨同時管理通膨上升和勞動市場走弱的困難挑戰後,股市跌幅擴大。

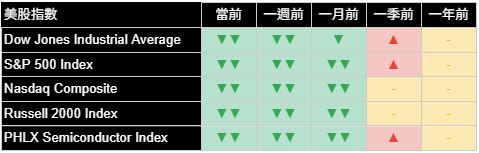

主要指數大幅收低,標普500指數下跌-2.24%,收於5,275.70點,道瓊工業指數下跌-1.73%至39,669.39點,那斯達克綜合指數暴跌-3.07%至16,307.16點。代表小型公司的羅素2000指數表現略為堅韌,下跌幅度較小,為-0.96%。因半導體股受到對中國出口新的限制,科技股為主的費城半導體指數受到特別嚴重打擊,暴跌-4.14%。

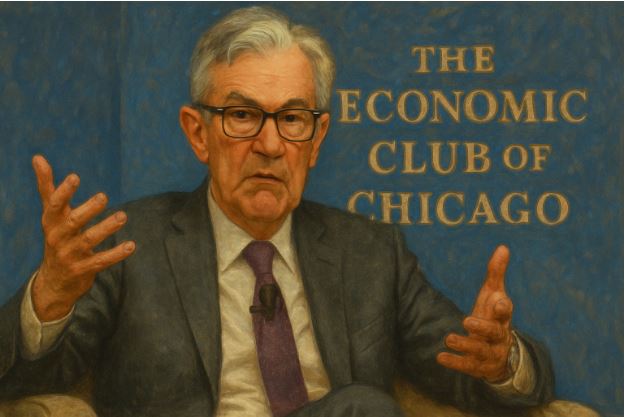

在芝加哥經濟俱樂部的演講中,美國聯準會主席鮑爾發表的言論加劇了市場焦慮。鮑爾表示:「我們可能會發現自己處於雙重使命但相互牽制的具挑戰性局面中」,指的是聯準會的最大就業和價格穩定目標。他指出,已宣布的關稅「遠遠超出預期」,並可能同時推高通膨並減緩經濟增長。鮑爾強調,央行「處於良好位置,並可以等待更明確的情況後再考慮任何政策立場的調整」,實際上表明儘管市場動盪,降息仍處於暫停狀態。這一立場讓許多市場參與者措手不及,因為之前市場普遍預期央行會採取貨幣寬鬆政策,以抵消關稅實施帶來的經濟阻力。

摘要

- 因鮑爾警告未來將出現「具挑戰性的局面」,主要指數大跌,道瓊下跌-1.73%,標普500下跌-2.24%,那斯達克暴跌-3.07%

- 美國聯準會主席鮑爾表示,將等待關稅影響更明確後才考慮降息

- 科技股領跌,輝達受新的中國出口限制而下跌-6.87%

- 美國國債價格上漲,黃金大漲+3.25%,投資者在經濟不確定性增加的環境中尋求安全

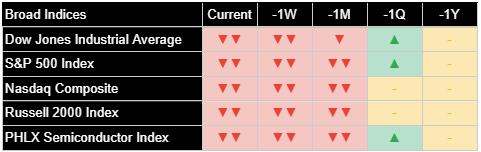

廣泛市場指數

週三所有主要美國指數均大幅下跌,延續前幾個交易日的負面趨勢。道瓊工業指數下跌-1.73%,30個成分股中有29個收低。標普500指數下跌-2.24%,連續第二天下跌,並進一步低於其近期高點。因科技公司承受了關稅擔憂和出口限制的衝擊,科技股為主的那斯達克綜合指數是主要指數中表現最差的,暴跌-3.07%。

小型股羅素2000指數比其大型同行表現更為堅韌,下跌-0.96%。這種相對較好的表現表明,以國內為重點的小型公司可能對國際貿易中斷的影響較小。同時,費城半導體指數暴跌-4.14%,反映出對美中貿易緊張關係的特別脆弱性,因為許多晶片公司嚴重依賴全球供應鏈和中國市場。

