【Joe’s華爾街脈動】周報:技術指標顯示市場復甦強勁,但關稅政策不確定性仍存在

茲威格廣量衡力指標觸發罕見買入信號,投資者密切關注貿易談判

Joe Lu, CFA 2025年4月26日 美東時間

免責聲明:本通訊僅包含市場分析事實,僅供參考。本文件中的任何內容均不構成投資建議、推薦或招攬買賣任何證券。過去的表現並不代表未來的結果。投資者在做出任何投資決定前應諮詢合格的金融專業人士。

一周市場觀點

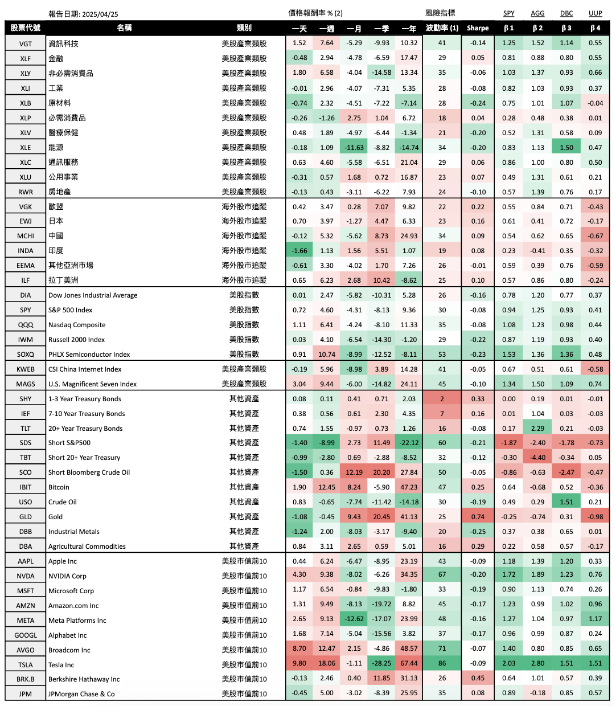

金融市場在過去一周表現出顯著的韌性,主要指數在過去三周內第二次周度上漲。這一復甦非常穩定,連續四天的上漲推動標普500指數在本周上漲+4.60%,而以科技為主的那斯達克指數飆升+6.41%。這一表現在4月2日關稅公告後的急劇調整後,代表著顯著的改善。

市場最顯著的技術發展是茲威格廣量衝力指標的觸發,這是一個相對罕見的現象,表明市場廣度從負面急遽轉向正面。這一技術模式自二戰以來僅被觸發19次,歷史上往往伴隨著接下來6-12個月的正面回報,為市場方向提供了潛在的建設性框架。

川普總統不斷變化的貿易政策聲明繼續製造大量不確定性。周二晚間的評論暫時緩解了市場壓力,明確表示他不會解僱美國聯準會主席鮑爾,並有意「大幅」降低對中國的關稅。然而,後續報導表明降幅可能比最初解讀的更為溫和,可能只將稅率降至50-60%區間——這對企業規劃和投資決策仍有高度限制。

由於企業需要確定價格結構,政策明確化的時機變得越來越重要。一天沒有解決方案,即可能通過減少商業投資及其乘數效應,潛在地放大了對經濟的影響。這種猶豫已經在航運數據中可見,預計5月初的預定船舶數量將較去年同期大幅下降。

儘管美中貿易發展存在相互矛盾的說法,市場仍能夠上漲,表明在政策面若有更具體的進展,市場可能更進一步復甦。然而,多個時間框架內持續的技術警告信號仍需謹慎對待。短期動能改善與具挑戰性的趨勢指標之間的張力,強化了保持防禦元素的審慎性,同時保持參與的準備,以應對條件可能持續穩定。

