【Joe’s華爾街脈動】隨著貿易談判推進,市場轉折點正在形成

市場在經濟訊號改善中趨於穩定;科技股財報成為關鍵方向

Joe Lu, CFA 2025年4月26日 美東時間

市場概況

週一市場保持謹慎,華爾街在持續的貿易緊張局勢以及關鍵的財報和經濟數據週中,試圖實現脆弱的復甦。儘管擔憂關稅可能對經濟造成影響,但數個基本指標顯示,市場在經歷了 4 月份的大幅修正後,可能正在站穩立足點。

標普 500 指數微幅上漲 +0.04%,連續五個交易日收高。道瓊工業平均指數表現較佳,上漲 +0.31%,而納斯達克綜合指數則下滑 -0.03%。羅素 2000 小型股指數展現相對強勢,上漲 +0.42%,因專注於國內業務的公司在貿易不確定性中顯示出韌性。值得注意的是,費城半導體指數 (SOX) 下跌 -0.21%,反映出對全球供應鏈中斷的持續擔憂。

今日謹慎的交易發生之際,投資者正在消化財政部長貝森特 (Scott Bessent) 的評論。財政部長表示,儘管與中國的緊張關係持續,美國在多個貿易方面都取得了進展。貝森特暗示,與印度的貿易協議可能是「最先實現的協議之一」,同時也強調,鑑於兩國之間的貿易不平衡,「需要由中國來降溫」。市場參與者似乎越來越相信,最嚴峻的關稅情境可能得以避免,這有助於近期股價的穩定,儘管對企業獲利指引的擔憂依然存在。

執行摘要

- 隨著投資者為本週的科技股財報做準備,市場收盤漲跌互見,標普 500 指數小幅上漲 +0.04%。

- 在持續的市場不確定性中,公用事業和醫療保健類股顯示出韌性。

- 儘管市場持續疲弱,經濟指標已顯示初步改善的跡象。

- 貿易談判似乎正在推進,美國財政部長暗示在多方面取得進展。

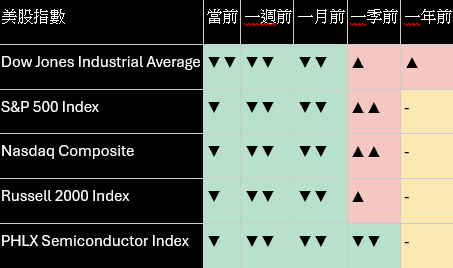

主要(廣泛)市場指數

今日主要指數表現略有分歧,道瓊工業平均指數領漲,漲幅為 +0.31%。標普 500 指數勉強維持在正值區域,上漲 +0.04%,而納斯達克綜合指數則受到部分科技股在財報公佈前走弱的壓力,則下滑 -0.03%。

羅素 2000 小型股指數展現出令人鼓舞的強勢,上漲 +0.42%,因投資者轉向受國際貿易緊張局勢影響較小的國內業務。與此同時,費城半導體指數下跌 -0.21%,因晶片製造商在全球供應鏈和出口管制方面面臨持續的不確定性,延續了其波動加劇的模式。

儘管多個時間週期內市場持續疲弱,但短期市場動能似乎正在改善。近期價格走勢與長期負面趨勢之間形成的這種分歧表明,我們可能正在接近一個重要的轉折點,儘管主要指數仍遠低於近期高點,但市場內部結構已開始走強。

美國(市值)前十大公司

今日美國大型公司漲跌互見,表現遜於大盤,因投資者在關鍵的財報週前減持倉位。將在本週公佈財報的「輝煌七雄」科技股中,有四家在交易時段內承受賣壓,但 Meta Platforms 和蘋果收盤時微幅上漲。

在今日表現最佳的公司中,蘋果上漲 +0.41%,Meta Platforms 上漲 +0.45%,儘管存在財報公佈前的緊張情緒,仍顯示出韌性。波克夏·海瑟威持平,+0.00%,特斯拉上漲 +0.33%。下跌方面,輝達是今日大型股中表現最差的,下跌 -2.05%,其次是 Alphabet 下跌 -0.83%,亞馬遜下跌 -0.68%。

