【Joe’s華爾街脈動】美股因總統批評聯準會主席加劇而暴跌 關稅不確定性持續

美元滑落至三年低點 黃金飆升至歷史新高 投資者尋求安全避險

Joe Lu CFA 2025年4月21日 美東時間

市場概況

因川普總統與聯準會主席鮑爾之間的緊張關係升級,加上貿易談判停滯,觸發大範圍拋售,美股週一經歷大幅拉回。白宮證實正在研究透過法律途徑於2026年鮑爾任期到期前將其免職,這進一步削弱了投資者的信心,引發市場對聯準會獨立性前所未有的質疑,給全球市場帶來衝擊。

道瓊工業平均指數大跌-2.48%(-971.82點),收盤於38,170.41點,而標普500指數下滑-2.36%(-124.50點)至5,158.20點。納斯達克綜合指數也遭遇類似的命運,下跌-2.55%(-415.55點),收於15,870.90點,羅素2000指數下跌-2.01%,表明小型公司也未能倖免於賣壓。這是道瓊指數和納斯達克連續第四個交易日下跌,因自4月2日關稅宣布以來,市場脆弱性已顯著增加。

今日股市的大幅下跌主要由白宮與聯準會之間的衝突加劇所致。川普總統稱鮑爾為「遲到先生,一個重大輸家」,並要求立即降息,但聯準會上週明確表示將等待「更大的明確性」才會調整貨幣政策。這種對聯準會獨立性的直接挑戰,導致美債殖利率上升並使美元急劇下跌,反映出市場對於在貿易緊張局勢已經不穩定的時期,可能出現的政治干預貨幣政策的擔憂日益增加。週末後與主要貿易夥伴的談判明顯缺乏進展,進一步加劇了市場的擔憂,尤其美日關稅談判缺乏突破。

摘要:

- 因白宮與聯準會之間的緊張關係升級,主要指數暴跌,道瓊斯指數下跌971.82點(-2.48%)

- 川普總統直接攻擊聯準會主席鮑爾為「重大輸家」,引發對聯準會獨立性的嚴重擔憂

- 防禦型類股表現相對較佳,必需消費品類股跌幅最小,僅下跌(-0.95%)

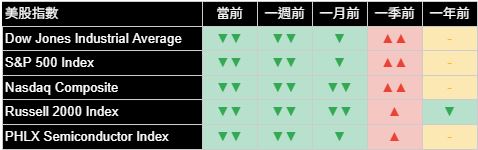

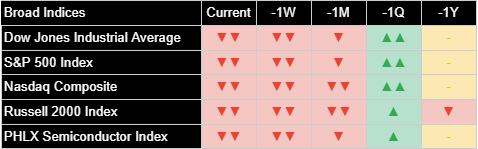

廣泛市場指數

主要指數全面遭受重大損失,大型、中型和小型股票的表現都一致呈現負面。道瓊工業平均指數下跌-2.48%,是自1月初以來最差單日表現,所有30檔成分股全部收跌。標普500指數下跌-2.36%,反映出隨著交易日的進行,賣壓越來越大,交易量比平均水平高出約25%。

納斯達克綜合指數下跌-2.55%,顯示科技股特別容易受到當前市場走勢的影響,半導體股票承受的壓力尤為明顯,費城半導體指數下跌-2.02%。羅素2000小型股指數下跌-2.01%,表現略優於大型股指數,但仍反映出市場全面下跌。這種相對表現表明,在這種規避風險的情況下,投資者並未明顯區分不同市值的股票。

所有主要指數的趨勢模式均顯著惡化,當前、一週和一個月的時間框架都呈現負面讀數。這與一季度和一年期的正面趨勢形成鮮明對比,凸顯出市場情緒因最近的政策發展而迅速轉變。多個時間框架中持續的負面模式表明,這不僅僅是暫時性的拉回,而且可能是市場動態的更重大變化。

美國十大公司

美國最大的公司承受了巨大的壓力,十大股票全部收跌,多數跌幅大於大盤。這種表現不佳表明機構投資者正在減少對市場權重最高組成部分的曝險,這可能是在政策不確定性上升的情況下的風險管理策略。

