【Joe’s華爾街脈動】漲勢在多空信號交錯中漸穩,關鍵財報與數據將至

美國股市因貿易希望普遍上漲,無視疲弱數據;美元走強

Joe Lu, CFA 2025年4月29日 美東時間

市場概況

因投資者對潛在貿易進展的樂觀情緒蓋過了令人失望的經濟數據,美國股市週二在震盪交易中強勢反彈,普遍收高。此動態發生在對美國國內前景保持謹慎的背景下。美股當日開盤市場走勢謹慎,但在商務部長盧特尼克 (Howard Lutnick) 暗示已與某未具名國家達成貿易協議後,市場於午後中段飆升。盧特尼克告訴CNBC:「我已經達成、達成、達成、達成了協議,但我需要等待他們的領導人和國會批准,我預計很快就會批准」,這將市場推至當日高點。

美國主要股票指數均反映了這波尾盤漲勢。標普500指數上漲 +0.63%。道瓊工業平均指數上漲 +0.73%。以科技股為主的納斯達克綜合指數上漲 +0.66%。以羅素2000指數為代表的小型股也參與上漲,漲幅 +0.59%。漲勢的廣泛性表明單日內風險偏好顯著改善,可能受到貿易不確定性降低的希望所推動。

距最初關稅實施近一個月,而今日的反彈主要由盧特尼克部長樂觀的貿易評論所驅動。雖然盧特尼克未指明涉及的國家,但他明確表示不是中國,並提到這些談判屬於財政部長貝森特 (Scott Bessent) 的「職權範圍」。此消息暫時蓋過了早些時候發布的令人擔憂的經濟數據:4月份消費者信心指數暴跌至86.0,為2020年以來最低;3月份JOLTS職位空缺數據也低於預期。除了貿易評論之外,川普總統本人向記者表示,與印度的談判「進展順利」,並暗示「我認為我們將與印度達成協議」。儘管相關數據疲弱,但市場對貿易談判作出的積極反應突顯了複雜的環境,其中政策預期可在短期內抵銷基本面信號。今日美元走強,上漲 +0.33%,與市場普遍認為美元走弱的預期形成顯著對比,需要密切關注。

摘要:

- 在貿易評論的推動下,美國主要指數經歷震盪後普遍收高:標普500指數 (+0.63%),道瓊工業平均指數 (+0.73%),納斯達克綜合指數 (+0.66%),羅素2000指數 (+0.59%)。

- 在商務部長盧特尼克 (Lutnick) 暗示已達成貿易協議、正等待某未具名國家領導人及其議會最終批准的言論後,美國股市於午後中段飆升。

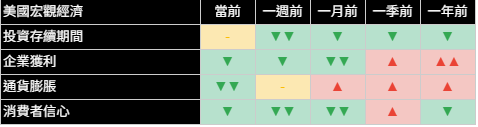

- 疲弱的經濟數據(消費者信心指數創2020年以來新低,JOLTS職位空缺數據不及預期)被潛在的貿易進展所蓋過;經濟指標分析顯示今日投資期限呈中性,通膨信號有所緩解。

- 多數類股上漲,由金融股 (+1.04%) 及消費必需品 (+0.83%) 等防禦性股票領漲。美國國債價格小幅上漲。

- 觀察到美元走強 (+0.33% DXY);國際市場表現各異,分析顯示歐洲和日本市場走強。

主要市場指數

主要市場指數週二在積極的貿易評論後扭轉了稍早的頹勢,穩健收高。道瓊工業平均指數 (+0.73%)、標普500指數 (+0.63%) 和納斯達克綜合指數 (+0.66%) 均上漲。小型股(以羅素2000指數衡量)也上漲 (+0.59%)。這種廣泛性的強勢表明,今日的走勢更多是由特定新聞(貿易希望)而非國內前景的基本面轉變所驅動,尤其是考慮到美國經濟成長的現有警示訊號。

儘管大盤反彈,費城半導體指數 (PHLX Semiconductor Index) 繼續表現不佳,收盤下跌 -0.90%。對該指數的基礎分析在多個時間範圍內仍然明顯不利,顯示出該產業持續存在的特定挑戰。

從分析角度來看,儘管日線強勁,但根據我們基於近期趨勢比較所做的分析,主要指數的近期市場特性仍較不利。今日的漲勢尚未扭轉過去一週和一個月內在我們指標框架中觀察到的負面轉變。這表明,雖然盤中情緒顯著改善,但仍需確認基礎條件出現可持續的正向轉變。

