【Joe’s華爾街脈動】GDP數據衝擊後股市急劇反彈,結束動盪月份;焦點轉向關鍵財報與通膨數據

GDP萎縮但美股於盤中反彈,標普/道瓊指數月線仍收黑

Joe Lu, CFA 2025年4月30日 美東時間

市場概況

美國股市週三經歷劇烈波動,在公佈令人意外的第一季經濟萎縮報告後盤初急挫,隨後因美中貿易談判重燃希望的報導,而於午後急劇反彈。商務部報告第一季國內生產毛額(GDP)年化率下降-0.3%,為2022年初以來首次下降,與第四季的+2.4%成長形成鮮明對比,為當日交易投下陰影。此負面數據主要由於企業趕在預期關稅生效前囤積貨物導致進口創紀錄激增,最初引發股市暴跌,標普500指數一度下跌超過2%,道瓊指數盤中最低點下挫近800點。然而,市場情緒在下午急轉直下,據報導是因中國官方媒體相關帳號發布美國尋求關稅談判的消息所觸發。這推動指數回升至正值區域,結束了這個充滿關稅不確定性和經濟交錯訊號的動盪月份。

主要美國股市指數反映了這次顯著的盤中逆轉。標普500指數 上漲 +0.04%。道瓊工業平均指數 上漲 +0.28%,延續其連漲紀錄。以科技股為主的那斯達克綜合指數 下跌-0.01%,而代表小型股的羅素2000指數 下跌-0.63%。儘管當日收盤強勁,但四月份對標普500指數(約-0.8%)和道瓊指數(約-3.2%)而言,均是連續第三個月下跌,而那斯達克指數則實現了月度上漲(約+0.9%)。

此交易日突顯了市場對貿易政策局勢的極度敏感,及其與經濟數據的複雜關係。GDP萎縮本身雖是負面頭條新聞,但很大程度上受到關稅前囤貨導致進口激增41.3%的扭曲。潛在的國內需求顯示出韌性,對國內消費者的最終銷售額成長了3.0%,儘管這也可能反映了關稅前的購買行為。此外,雖然第一季消費者支出成長放緩(季增率1.8%,對比第四季的4.0%),但三月份出現了強勁的月度成長(+0.7%)。通貨膨脹信號亦呈現分歧:第一季「核心」個人消費支出(PCE)價格指數年成長率3.5%,高於預期,但三月份讀數顯示出令人欣慰的降溫(月成長率0.0%)。這些相互矛盾的數據,加上持續存在的貿易不確定性以及主要財報季的尾聲,為未來潛在的持續波動埋下了伏筆。

重點摘要

- 在第一季GDP意外萎縮後,美股主要指數從早盤急跌中恢復,收盤普遍上漲:標普500指數 (+0.04%),道瓊指數 (+0.28%),那斯達克指數 (-0.01%),羅素2000指數 (-0.63%)。