市場領導者中跌幅最大的是特斯拉(-5.78%)、輝達(-4.51%)和Meta平台(-3.35%),都明顯表現不如大盤。亞馬遜(-3.06%)和微軟(-2.35%)也出現了大幅虧損。前十大公司中,相對表現較好的是摩根大通(-1.28%)和蘋果(-1.94%),儘管兩者仍出現明顯下跌。這種相對表現模式表明,科技股在當前環境中面臨特別大的壓力,而摩根大通等金融機構在不確定的政策環境中,可能處於較有利的位置。

觀察趨勢模式,大多數大型公司在目前、一週和一個月的時間框架中都表現出持續負面的趨勢,反映出更廣泛的市場惡化。值得注意的是,波克夏海瑟威在表現出更為韌性的模式,有中性的當前讀數以及在一個月、一個季度和一年的角度來看呈現積極走勢。這種差異可能反映出投資者在不確定市場時期對波克夏擁有大量現金和多元化業務模式的欣賞。

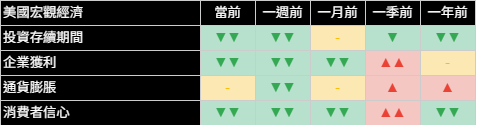

經濟指標

經濟指標大幅惡化,多個指標顯示對經濟前景的謹慎程度增加。投資期限在所有時間範圍內都顯示出明顯的疲弱,表明對短期資產的偏好日益增加,暗示對長期經濟增長前景的擔憂。這種投資期限偏好的嚴重惡化往往預示著更廣泛的經濟挑戰,並表明機構投資者正在採取防禦性定位。

公司獲利指標也在最近的時間框架內有所減弱,儘管一季度的角度來看仍保持積極,反映出當前市場動盪之前,第一季獲利情況普遍穩健。消費者信心已大幅下降,在目前、一週和一個月的角度來看都呈現負面讀數。這種消費者信心指標的迅速惡化表明,關稅和政策不確定性影響家庭信心和消費模式的擔憂日益增加。

通貨膨脹讀數呈現更為複雜的局面,當前中性讀數表明短期內價格穩定。然而,市場通脹預期不斷上升,這對消費者不利。通脹壓力的增長使聯準會在政策決策方面的靈活性降低,並增加市場對未來貨幣政策走勢的不確定性。

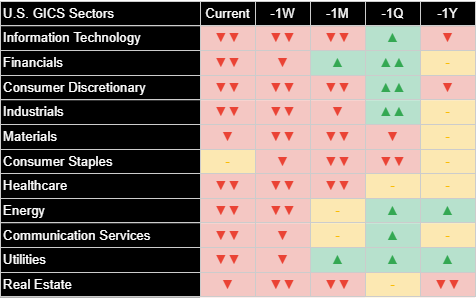

產業概況

週一的交易中,標普500指數的所有十一個產業均呈現負面表現,但下跌幅度的差異很大。必需消費品表現出最大的相對韌性,僅下跌-0.95%,明顯優於大盤,因為投資者轉向防禦性定位。原物料(-1.52%)和房地產(-2.02%)也表現出相對優勢,儘管兩者仍出現大幅虧損。

表現最差的產業是非必需消費品(-2.67%)、公用事業(-2.37%)和資訊科技(-3.15%),分別反映出對消費支出、利率敏感性和增長預期的特別擔憂。能源(-2.61%)也明顯表現不佳,因為油價下跌反映出對全球經濟增長和潛在貿易中斷的擔憂增加。

產業趨勢在目前、一週和一個月的時間框架內大多呈現負面模式。然而,從長期來看,公用事業、金融和必需消費品表現出更具建設性的模式,在這些傳統防禦型產業的一個季度趨勢中可見積極性。短期疲弱與防禦型產業的長期韌性之間的差異,支持了投資者重新定位,以求安全,同時維持選擇性投資於那些不易受當前政策不確定性影響的領域。