美國十大公司

今日,美國大型公司的表現多數為正面,參與了由貿易樂觀情緒引發的廣泛市場反彈,儘管本週公布財報的公司表現參差不齊。其表現反映了在應對國內成長擔憂的普遍環境下,每日新聞事件的影響。

從當日個股表現來看:特斯拉 (TSLA) 飆升 +2.15%。Meta Platforms (META) (+0.85%) 和微軟 (MSFT) (+0.74%) 在財報公告前均上漲。波克夏·海瑟威 (BRK.B) 上漲 +0.68%,摩根大通 (JPM) 上漲 +0.58%。蘋果 (AAPL) 上漲 +0.51%。相比之下,博通 (AVGO) 下跌 -0.68%。Alphabet (GOOGL) 回落 -0.28%,亞馬遜 (AMZN) 在財報前下跌 -0.17%。亞馬遜的表現發生在爭議之際,因白宮批評有關該公司計劃在產品列表上顯示關稅成本的報導,川普總統還親自致電貝佐斯 (Jeff Bezos)。亞馬遜隨後澄清,此類計劃「從未被批准」且「不會發生」。輝達 (NVDA) 僅上漲 +0.27%,落後於科技股漲勢。

解讀潛在的分析信號,根據我們的指標,這些公司中大多數的市場特性近期仍為不利或中性,儘管許多公司今日價格走勢積極。這突顯了一種分歧,即當日價格行為顯著改善,但潛在趨勢分析尚未確認近期疲弱趨勢的逆轉。波克夏·海瑟威在多個時間範圍內仍繼續顯示有利特徵。本週備受期待的財報將是關鍵事件,可能改變這些潛在訊號。

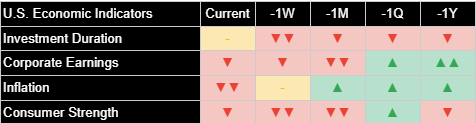

經濟指標

今日的經濟發展突顯了新發布數據與市場情緒之間的張力。關於消費者信心(暴跌至86.0)和JOLTS職位空缺(低於預期的719.2萬)的官方報告明顯疲弱,與已識別的美國成長阻力一致,並驗證了我們由市場衍生的消費者信心指標持續發出的負面信號。

儘管如此,市場焦點仍集中在盧特尼克關於已完成協議並等待最終批准的評論,以及川普總統暗示與印度談判取得進展的潛在貿易利多。我們的經濟指標提供了進一步的背景:分析表明今日在投資存續期間持中性立場。關於消費者信心的信號仍然疲弱,反映了家庭財務持續承受壓力。從市場分析得出的企業獲利近期前景仍平淡。有趣的是,與通膨相關的信號今日顯示有所緩解,儘管較長時間範圍內持續的正面信號表明,潛在的價格壓力尚未完全消散。市場能夠在疲弱數據下反彈,突顯了政策預期的影響,但並未否定來自官方報告和我們分析的警示訊號。

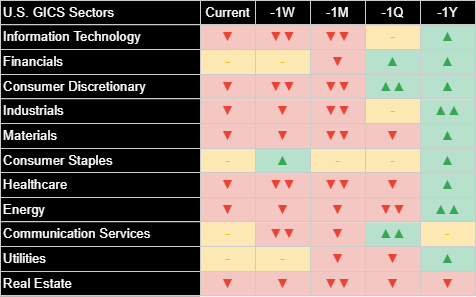

類股概覽

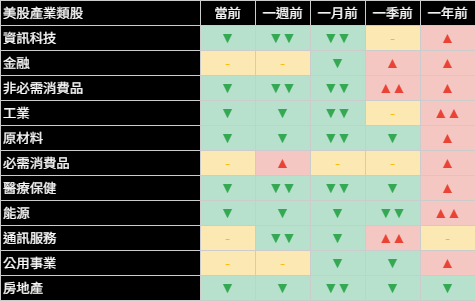

週二,標普500指數內的類股表現普遍積極,受美商務部長盧特尼克貿易評論後,午後漲勢的推動。十一個類股中有十個收高,表明在貿易樂觀情緒的刺激下,市場上漲具有廣泛參與性,儘管領漲類股顯示出週期性與防禦性特徵的混合。