- 儘管當日強勁反彈,根據分析,近期整體市場特性依然不佳,標普500和道瓊指數連續第三個月收黑。

- 第一季GDP下降-0.3%,主要受關稅前進口量激增拖累;第一季核心通膨高於預期(3.5%),但三月數據顯示降溫。

- 多數類股上漲,由消費必需品 (+0.73%)和醫療保健 (+0.85%)領漲;能源 (-2.7%)表現落後。公債價格上漲,殖利率下降。

- 市場焦點密切轉向本週結束的主要科技公司財報,以及明日關鍵的PCE通膨數據。

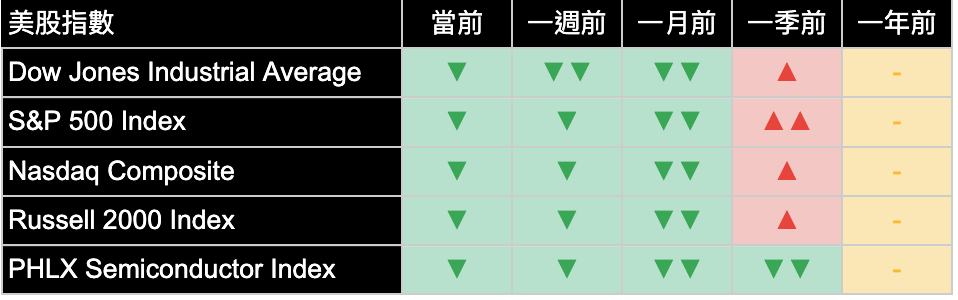

主要市場指數

主要市場指數週三在經歷戲劇性的盤中反轉後,收盤小幅上漲。道瓊工業平均指數 (+0.28%),標普500指數 (+0.04%),因負面GDP數據引發的盤初急跌中恢復,略有上漲。那斯達克綜合指數 收盤基本持平 (-0.01%),不過羅素2000指數 (-0.63%)明顯走低,顯示小型股並未充分參與下午的飯談。午後與潛在美中貿易談判報導相關的漲勢顯示出顯著的韌性和逢低買盤興趣。

費城半導體指數 持續明顯疲弱,僅上漲0.79%。對此關鍵科技類股的潛在分析在多個時間範圍內仍顯示極度不利,表明持續存在的行業挑戰正壓過大盤情緒的波動。

從分析角度來看,儘管盤中有強勁的復甦且收盤上漲,根據我們基於近期趨勢比較的分析,主要指數的近期市場潛在特性仍普遍不利。今日的價格走勢尚未證實我們指標框架內前幾週觀察到的負面轉變。雖然反彈能力從市場情緒角度看是建設性的,但仍需確認潛在市場狀況出現可持續的改善。

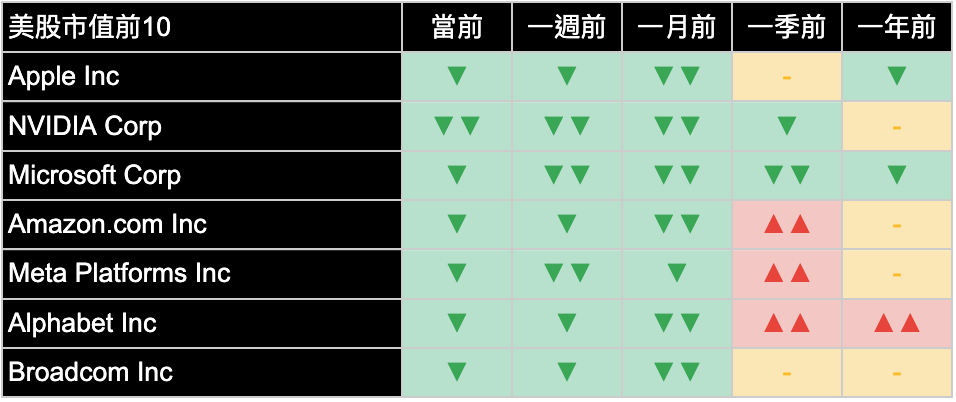

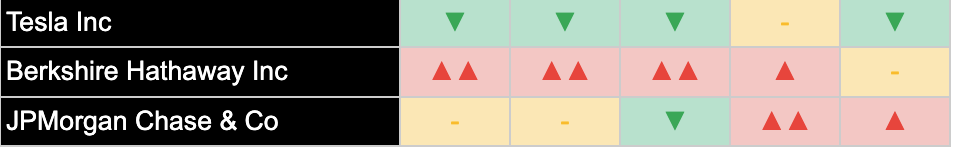

美國前十大公司

美國大型公司今日表現大多正面,為市場反彈貢獻顯著力量,但值得注意的是,分歧依然存在,尤其是在關鍵財報仍在陸續公佈的情況下。

縱觀今日個股表現:微軟 (Microsoft Corp) 在財報公佈後上漲 +0.31%,蘋果 (Apple Inc) 在明日公佈財報前上漲 +0.61%,波克夏·海瑟威 (Berkshire Hathaway Inc Class B) 上漲 +0.68%,博通 (Broadcom Inc) 也上漲 +0.68%。相比之下,特斯拉 (Tesla Inc) 下跌 -3.38%,亞馬遜 (Amazon.com Inc) 在公佈財報前下跌 -1.58%,Meta Platforms Inc 下跌 -0.98%,Alphabet Inc (Alphabet Inc Class A) 下跌 -0.85%,摩根大通 (JPMorgan Chase & Co) 收盤持平 (0.00%),輝達 (NVIDIA Corp) 小幅下跌 -0.09%。