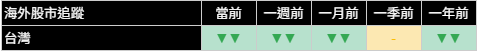

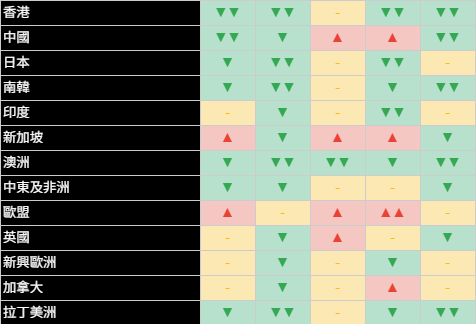

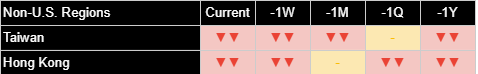

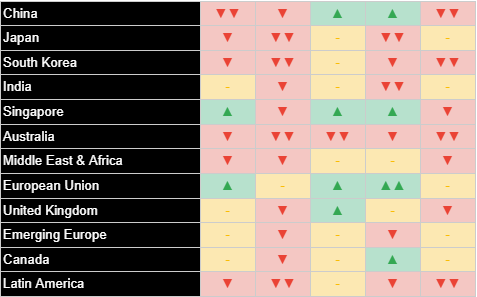

國際市場

週一全球市場表現出明顯的分化,部分亞洲和歐洲市場在美國疲弱的背景下表現出卓越的韌性。印度表現突出,上漲+1.42%,而新加坡的漲幅較為溫和+0.60%。中國股市收盤略漲+0.20%,基本與美國市場動態脫鉤。這些亞洲主要市場的積極表現顯示,國際投資者可能認為非美國股票相對不受當前美國政策不確定性的影響。

歐洲市場表現不一,歐盟大盤指數表現出一定彈性。英國保持中性立場,而許多歐洲大陸市場因復活節週一休市,交易活動有限。相比之下,大多數亞洲已開發國家面臨壓力,日本下跌-0.22%,韓國下跌-0.21%,但這些損失明顯輕於美國市場的損失。

新興市場表現出特別明顯的分化,拉丁美洲(-0.21%)和新興歐洲(-0.26%)跌幅偏小,而新興亞洲(+0.60%)表現出韌性。這種模式表明投資者基於其對美國政策轉變和貿易緊張局勢的脆弱性,正在對新興市場地區進行區分,亞洲市場目前被認為更有能力應對不確定的全球格局。

其他資產

跨資產市場顯示出明顯的傳統避險趨勢,黃金大漲+3.09%,至歷史新高$3,433.80。黃金的這一顯著變動反映出投資者對地緣政治緊張局勢和聯準會獨立性潛在威脅的擔憂日益增加。比特幣也強勁上漲+3.03%,表明數位資產在美元疲弱和政策不確定性時期,可能越來越被視為價值儲存的替代品。

美國國債價格普遍下跌,20年期以上國債下跌-1.75%,殖利率曲線全線上升。7-10年期債券下跌-0.54%,而1-3年期國債指數幾乎持平,為-0.02%。這種殖利率曲線的陡峭化可能反映出對關稅可能帶來的長期通脹影響的擔憂,以及對貨幣政策獨立性的質疑,而非對當前經濟增長的恐懼。

美元指數暴跌-0.98%,至三年低點,為近幾個月來貨幣市場最顯著的變動之一,反映出國際對美國政策方向的擔憂。由於對經濟成長的擔憂超過了潛在供應中斷風險,原油下跌-1.24%。農產品表現出韌性,僅小幅下跌-0.19%,而工業金屬下跌-0.89%,反映出不同商品類別對全球需求和關稅影響的預期不一。

總結來說,今日市場走勢反映出投資者情緒因白宮與聯準會之間緊張關係升級而顯著轉變,加上貿易談判缺乏進展。黃金等傳統避險資產的飆升,加上股票和美元的疲弱,表明對經濟成長前景和傳統政策框架穩定性的擔憂日益增加。儘管部分國際市場和防禦型產業表現出相對韌性,但大多數資產類別普遍的負面趨勢模式表明,在政策明朗之前,繼續保持謹慎是有其必要性。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Dollar Slides to Three-Year Low While Gold Surges to Record Highs as Investors Seek Safety

Joe Lu, CFA April 21, 2025

MARKET OVERVIEW

Markets experienced a severe pullback on Monday as escalating tensions between President Trump and Federal Reserve Chair Jerome Powell combined with stalled trade negotiations to trigger a widespread selloff. Investor confidence was further eroded by the White House's confirmation that it was exploring legal options to potentially remove Powell before his term expires in 2026, raising unprecedented questions about central bank independence that sent shockwaves through global markets.

The Dow Jones Industrial Average plunged -2.48% (-971.82 points) to close at 38,170.41, while the S&P 500 tumbled -2.36% (-124.50 points) to 5,158.20. The Nasdaq Composite suffered a similar fate, dropping -2.55% (-415.55 points) to end at 15,870.90, and the Russell 2000 declined -2.01% as smaller companies were not spared from the selling pressure. This marks the fourth consecutive daily loss for both the Dow and Nasdaq as market vulnerability has significantly increased since the April 2nd tariff announcements.

