【Joe’s華爾街脈動】市場震盪:關稅緊張局勢與鮑爾-川普爭端蓋過財報季

貿易政策不確定性加劇,道瓊指數暴跌超500點,標普500指數微幅上漲

Joe Lu, CFA 2025年4月17日 美東時間

市場概述

美國股市週四收盤漲跌互現,在一個充滿波動的交易日中,市場主要受到關稅擔憂、聯準會利率政策辯論,以及川普總統對聯準會主席鮑爾不斷升級的批評所影響。標普500指數小幅上漲+0.14%至5,282.70點,而道瓊工業指數則暴跌-1.33%至39,142.23點,主要受醫療巨頭聯合健康保險 (UNH-US) 財報不佳導致暴跌-22.38%所拖累。納斯達克綜合指數小幅下滑-0.13%至16,286.45點。三大指數在因復活節假期縮短的交易一週內,均出現週度跌幅。

市場表現持續受到關稅風波的嚴重影響,在川普總統表示可能與中國和歐盟達成貿易協議後,股市曾短暫上漲。但這種短暫的樂觀情緒不足以克服更廣泛的市場擔憂,因為投資者仍努力應對關稅帶來的通脹影響。自川普4月2日宣布「互惠」關稅 (後來部分撤回) 以來,標普500指數已下跌近7%,反映了這些政策為市場預期帶來的重大不確定性。

執行摘要:

- 道瓊斯指數暴跌-1.33%,聯合健康保險 (UnitedHealth, UNH-US) 因財報失望崩跌-22.38%

- 儘管關稅問題持續,標普500指數仍小幅上漲+0.14%

- 能源 (+2.26%) 和必需消費品 (+2.13%) 領漲,顯示防禦性佈局正在形成

- 美債殖利率曲線升至三年來最高水平,發出警告信號

- 川普總統對聯準會主席鮑爾的批評加劇,造成額外的市場不確定性

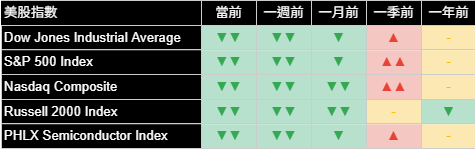

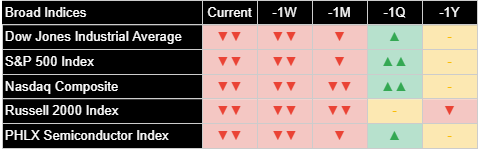

大盤指數

主要指數之間的分化突顯了市場對當前經濟和政策不確定性的選擇性反應。道瓊工業指數日跌幅達-1.36%,連續第三個交易日延續負面趨勢,使其週度跌度達到-2.7%。這種相對其他指數的顯著表現不佳主要是由於聯合健康保險 (UNH-US) 的獲利令人大失所失望,展示了個別成分股疲弱會對價格加權指數產生顯著影響。

相比之下,標普500指數和羅素2000指數表現出相對韌性,分別上漲+0.14%和+0.82%,而納斯達克綜合指數小幅下跌-0.13%。費城半導體指數以-0.63%的跌幅延續其令人擔憂的軌跡,將月度跌幅擴大至-17.95%,反映了對技術出口管制和全球需求模式的持續擔憂。

美國十大公司

美國十大企業的表現以負面為主,週四有8家公司股價下跌。輝達領跌,大跌-2.93%,延續了其近期疲弱表現,因為投資者正在消化有關其先進H20 晶片遭美管制禁止出口中國,而認列約55億美元季度損失的消息。這家半導體巨頭過去一個月已下跌-15.14%,反映了公司本身面臨的挑戰,以及對美中在科技方面關係緊張的普遍擔憂。

蘋果在大型科技股中提供了罕見的亮點,儘管市場整體疲弱,仍上漲+1.37%。波克夏海瑟威和摩根大通也分別小幅上漲+0.34%和+0.43%,突顯了投資者定位的選擇性。這些公司的財務實力似乎正在吸引資金,因為市場參與者在不確定性中尋求優質資產。

大多數頂尖公司的趨勢模式在當前和近期時間段內保持明顯負面,十大美國公司中有九家顯示當前趨勢為負。由於這些公司在主要指數表現中佔有不成比例的份額,因此市場領導者的表現普遍惡化尤其令人擔憂。