解讀潛在的分析信號,即使今日有所上漲,根據我們的指標,這些公司中大多數的近期市場特性仍處於不利或中性狀態。這種持續的分歧突顯出分析所識別的近期潛在弱點,尚未被價格行為決定性地克服。波克夏·海瑟威仍是個例外,顯示出有利的特性。市場對亞馬遜和蘋果明日公布之財報的反應,將對於塑造近期市場情緒至關重要,並可能影響這些分析訊號。

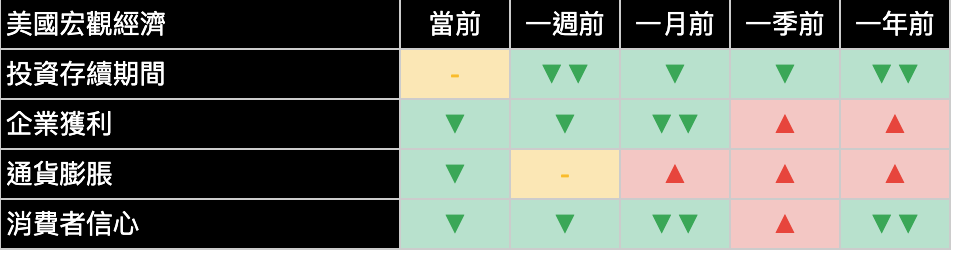

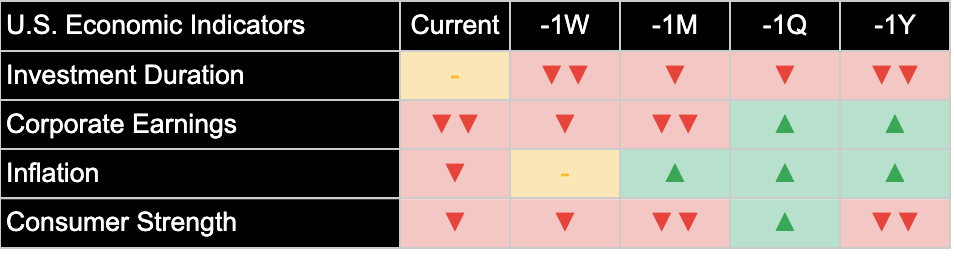

經濟指標

今日的經濟數據呈現了複雜且略有矛盾的美國經濟景象。第一季GDP萎縮(-0.3%)的頭條數據是因貿易扭曲(進口激增),而非國內消費驟降所驅動,儘管潛在的增長組成部分也顯示放緩。最終國內需求成長穩健,但可能受到關稅前購買的提振。消費者支出季度增長顯著放緩(1.8% 對比 第四季的4.0%),這與我們市場衍生的消費者信心經濟指標發出的疲弱訊號一致,該指標今日依然為負。官方第一季核心PCE通膨數據高於預期(3.5%)帶來挑戰,不過三月份數據持平提供了些許緩解,並與我們通膨經濟指標今日觀察到的緩和訊號一致。

我們整套經濟指標反映了今日這種微妙的環境:分析顯示,投資存續期間立場中性。消費者信心訊號持續疲軟。市場分析得出的企業獲利前景在短期內保持低迷,這與GDP報告中潛在的疲弱以及近期顯示商業信心下降的調查數據一致。如前所述,通膨訊號當日有所緩和。總體而言,這些數據強化了這樣一種景象:經濟正在應對來自貿易政策的影響、成長放緩以及好壞參半的通膨信號等多重因素,需要密切監控。

