【Joe’s華爾街脈動】科技股領漲行情持續第三日 儘管中國釋放混合信號 但市場信心仍增長

輝煌七雄股推動主要指數走高 南韓貿易協議展現希望

Joe Lu, CFA 2025年4月24日 美東時間

市場概況

儘管貿易前景出現混合信號,科技股持續強勁反彈,週四為市場連續第三個交易日走高。標普500指數上漲+2.10%收於5,484.77點,科技股為主的納斯達克綜合指數大漲+2.81%,收於17,166.04點,兩指數均較本週稍早時候加速上漲。道瓊工業平均指數上漲+1.28%,收於40,093.40點,儘管受到IBM -6.60%下跌的拖累,仍重返自4月15日以來心理重要的40,000點關卡。

今日市場積極表現背後的緣由是關於美中貿易談判的矛盾消息。投資者最初延續本週稍早時候川普總統和財政部長貝森特傾向和解的言論帶來的樂觀情緒,但中國商務部發言人何亞東隔夜表示,目前與美國沒有進行雙邊貿易談判,並呼籲取消「單邊」關稅。儘管出現這一明顯挫折,市場仍保持上漲趨勢,表明投資者更加關注政府表達的談判意願,而非當前缺乏正式談判的事實。

在盤中交易後半段時,財政部長貝森特宣布,政府可能「最快下週」與南韓就貿易達成「諒解協議」,他指出:「南韓人來得早,他們帶來了最佳陣容,我們將看看他們是否會落實」。與美國主要貿易夥伴的潛在磋商進展似乎強化了投資者的信心,即使與中國的關係仍然充滿挑戰,美國政府的貿易策略仍能與其他國家取得積極成果。市場能夠克服負面消息並專注於潛在積極發展,顯示與近期拋售相比情緒出現顯著轉變,儘管許多分析師在沒有解決更廣泛貿易緊張局勢的具體進展之前,仍對目前反彈的可持續性持謹慎態度。

摘要:

- 標普500指數上漲+2.10%,納斯達克大漲+2.81%,科技股強勢推動市場連續第三日上揚

- 資訊科技類股領漲,漲幅達+3.76%,費城半導體指數大幅跳升+5.68%

- 儘管先前樂觀情緒,但中國否認正進行貿易談判;另一方面,財政部長貝森特宣布與南韓可能「最快下週」達成貿易協議

- 儘管貿易談判存在分歧,市場仍保持韌性,道瓊指數自4月中旬以來首次突破40,000點關卡

- 博通(+6.35%)和輝達(+3.62%)在頂級公司中漲幅最大,反映投資者對科技硬體信心重振

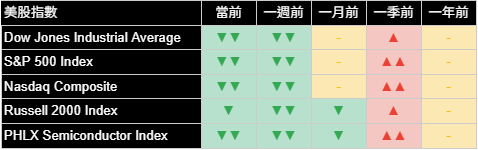

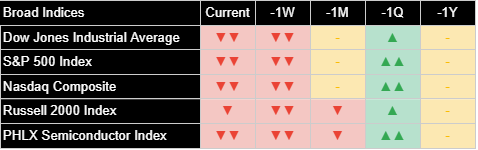

廣泛市場指數

主要指數全面強勁上漲,連續第三個交易日延續反彈走勢,明顯由科技和成長導向類股領漲。納斯達克綜合指數上漲+2.81%,繼續超越其他主要基準指數,反映科技和半導體股表現特別強勁。標普500指數上漲+2.10%,展示了大多數市場類股的廣泛參與,儘管各類股間表現差異明顯。羅素2000小型股指數上漲+2.00%,較近期交易日表現出改善的動能,暗示市場強度正在擴展。

費城半導體指數大漲+5.68%,作為近期貿易緊張局勢中波動最大的類股,繼續強勁復甦。這一顯著優於大盤的表現,反映了投資人對那些最易受關稅潛在干擾的供應鏈重拾信心,特別是隨著美國政府顯示尋求更加溫和的貿易談判方法的跡象。道瓊工業平均指數相對溫和的+1.28%漲幅部分,反映了IBM在令人失望的獲利後大幅下跌,顯示儘管大盤走勢積極,個別公司業績仍能顯著影響指數表現。