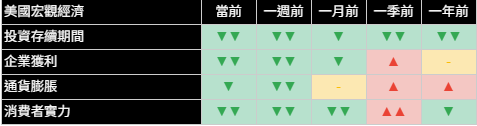

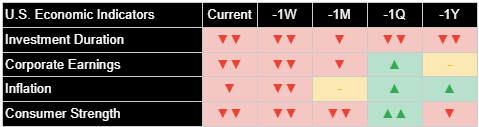

經濟指標

經濟指標繼續顯示令人擔憂的惡化,特別是在投資時限方面,反映了市場參與者在政策不確定性中對短期資產的偏好增加。這種轉變表明對長期經濟前景的懷疑日益增加,以及對更長投資期限的適應性下降。

企業獲利指標顯示出顯著的疲弱,季度趨勢在數個時期後首次轉為負面。隨著財報季加速,這種趨勢逆轉特別令人擔憂,聯合健康保險 (UNH-US) 的大幅虧損可能預示著其他主要公司的挑戰。

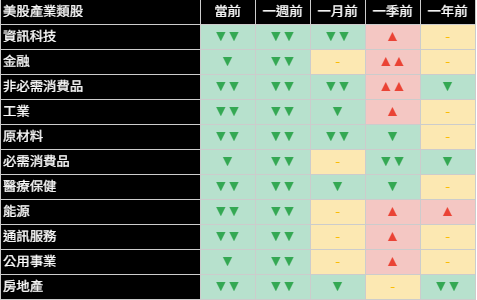

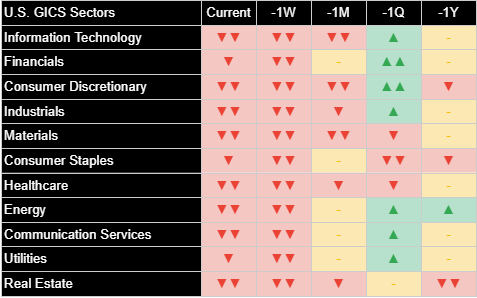

類股概述

週四的類股表現顯示出明顯的防禦性定位,傳統穩定類股的表現優於更具經濟敏感性的領域。隨著原油價格飆升近+3%,能源類股以+2.26%的漲幅領先所有類股,緊隨其後的是必需消費品類股+2.13%和公用事業類股+1.03%。資金轉向這些傳統避險領域表明,投資者對貿易政策不確定性下的經濟增長前景越來越擔憂。

房地產類股也顯示出顯著強勢,上漲+1.56%,延續其近期積極走勢,週漲幅達+5.11%。考慮到長期利率上升,這種表現有些令人驚訝,顯示儘管該類股對利率敏感,投資者可能仍將其視為潛在的通膨對沖工具。

在走勢積極表現的另一端,資訊科技類股下跌-0.44%,反映了對出口管制和全球科技需求的持續擔憂。受到聯合健康保險 (UNH-US) 獲利不佳的拖累,醫療保健類股也明顯疲弱,下跌-0.59%。市場明顯偏好防禦性類股而非成長導向類股的移轉模式表明,在不確定的政策環境中,市場正在採取風險規避定位。

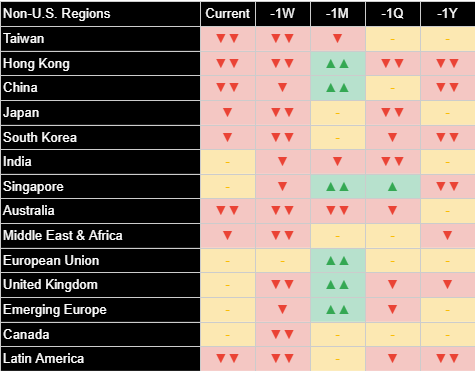

國際市場

全球市場顯示出多樣化的表現模式,區域轉動越來越明顯。日本以+1.93%的可觀漲幅脫穎而出,而印度上漲+2.21%,拉丁美洲上漲+2.22%。這些地區似乎正受益於資本從更直接受到美中貿易緊張影響的市場中移轉。

歐洲市場顯示出溫和強勢,上漲+1.04%,可能反映了歐洲央行降低利率而美國聯準會保持不變令市場鬆了一口氣。歐盟在中期時間框架內的趨勢模式改善表明,儘管對經濟增長的持續擔憂,但對該地區的情緒正在改善。

中國市場波動有限,僅上漲+0.26%,掩蓋了其趨勢模式中的極端波動性。月度趨勢讀數明顯為負面-15.96%,突顯了關稅擔憂對中國股市的重大影響。相較之下,季度趨勢積極表明市場可能在今年早些時候過度樂觀,而近期政策發展引發了急劇重新評估。

新興亞洲整體上漲+0.91%,延續其近期積極走勢,週漲幅達+4.01%。該地區相對有利的通膨動態以及受美國關稅政策直接影響程度有限,透露出似乎正在吸引尋求受貿易緊張局勢直接影響市場的資金替代。