所有主要指數的一致性惡化表明投資者對經濟增長前景的擔憂加劇。近幾週所有主要指數可見的加速下跌模式,加上今天的大幅波動,表明市場正接近關鍵時刻。科技為主的指數表現出特別疲弱,突顯市場的擔憂,引領經濟成長的行業現在可能最容易受到政策轉變的影響。

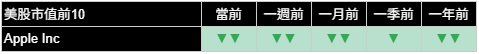

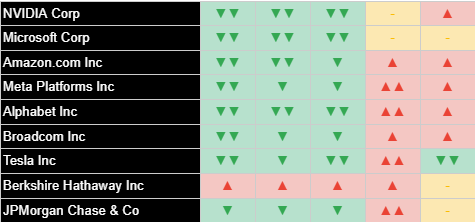

美國十大公司

美國市值最大的公司基本上反映了大盤的下跌趨勢,其中科技巨頭領跌。按市值計算的十大美國公司中有九家出現虧損,僅波克夏海瑟威例外,小幅上漲+0.12%。大型科技股的下跌幅度表明,投資者正在重新評估這個近年來主導市場表現的行業的成長預期。

輝達是十大公司中表現最差的,在披露將因中國出口限制而計入55億美元的季度費用後,暴跌-6.87%。該公司的困境突顯了不斷變化的貿易政策對市場上最大和最具主導地位的參與者的直接影響。其他顯著下跌包括特斯拉公司下跌-4.94%,蘋果公司下跌-3.89%,以及微軟公司下跌-3.66%。Meta平台公司和亞馬遜公司也分別大幅下跌-3.68%和-2.93%。

科技領導者的普遍疲弱反映出對該行業易受貿易中斷和監管挑戰影響的擔憂日益增加。這些公司在多個時期內持續的負面趨勢表明,市場領導地位可能正在發生潛在的結構性轉變。由於科技行業在近年來推動了市場的大部分漲幅,這些具領導地位的科技巨頭的持續疲弱可能對未來幾個月的整體市場表現產生重大影響。

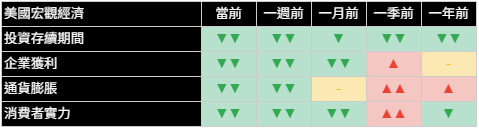

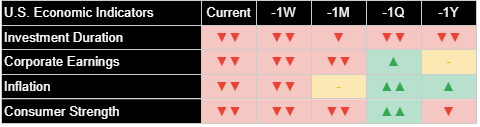

經濟指標

經濟指標顯示普遍惡化,表明整體經濟環境壓力增加。投資期限在所有時間框架內都顯示出明顯疲弱,表明對長期增長前景的擔憂日益增加。這種持續惡化與美國聯準會主席鮑爾對經濟前景的謹慎立場一致。消費者強度也顯示出實質性惡化,反映出在關稅可能帶來的通膨壓力下,家庭消費能力的不確定性日益增加。

通膨指標顯示令人擔憂的上行壓力跡象,特別是在短期讀數上。這一發展直接連接到鮑威爾的警告,即關稅「極有可能至少產生暫時性的通膨上升」。通膨前景看起來特別令人擔憂,因為它與消費者強度疲弱同時出現,造成了鮑爾在討論聯準會「具挑戰性」立場時提到的潛在停滯性通膨情景。企業獲利指標顯示出混合趨勢,長期視野有所改善,但近期表現惡化。

這些經濟趨勢顯示市場和政策制定者面臨的複雜前景。正如鮑爾所指出的,聯準會可能很快面臨其雙重使命目標之間的艱難權衡:價格穩定和最大就業。如果由於關稅導致通膨上升,同時經濟增長放緩和失業率上升,央行將面臨是優先考慮抗擊通膨還是支持經濟增長的艱難選擇。對投資者而言,這種經濟背景意味著隨著市場消化這些相互競爭的力量,未來波動性可能會增加。