大型科技股的短期動能前景依然令人擔憂,儘管部分公司的每週和每月趨勢近期有所改善,但大多數股票仍呈現負面表現特徵。這種矛盾的訊號模式表明,隨著市場消化即將公佈的財報和可能涉及關稅影響的前瞻性指引,未來可能出現波動。

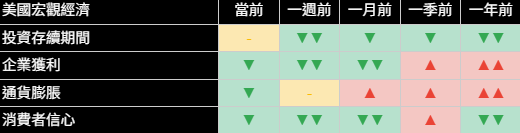

經濟指標

儘管市場持續擔憂,經濟狀況已顯示出初步穩定的跡象。投資存續期間在所有時間週期內均顯著改善,表明儘管近期市場承壓,但金融狀況可能正變得更有利於長期經濟成長。

企業獲利能力指標仍然好壞參半,短期改善與季度數據的持續疲弱形成對比。這種分歧突顯了關稅對企業獲利的不確定影響,公司在不斷變化的貿易談判中調整方針策略。尤其令人擔憂的是消費者信心讀數持續疲弱,表明家庭支出在當前環境下可能較為脆弱。

展望未來,投資存續期間的改善為經濟前景提供了最有希望的發展。這個衡量貨幣狀況和風險偏好的早期指標通常領先於更廣泛的經濟改善,並可能預示著市場參與者開始將目光投向當前不確定性之外,期待貿易緊張局勢最終得到解決。

類股概況

今日類股表現反映出防禦性傾向,資金持續轉動至傳統的避險類股。公用事業 (+0.61%)、醫療保健 (+0.40%) 和房地產 (+0.69%) 均優於大盤,突顯出儘管近期市場趨於穩定,投資者仍保持謹慎。

能源股成為今日表現最佳的類股,上漲 +0.70%,受益於近期持續疲軟後的技術性反彈。金融類股也表現強勁,上漲 +0.31%。下跌方面,科技類股下跌 -0.19%,受到關鍵財報公佈前的謹慎情緒拖累,而必需消費品類股下跌 -0.33%,扭轉了近期的防禦性倉位。

產業趨勢圖繼續顯示防禦性領域和週期性領域之間存在顯著分歧。公用事業、通訊服務和必需消費品相對於材料、工業和能源等週期性領域,表現出相對更強的特徵。然而,近期部分週期性領域的動能改善表明,隨著關稅貿易明朗化,這種防禦性佈局可能開始轉變。

國際市場

今日全球市場呈現顯著的區域分歧,已開發國際市場普遍優於美國指數。日本領漲主要區域,上漲 +1.37%,而歐洲市場上漲 +0.65%,因投資者評估貿易談判取得進展的可能性。

已開發市場表現尤為強勁,日本在多個時間週期內均顯示出改善的表現特徵。印度今日也出現 +0.83% 的強勁漲幅。新興亞洲市場微幅上漲 +0.12%,而中國股市因與美國的貿易談判持續存在不確定性,則下跌 -0.12%。

區域動能圖顯示,歐洲市場、日本以及包括新加坡和加拿大在內的部分發展中地區正形成明顯的強勢。這些地區呈現出改善的表現趨勢,與美國指數的持續疲弱形成對比,表明如果全球貿易緊張局勢緩和,國際市場可能處於更有利的位置。美國和國際市場之間日益擴大的表現差異值得密切關注,因為這可能是更廣泛市場走向的潛在領先指標。

其他資產

跨資產市場表現反映出不確定性加劇以及為應對不斷變化的貿易動態而持續進行的重新佈局。儘管近期股市趨於穩定,投資者仍在尋求避險,美國國債價格在整個收益率曲線上漲,20 年期以上國債上漲 +0.63%。

在固定收益方面,各期限美國國債價格均上漲,長期限債券表現尤佳。7-10 年期國債上漲 +0.40%,而較短期的 1-3 年期國債漲幅較小,為 +0.14%。這些價格上漲對應著收益率下降,反映出儘管近期股市反彈,對避險資產的需求依然持續。

大宗商品方面,黃金飆升 +1.42%,延續了近期的強勁表現。因對全球需求的擔憂再起,原油則大幅下跌 -1.84%。比特幣下跌 -0.72%,在更廣泛的市場不確定性中持續波動。農產品下跌 -0.69%,工業金屬微幅下跌 -0.05%。