Today's sharp decline was primarily driven by the intensifying conflict between the White House and the Federal Reserve, with President Trump referring to Powell as "Mr. Too Late, a major loser" and demanding immediate rate cuts despite the Fed's clear stance last week that it would wait for "greater clarity" before adjusting monetary policy. This direct challenge to central bank independence sent Treasury yields higher and the dollar sharply lower, reflecting growing market concerns about potential political interference in monetary policy during a period already destabilized by trade tensions. The apparent absence of progress in trade negotiations with major trading partners following the weekend further exacerbated market concerns, with particular focus on the lack of breakthrough in US-Japan tariff talks.

Executive Summary:

- Major indices plummeted with Dow Jones dropping 971.82 points (-2.48%) amid escalating tensions between the White House and Federal Reserve

- President Trump's direct attacks on Fed Chair Powell as a "major loser" raised serious concerns about central bank independence

- Defensive sectors outperformed as Consumer Staples showed relative resilience with smallest sector decline (-0.95%)

- Gold surged 3.09% to record high of $3,433.80 as investors fled to safety while the dollar index tumbled -0.98%

- International markets showed divergence with India (+1.42%) and Singapore performing strongly against backdrop of US weakness

BROAD MARKET INDICES

The Nasdaq Composite's -2.55% drop showed technology's particular vulnerability to the current market narrative, with semiconductor stocks experiencing disproportionate pressure as reflected in the Philadelphia Semiconductor Index's decline of -2.02%. The Russell 2000 small-cap index fell -2.01%, performing marginally better than large-cap indices but still reflecting the market-wide retreat. This relative performance suggests investors aren't discriminating significantly between market capitalizations during this risk-off episode.

Trend patterns across all major indices have deteriorated significantly, with negative readings now present across current, one-week, and one-month timeframes. This represents a sharp reversal from the positive long-term trends visible in the one-quarter and one-year views, highlighting how quickly market sentiment has shifted in response to recent policy developments. The persistent negative pattern across multiple timeframes suggests this is not merely a temporary pullback but potentially a more significant change in market dynamics.

TOP 10 U.S. COMPANIES

The largest U.S. companies experienced substantial pressure, with all ten largest stocks closing in negative territory and most declining more sharply than the broader market. This underperformance suggests institutional investors are reducing exposure to the market's most heavily-weighted components, potentially as a risk management strategy amid rising policy uncertainty.

The steepest declines among market leaders came from Tesla (-5.78%), NVIDIA (-4.51%), and Meta Platforms (-3.35%), all significantly underperforming the broader market. Amazon (-3.06%) and Microsoft (-2.35%) also posted substantial losses. The relative outperformers among the top ten were JPMorgan Chase (-1.28%) and Apple (-1.94%), though both still declined meaningfully. This pattern of relative performance suggests technology stocks are facing particular pressure in the current environment, while financial institutions like JPMorgan may be somewhat better positioned to navigate the uncertain policy landscape.

Looking at trend patterns, most of the largest companies show consistently negative trends across current, one-week, and one-month timeframes, mirroring the broader market deterioration. Notably, Berkshire Hathaway demonstrates a more resilient pattern with neutral current readings and positive trends visible in the one-month, one-quarter, and one-year views. This divergence likely reflects investor appreciation for Berkshire's significant cash reserves and diversified business model during uncertain market periods.

ECONOMIC INDICATORS

Economic measures have deteriorated sharply, with multiple indicators signaling increased caution about the economic outlook. Investment duration shows significant weakness across all timeframes, indicating a growing preference for shorter-term assets and suggesting concerns about long-term economic growth prospects. This severe deterioration in duration preferences often precedes broader economic challenges and suggests institutional investors are positioning defensively.

Corporate earnings measures have also weakened across recent timeframes, although the one-quarter view remains positive, reflecting the generally solid Q1 earnings season that preceded current market turbulence. Consumer strength has deteriorated significantly, with negative readings across current, one-week, and one-month perspectives. This rapid weakening of consumer metrics suggests growing concern about how tariffs and policy uncertainty might affect household confidence and spending patterns.