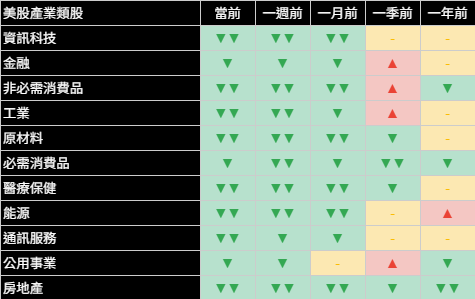

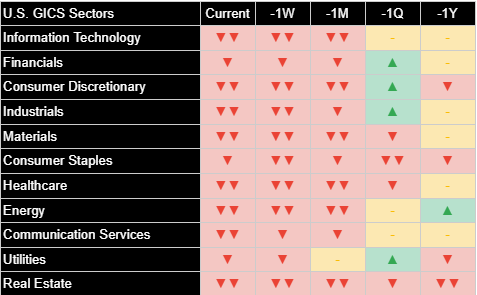

行業概況

週三各類股表現普遍不佳,標普500指數的11個類股中有9個收低。能源類股表現最佳,上漲+0.82%,其次是房地產,小幅上漲+0.12%。資訊科技類股領跌,大幅下跌-3.43%,其次是通訊服務下跌-2.69%和非必需消費品下跌-2.47%。

在表現最差的類股中,資訊科技類股下跌-3.43%,反映了硬體、軟體和半導體公司的普遍疲弱。半導體類股受到特別嚴重打擊,因為有關對中國額外出口限制的消息和輝達宣布與這些限制相關的費用。消費者導向的類股也顯示出明顯疲弱,非必需消費品下跌-2.47%,必需消費品下跌-1.07%,突顯了對通膨升高可能影響消費者購買力的擔憂。

類股表現模式揭示了市場從成長導向類股轉為傾向更具防禦性和抗通膨領域的明顯移動。這種轉動模式支持市場正在適應通膨和成長問題同時存在的新經濟格局之觀點。

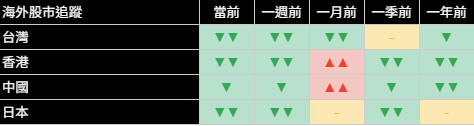

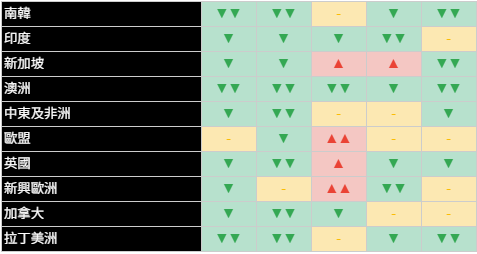

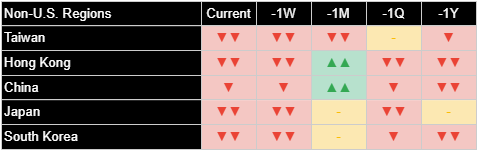

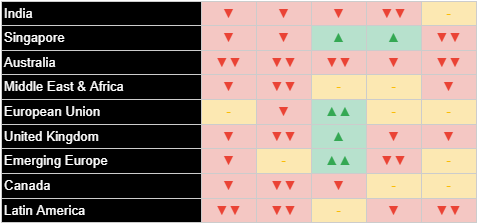

國際市場

全球市場週三普遍疲弱,大多數地區與美國市場同步下跌。亞洲市場受到特別嚴重打擊,隨著貿易緊張局勢升級,中國下跌-2.01%。歐洲市場表現不一,一些地區相對於美國市場展現出些許韌性。拉丁美洲表現出相對強勢,小幅上漲+0.17%,表明一些新興市場可能受益於從較發達地區的資本流出。

