【Joe’s華爾街脈動】科技巨頭重燃AI樂觀情緒,股市上漲;就業數據增添複雜性

科技股領漲,但就業數據引發擔憂;蘋果、亞馬遜財報成焦點

Joe Lu, CFA 2025年5月1日 美東時間

市場概況

由於微軟和Meta的強勁財報緩解了對AI投資週期的擔憂,美股在五月第一個交易日迎來穩健上漲。微軟公布優於預期的業績,並強調計劃增加資料中心的資本支出後,股價躍升+7.63%。Meta在公布正向的業績成果後上漲+4.23%,顯示儘管近期面臨經濟挑戰,科技支出仍具韌性。

此積極的催化劑帶動美股主要指數,收復了自四月初宣布關稅以來失地的重要部分。以科技股為主的 那斯達克綜合指數 以+1.31%的漲幅領漲,而 標普500指數 上漲+0.71%,道瓊工業平均指數 則上漲+0.27%。

然而,今日的樂觀情緒受到經濟數據的些許抑制,數據顯示本週初請失業金人數為24.1萬人,高於預期的22.5萬人。這是在昨日意外的GDP萎縮之後發布的,加劇了對勞動市場的擔憂。同樣值得注意的是,一份G30的報告建議美國聯準會應更嚴格地關注通膨而非就業,這可能預示著未來解讀經濟數據的政策方向將發生轉變。

重點摘要

- 科技股領漲市場反彈: 標普500指數 (+0.71%)、道瓊指數 (+0.27%) 和 那斯達克指數 (+1.31%) 今日在強勁的微軟和Meta財報帶動下反彈。

- 科技業財報緩解貿易擔憂: 微軟 (+7.63%) 和 Meta (+4.23%) 的財報顯示,儘管經濟存在不確定性,AI投資依然強勁。

- 經濟警訊: 繼昨日負面的GDP報告後,本週初請領失業金人數高於預期(24.1萬 vs 22.5萬)。

- 市場轉動: 科技類股 (+1.77%) 表現大幅領先,而醫療保健類股 (-2.73%) 則急劇下跌。

- 焦點轉移: 目前所有目光都集中在週五的就業報告以及今晚將公布的蘋果和亞馬遜財報。

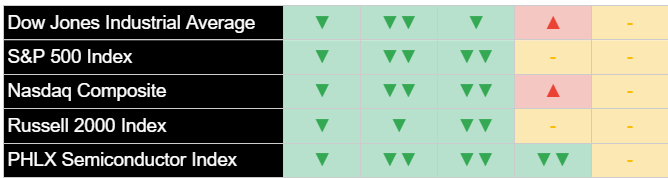

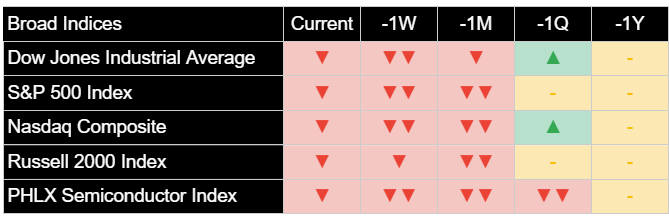

主要市場指數

今日主要指數顯著收高,科技股帶動漲勢。那斯達克綜合指數 以+1.31%的漲幅領漲,有效抹去了四月初以來的跌幅。標普500指數 上漲+0.71%,接近川普總統宣布關稅前的水平。道瓊工業平均指數 漲幅較為溫和,上漲+0.27%,反映了今日由科技股驅動的反彈具有集中性。

小型股也參與了這波正面情緒,羅素2000指數 上漲+0.62%。費城半導體指數 上漲+0.45%,顯示出大型科技股財報帶來了一些外溢效應。

儘管今日價格走勢強勁,潛在的市場狀況仍顯示需保持謹慎。此波反彈似乎集中在特定類股,而非展現廣泛的市場力道,表明這可能更多是受財報驅動的反彈,而非市場方向的根本性轉變。

美國前十大公司

美國大型公司今日表現強勁正面,尤其是在科技類股財報公布後。

微軟 (Microsoft) 在業績超出預期並對AI投資前景表示樂觀後,股價飆升+7.63%。Meta Platforms 在公布強勁業績,緩解了對廣告支出擔憂後,上漲+4.23%。亞馬遜 (Amazon) 在今日收盤後公布財報前上漲+3.13%。其他表現突出的包括輝達 (Nvidia) (+2.47%) 和 博通 (Broadcom) (+2.53%),兩者均受益於重燃的AI樂觀情緒。