Inflation readings present a more mixed picture, with neutral current conditions suggesting price stability in the immediate term. Market inflationary expectations are increasing, which would be detrimental for consumers. This increase in inflationary pressures provides the Federal Reserve with less flexibility in its policy decisions, and contributes to market uncertainty about the future trajectory of monetary policy.

SECTOR OVERVIEW

Monday's trading session saw negative performance across all eleven S&P 500 sectors, though with meaningful divergence in the magnitude of declines. Consumer Staples demonstrated the greatest relative resilience with a decline of just -0.95%, significantly outperforming the broader market as investors shifted toward defensive positioning. Materials (-1.52%) and Real Estate (-2.02%) also showed relative strength, though both still posted substantial losses.

The worst performing sectors were Consumer Discretionary (-2.67%), Utilities (-2.37%), and Information Technology (-3.15%), reflecting particular concern about consumer spending, interest rate sensitivity, and growth expectations respectively. Energy (-2.61%) also underperformed significantly as oil prices declined amid growing concerns about global economic growth and potential trade disruptions.

Sector trends show broadly negative patterns across most sectors in current, one-week, and one-month timeframes. However, Utilities, Financials, and Consumer Staples demonstrate more constructive patterns in the longer-term views, with positive one-quarter trends visible in these traditionally defensive sectors. This divergence between short-term weakness and longer-term resilience in defensive sectors supports the narrative of investors repositioning toward safety while maintaining selective exposure to areas perceived as less vulnerable to current policy uncertainties.

INTERNATIONAL MARKETS

Global markets showed significant divergence on Monday, with select Asian and European markets demonstrating remarkable resilience against the backdrop of U.S. weakness. India stood out with a gain of +1.42%, while Singapore posted a more modest +0.60% advance. China closed marginally higher at +0.20%, largely disconnected from U.S. market dynamics. These positive performances in key Asian markets suggest international investors may be viewing non-U.S. equities as relatively insulated from current U.S. policy uncertainties.

European markets demonstrated a mixed performance, with the broader European Union index showing some resilience. The United Kingdom maintained a neutral stance while many continental European markets were closed for Easter Monday, limiting trading activity. In contrast, most of developed Asia faced pressure, with Japan declining -0.22% and South Korea falling -0.21%, though these losses were notably milder than those experienced in U.S. markets.

Emerging markets demonstrated particular divergence, with Latin America (-0.21%) and Emerging Europe (-0.26%) posting moderate declines while Emerging Asia (+0.60%) showed resilience. This pattern suggests investors are differentiating between emerging market regions based on their vulnerability to U.S. policy shifts and trade tensions, with Asian markets currently perceived as better positioned to navigate the uncertain global landscape.

OTHER ASSETS

The cross-asset landscape revealed a pronounced flight to traditional safe havens, with gold surging +3.09% to reach a record high of $3,433.80. This remarkable move in the yellow metal reflects growing investor anxiety about both geopolitical tensions and potential threats to central bank independence. Bitcoin also posted a strong gain of +3.03%, suggesting digital assets may be increasingly viewed as an alternative store of value during periods of dollar weakness and policy uncertainty.

Treasury prices moved broadly lower, with the 20+ year Treasury bonds declining -1.75% as yields rose across the curve. The 7-10 year segment fell -0.54%, while the 1-3 year Treasury index was nearly flat at -0.02%. This steepening yield curve likely reflects concerns about potential long-term inflation impacts from tariffs and questions about monetary policy independence rather than immediate economic growth fears.

The U.S. Dollar Index tumbled -0.98% to a three-year low, representing one of the most significant moves in currency markets in recent months and reflecting international concerns about U.S. policy direction. Crude oil declined -1.24% as economic growth concerns outweighed potential supply disruption risks. Agricultural commodities showed resilience with a modest -0.19% decline, while industrial metals fell -0.89%, reflecting mixed expectations about global demand and tariff impacts across different commodity categories.

In summary, today's market movements reflect a significant shift in investor sentiment driven by escalating tensions between the White House and Federal Reserve, compounded by lack of progress in trade negotiations. The flight to traditional safe havens like gold alongside weakness in equities and the dollar suggests growing concern about both economic growth prospects and the stability of traditional policy frameworks. While select international markets and defensive sectors have demonstrated relative resilience, the broadly negative trend patterns across most asset classes suggest continued caution is warranted until greater policy clarity emerges.