已開發市場展現出令人擔憂的趨勢,日本下跌-0.98%,歐洲下跌-0.40%。英國表現出特別疲弱,今日下跌近-1%。這些下跌發生在多個時期表現惡化的背景下,表明全球經濟擔憂正在擴大。日本市場持續疲弱,反映了該國對貿易的依賴和對全球經濟放緩的經濟脆弱性。

新興市場表現不一,中國下跌-2.01%,突顯其對美貿易政策的特別脆弱性。印度維持0.00%不變,顯示出相對韌性,而拉丁美洲小幅上漲。新興市場之間的表現差異表明投資者開始根據其對美中貿易緊張關係的曝險和國內經濟基本面來區分市場。隨著全球市場度過這一不確定時期,區域表現差異可能會增加,進而在波動中創造潛在機會。

其他資產

週三的跨資產表現顯示出在經濟不確定性加劇的環境中典型的避險情況。黃金大漲+3.25%,美國國債價格全面上漲,美元指數下跌-0.84%,因投資者在鮑爾評論後重新評估其定位。這些走勢反映出對經濟前景的擔憂日益增加,以及對傳統避險資產的需求增加。

各期限美國國債在價格方面表現強勁,長期國債價格上漲+0.56%(殖利率下降),中期國債價格上漲+0.43%(殖利率下降),短期國債價格小幅上漲+0.15%(殖利率下降)。這種普遍性的國債價格上漲表明投資者在尋求安全的同時,也降低了對經濟成長的預期。這些走勢所暗示的殖利率曲線平坦化,與在關稅引發的通膨壓力下對未來經濟增長前景的擔憂一致。

大宗商品表現不一,黃金在明確的避險需求下大漲+3.25%。WTI原油上漲+1.91%,可能反映了對通膨壓力或供應限制的擔憂。農產品也表現強勁,上漲+1.45%,而工業金屬小幅下跌-0.17%。加密貨幣市場在動盪中保持相對穩定,比特幣上漲+0.46%。黃金和農產品等傳統通膨對沖資產的強勁表現,加上美國國債價格上漲,表明市場正在為通膨和增長擔憂同時存在的複雜經濟情景定價。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Plunge as Powell Signals No Rush to Cut Rates Amid Tariff Concerns

Fed Chair warns of dual threats to economy as stocks slide sharply

Joe Lu, CFA April 16, 2025

MARKET OVERVIEW

U.S. markets suffered steep losses on Wednesday as Federal Reserve Chair Jerome Powell signaled the central bank would not rush to cut interest rates despite mounting concerns about President Trump's tariff policies. Stocks extended their decline after Powell warned that the Fed could face the difficult challenge of managing both rising inflation and a weakening labor market simultaneously.

The major indices closed sharply lower, with the S&P 500 Index falling -2.24% to end at 5,275.70, the Dow Jones Industrial Average declining -1.73% to 39,669.39, and the Nasdaq Composite tumbling -3.07% to 16,307.16. The Russell 2000 Index, representing smaller companies, showed somewhat more resilience with a smaller decline of -0.96%. The technology-heavy PHLX Semiconductor Index was particularly hard hit, plunging -4.14% as semiconductor stocks grappled with new export restrictions to China.

In a speech to the Economic Club of Chicago, Federal Reserve Chair Jerome Powell delivered remarks that intensified market anxiety. "We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension," Powell said, referring to the Fed's objectives of maximum employment and price stability. He noted that the announced tariffs were "significantly larger than anticipated" and would likely push inflation higher while simultaneously slowing economic growth. Powell emphasized that the central bank is "well positioned to wait for greater clarity before considering any adjustments to our policy stance," effectively signaling that rate cuts are on hold despite market turbulence. This stance caught many market participants off guard, as there had been growing expectations for potential monetary easing to counteract economic headwinds from tariff implementation.