表現最佳的包括金融股 (+1.04%),可能反映了對貿易進展的樂觀情緒。消費必需品 (+0.83%) 和公用事業 (+0.78%) 等防禦性類股的強勁表現表明,即使在反彈中,投資者仍保持一定的防禦性偏好。其他上漲類股如原材料 (+0.83%) 和工業股 (+0.65%) 受益於廣泛的積極情緒,並可能從改善的貿易條件中獲益。資訊科技 (+0.48%) 和通訊服務 (+0.73%) 亦上漲。主要的落後者是能源股 (-0.29%),受到油價下跌的壓力。房地產 (-0.25%) 也收低。

從分析角度來看,儘管普遍上漲,但我們的分析所顯示的潛在近期狀況對大多數類股而言仍為不利或中性。今日的積極價格走勢尚未轉化為我們框架內大多數類股分析訊號的明確積極轉變,表明今日的走勢仍待進一步確認,才能標誌著與近期盤整的明確突破。

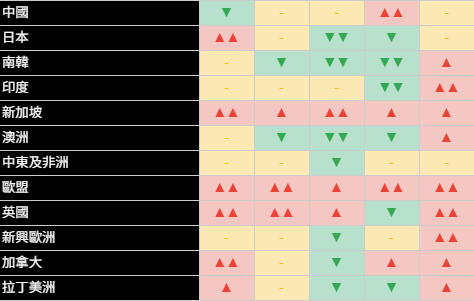

國際市場

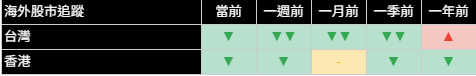

週二,全球多元化主題仍然重要。儘管美國市場因潛在貿易協議的特定消息而強勁反彈,但主要已開發市場仍顯示出基本的分析實力。今日美元走強 +0.33%。

已開發市場小幅上漲:歐洲股市上漲 +0.21%,日本股市上漲 +0.39%。美財政部長貝森特提到,與日本就可能的貿易協議進行了「實質性會談」,這可能助長了積極情緒。分析結果繼續顯示這些地區的積極特性正在增強,表明其積極趨勢比美國市場近期的波動更為穩固。

新興市場表現各異:新興亞洲市場上漲 +0.43%,印度上漲 +0.47%,拉丁美洲下跌 -0.04%。中國股市下跌 -0.33%。鑑於川普表示與印度即將達成協議,印度的表現尤其值得注意,貝森特並補充說道,「(與印度)接近達成協議」。這突顯了特定資產特徵如何導致持倉與更廣泛的區域趨勢有所不同。

其他資產

週二跨資產市場的活動反映了貿易樂觀情緒提振股市、令人失望的經濟數據支撐債券以及特定商品動態之間複雜的相互作用。

在固定收益方面,美國國債價格小幅上漲,受到疲弱經濟數據的支撐。短期 (+0.06%)、中期 (+0.35%) 和長期 (+0.84%) 國債價格均上漲,推低了收益率。美國綜合債券價格上漲 +0.24%。

大宗商品表現多數為負面。WTI原油價格急劇下跌 -2.82%。黃金價格下跌 -0.97%,可能受到美元走強,以及貿易評論後即時經濟擔憂減輕的影響。農產品下跌 -1.14%。基本金屬 (+0.44%) 逆勢上揚,可能受益於貿易情緒改善。美元指數 (DXY) 走強,上漲 +0.33%。在數位資產方面,比特幣價格上漲 +0.63%。將黃金和農產品等資產納入投資組合可提供多元化效益。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Rally Gains Traction Amid Mixed Signals, Key Earnings and Data Loom Large

U.S. Equities Rally Broadly on Trade Hopes, Shrugging Off Weak Data; Dollar Firms

Joe Lu, CFA April 29, 2025

MARKET OVERVIEW

U.S. equity markets staged a significant comeback during a volatile session on Tuesday, closing broadly higher as investor optimism around potential trade progress overshadowed disappointing economic data releases. This dynamic unfolded against a backdrop where caution regarding the U.S. domestic outlook remains a consideration. The day began tentatively, but markets surged mid-afternoon following remarks from Commerce Secretary Howard Lutnick suggesting a trade deal had been reached with an unnamed country. Lutnick told CNBC, "I have a deal done, done, done, done, but I need to wait for their prime minister and their parliament to give its approval, which I expect shortly," driving markets to their daily highs.