各類資產的走勢表明,儘管市場出現初步穩定的跡象,投資者仍保持防禦姿態。國債價格的持續走強以及黃金的上漲突顯了對避險資產的持續需求,表明儘管部分前瞻性指標近期有所改善,市場參與者對經濟前景仍持謹慎態度。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

MARKET INFLECTION POINT FORMING AS TRADE NEGOTIATIONS ADVANCE

Markets stabilize amid improving economic signals; tech earnings critical for direction

Joe Lu, CFA April 28, 2025

MARKET OVERVIEW

Markets remained cautious Monday as Wall Street navigated a fragile recovery amid ongoing trade tensions and a pivotal week of earnings and economic data. Despite concerns about potential economic impact from tariffs, several underlying indicators suggest markets may be finding their footing after the sharp April correction.

The S&P 500 managed a minimal gain of +0.04%, extending its winning streak to five consecutive sessions. The Dow Jones Industrial Average outperformed with a +0.31% advance, while the Nasdaq Composite slipped -0.03%. The Russell 2000 small-cap index demonstrated relative strength, rising +0.42% as domestic-focused companies showed resilience amid trade uncertainties. Notably, the Philadelphia Semiconductor Index (SOX) declined -0.21%, reflecting continued concerns about global supply chain disruptions.

Today's cautious trading came as investors digested comments from Treasury Secretary Scott Bessent, who indicated the U.S. was making progress on multiple trade fronts despite continued tensions with China. Bessent suggested that a trade deal with India could be "one of the first" to materialize, while also emphasizing that "it's up to China to de-escalate" given the trade imbalance between the two nations. Market participants appear to be increasingly confident that the most severe tariff scenarios may be avoided, contributing to the recent stabilization in equity prices despite lingering concerns about corporate earnings guidance.

EXECUTIVE SUMMARY

- Markets ended mixed with the S&P 500 eking out a +0.04% gain as investors prepare for tech earnings this week

- Utility and healthcare sectors showed resilience amid ongoing market uncertainty

- Economic indicators are showing early signs of improvement despite persistent market weakness

- Trade negotiations appear to be advancing with Treasury Secretary suggesting progress on multiple fronts

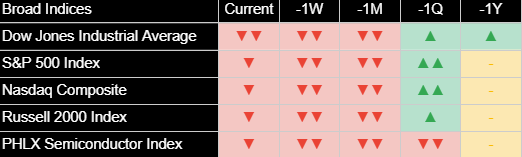

BROAD MARKET INDICES

Major indices demonstrated modest divergence today, with the Dow Jones Industrial Average leading the advance at +0.31%. The S&P 500 barely held positive territory with a +0.04% gain, while the Nasdaq Composite slipped -0.03%, pressured by weakness in select technology names ahead of earnings.

The Russell 2000 small-cap index showed encouraging strength, rising +0.42% as investors rotated toward domestically-focused businesses less exposed to international trade tensions. Meanwhile, the Philadelphia Semiconductor Index declined -0.21%, continuing its pattern of heightened volatility as chip manufacturers face ongoing uncertainty regarding global supply chains and export controls.

Short-term market momentum appears to be improving despite persistent weakness across multiple timeframes. This developing divergence between recent price action and longer-term negative trends suggests we may be approaching an important inflection point, with market internals beginning to strengthen despite headline indices remaining well below their recent peaks.

TOP 10 U.S. COMPANIES

The largest U.S. companies delivered mixed performance today, underperforming the broader market as investors reduced exposure ahead of a critical earnings week. Four of the "Magnificent Seven" tech giants reporting this week experienced selling pressure during the session, though Meta Platforms and Apple managed to close slightly higher.

Among today's top performers, Apple gained +0.41% and Meta Platforms rose +0.45%, showing resilience despite pre-earnings jitters. Berkshire Hathaway was unchanged at +0.00%, while Tesla advanced +0.33%. On the downside, NVIDIA was today's worst performer among megacaps, falling -2.05%, followed by Alphabet at -0.83% and Amazon at -0.68%.