Executive Summary

- Major indices tumbled with Dow dropping -1.73%, S&P 500 falling -2.24%, and Nasdaq plummeting -3.07% as Powell warned of "challenging scenario" ahead

- Fed Chair Powell indicated the central bank will wait for greater clarity on tariff effects before considering rate cuts

- Tech stocks led declines with NVIDIA dropping -6.87% amid new China export restrictions

- Treasury prices rose and gold surged +3.25% as investors sought safety amid growing economic uncertainty

BROAD MARKET INDICES

All major U.S. indices retreated significantly on Wednesday, continuing their negative trend from previous sessions. The Dow Jones Industrial Average fell -1.73%, with 29 of its 30 components closing lower. The S&P 500 Index dropped -2.24%, marking its second consecutive day of losses and falling further below its recent highs. The technology-heavy Nasdaq Composite was the worst performer among major indices, plummeting -3.07% as tech companies bore the brunt of tariff concerns and export restrictions.

The Russell 2000 Index of small-cap stocks showed more resilience than its larger counterparts, declining -0.96%. This relative outperformance suggests smaller domestic-focused companies may be somewhat less vulnerable to international trade disruptions. Meanwhile, the PHLX Semiconductor Index plunged -4.14%, reflecting particular vulnerability to U.S.-China trade tensions, as many chip companies depend heavily on global supply chains and Chinese markets.

The consistent deterioration across all major indices signals heightened investor concern about economic growth prospects. The pattern of accelerating declines visible in recent weeks across all major indices, combined with today's sharp moves, suggests the market is approaching a critical juncture. The technology-focused indices are showing particular weakness, highlighting the market's concern that the sectors that have led growth may now be most vulnerable to policy shifts.

TOP 10 U.S. COMPANIES

The largest U.S. companies largely mirrored the broader market's decline, with technology giants leading the way down. Nine of the top ten U.S. companies by market capitalization posted losses, with Berkshire Hathaway being the sole exception, recording a modest gain of +0.12%. The magnitude of declines among mega-cap technology stocks suggests investors are reassessing growth expectations for the sector that has led market performance in recent years.

NVIDIA Corporation was the worst performer among the top ten, plunging -6.87% after disclosing it would take a $5.5 billion quarterly charge related to China export restrictions. The company's struggles highlight the direct impact of evolving trade policies on even the market's largest and most dominant players. Other significant declines included Tesla Inc. at -4.94%, Apple Inc. at -3.89%, and Microsoft Corp. at -3.66%. Meta Platforms Inc. and Amazon.com Inc. also posted substantial losses of -3.68% and -2.93% respectively.

The widespread weakness among technology leaders reflects growing concern about the sector's vulnerability to trade disruptions and regulatory challenges. The persistent negative trend across multiple time periods for most of these companies suggests a potential structural shift in market leadership may be underway. With the technology sector having driven much of the market's gains in recent years, continued weakness among these top companies could have significant implications for broader market performance in the coming months.

ECONOMIC INDICATORS

Economic indicators displayed broad deterioration, suggesting increased stress in the overall economic environment. Investment duration showed significant weakness across all time frames, indicating mounting concerns about long-term growth prospects. This persistent deterioration aligns with Federal Reserve Chair Powell's cautious stance on the economic outlook. Consumer strength also showed substantial deterioration, reflecting growing uncertainty about household spending power in the face of potential inflation pressures from tariffs.

Inflation metrics showed concerning signs of upward pressure, particularly in shorter-term readings. This development directly connects to Powell's warning that tariffs are "highly likely to generate at least a temporary rise in inflation." The inflation outlook appears particularly troubling as it coincides with weakening consumer strength, creating the potential stagflation scenario that Powell referenced when discussing the Fed's "challenging" position. Corporate earnings metrics showed mixed trends, with some improvement over longer-term horizons but deterioration in recent periods.

These economic trends point toward a complicated path forward for markets and policymakers. As Powell noted, the Fed may soon face difficult trade-offs between its dual mandate goals of price stability and maximum employment. If inflation rises due to tariffs while economic growth slows and unemployment increases, the central bank will face difficult choices about whether to prioritize fighting inflation or supporting economic growth. For investors, this economic backdrop suggests increased volatility ahead as markets digest these competing forces.