一周市場摘要

- 主要指數本周均大幅上漲,標普500指數上漲+4.60%,那斯達克指數飆升+6.41%,科技股引領市場廣泛反彈

- 周四觸發了一個被稱為茲威格廣量衝力的罕見技術信號,這一模式歷史上往往預示未來6-12個月的正面回報

- 川普總統關於中國關稅的言論仍不穩定,有報導顯示關稅可能將降至50-60%區間,但這仍代表著高度限制性的貿易環境

- 國債展現積極技術模式,儘管存在潛在的波動性擔憂,長期國債本周上漲+1.55%

- 本周將公布多項關鍵經濟數據,包括第一季度GDP、PCE通膨、ISM製造業PMI和4月就業報告,同時多家科技巨頭即將發布財報

關注名單亮點

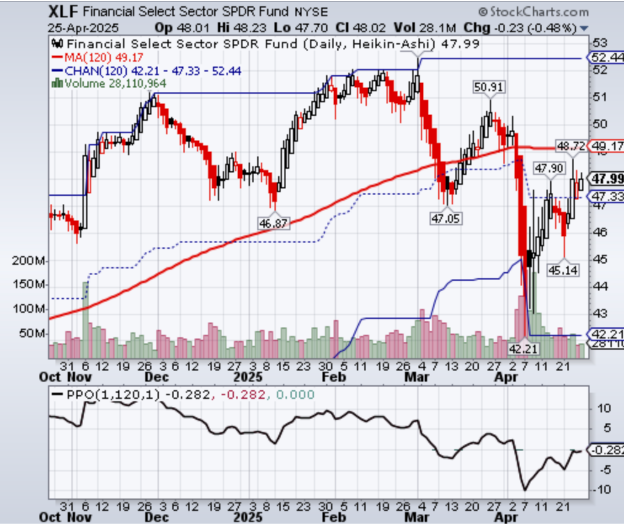

金融業

- 儘管對經濟增長前景持續擔憂,本周仍小幅上漲+2.94%

- 技術模式顯示貨幣中心銀行和資本市場領域的新興強度

- 相比高貝塔值的科技和非必需消費品類股展現相對穩定性

- 當周動能顯示有意義的改善,同時保持防禦性定位特徵

通訊服務

- 本周上漲+4.60%,與大盤持平,因投資者尋求防禦性增長特徵

- 技術模式在具有經常性收入模式的媒體和娛樂類股中,顯示出特別的強度

- 與科技股相比,波動性較低,同時保持成長曝險

- 多元化商業模式提供對特定貿易干擾的抵抗力

- 技術結構支持在市場導航不確定政策環境時繼續納入

公用事業

- 儘管大盤明顯傾向於成長,本周仍小幅上漲+0.57%

- 技術模式在波動市場環境中展示防禦性質

- 穩定的商業模式和可靠的現金流在政策不確定中提供穩定性

- 通膨保護特性為潛在關稅對消費者價格的影響提供緩衝

- 與大盤較低的相關性支持整體投資組合多元化

歐洲股市

- 技術模式顯示令人印象深刻的單周+3.47%漲幅,反映較少直接暴露於美中貿易緊張局勢

- 在多個時間框架內展示相對於美國市場的相對強度

- 因為全球資本尋求與美國政策風險的多元化,當前讀數反映出有利的定位

- 當周動能信號在多個地區顯示積極的技術特徵

- 貨幣政策分歧為持續表現創造支持性背景

日本股市

- 技術模式顯示令人印象深刻的單周+3.97%漲幅,儘管對美貿易談判方面進展有限

- 相比其他國際市場,在全球不確定性中展示相對韌性

- 當前讀數反映出在公司多元化製造的全球供應鏈中的有利定位

- 當周動能信號顯示與仍具挑戰性的長期趨勢的積極分歧

- 日元疲弱為出口導向公司提供潛在助力

中國股市

- 儘管持續否認與美國進行積極貿易談判,本周仍取得些微+5.32%漲幅

- 技術模式顯示相對強度,儘管直接暴露於關稅實施風險

- 市場定位反映出儘管近期不確定性,最終貿易解決的潛在可能性

- 當周動能顯示改善,同時對政策發展保持謹慎

- 技術結構暗示選擇性強度而非廣泛的復甦

印度股市

- 儘管更廣泛的新興市場表現出韌性,本周仍下跌-1.66%

- 技術模式繼續展示相比其他新興經濟體較低的波動性

- 有限的直接暴露於美中貿易緊張局勢提供相對隔離

- 國內成長特性提供美國對全球貿易干擾的潛在緩衝