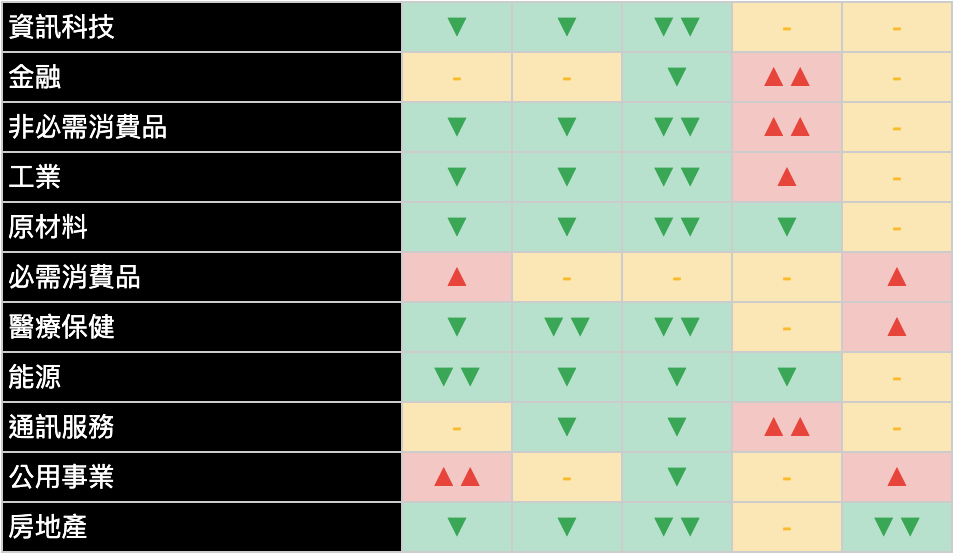

類股概況

隨著市場在午後上演驚人的反彈,標普500指數的類股週三表現普遍正向,十一個類股中有十個收高。復甦範圍廣泛,涵蓋了週期型和防禦型領域。

表現最佳的類股為防禦型較佳的產業:醫療保健 (+0.85%) 及必需消費品 (+0.73%)。工業 (+0.72%) 和房地產 (+0.77%) 均小幅上漲。原材料 (+0.52%) 和公用事業 (-0.5%) 的走勢不一。資訊科技 (+0.24%) 略有成長。相較之下,能源 (-2.70%) 產業受到原油價格走弱的拖累,表現最差。非必需消費品 (-0.91%) 和金融 (+0.18%) 的表現疲弱,漲幅也有限。通訊服務 (+0.03%) 收盤基本上持平。

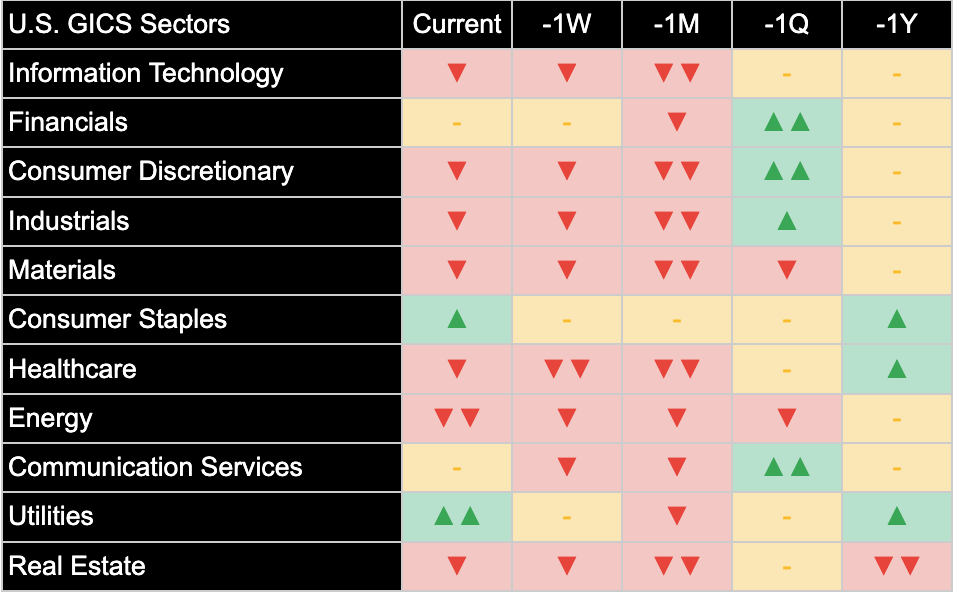

從分析角度來看,儘管普遍上漲,我們的分析顯示,近期潛在的狀況對大多數類股而言仍是不利或中性的。今日各類股表現好壞參半,以防禦性類股為主,顯示市場仍保持謹慎。而今日稍早強勁的價格上漲尚未在我們的框架內為多數類股帶來確定的正面分析訊號轉變。這表明,儘管市場情緒顯著改善,仍需更多證據來確認市場多數領域已明確結束近期的盤整階段。