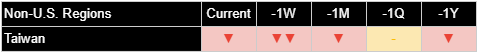

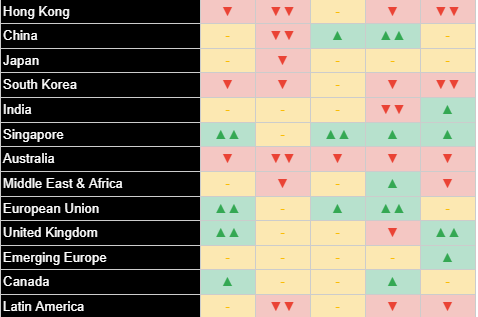

儘管近三天內的復甦令人印象深刻,所有主要指數的趨勢模式仍處於下跌趨勢,在當前和一週時間框架內均呈現負面讀數。然而,包括標普500指數和納斯達克在內的幾個主要指數,在一個月模式中顯示出早期穩定跡象,表明如果目前動能繼續,中期動態可能會改善。持續負面短期趨勢與改善的當前表現之間的差異,創造了有趣的技術背景,市場可能正接近一個重要的轉折點,這將決定近期反彈是僅代表技術性反彈,還是更實質性復甦的開始。

美國十大公司

週四美國大型股展現出令人印象深刻的強勁表現,輝煌七雄科技領導者延續復甦走勢。這一強勁表現表明儘管貿易不確定性持續,機構投資者對這些市場龍頭的成長前景越來越有信心。科技為重點的持股表現出特別強勢,強化了它們在市場更廣泛復甦動能中的核心角色。

博通領漲,出色上揚+6.35%,其後是輝達(+3.62%)和微軟(+3.45%),均顯著優於大盤。亞馬遜(+3.29%)和Meta平台(+2.48%)也大幅上漲,蘋果上漲+1.84%。半導體和雲端運算領導企業的集中優勢表明,投資者特別關注那些結合強勁結構性成長趨勢,和近期因貿易相關拋售壓力而出現超賣狀況的類股。隨著投資者重新評估關稅對其全球運營和電動車需求的影響,特斯拉再次穩定上漲+3.50%,延續復甦走勢。

儘管近期上漲,大多數大型公司在當前和一週時間框架內仍顯示負面趨勢,反映4月拋售期間造成的顯著技術性損害。然而,幾家領導者特別是在半導體和軟體類股顯示出積極的單日動能讀數,表明技術狀況正在改善,如果持續下去,最終可能轉化為更具建設性的趨勢模式。值得注意的是,波克夏海瑟威在市場波動中繼續展現相對穩定,其積極的一個月趨勢突顯了其多元化商業模式在政策不確定時期的價值。

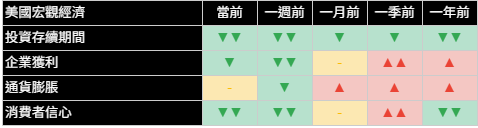

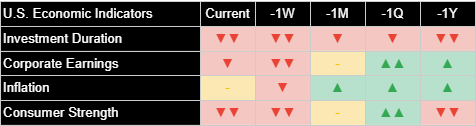

經濟指標

儘管近期市場強勁,經濟指標繼續呈現複雜局面,幾個關鍵指標在多個時間框架內仍顯示持續疲弱。投資存續期間在當前和長期角度中仍面臨挑戰,表明儘管市場近期復甦,對經濟成長前景仍保持謹慎。這種改善的價格表現與仍謹慎的期限偏好之間的脫節表明,投資者可能在選擇性擁抱風險資產的同時,仍對更廣泛的經濟軌跡保持擔憂。