- 在新興市場配置中保持重要的多元化收益

拉丁美洲股市

- 由於商品驅動的經濟體表現強勁,本周出現令人印象深刻+6.23%的漲幅

- 技術型態顯示與風險偏好改善具相關性,同時保持區域多元化

- 農業和能源曝險提供通膨避險特性

- 當周動能在多個時間框架內顯示顯著改善

- 技術結構支持繼續納入區域多元化優勢

短期國債

- 在更廣泛的市場波動中顯示穩定性,本周變化最小,為+0.11%

- 技術模式在不確定時期展示防禦特性

- 隨著殖利率曲線動態變化,較低的存續期特性可降低利率敏感度

- 在政策不確定的情況下,流動性特徵提供重要的投資組合保護

- 目前讀數表明,在市場轉型期間,持續價值可作為防禦性支撐

中期國債

- 隨著投資者評估貿易政策對通膨和成長的影響,本周小幅上漲+0.56%

- 在先前對外國賣壓擔憂後,技術模式出現改善

- 平衡的存續期結構提供殖利率與利率敏感性之間的折衷

- 儘管政策不確定性持續,一周動能顯示穩定性

比特幣

- 本周大幅上漲+12.45%,顯著優於傳統資產,展示出卓越的技術強度

- 在多個時間框架內顯示明確的正面動能,延續先前確認的強度

- 單周模式顯示,越來越多機構採用比特幣作為通膨避險工具和替代價值儲存的手段

- 與傳統資產類別保持低相關性,在當前環境中提供多元化收益

- 技術結構表明如果全球貨幣波動性持續,強度可能繼續

黃金

- 儘管繼續展現避險特性,本周小幅下跌-0.45%

- 技術模式在近期鞏固期後仍保持建設性,延續近期的強勁表現

- 保持作為投資組合多元化和潛在通膨避險的重要角色

- 單周動能在延長的上漲後趨於緩和,但長期趨勢仍然正面

- 當前結構表明,如果政策不確定性加劇,可能恢復強勁表現

農業商品

- 隨著市場評估貿易政策對全球供應鏈的潛在影響,本周漲幅達+3.11%,表現穩健

- 技術模式在更廣泛的市場波動中顯示韌性

- 直接暴露於關稅實施的風險,提供通膨避險特性

- 單周動能在多個時間框架內顯示改善

波克夏·海瑟威

- 在持續的市場波動中展現出卓越的技術韌性,本周上漲+2.46%

- 當前模式突顯了多元化商業模式和大量現金儲備在不確定時期的價值

- 在多個時間框架內顯示積極動能,延續先前確認的強度

- 保持防禦特性,同時通過經營業務提供對經濟復甦的曝險

- 技術結構表明如果市場波動性持續,可能繼續表現優越

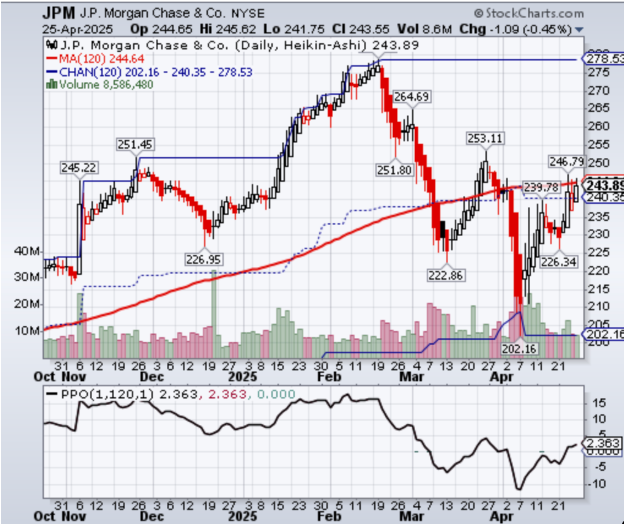

摩根大通

- 隨著金融業氣氛改善的情況下,本周上漲+5.00%

- 技術模式顯示,與區域銀行同行相比的相對強勢

- 多元化商業模式在不斷變化的利率預期中提供穩定性

- 單周動能顯示改善,同時保持金融業曝險

- 技術結構支持繼續納入作為更廣泛金融系統韌性的代表

關注名單調整

本周的關注名單與上周保持一致,反映先前確認模式的持續相關性。雖然幾個領域已經展示出有意義的技術改善,但使它們值得納入的基本特徵仍然存在。儘管貿易局勢不斷變化和短期波動性不斷演變,但我們關注領域的一致性突顯了關鍵市場主題的持續性。