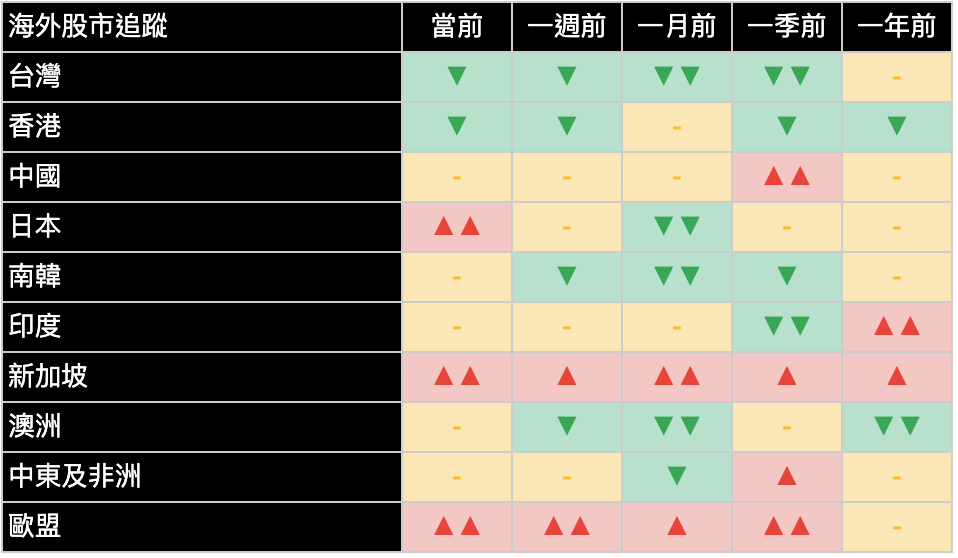

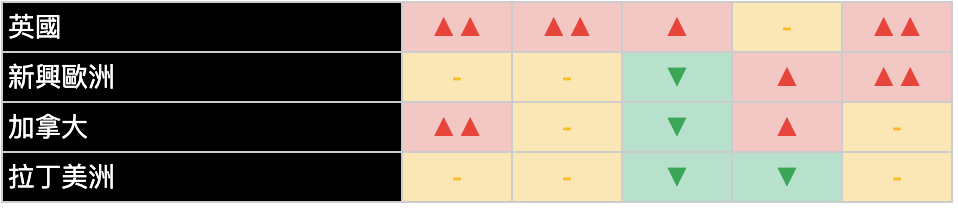

國際市場

儘管美國市場上演了戲劇性的逆轉,收盤表現不一,而國際市場表現也呈現分化態勢。美元 當日升值 +0.37%。

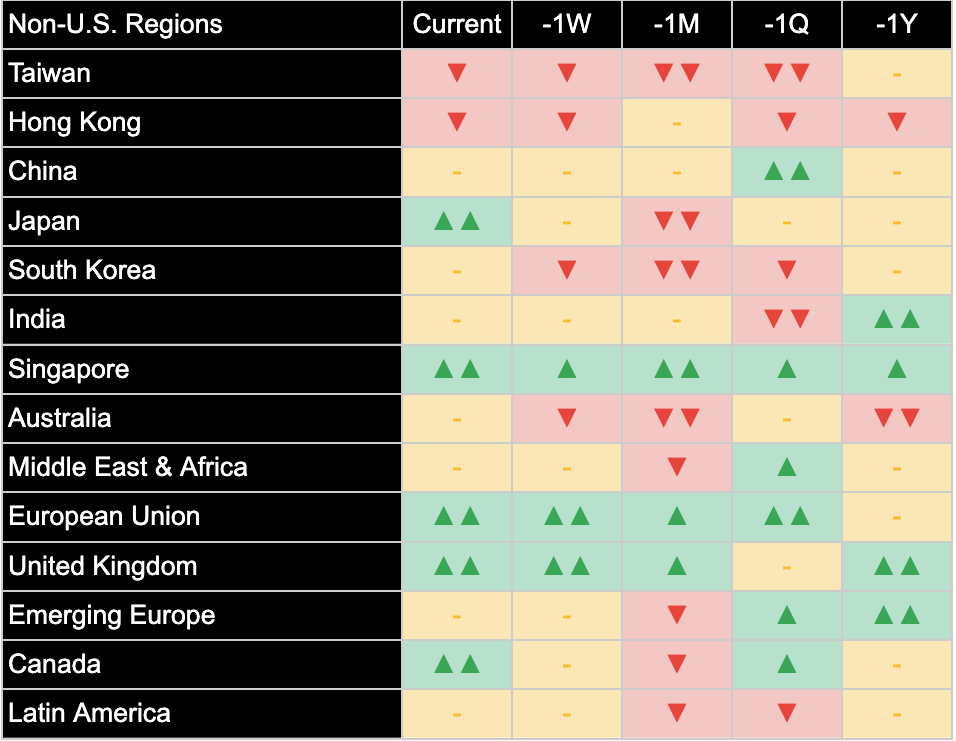

已開發市場表現不一:歐洲股市下跌 -0.10%,日本股市下跌 -0.82%。儘管今日表現不佳,分析持續顯示,相較於波動較大的美國市場背景,這些地區呈現出成強中的正面特性。

新興市場表現各異:新興亞洲市場股市上漲 +0.41%,印度股市上漲 +0.06%,而拉丁美洲股市下跌 -0.80%。中國股市收盤基本持平 -0.04%。這種不同的表現突顯了在國際配置中評估特定國家和資產特性的重要性。

其他資產

週三其他資產類別的活動反映了當日市場的波動和局勢轉變。債券受GDP影響後上漲,而大宗商品大多下跌,美元則走強。

固定收益方面,美國公債價格 在GDP報告後因殖利率下降而上漲。短期 (+0.13%),中期 (+0.16%)及長期 (-0.81%),美國公債價格走勢不一。整體美國綜合債券價格 小幅下跌 (-0.09%)。這種對債券的需求反映了市場正在努力消化經濟萎縮(即使存在扭曲)的影響。

大宗商品表現普遍為負。WTI原油 大幅下跌 -3.48%。黃金價格 下跌 -0.75%,可能受到美元走強或股市反彈期間避險需求減弱的壓力。農產品 下跌 -0.63%。基本金屬-3.32% 是個明顯的例外,成功錄得漲幅。美元指數 走強,上漲 +0.37%。在數位資產方面,比特幣價格 下跌 -1.31%。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。 Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。 Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Stocks Rebound Sharply After GDP Shock, Capping Volatile Month; Earnings, Inflation Data Now Critical

GDP Contracts but Stocks Rally Intraday, Monthly Losses Persist for S&P/Dow

Joe Lu, CFA April 30, 2025

MARKET OVERVIEW

U.S. equity markets experienced extreme volatility on Wednesday, plunging sharply early in the session following a surprising report showing the economy contracted in the first quarter, only to stage a dramatic afternoon rebound reportedly fueled by renewed hopes regarding U.S.-China trade discussions. The day began on a sour note as the Commerce Department reported that Q1 Gross Domestic Product (GDP) decreased at a -0.3% annualized rate, the first decline since early 2022 and starkly contrasting with Q4's +2.4% growth. This negative print, driven primarily by a record surge in imports as businesses apparently stockpiled goods ahead of anticipated tariff impacts, initially sent stocks tumbling, with the S&P 500 down over 2% and the Dow shedding nearly 800 points at their lows. However, sentiment reversed sharply in the afternoon, reportedly triggered by posts from Chinese state-media affiliated accounts suggesting the U.S. was seeking tariff negotiations. This propelled indices back towards the flatline or slightly higher, capping a turbulent month defined by tariff uncertainty and economic crosscurrents.