公司獲利指標在近期惡化後的每週時間框架內顯示適度改善,可能反映了許多公司報告的普遍穩健第一季度業績,儘管存在貿易擔憂。這種相對健康的企業表現與更謹慎的經濟情緒之間的差異突顯了美國公司在當前不確定性中的韌性,儘管未來指引仍然謹慎,因為許多高管將貿易政策列為其前景中的關鍵變數。穩健的當前業績與謹慎的前瞻性指引互相結合,為試圖評估2025年剩餘時間可能的獲利軌跡的投資者創造了複雜的背景。

消費者信心在多個時間框架內繼續顯示令人擔憂的疲弱,顯示市場持續擔憂貿易動態和政策不確定性對家庭支出模式和信心的影響。考慮到消費力在美國經濟成長中扮演著關鍵的角色,消費者指標的疲弱對經濟前景構成重大風險,如果沒有更具實質性的政策明確性,可能會限制任何市場復甦的持久性。前瞻性指標表明,雖然商業投資可能因貿易的改善而更快復甦,但由於不確定性對家庭信心和財務規劃期限的累積影響,消費者支出可能會滯後。

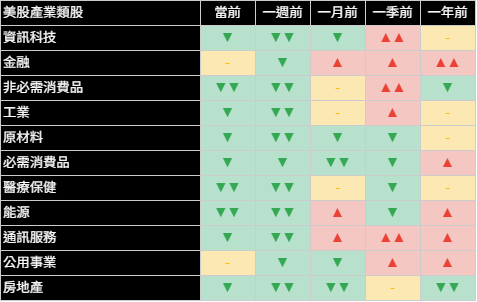

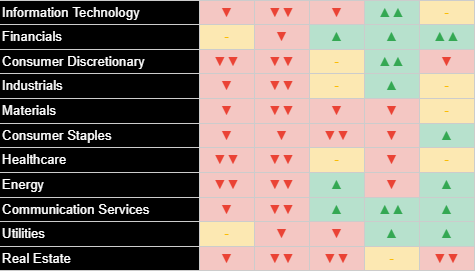

類股概況

週四交易中,標普500指數中大多數類股表現積極,顯示廣泛參與,但明顯由成長和科技導向類別領漲。資訊科技類股以令人印象深刻的+3.76%漲幅領先,隨著投資者重新評估潛在貿易影響對全球科技供應鏈的影響而繼續復甦。原物料(+2.16%)、工業(+2.24%)和非必需消費品(+1.99%)也強勁上漲,反映隨著對貿易戰的擔憂減緩,而重拾對經濟敏感類股的信心。

表現最弱的是必需消費品(-0.88%)和公用事業(+0.15%),這些最具防禦性的類股在強勁風險偏好環境下通常表現落後。這種從防禦性到週期性領導的轉換進一步證明風險偏好正在改善,並表明儘管貿易不確定性持續,投資者對經濟成長前景越來越有信心。金融類股上漲+1.11%,醫療保健上漲+1.22%,代表較為溫和的漲幅,因投資者在類股配置中保持一定謹慎。

儘管近期上漲,類股趨勢在當前和一週時間框架內仍普遍呈現負面,不過幾個類股在當前和每週動能讀數上顯示出潛在改善跡象。資訊科技、非必需消費品和原物料類股展現出特別鼓舞人心的短期動態,積極的當日讀數表明動能可能正在向更具建設性的方向轉變。如果得到貿易協商持續取得進展,這種仍然負面的趨勢與改善的短期動能之間的新興分歧可能暗示更可持續復甦的開始。