並非所有超大型股都同樣參與了今日的反彈。特斯拉 (Tesla) 下跌-0.58%,波克夏海瑟威 (Berkshire Hathaway) 下跌-0.57%,突顯了今日漲勢的選擇性。這些分歧表明投資者正在進行仔細的區分,而非廣泛買入市場。

儘管今日漲幅可觀,但其中許多公司的長期前景仍然好壞參半。市場狀況持續顯示壓力訊號,可能影響未來表現,特別是如果經濟數據持續令人失望。

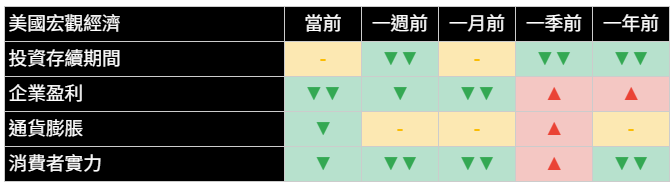

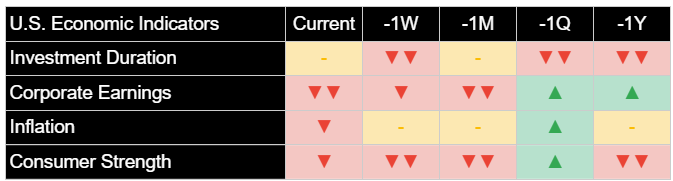

經濟指標

今日的經濟數據為市場局勢增添了複雜性。本週初請失業金人數升至24.1萬人,超出預期,指向勞動市場可能正在走弱。這是在昨日的負面GDP數據公告之後,引發了對經濟實力的疑問。

隨著政策討論的演變,勞動市場的健康狀況變得更加重要。一份G30的報告建議美國聯準會採取更嚴格的通膨焦點,放棄其更廣泛的就業政策。財政部長Bessent指出,債券市場正發出預期降息的訊號,為政策前景增添了另一個層面。

根據市場訊號,消費者信心顯得尤為疲弱,支出模式顯示出壓力。除特定科技公司外,企業獲利前景仍然謹慎。這些相互矛盾的訊號——強勁的科技業財報對比更廣泛的經濟擔憂——為投資者在明日重要的就業報告前創造了一個複雜的環境。

類股概況

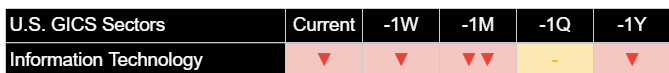

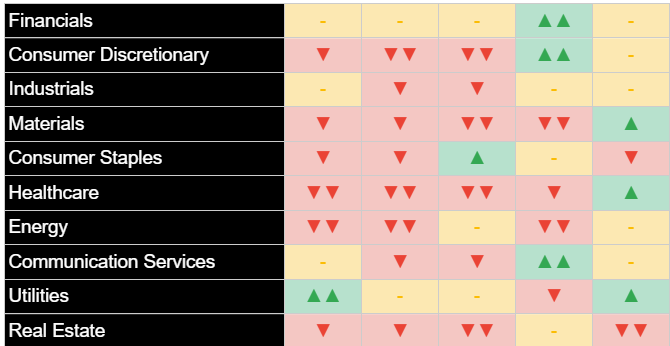

今日的類股表現由 資訊科技 (+1.77%) 主導,得益於微軟和Meta的強勁財報,其表現顯著,超越所有其他類股。

通訊服務 (+0.51%) 也受益於Meta的業績而上漲。其他呈現小幅上漲的類股包括 工業 (+0.75%) 和 非必需消費品 (+0.55%)。能源類股 勉強微幅上漲+0.37%,而 房地產 和 公用事業 均上漲+0.29%。

防禦性類股普遍表現落後,必需消費品 下跌-0.87%。醫療保健 表現最差,急跌-2.73%,可能受到禮來公司 (Eli Lilly) 在下調財測後,股價下跌11%的影響。金融 收盤基本持平 (-0.02%),而 原物料 則下跌-0.44%。

今日的類股轉動顯示出對成長股的明顯偏好,而非價值股,並表明投資者正在選擇性地尋找機會,而非廣泛押注市場。這種特定類股領漲而非市場普漲的模式,通常發生在不確定時期。