其他資產

跨資產表現反映了在政策不確定性下不斷增長的通膨擔憂和對沖行為。由於投資者對潛在的供應中斷和因貿易限制導致的更高能源成本進行了準備,原油價格飆升+2.55%至每桶64.33美元,將其週漲幅擴大至+6.37%。長期美國國債價格的明顯疲弱,長期債券價格下跌-0.88%,表明儘管鮑爾立場強硬,通膨預期仍在上升。

黃金價格下跌-0.44%,在最近強勁上漲後,該貴金屬月漲幅達+10.62%,季度漲幅達+22.81%。這種溫和回調可能代表獲利了結,而非市場情緒的根本轉變,因為黃金作為通膨對沖和地緣政治風險晴雨表的傳統角色在不確定時期繼續吸引投資。

自川普表明傾向加密貨幣的政策立場獲得關注以來,比特幣上漲+0.63%,將其驚人的月度漲幅擴大至+38.84%。該加密貨幣似乎受益於其作為通膨和政策不確定性潛在對沖的感知,儘管其極端波動性繼續限制其作為主流防禦資產的採用。

殖利率曲線動態尤其值得關注,10年期和2年期美國國債殖利率之間的差距擴大至約50個基點 - 三年來的最高水平。從歷史上來看,這種在倒掛期後的「熊市陡峭化模式」往往早於或伴隨著經濟衰退,並表明債券市場在對更高的長期通膨預期定價的同時,對近期增長前景也存在擔憂。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Markets Falter as Tariff Tensions and Powell-Trump Feud Overshadow Earnings Season

Dow plunges over 500 points while S&P 500 ekes out slight gain amid escalating trade policy uncertainty

Joe Lu, CFA April 17, 2025

MARKET OVERVIEW

U.S. markets closed mixed on Thursday in a volatile session dominated by tariff concerns, Federal Reserve interest rate policy debates, and President Trump's escalating criticism of Fed Chair Jerome Powell. The S&P 500 managed to eke out a slight gain of +0.14% to 5,282.70, while the Dow Jones Industrial Average plunged -1.33% to 39,142.23, dragged down by healthcare giant UnitedHealth's -22.38% collapse after disappointing earnings. The Nasdaq Composite slipped -0.13% to 16,286.45, with all three major indices posting weekly losses in this holiday-shortened trading week.

Market performance was heavily influenced by the ongoing tariff saga, with stocks briefly jumping after President Trump indicated potential trade deals with China and the European Union. This momentary optimism was insufficient to overcome broader market concerns, as investors continue grappling with the inflationary implications of proposed tariffs. Since Trump's April 2nd announcement of "reciprocal" tariffs (which he later partially walked back), the S&P 500 has dropped nearly 7%, reflecting the significant uncertainty these policies have introduced into market expectations.

Executive Summary:

- Dow Jones plummeted -1.33% as UnitedHealth collapsed -22.38% on disappointing earnings

- S&P 500 managed a marginal gain of +0.14% despite ongoing tariff concerns

- Energy (+2.26%) and Consumer Staples (+2.13%) led sectors as defensive positioning emerges

- Treasury yield curve steepened to highest level in three years, sending warning signals

- President Trump's criticism of Fed Chair Powell intensified, creating additional market uncertainty

BROAD MARKET INDICES

The divergence between major indices highlighted the market's selective response to current economic and policy uncertainties. The Dow Jones Industrial Average suffered a significant -1.36% daily decline, extending its negative trend for the third consecutive session and bringing its weekly loss to -2.7%. This substantial underperformance relative to other indices was primarily driven by UnitedHealth's earnings disappointment, demonstrating how individual component weakness can dramatically impact the price-weighted index.

In contrast, the S&P 500 and Russell 2000 showed relative resilience with gains of +0.14% and +0.82% respectively, while the Nasdaq Composite edged lower by -0.13%. The Philadelphia Semiconductor Index continued its concerning trajectory with a -0.63% drop, extending its monthly decline to -17.95% and reflecting ongoing concerns about technology export controls and global demand patterns.

TOP 10 U.S. COMPANIES

Performance among the largest U.S. companies was predominantly negative, with 8 of the top 10 firms declining on Thursday. NVIDIA led the declines with a substantial -2.93% drop, extending its recent weakness as investors digest news of a $5.5 billion quarterly charge related to export controls on its advanced H20 GPUs to China. The semiconductor giant has now fallen -15.14% over the past month, reflecting both company-specific challenges and broader concerns about U.S.-China technology tensions.