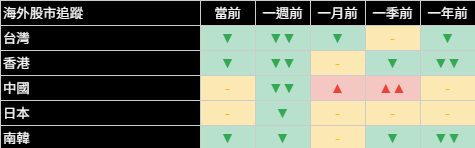

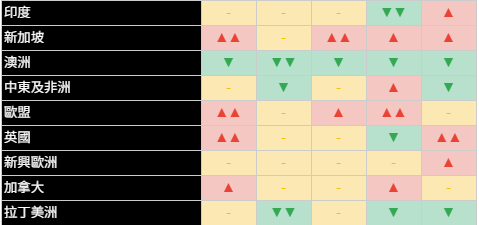

國際市場

週四全球市場表現參差不齊,區域差異突顯了不斷演變的貿易動態局勢的複雜影響。因投資者對美國貿易關係可能改善作出積極回應,歐洲市場展現溫和強勢,MSCI歐洲上漲+1.31%。而英國上漲+1.25%,展現類似樂觀情緒,儘管其對美中貿易緊張局勢的直接曝險較為有限。亞洲市場呈現更加多樣化的局面,日本上漲+1.15%,而中國溫和上漲+0.60%,反映出在中國政府聲明否認與美國正在進行貿易談判後的謹慎定位。

新興市場表現相對強勁,儘管中國消息訊號不一,但MSCI新興亞洲整體上漲+1.27%。拉丁美洲上漲+1.64%,印度上漲+1.05%,表明隨著全球貿易緊張局勢可能緩和的跡象,對成長導向市場的情緒正在改善。新加坡以+1.89%的漲幅表現突出,繼續受益於其作為跨國公司尋求減少中國曝險的貿易多元化努力的潛在受益者地位。

國際市場表現的差異突顯了當前貿易動態的細微影響,被視為潛在替代製造或採購目的地的國家展現相對優勢。儘管政府對貿易談判進展表示反對,中國市場仍小幅上漲,表明投資者儘管面對當前官方立場,仍對最終談判抱有希望。這種區域分散為有針對性的國際配置創造了潛在機會,隨著貿易局勢的發展,市場根據其對不斷變化的全球貿易格局中的風險和機會的曝險而定位不同。

其他資產

跨資產市場顯示風險規避情緒減緩,儘管股市強勁,傳統避險資產仍小幅上漲。黃金上漲+1.46%,繼續其上揚的軌跡,但與近幾週相比,速度更為溫和,表明儘管市場情緒改善,投資者仍在維持一些避險頭寸。比特幣基本持平,小幅上漲+0.11%,因加密貨幣市場評估不斷演變的貿易政策和潛在監管發展的影響,在近期波動後暫停。

美國國債價格全面小幅上漲,20年期以上國債上漲+1.05%,殖利率略微下降。7-10年期債券上漲+0.54%,1-3年期國債上漲+0.12%。儘管股市強勁反彈,這種固定收益市場的普遍積極表現表明投資者對長期成長前景仍持一定謹慎態度,即使他們在近期擁抱風險資產。殖利率曲線相對表現中可見的平坦偏好顯示出對成長可持續性的一些揮之不去的擔憂,如果沒有更具體的經濟改善,這可能會限制當前股市反彈的持久性。

美元指數溫和走強,因財政部長貝森特關於與南韓可能取得進展的言論提供支持,同時大多數商品類別小幅上漲。因貿易緊張緩和改善了全球需求前景工業,金屬上漲+1.48%,農產品上漲+1.04%。因更廣泛的經濟情緒改善,原油上漲+0.60%,從近期疲弱中溫和復甦。各種商品類別的這種同步但適度的強勢表明對全球成長前景的謹慎樂觀,而非科技股中可見的更為熱情的情緒。

總結來說,週四市場行動延續了本週的復甦反彈,科技領導推動主要指數連續第三日上漲,儘管美中貿易前景的訊號不一。財政部長貝森特宣布與南韓可能取得進展,此具有建設性的言論幫助抵消了中國否認正在進行談判的影響,表明政府的貿易策略可能至少與一些貿易夥伴取得成果。儘管面對矛盾消息,市場仍能夠保持積極動能,顯示與近幾週相比,投資者信心有所改善。不過大多數時間框架內仍然負面的趨勢模式表明,謹慎態度仍有必要。改善的短期動能與持續的中期挑戰之間的差異,突顯了當前復甦的條件性質,這可能需要更實質性的貿易進展和經濟改善才能在未來幾週維持其上升軌跡。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Tech-Led Rally Continues for Third Day as Market Confidence Grows Despite China's Mixed Signals