SECTOR OVERVIEW

Sector performance was broadly negative on Wednesday, with nine of eleven S&P 500 sectors closing lower. The Energy sector was the top performer with a gain of +0.82%, followed by Real Estate with a modest increase of +0.12%. The Information Technology sector led declines with a significant drop of -3.43%, followed by Communication Services at -2.69% and Consumer Discretionary at -2.47%.

Among the worst performers, the Information Technology sector's -3.43% decline reflected broad-based weakness across hardware, software, and semiconductor companies. Semiconductor stocks were particularly hard hit following news of additional export restrictions to China and NVIDIA's announced charge related to these constraints. The consumer-oriented sectors also showed significant weakness, with Consumer Discretionary falling -2.47% and Consumer Staples declining -1.07%, highlighting concerns about potential impacts on consumer spending power from higher inflation.

The sector performance pattern reveals a clear rotation away from growth-oriented sectors toward more defensive and inflation-resistant areas. This rotation pattern supports the narrative of a market adapting to a changed economic landscape where both inflation and growth concerns are simultaneously present.

INTERNATIONAL MARKETS

Global markets showed widespread weakness on Wednesday, with most regions declining in solidarity with U.S. markets. Asian markets were particularly hard hit, with China falling -2.01% as trade tensions escalated. European markets demonstrated mixed performance, with some regions showing slight resilience compared to their U.S. counterparts. Latin America displayed relative strength with a modest gain of +0.17%, suggesting some emerging markets might benefit from capital flowing out of more developed regions.

Developed markets exhibited concerning trends, with Japan declining -0.98% and Europe falling -0.40%. The United Kingdom showed particular weakness, dropping nearly -1% in today's session. These declines come against a backdrop of deteriorating performance across multiple time periods, suggesting global economic concerns are broadening. Japanese markets have shown persistent weakness, reflecting the country's trade dependence and economic vulnerability to global slowdowns.

Emerging markets displayed mixed performance, with China's -2.01% decline highlighting its particular vulnerability to U.S. trade policies. India remained flat at 0.00%, showing relative resilience, while Latin America posted a slight gain. The divergent performance among emerging markets suggests investors are beginning to differentiate between markets based on their exposure to U.S.-China trade tensions and their domestic economic fundamentals. As global markets navigate this period of uncertainty, regional performance dispersion may increase, creating potential opportunities amid the volatility.

OTHER ASSETS

Cross-asset performance on Wednesday revealed a classic flight to safety amid heightened economic uncertainty. Gold surged +3.25%, Treasury prices rose across the curve, and the U.S. Dollar Index fell -0.84% as investors reassessed their positioning following Powell's comments. These movements reflect growing concern about the economic outlook and increasing demand for traditional safe-haven assets.

Treasury prices showed strength across the maturity spectrum, with long-term Treasury prices rising +0.56% (yields falling), intermediate Treasury prices increasing +0.43% (yields declining), and short-term Treasury prices edging up +0.15% (yields decreasing). This broad-based Treasury price rally suggests investors are seeking safety while simultaneously pricing in lower growth expectations. The flattening yield curve implied by these moves aligns with concerns about future economic growth prospects in the face of tariff-induced inflation pressures.

Commodities displayed mixed performance, with gold surging +3.25% in a clear safe-haven bid. WTI Crude Oil gained +1.91%, potentially reflecting concerns about inflationary pressures or supply constraints. Agricultural commodities also showed strength with a +1.45% increase, while industrial metals declined slightly by -0.17%. Cryptocurrency markets remained relatively stable amid the turmoil, with Bitcoin gaining +0.46%. The strong performance of traditional inflation hedges like gold and agricultural commodities, coupled with Treasury price gains, indicates that markets are pricing in a complicated economic scenario where both inflation and growth concerns are simultaneously present.