當市場進入當前過渡階段之際,防禦性定位與成長風險之間的平衡繼續提供適當的框架。金融、通訊服務和公用事業提供基本穩定性,而全球市場的區域多元化提供對美國特定政策風險的保護。固定收益和替代資產組成部分以各種防禦特性完成這種平衡方法。

由於國債及股票市場技術性改善,我們已將避險從重點清單中移除。隨著市場評估潛在政策對不同資產類別和區域的影響,單周技術證據繼續支持這種多元化方法。

一周展望

未來一周市場將迎來許多重大事件,可能顯著影響當前技術模式。最值得注意的是,投資者將密切關注美中貿易爭端的發展,特別關注關稅政策的潛在明確化。由於企業需要確定性進行規劃和投資決策,任何朝向政策穩定的具體進展可能為市場提供顯著支持。

第一季度2025年GDP的首次預估將引起實質性關注,當前預測表明經濟成長顯著放緩,一些分析師甚至預測可能出現衰退。這一數據點將為評估經濟軌跡提供關鍵背景,以應對潛在的關稅影響,這些影響通常會在隨後的季度中反映出來。

全球財報季進入關鍵階段,包括蘋果、微軟、亞馬遜和Meta在內的科技巨頭即將公佈財報。這些結果將提供寶貴見解,說明主要公司如何應對當前政策不確定性並潛在的供應鏈調整計劃。管理層有關關稅影響和策略反應的評論將對整體市場局勢尤其重要。

額外的經濟發布包括PCE通膨數據、ISM製造業PMI和4月就業報告,將幫助投資人了解經濟狀況的全貌。鑒於關稅政策可能對價格產生影響,通膨指標尤為重要。而製造業和就業數據將幫助衡量近期政策不確定性是否已開始影響更廣泛的經濟活動。

貿易政策發展、企業獲利和經濟數據的這種組合創造了一個特別重要的環境,用於評估近期技術改善是否代表持續動能還是僅僅是暫時反彈。我們關注名單中的防禦元素在這一評估期間提供重要穩定性,同時保持對顯示技術強度領域的曝險。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Technical Signals Show Market Recovery Strength Amid Tariff Policy Uncertainty

Zweig Breadth Thrust indicator triggers rare buy signal as investors monitor trade negotiations

Joe Lu, CFA April 26, 2025

Disclaimer: This newsletter contains factual market analysis and is for informational purposes only. Nothing in this document constitutes investment advice, recommendation or solicitation to buy or sell any securities. Past performance is not indicative of future results. Investors should consult with qualified financial professionals before making any investment decisions.

Market Perspective

Financial markets demonstrated remarkable resilience over the past week as major indices recorded their second positive week out of the last three. The recovery was impressively consistent, with four consecutive days of gains pushing the S&P 500 Index up +4.60% for the week while the technology-heavy Nasdaq Composite surged +6.41%. This performance represents a significant improvement following the sharp correction that began after tariff announcements on April 2nd.

The market's most notable technical development was the triggering of a Zweig Breadth Thrust indicator, a relatively rare occurrence that signals an abrupt shift from negative to positive market breadth. This technical pattern has been triggered only 19 times since World War II and has historically been followed by positive returns over subsequent 6-12 month periods, providing a potentially constructive framework for market direction.

President Trump's evolving statements on trade policy continue to create substantial uncertainty. His Tuesday evening comments provided temporary market relief with clarification that he won't fire Fed Chair Powell and intentions to reduce China tariffs "substantially." However, subsequent reports suggest the reductions might be more modest than initially interpreted, potentially only reducing rates to the 50-60% range - still highly restrictive for business planning and investment decisions.

The timing of policy clarification is increasingly important as businesses require certainty about pricing structures. Every day without resolution potentially amplifies the economic impact through reduced business investment and its multiplier effects. This hesitation is already visible in shipping data, with scheduled vessels for early May expected to decline significantly year-over-year.

The market's ability to advance despite this conflicting narrative suggests potential for further recovery if concrete progress emerges. However, the persistent technical warning signs across longer-term timeframes warrant continued caution. This tension between improving short-term momentum and challenging trend indicators reinforces the prudence of maintaining defensive elements while remaining positioned to participate should conditions continue to stabilize.