The major U.S. stock indices reflected this remarkable intraday turnaround, though gains were more muted by the close than intraday highs suggested. The S&P 500 Index gained +0.04%. The Dow Jones Industrial Average rose +0.28%. The technology-centric Nasdaq Composite Index slipped -0.01%, while small-capitalization stocks, represented by the Russell 2000 Index, finished significantly lower, falling -0.63%. Despite the partial recovery, April marked the third consecutive monthly loss for both the S&P 500 (approx. -0.8%) and the Dow (approx. -3.2%), while the Nasdaq managed a monthly gain (approx. +0.9%).

The session underscored the market's heightened sensitivity to trade policy narrative and its complex relationship with economic data. The GDP contraction itself, while negative headline news, was significantly distorted by the 41.3% surge in imports attributed to tariff front-loading. Underlying domestic demand showed resilience, with final sales to private domestic purchasers growing at a 3.0% rate, though this too may reflect pre-tariff buying. Furthermore, while consumer spending growth slowed in Q1 (1.8% rate vs 4.0% in Q4), March saw a strong monthly jump (+0.7%). Inflation signals were also mixed: the Q1 "core" PCE price index ran hotter than expected at 3.5%, but the March reading showed a welcome cooling (0.0% month-over-month). This conflicting data, combined with the ever-present trade uncertainty and the tail end of a major earnings season, sets the stage for continued potential volatility.

EXECUTIVE SUMMARY

- Major U.S. indices recovered from sharp early losses to close broadly higher after Q1 GDP unexpectedly contracted: S&P 500 (+0.04%), Dow (+0.28%), Nasdaq (-0.01%), Russell 2000 (-0.63%).

- Despite the volatile recovery, underlying near-term market character remained broadly unfavorable according to analysis, closing out a third consecutive losing month for the S&P 500 and Dow.

- Q1 GDP fell at a -0.3% rate, dragged down by a record surge in imports ahead of tariffs; Q1 core inflation ran hotter than expected (3.5%), though March showed cooling.

- Most sectors advanced, led by Consumer Staples (+0.73%) and Healthcare (+0.85%); Energy (-2.70%) lagged severely. Treasury prices gained.

- Focus shifts intensely to major tech earnings concluding this week and crucial economic data including PCE inflation tomorrow.

BROAD MARKET INDICES

Broad market indices finished mixed on Wednesday following a dramatic intraday reversal that ultimately faded for some benchmarks. The Dow Jones Industrial Average (+0.28%) and S&P 500 Index (+0.04%) managed slight gains after recovering from steep early losses attributed to the negative GDP print. The Nasdaq Composite (-0.01%) ended virtually unchanged. However, the Russell 2000 Index (-0.63%) closed notably lower, indicating small-caps did not fully participate in the afternoon rebound. The afternoon rally attempt, linked to trade talk reports, showed resilience but lacked broad conviction into the close.

The PHLX Semiconductor Index continued its pronounced weakness, rising only +0.79% on a day when the broader tech index was flat, significantly underperforming the recovery seen elsewhere. Underlying analysis for this key technology group remains pronouncedly unfavorable across multiple timeframes, suggesting persistent industry challenges.

From an analytical perspective, despite the powerful intraday recovery attempt, the underlying near-term market character across the major indices remained predominantly unfavorable according to our analysis based on recent trend comparisons. Today's price action has not yet confirmed a reversal of the negative shifts observed over the preceding weeks within our indicator framework. While the ability to rebound intraday is noted, confirmation of a sustainable improvement in underlying market conditions is still awaited.

TOP 10 U.S. COMPANIES

Performance among the largest U.S. companies was mixed today, reflecting the volatile market and specific reactions to earnings or anticipation thereof.

Looking at individual stock performance for the day: Microsoft Corp gained +0.31% post-earnings. Apple Inc rose +0.61% ahead of its report tomorrow. Berkshire Hathaway Inc Class B added +0.68%. Broadcom Inc also gained +0.68%. In contrast, Tesla Inc fell -3.38%. Amazon.com Inc slipped -1.58% before releasing its earnings. Meta Platforms Inc declined -0.98%. Alphabet Inc Class A retreated -0.85%. JPMorgan Chase & Co finished flat (0.00%). NVIDIA Corp was down -0.09%.