The major U.S. stock indices reflected this late-day surge. The S&P 500 Index gained +0.63%. The Dow Jones Industrial Average rose +0.73%. The technology-centric Nasdaq Composite Index advanced +0.66%. Small-capitalization stocks, represented by the Russell 2000 Index, also participated, gaining +0.59%. The broad nature of the rally indicated a significant intraday improvement in risk appetite, potentially fueled by hopes of reduced trade uncertainty.

The session was primarily driven by Secretary Lutnick's optimistic trade comments, which came nearly a month after the initial tariff implementation. While Lutnick didn't identify the country involved, he did specify it wasn't China, noting those negotiations were in Treasury Secretary Scott Bessent's "portfolio." This news temporarily overshadowed the concerning economic data released earlier: the April Consumer Confidence index plunged to 86.0, its lowest since 2020, and March JOLTS job openings missed estimates. Adding to the trade narrative, President Trump himself remarked to reporters that negotiations with India were "coming along great," suggesting, "I think we'll have a deal with India." The market's positive reaction to trade talk despite weak data underscores the complex environment, where policy expectations can counteract fundamental signals in the short term. The strengthening of the U.S. Dollar today, rising +0.33%, presented a notable counterpoint to some widely held expectations of dollar weakness, requiring close monitoring.

Executive Summary:

- Major U.S. indices finished broadly higher after a volatile session buoyed by trade commentary: S&P 500 (+0.63%), Dow (+0.73%), Nasdaq (+0.66%), Russell 2000 (+0.59%).

- Markets surged mid-afternoon following Commerce Secretary Lutnick's remarks suggesting a completed trade deal awaiting final approval from an unnamed country's leaders.

- Weak economic data (Consumer Confidence lowest since 2020, JOLTS miss) was overshadowed by potential trade progress; economic indicator analysis showed neutral duration and easing inflation signals today.

- Most sectors advanced, led by Financials (+1.04%) and defensive plays like Consumer Staples (+0.83%). Treasury prices gained modestly.

- Dollar strength observed (+0.33% DXY); international markets showed varied performance, with analysis indicating strength in Europe and Japan.

BROAD MARKET INDICES

Broad market indices finished solidly higher on Tuesday, reversing earlier weakness following the positive trade commentary. The Dow Jones Industrial Average (+0.73%), S&P 500 Index (+0.63%), and Nasdaq Composite (+0.66%) all posted firm gains. Small-cap stocks, via the Russell 2000 Index (+0.59%), also rallied. This broad strength suggests today's move was driven more by specific news (trade hopes) than a fundamental shift in the domestic outlook, particularly given existing caution signals around U.S. growth.

Despite the rally, the PHLX Semiconductor Index continued its underperformance, closing down -0.90%. Underlying analysis for this index remains pronouncedly unfavorable across multiple timeframes, indicating persistent sector-specific challenges.

From an analytical perspective, despite the strong positive daily returns, the underlying near-term market character across major indices remained predominantly unfavorable according to our analysis based on recent trend comparisons. Today's rally did not yet reverse the negative shifts observed over the past week and month within our indicator framework. This suggests that while sentiment improved significantly intraday, confirmation of a sustainable positive shift in underlying conditions is still needed.

TOP 10 U.S. COMPANIES

Performance among the largest U.S. companies was mostly positive today, participating in the broad market rally spurred by trade optimism, though results were mixed among those reporting earnings this week. The performance reflects the daily news impact within the prevailing environment of navigating domestic growth concerns.

Looking at individual stock performance for the day: Tesla Inc (TSLA) surged +2.15%. Pre-earnings gains were seen in Meta Platforms Inc (META) (+0.85%) and Microsoft Corp (MSFT) (+0.74%). Berkshire Hathaway Inc Class B (BRK.B) added +0.68%, and JPMorgan Chase & Co (JPM) advanced +0.58%. Apple Inc (AAPL) gained +0.51%. In contrast, Broadcom Inc (AVGO) fell -0.68%. Alphabet Inc Class A (GOOGL) retreated -0.28%, and Amazon.com Inc (AMZN) slipped -0.17% pre-earnings. Amazon's performance came amid controversy as the White House criticized reports that the company planned to display tariff costs on product listings, with President Trump personally calling Jeff Bezos about the matter. Amazon later clarified that such a plan was "never approved" and would "not going to happen." NVIDIA Corp (NVDA) gained only +0.27%, lagging the tech rally.