Executive Summary

- Major indices recorded substantial weekly gains with S&P 500 advancing +4.60% and Nasdaq surging +6.41% as tech stocks led broad market recovery

- A rare technical signal known as the Zweig Breadth Thrust triggered on Thursday, a pattern that has historically preceded positive returns over the following 6-12 months

- President Trump's statements on China tariffs remain fluid, with reports suggesting potential reductions to the 50-60% range still representing a highly restrictive trade environment

- Treasury bonds demonstrated positive technical patterns with long-term Treasuries gaining +1.55% for the week despite underlying volatility concerns

- Upcoming week features critical economic data including Q1 GDP, PCE inflation, ISM Manufacturing PMI, and April jobs report, alongside major tech earnings

Focus List Highlights

Financial Sector

- Recorded moderate +2.94% weekly gain despite ongoing concerns about economic growth outlook

- Technical pattern shows emerging strength in money center banks and capital markets segments

- Demonstrated relative stability compared to higher-beta technology and consumer discretionary sectors

- Weekly momentum shows meaningful improvement while maintaining defensive positioning characteristics

Communication Services

- Gained +4.60% for the week, matching the broader market as investors sought defensive growth characteristics

- Technical patterns show particular strength in media and entertainment segments with recurring revenue models

- Lower volatility profile compared to technology sector while maintaining growth exposure

- Diversified business models providing resilience against trade-specific disruptions

- Technical structure supports continued inclusion as market navigates uncertain policy landscape

Utilities

- Recorded modest +0.57% gain for the week despite broader market's pronounced tilt toward growth

- Technical patterns demonstrate defensive nature in volatile market environment

- Steady business models and reliable cash flows providing stability amid policy uncertainty

- Inflation-protected characteristics offering buffer against potential tariff impacts on consumer prices

- Lower correlation with broader market supporting overall portfolio diversification

European Equities

- Technical patterns show impressive +3.47% weekly gain reflecting less direct exposure to U.S.-China trade tensions

- Demonstrated relative strength compared to U.S. markets across multiple timeframes

- Current readings reflect advantageous positioning as global capital seeks diversification from U.S. policy risk

- Weekly momentum signals show positive technical characteristics across multiple regions

- Monetary policy divergence creating supportive backdrop for continued performance

Japanese Equities

- Technical patterns show impressive +3.97% weekly gain despite limited progress in U.S.-China trade negotiations

- Demonstrates relative resilience compared to other international markets amid global uncertainties

- Current readings reflect advantageous positioning in global supply chains as companies diversify manufacturing

- Weekly momentum signals show positive divergence from still-challenging longer-term trends

- Yen weakness provides potential tailwind for export-oriented companies

Chinese Equities

- Recorded moderate +5.32% weekly gain despite continued denials of active trade negotiations with U.S.

- Technical patterns show relative strength despite direct exposure to tariff implementation risks

- Market positioning reflects potential for eventual trade resolution despite near-term uncertainties

- Weekly momentum showing improvement while maintaining caution regarding policy developments

- Technical structure suggests selective strength rather than broad-based recovery

Indian Equities

- Declined -1.66% for the week despite broader emerging market resilience

- Technical patterns continue to demonstrate lower volatility compared to other emerging economies

- Limited direct exposure to U.S.-China trade tensions providing relative insulation

- Domestic growth characteristics offering potential buffer against global trade disruption

- Maintains important diversification benefits within emerging market allocation

Latin American Equities

- Posted impressive +6.23% weekly gain as commodity-driven economies showed strength

- Technical patterns demonstrate correlation with improving risk appetite while maintaining regional diversification

- Agricultural and energy exposures providing inflation hedge characteristics

- Weekly momentum showing significant improvement across multiple timeframes

- Technical structure supports continued inclusion for regional diversification benefits

Short-Term Treasury Bonds

- Showed stability with minimal +0.11% weekly change amid broader market volatility

- Technical patterns demonstrate defensive characteristics during periods of uncertainty

- Lower duration profile providing reduced interest rate sensitivity as yield curve dynamics evolve

- Liquidity characteristics offering important portfolio protection amid policy uncertainty

- Current readings suggest continued value as defensive anchor during market transitions

Intermediate Treasury Bonds

- Recorded modest +0.56% weekly gain as investors assessed inflation and growth implications of trade policies

- Technical patterns show improvement following previous concerns about foreign selling pressure