Magnificent Seven Stocks Drive Major Indices Higher While South Korea Trade Deal Shows Promise

Joe Lu, CFA April 24, 2025

MARKET OVERVIEW

Markets rallied for a third consecutive session on Thursday as technology stocks continued their impressive recovery despite mixed signals on the trade front. The S&P 500 advanced +2.10% to close at 5,484.77, while the tech-heavy Nasdaq Composite surged +2.81% to end at 17,166.04, with both indices accelerating their gains from earlier in the week. The Dow Jones Industrial Average gained +1.28% to finish at 40,093.40, reclaiming the psychologically important 40,000 level for the first time since April 15th despite being weighed down by IBM's -6.60% decline.

Today's positive market action came against a backdrop of contradictory headlines regarding U.S.-China trade negotiations. While investors initially built on optimism from President Trump's and Treasury Secretary Bessent's more conciliatory comments earlier in the week, China's Ministry of Commerce spokesperson He Yadong stated overnight that no bilateral trade talks were currently taking place with the United States and called for the removal of "unilateral" tariffs. Despite this apparent setback, markets maintained their upward trajectory, suggesting investors are focusing more on the administration's expressed willingness to negotiate rather than the current absence of formal talks.

Providing a more constructive narrative late in the session, Treasury Secretary Scott Bessent announced that the administration may reach "an agreement on understanding" with South Korea on trade "as soon as next week," noting that "South Koreans came early, they came with their A-game, and we will see if they follow through on that." This potential progress with a major U.S. trading partner appeared to reinforce investor confidence that the administration's trade strategy could yield positive results with other countries even as China relations remain challenging. The market's ability to overcome negative headlines and focus on potential positive developments demonstrates a significant shift in sentiment compared to the recent selloff, though many analysts remain cautious about the sustainability of the current rally without concrete progress in resolving broader trade tensions.

Executive Summary:

- S&P 500 advanced +2.10% and Nasdaq surged +2.81% as tech strength propelled markets to third consecutive day of gains

- Information Technology sector led the advance with impressive +3.76% gain while Philadelphia Semiconductor Index jumped +5.68%

- China denied ongoing trade negotiations despite earlier optimism, but Treasury Secretary Bessent announced potential South Korea trade agreement "as soon as next week"

- Market resilience continues despite conflicting trade narratives, with Dow Jones crossing 40,000 threshold for first time since mid-April

- Broadcom (+6.35%) and NVIDIA (+3.62%) posted strongest gains among top companies, reflecting renewed investor confidence in tech hardware

BROAD MARKET INDICES

Major indices posted solid gains across the board, extending their recovery rally to a third consecutive session with clear leadership from technology and growth-oriented segments. The Nasdaq Composite's +2.81% advance continued to outpace other major benchmarks, reflecting particularly strong performance in technology and semiconductor stocks. The S&P 500's +2.10% gain demonstrated broad participation across most market segments, though with meaningful performance dispersion between sectors. The Russell 2000 small-cap index rose +2.00%, showing improved momentum compared to recent sessions and suggesting broadening market strength.

The Philadelphia Semiconductor Index surged an impressive +5.68%, continuing its strong recovery as the most volatile segment during recent trade tensions. This dramatic outperformance reflects renewed investor confidence in supply chains most exposed to potential disruption from tariffs, particularly as the administration shows signs of seeking a more moderate approach to trade negotiations. The Dow Jones Industrial Average's relatively modest +1.28% gain partly reflected IBM's substantial decline following disappointing earnings, demonstrating how individual company results can still significantly impact index performance despite the broader positive trend.

Despite the impressive three-day recovery, trend patterns for all major indices remain in downtrends, with negative readings across current and one-week timeframes. However, several major indices including the S&P 500 and Nasdaq are showing early signs of stabilization in one-month patterns, suggesting potential improvement in medium-term dynamics if the current momentum continues. The divergence between persistent negative short-term trends and improving daily performance creates an interesting technical backdrop, with the market potentially approaching an important inflection point that could determine whether the recent rally represents merely a technical bounce or the beginning of a more substantial recovery.