Interpreting the underlying analytical signals, the near-term market character for most of these companies remained unfavorable or neutral according to our indicators, despite the positive price moves for many today. This highlights a divergence where price action improved significantly on the day, but the underlying trend analysis has not yet confirmed a reversal of recent weakness. Berkshire Hathaway continues to show favorable characteristics across multiple timeframes. The highly anticipated earnings reports this week will be critical events that could potentially shift these underlying signals.

ECONOMIC INDICATORS

Today's economic developments highlighted the tension between incoming data and market sentiment. Official reports on Consumer Confidence (plummeting to 86.0) and JOLTS Job Openings (missing estimates at 7.192M) were notably weak, aligning with identified U.S. growth headwinds and validating the persistently negative signal from our market-derived Consumer Strength indicator.

Despite this, the market focused on potential trade positives centered around Lutnick's comments about a completed deal awaiting final approval, and President Trump's suggestion of progress with India. Our economic indicators provided further context: analysis indicated a neutral stance regarding investment horizons (Investment Duration) today. Signals concerning Consumer Strength remained weak, reflecting ongoing pressure on household finances. The outlook for Corporate Earnings derived from market analysis stayed muted in the near term. Interestingly, signals related to Inflation showed some easing today, though persistent positive signals over longer timeframes suggest underlying price pressures haven't fully dissipated. The market's ability to rally despite weak data underscores the impact of policy expectations but doesn't negate the cautionary signals from official reports and our analysis.

SECTOR OVERVIEW

Sector performance within the S&P 500 was broadly positive on Tuesday, fueled by the afternoon rally following Lutnick's trade comments. Ten out of eleven sectors finished higher, indicating widespread participation in the advance spurred by trade optimism, although leadership revealed a mix of cyclical and defensive characteristics.

Top performers included Financials (+1.04%), potentially reflecting optimism from trade progress. Strong performance from defensive sectors like Consumer Staples (+0.83%) and Utilities (+0.78%) suggests investors maintained some defensive bias even amidst the rally. Other gainers like Materials (+0.83%) and Industrials (+0.65%) benefited from the broad positive sentiment and would potentially gain from improved trade conditions. Information Technology (+0.48%) and Communication Services (+0.73%) also advanced. The primary laggard was Energy (-0.29%), pressured by falling oil prices. Real Estate (-0.25%) also finished lower.

From an analytical perspective, despite the broad gains, the underlying near-term conditions indicated by our analysis remained unfavorable or neutral for most sectors. The positive price action today has not yet translated into a definitive positive shift in the analytical signals for most sectors within our framework, suggesting today's move requires further confirmation to signal a definitive break from the recent consolidation.

INTERNATIONAL MARKETS

Global diversification themes remained relevant on Tuesday. While the U.S. market rallied strongly on specific news around potential trade deals, underlying analytical strength continued to be indicated in key developed markets. The U.S. Dollar strengthened +0.33% today.

Developed markets posted modest gains: European equities rose +0.21% and Japanese equities gained +0.39%. Treasury Secretary Bessent mentioned "substantial talks" with Japan over a possible trade deal, which could be contributing to positive sentiment. Analysis continues to show strengthening positive characteristics for these regions, suggesting more established positive trends than in the U.S. market's recent choppiness.

Emerging markets were varied: Emerging Markets Asia gained +0.43%, India rose +0.47%, and Latin America dipped -0.04%. Chinese equities fell -0.33%. India's performance is particularly noteworthy given Trump's comments about being close to a deal with the country, with Bessent adding they were "very close on India." This highlights how specific asset characteristics can lead to holdings that differ from broader regional trends.

OTHER ASSETS

Activity across other asset classes on Tuesday reflected the complex interplay of trade optimism boosting equities, disappointing economic data supporting bonds, and specific commodity dynamics.

In fixed income, U.S. Treasury prices registered modest gains, supported by the poor economic data. Short-term (+0.06%), Intermediate (+0.35%), and Long-term (+0.84%) Treasury prices all rose, pushing yields lower. Broad U.S. Aggregate Bond prices rose +0.24%.

Commodity performance was mostly negative. WTI Crude Oil fell sharply by -2.82%. Gold prices declined -0.97%, potentially responding to dollar strength and reduced immediate economic concerns following the trade commentary. Agricultural Commodities fell -1.14%. Base Metals (+0.44%) bucked the trend, possibly benefiting from improved trade sentiment. The US Dollar Index (DXY) strengthened, rising +0.33%. In digital assets, Bitcoin prices gained +0.63%. The inclusion of assets like Gold and Agricultural commodities provides diversification benefits within a portfolio context.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)