The short-term momentum picture for large-cap technology remains concerning, with most names experiencing negative performance characteristics despite some recent improvement in weekly and monthly trends for select companies. This conflicting signal pattern suggests potential volatility ahead as the market digests upcoming earnings reports and forward guidance that may address tariff impacts.

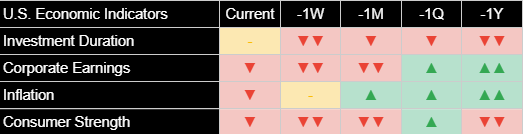

ECONOMIC INDICATORS

Economic conditions are showing early signs of stabilization despite ongoing market concerns. The investment duration outlook has notably improved across all timeframes, suggesting financial conditions may be becoming more supportive of longer-term economic growth despite recent market stress.

Corporate profitability measures remain mixed, with short-term improvements contrasting with ongoing weakness in quarterly readings. This divergence highlights the uncertain impact of tariffs on corporate earnings, with companies adjusting guidance amid evolving trade negotiations. Particularly concerning is the continued weakness in consumer strength readings, suggesting household spending may be vulnerable in the current environment.

Looking forward, the improving investment duration signals provide the most promising development for economic prospects. This early indicator of monetary conditions and risk appetite often leads to broader economic improvements and could signal that market participants are beginning to look beyond current uncertainties toward eventual resolution of trade tensions.

SECTOR OVERVIEW

Sector performance today reflected a defensive tilt with ongoing rotation toward traditional safety sectors. Utilities (+0.61%), healthcare (+0.40%), and real estate (+0.69%) all outperformed the broader market, highlighting continued investor caution despite recent market stabilization.

Energy emerged as today's top-performing sector with a +0.70% gain, benefiting from a technical rebound after sustained weakness in recent periods. Financials also showed strength with a +0.31% advance. On the downside, technology declined -0.19%, pressured by caution ahead of key earnings reports, while consumer staples fell -0.33% in a reversal of recent defensive positioning.

The sector trend picture continues to show significant divergence between defensive and cyclical areas. Utilities, communication services, and consumer staples display relatively stronger performance characteristics than cyclical sectors like materials, industrials, and energy. However, recent momentum improvements in select cyclical areas suggest this defensive positioning may be starting to shift as trade clarity emerges.

INTERNATIONAL MARKETS

Global markets exhibited notable regional divergence today, with developed international markets generally outperforming U.S. indices. Japan led major regions with a +1.37% advance, while European markets rose +0.65% as investors assessed the potential for progress in trade negotiations.

Developed markets showed particular strength, with Japan demonstrating improving performance characteristics across multiple timeframes. India also posted strong gains at +0.83% today. Emerging Asia managed a modest +0.12% advance, while Chinese shares slipped -0.12% amid ongoing uncertainty regarding trade discussions with the United States.

The regional momentum picture shows pronounced strength developing in European markets, Japan, and select developing regions including Singapore and Canada. These areas are displaying improving performance trends that contrast with persistent weakness in U.S. indices, suggesting international markets may be better positioned if global trade tensions de-escalate. The growing performance divergence between U.S. and international markets bears close watching as a potential leading indicator for broader market direction.

OTHER ASSETS

Cross-asset performance reflected heightened uncertainty and continued repositioning in response to evolving trade dynamics. Treasury prices rose across the yield curve, with the 20+ year segment advancing +0.63% as investors continued to seek safety despite recent equity stabilization.

In fixed income, Treasury prices gained across all maturities, with longer-duration bonds outperforming. The 7-10 year segment rose +0.40%, while shorter-term 1-3 year Treasuries gained a more modest +0.14%. These price increases corresponded with declining yields, reflecting continued demand for safety assets despite the recent equity market rebound.

Among commodities, gold surged +1.42% to continue its strong recent performance, while crude oil dropped significantly, falling -1.84% on renewed concerns about global demand. Bitcoin declined -0.72%, experiencing continued volatility amid broader market uncertainty. Agricultural commodities fell -0.69%, while industrial metals slipped a modest -0.05%.

The pattern across asset classes suggests investors remain defensive despite early signs of market stabilization. The continued strength in Treasury prices alongside gold's advance highlights persistent demand for safety assets, indicating market participants remain cautious about the economic outlook despite recent improvements in select forward-looking indicators.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)