TOP 10 U.S. COMPANIES

The largest U.S. companies demonstrated impressive strength on Thursday, with the Magnificent Seven technology leaders continuing their recovery rally. This robust performance suggests institutional investors are growing more confident about growth prospects for these market leaders despite ongoing trade uncertainties. The technology-focused holdings showed particular strength, reinforcing their central role in the market's broader recovery momentum.

Broadcom led the advance with an outstanding +6.35% gain, followed by NVIDIA (+3.62%) and Microsoft (+3.45%), all significantly outperforming the broader market. Amazon (+3.29%) and Meta Platforms (+2.48%) also posted substantial gains, while Apple rose +1.84%. The concentrated strength among semiconductor and cloud computing leaders suggests investors are particularly focused on segments that combine strong structural growth trends with recent oversold conditions from trade-related selling pressure. Tesla posted another solid gain of +3.50%, extending its recovery as investors reassess the impact of tariffs on its global operations and electric vehicle demand.

Most of the largest companies continue to show negative trends across current and one-week timeframes despite recent gains, reflecting the significant technical damage inflicted during the April selloff. However, several leaders are showing positive daily momentum readings, particularly in the semiconductor and software segments, suggesting improving technical conditions that could eventually translate into more constructive trend patterns if sustained. Notably, Berkshire Hathaway continues to demonstrate relative stability amid market volatility, with positive one-month trends highlighting the value of its diversified business model during periods of policy uncertainty.

ECONOMIC INDICATORS

Economic measures continue to present a mixed picture despite recent market strength, with several key indicators still showing persistent weakness across multiple timeframes. Investment duration remains challenged in both current and longer-term views, suggesting ongoing caution about economic growth prospects despite the market's recent recovery. This disconnect between improving price action and still-cautious duration preferences suggests investors may be selectively embracing risk assets while maintaining concerns about the broader economic trajectory.

Corporate earnings measures show modest improvement in the weekly timeframe after recent deterioration, potentially reflecting the generally solid first-quarter results reported by many companies despite trade concerns. This divergence between relatively healthy corporate performance and more cautious economic sentiment highlights the resilience of U.S. companies in navigating the current uncertainty, though future guidance remains cautious as many executives cite trade policy as a key variable in their outlook. The combination of solid current results and cautious forward guidance creates a complex backdrop for investors trying to assess the likely earnings trajectory through the remainder of 2025.

Consumer strength continues to show concerning weakness across multiple timeframes, indicating persistent worry about how trade dynamics and policy uncertainty might affect household spending patterns. This weakness in consumer measures presents a meaningful risk to the economic outlook given consumption's critical role in U.S. economic growth, potentially limiting the durability of any market recovery absent more substantial policy clarity. Forward-looking indicators suggest that while business investment may recover more quickly based on improved trade sentiment, consumer spending could lag due to the accumulated impact of uncertainty on household confidence and financial planning horizons.

SECTOR OVERVIEW

Thursday's trading saw positive performance across most S&P 500 segments, with broad-based participation but clear leadership from growth and technology-oriented categories. The Information Technology segment led advances with an impressive gain of +3.76%, continuing its recovery as investors reassessed potential trade impacts on global technology supply chains. Materials (+2.16%), Industrials (+2.24%), and Consumer Discretionary (+1.99%) also posted strong gains, reflecting renewed confidence in economically sensitive segments as trade concerns moderated.

The weakest performers were Consumer Staples (-0.88%) and Utilities (+0.15%), the most defensive segments that typically lag during strong risk-on sessions. This rotation from defensive to cyclical leadership provides further evidence of improving risk appetite and suggests investors are becoming more confident about economic growth prospects despite ongoing trade uncertainties. Financials gained +1.11% and Healthcare rose +1.22%, representing more moderate advances as investors maintained some caution in their sector allocations.