Apple provided a rare bright spot among mega-caps, rising +1.37% despite the broader market weakness. Berkshire Hathaway and JPMorgan Chase also managed modest gains of +0.34% and +0.43% respectively, highlighting the selective nature of investor positioning. The financial strength of these companies appears to be attracting capital as market participants seek quality amid uncertainty.

The trend patterns for most top companies remain decisively negative across current and recent time periods, with nine of the ten largest U.S. companies showing negative current trends. This widespread deterioration among market leaders is particularly concerning as these firms account for a disproportionate share of major index performance.

ECONOMIC INDICATORS

Economic measures continued to show concerning deterioration, particularly in investment duration, which is reflecting market participants' increasing preference for shorter-term assets amid policy uncertainty. This shift indicates growing skepticism about long-term economic prospects and comfort with longer investment horizons.

Corporate earnings measures displayed significant weakness with quarterly trends turning negative for the first time in several periods. This trend reversal is particularly concerning as earnings season gains momentum, with UnitedHealth's dramatic miss potentially foreshadowing challenges for other major corporations.

SECTOR OVERVIEW

Thursday's sector performance revealed a distinct defensive positioning, with traditionally stable sectors outperforming more economically sensitive areas. Energy led all sectors with a +2.26% gain as crude oil prices surged nearly +3%, followed closely by Consumer Staples at +2.13% and Utilities at +1.03%. The rotation into these traditional safe-haven sectors suggests investors are increasingly concerned about economic growth prospects amid trade policy uncertainty.

Real Estate also demonstrated significant strength with a +1.56% advance, continuing its recent positive momentum with a weekly gain of +5.11%. This performance is somewhat surprising given rising long-term interest rates, suggesting investors may be viewing the sector as a potential inflation hedge despite its interest rate sensitivity.

At the opposite end of the performance spectrum, Information Technology declined -0.44%, reflecting ongoing concerns about export controls and global tech demand. Healthcare was also notably weak with a -0.59% drop, dragged down by UnitedHealth's earnings disappointment. The sector rotational pattern clearly favoring defensive sectors over growth-oriented ones suggests a risk-averse market positioning amid the uncertain policy environment.

INTERNATIONAL MARKETS

Global markets displayed diverse performance patterns, with regional rotation becoming increasingly evident. Japan stood out with a substantial +1.93% gain, while India rose +2.21% and Latin America advanced +2.22%. These regions appear to be benefiting from capital rotation away from markets more directly exposed to U.S.-China trade tensions.

European markets showed moderate strength with a +1.04% increase, potentially reflecting relief that the European Central Bank cut interest rates while the Federal Reserve remains on hold. The improving trend patterns for the European Union in intermediate timeframes suggest improving sentiment toward the region despite ongoing concerns about economic growth.

China's market experienced limited movement with just a +0.26% gain, masking the extreme volatility in its trend patterns. The pronounced negative monthly trend reading of -15.96% highlights the significant impact of tariff concerns on Chinese equities. The contrasting positive quarterly trend suggests the market may have been overly optimistic earlier in the year, with recent policy developments triggering a sharp reassessment.

Emerging Asia broadly gained +0.91%, continuing its recent positive momentum with a weekly gain of +4.01%. The region's relatively favorable inflation dynamics and limited direct exposure to U.S. tariff policies appear to be attracting capital seeking alternatives to markets more directly affected by trade tensions.

OTHER ASSETS

Cross-asset performance reflected growing inflation concerns and hedging behavior amid policy uncertainty. Crude oil prices surged +2.55% to $64.33 per barrel, extending their weekly gain to +6.37% as investors positioned for potential supply disruptions and higher energy costs resulting from trade restrictions. The pronounced weakness in long-term Treasury prices with long-duration bond prices falling -0.88% indicated rising inflation expectations despite Powell's hawkish stance.

Gold prices declined -0.44% following their recent strong run that has seen the precious metal gain +10.62% monthly and +22.81% quarterly. This modest pullback likely represents profit-taking rather than a fundamental shift in sentiment, as gold's traditional role as an inflation hedge and geopolitical risk barometer continues to attract investment during uncertain times.

Bitcoin advanced +0.63%, extending its dramatic monthly gain to +38.84% since President Trump's pro-crypto policy positions have gained attention. The cryptocurrency appears to be benefiting from its perception as a potential hedge against both inflation and policy uncertainty, though its extreme volatility continues to limit its adoption as a mainstream defensive asset.

The yield curve dynamics deserve particular attention, with the spread between 10-year and 2-year Treasury yields widening to approximately 50 basis points - the highest level in three years. This bear steepening pattern following a period of inversion has historically signaled impending economic weakness and suggests bond markets are pricing in higher long-term inflation expectations while simultaneously harboring concerns about near-term growth prospects.