- Balanced duration profile offering compromise between yield and interest rate sensitivity

- Weekly momentum showing stability despite continued policy uncertainty

Bitcoin

- Demonstrated exceptional technical strength with +12.45% weekly advance, significantly outperforming traditional assets

- Shows clear positive momentum across multiple timeframes, extending previously identified strength

- Weekly pattern reveals growing institutional adoption as both inflation hedge and alternative store of value

- Maintains low correlation with traditional asset classes, providing diversification benefits in current environment

- Technical structure suggests potential continuation of strength if global currency volatility persists

Gold

- Recorded -0.45% weekly decline despite continued safe-haven characteristics

- Technical patterns remain constructive despite near-term consolidation following recent strength

- Maintains important role as portfolio diversifier and potential inflation hedge

- Weekly momentum moderating following extended advance but longer-term trends remain positive

- Current structure suggests potential for renewed strength if policy uncertainty intensifies

Agricultural Commodities

- Posted solid +3.11% weekly gain as markets assessed potential trade policy impacts on global supply chains

- Technical patterns show resilience amid broader market volatility

- Direct exposure to tariff implementation providing inflation hedge characteristics

- Weekly momentum showing improvement across multiple timeframes

Berkshire Hathaway

- Demonstrated exceptional technical resilience with +2.46% weekly gain amid continued market volatility

- Current pattern highlights the value of diversified business model and substantial cash reserves during uncertain periods

- Shows positive momentum across multiple timeframes, extending previously identified strength

- Maintains defensive characteristics while providing exposure to economic recovery through operating businesses

- Technical structure suggests continued outperformance if market volatility persists

JPMorgan Chase

- Posted moderate +5.00% weekly gain amid improving financial sector sentiment

- Technical patterns demonstrate relative strength compared to regional banking peers

- Diversified business model providing stability amid evolving interest rate expectations

- Weekly momentum showing improvement while maintaining financial sector exposure

- Technical structure supports continued inclusion as proxy for broader financial system resilience

Focus List Adjustments

This week's focus list remains consistent with last week's selections, reflecting the continued relevance of previously identified patterns. While several areas have demonstrated meaningful technical improvement, the underlying characteristics that merited their inclusion remain intact. The consistency in our focus areas highlights the persistence of key market themes despite evolving trade narratives and short-term volatility.

The balance between defensive positioning and growth exposure continues to provide an appropriate framework as markets navigate the current transition phase. Financial, Communication Services, and Utilities sectors provide essential stability, while regional diversification across global markets offers protection against U.S.-specific policy risks. The fixed income and alternative asset components complete this balanced approach with varying protective characteristics.

As treasury and equity market technical improve, we have removed the hedges from the focused list. The weekly technical evidence continues to support this diversified approach as markets assess potential policy impacts across different asset classes and regions.

Looking Ahead

The coming week features a particularly crowded calendar of market-moving events that could significantly impact current technical patterns. Most notably, investors will closely monitor developments in the ongoing U.S.-China trade dispute, with particular focus on potential clarification of tariff policies. As businesses require certainty for planning and investment decisions, any concrete progress toward policy stabilization would likely provide significant market support.

The first estimate of Q1 2025 GDP will command substantial attention, with current forecasts suggesting a significant slowdown and some analysts even projecting possible contraction. This data point will provide crucial context for assessing the economic trajectory ahead of potential tariff impacts, which would typically be reflected in subsequent quarters.

Global earnings season enters a critical phase with technology giants including Apple, Microsoft, Amazon, and Meta scheduled to report. These results will provide valuable insights into how major corporations are navigating the current policy uncertainty and planning for potential supply chain adjustments. Management commentary regarding tariff impacts and strategic responses will be particularly significant for overall market sentiment.

Additional economic releases including PCE inflation data, ISM Manufacturing PMI, and the April jobs report will complete a comprehensive view of the economic landscape. The inflation metrics will be especially relevant given the potential price impacts of tariff policies, while manufacturing and employment data will help gauge whether recent policy uncertainty has begun to impact broader economic activity.

This combination of trade policy developments, corporate earnings, and economic data creates a particularly consequential environment for assessing whether the recent technical improvements represent sustained momentum or merely a temporary bounce. The defensive elements within our focus list provide important stability during this assessment period while maintaining exposure to areas showing technical strength.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)