Sector trends remain generally negative across current and one-week timeframes despite recent gains, though several segments are showing signs of potential improvement in daily and weekly momentum readings. The Information Technology, Consumer Discretionary, and Materials segments are demonstrating particularly encouraging short-term dynamics, with positive daily readings suggesting momentum may be shifting in a more constructive direction. This emerging divergence between still-negative trends and improving short-term momentum could signal the beginning of more sustainable recovery if supported by continued progress on the trade front.

INTERNATIONAL MARKETS

Global markets demonstrated mixed performance on Thursday, with regional divergence highlighting the complex impact of evolving trade dynamics. European markets showed moderate strength, with MSCI Europe gaining +1.31% as investors responded positively to the possibility of improved U.S. trade relations. The United Kingdom advanced +1.25%, showing similar optimism despite its more limited direct exposure to U.S.-China trade tensions. Asian markets presented a more varied picture, with Japan gaining +1.15% while China rose a modest +0.60%, reflecting cautious positioning following the Chinese government's statement denying ongoing trade talks with the United States.

Emerging markets demonstrated relatively strong performance, with broad MSCI Emerging Asia gaining +1.27% despite the mixed China news. Latin America advanced +1.64% and India rose +1.05%, suggesting improving sentiment toward growth-oriented markets as global trade tensions showed signs of potential moderation. Singapore stood out with a +1.89% gain, continuing to benefit from its position as a potential beneficiary of trade diversification efforts by multinational companies seeking to reduce China exposure.

The varied performance across international markets highlights the nuanced impact of current trade dynamics, with countries perceived as potential alternative manufacturing or sourcing destinations showing relative strength. The modest gain in Chinese markets despite the government's pushback on trade talk progress suggests investors remain hopeful for eventual negotiations despite the current official stance. This regional dispersion creates potential opportunities for targeted international allocation as the trade situation evolves, with markets differently positioned based on their exposure to both risks and opportunities in the changing global trade landscape.

OTHER ASSETS

The cross-asset landscape showed a moderating risk-off tone as traditional safe havens posted modest gains despite the equity market strength. Gold advanced +1.46%, continuing its upward trajectory though at a more measured pace compared to recent weeks, suggesting investors are maintaining some hedges despite improved market sentiment. Bitcoin was essentially flat with a slight gain of +0.11%, pausing after its recent volatility as crypto markets assessed the implications of evolving trade policy and potential regulatory developments.

Treasury prices showed modest gains across the curve, with the 20+ year Treasury segment advancing +1.05% as yields declined slightly. The 7-10 year segment rose +0.54%, while the 1-3 year Treasury segment gained +0.12%. This generally positive performance across fixed income despite the strong equity rally suggests investors remain somewhat cautious about longer-term growth prospects even as they embrace risk assets in the near term. The flattening bias visible in relative performance across the curve indicates some lingering concerns about growth sustainability that could limit the duration of the current equity rally without more concrete economic improvement.

The U.S. Dollar Index strengthened moderately as Treasury Secretary Bessent's comments on potential progress with South Korea provided support, while most commodity categories posted modest gains. Industrial metals advanced +1.48% and agricultural commodities rose +1.04% as trade tension moderation improved the outlook for global demand. Crude oil gained +0.60%, recovering modestly from recent weakness as broader economic sentiment improved. This synchronized but measured strength across various commodity categories suggests cautious optimism about global growth prospects rather than the more enthusiastic sentiment visible in technology equities.

In summary, Thursday's market action extended the week's recovery rally, with technology leadership driving major indices to their third consecutive day of gains despite mixed signals on the U.S.-China trade front. Treasury Secretary Bessent's announcement of potential progress with South Korea provided a constructive narrative that helped offset China's denial of ongoing negotiations, suggesting the administration's trade strategy may be yielding results with at least some trading partners. The market's ability to maintain positive momentum despite contradictory headlines demonstrates improved investor confidence compared to recent weeks, though the still-negative trend patterns across most timeframes suggest caution remains warranted. The divergence between improving short-term momentum and persistent medium-term challenges highlights the conditional nature of the current recovery, which will likely require more substantive trade progress and economic improvement to sustain its upward trajectory over the coming weeks.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)