Interpreting the underlying analytical signals, the near-term market character for most of these companies remained unfavorable or neutral according to our indicators. The mixed price performance today did little to change the underlying picture of recent weakness identified by analysis. Berkshire Hathaway remains an exception with favorable characteristics indicated. The market's reaction to the earnings reports from Amazon and Apple tomorrow will be crucial for shaping near-term sentiment and potentially influencing these analytical signals for key market leaders.

ECONOMIC INDICATORS

Today's economic data provided a complex and somewhat conflicting picture of the U.S. economy. The headline Q1 GDP contraction (-0.3%) was driven by trade distortions (import surge) rather than a collapse in domestic activity, though underlying growth components also showed moderation. Final domestic demand grew solidly, but likely aided by pre-tariff buying. Consumer spending growth slowed significantly quarter-over-quarter (1.8% vs 4.0%), aligning with the weak signal from our market-derived Consumer Strength economic indicator, which remained negative today.

Our suite of economic indicators reflected this nuanced environment today: analysis indicated a neutral stance regarding Investment Duration. The Consumer Strength signal remained weak. The outlook for Corporate Earnings derived from market analysis stayed muted in the near term, consistent with the GDP report's underlying softness and recent survey data showing declining business confidence. As mentioned, the Inflation signals eased on the day. Overall, the data reinforces a picture of an economy navigating significant crosscurrents from trade policy impacts, moderating growth, and mixed inflation signals, demanding careful monitoring.

SECTOR OVERVIEW

Sector performance within the S&P 500 was mixed on Wednesday, despite the market's intraday rally attempt. Defensive sectors generally outperformed, while cyclical areas lagged, reflecting the underlying economic uncertainty despite the afternoon trade headlines.

The top-performing sectors were defensive stalwarts: Healthcare (+0.85%) and Consumer Staples (+0.73%). Industrials (+0.72%) and Real Estate (+0.77%) also posted solid gains. Materials (+0.52%) and Utilities (-0.50%) had varied results. Information Technology (+0.24%) managed a slight gain. In contrast, Energy (-2.70%) was by far the worst performer, tracking the sharp decline in crude oil prices. Consumer Discretionary (-0.91%) and Financials (+0.18%) also showed weakness or limited gains. Communication Services (+0.03%) finished nearly flat.

From an analytical perspective, the underlying near-term conditions indicated by our analysis remained unfavorable or neutral for most sectors. The mixed performance today, with defensive leadership, suggests the market remains cautious beneath the surface. The strong positive price action earlier has not yet generated a confirmed positive shift in the analytical signals for most sectors within our framework, indicating the consolidation phase may persist.

INTERNATIONAL MARKETS

Global diversification themes remained pertinent on Wednesday. While the U.S. market executed a dramatic reversal intraday, the closing performance was mixed, and international markets also showed varied results. The U.S. Dollar strengthened +0.37% for the day.

Developed markets posted mixed results: European equities fell -0.10% while Japanese equities declined -0.82%. Despite the negative daily performance, analysis continues to indicate underlying strengthening positive characteristics for these regions compared to the U.S.

Emerging markets were also varied: Emerging Markets Asia gained +0.41%, India rose +0.06%, while Latin America fell -0.80%. Chinese equities finished nearly flat (-0.04%). This varied performance underscores the importance of evaluating specific country and asset characteristics within international allocations.

OTHER ASSETS

Activity across other asset classes on Wednesday reflected the day's volatility and shifting narratives. Bonds gained on the initial weak GDP reading, while commodities mostly fell, and the dollar firmed.

In fixed income, U.S. Treasury prices registered gains as yields declined following the GDP report. Short-term (+0.13%), Intermediate (+0.16%), and Long-term (-0.81%) Treasury prices showed mixed direction, with longer duration bonds reversing lower. Broad U.S. Aggregate Bond prices fell slightly (-0.09%). The initial demand for bonds reflected the market grappling with the implications of contracting growth, though the long end gave back gains.

Commodity performance was predominantly negative. WTI Crude Oil fell sharply by -3.48%. Gold prices declined -0.75%, perhaps pressured by the dollar strength. Agricultural Commodities fell -0.63%. Base Metals declined significantly, falling -3.32%. The US Dollar Index strengthened, rising +0.37%. In digital assets, Bitcoin prices fell -1.31%.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)