國際市場

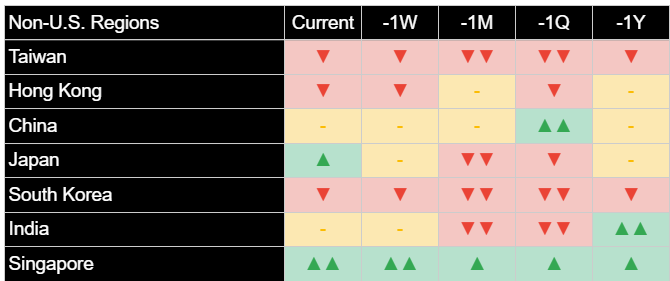

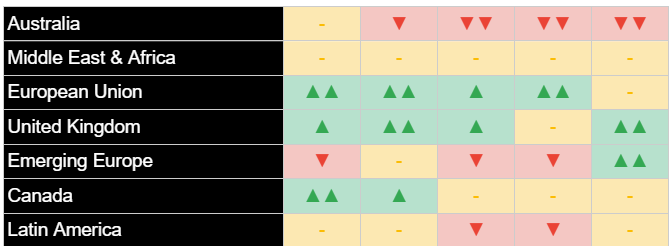

今日國際市場表現好壞參半,未能完全參與由美國科技股引領的反彈。美元指數 走弱-0.52%,這通常對國際資產有利。

儘管存在這種貨幣優勢,已開發市場仍表現掙扎,歐洲股市 下跌-0.36%,日本股市 也下跌-0.36%。這種與美股的分歧表明,國際投資者對全球成長前景仍持謹慎態度。

新興市場表現各異。新興亞洲市場 微幅上漲+0.05%,而 印度 近乎持平於-0.06%。拉丁美洲市場 下跌-0.48%,中國股市 下跌-0.14%。

這些好壞參半的國際市場結果突顯了今日反彈的選擇性,其主要似乎是由美國科技業財報而非全球市場情緒的改善所驅動。區域經濟狀況和貿易擔憂持續對美國以外的市場構成壓力。

其他資產

其他資產類別的活動反映了股市中風險偏好的改善,傳統避險資產普遍走弱。

隨著股市反彈,公債價格 普遍下跌,導致殖利率上升。短期公債價格 下跌-0.52%,中期公債價格 下跌-0.76%,長期公債價格 下跌-0.87%。整體美國綜合債券指數 下跌-0.60%。這表明隨著股市情緒改善,投資者從避險資產撤離。

大宗商品表現好壞參半。WTI原油 上漲+1.51%,與風險偏好情緒一致。黃金價格 急劇下跌-2.08%,與避險需求減少相符。農產品 下跌-0.71%,而 基本金屬 上漲+1.12%,反映出不同的工業需求訊號。

數位資產加入了風險偏好行情,比特幣價格 飆升+2.69%。這種跨資產的景象表明,投資者在佈局上變得更具選擇性,而非在所有市場進行廣泛的方向性押注。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。 Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。 Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Stocks Rise as Tech Giants Rekindle AI Optimism; Jobs Data Adds Complexity

Joe Lu, CFA May 1, 2025

MARKET OVERVIEW

US markets kicked off May with solid gains as strong earnings from Microsoft and Meta eased concerns about the AI investment cycle. Microsoft shares jumped 7.63% after reporting better-than-expected results and emphasizing plans to increase capital spending on data centers. Meta rose 4.23% after positive results suggested tech spending remains resilient despite recent economic challenges.

This positive catalyst helped major indices recover significant ground lost since early April's tariff announcements. The tech-heavy Nasdaq Composite led with a 1.31% gain, while the S&P 500 added 0.71% and the Dow Jones increased 0.27%.

Today's enthusiasm was tempered somewhat by economic data showing weekly jobless claims at 241,000, higher than the 225,000 expected. This follows yesterday's surprising GDP contraction and adds to labor market concerns. Also notable was a G30 report suggesting the Federal Reserve should focus more strictly on inflation rather than employment, potentially signaling a policy shift in how economic data is interpreted going forward.

EXECUTIVE SUMMARY

- Tech Leads Market Rally: S&P 500 (+0.71%), Dow (+0.27%), Nasdaq (+1.31%) rallied today, powered by strong Microsoft and Meta earnings

- Tech Earnings Ease Trade Concerns: Microsoft (+7.63%) and Meta (+4.23%) showed AI investments remain strong despite economic uncertainties

- Economic Caution Signs: Weekly jobless claims rose higher than expected (241k vs 225k), following yesterday's negative GDP report

- Market Rotation: Technology sector (+1.77%) significantly outperformed while Healthcare (-2.73%) declined sharply

- Focus Shifts: All eyes now on Friday's jobs report and tonight's Apple and Amazon earnings releases

BROAD MARKET INDICES

Major indices finished significantly higher today, with technology stocks driving the advance. The Nasdaq Composite led with a 1.31% gain, effectively erasing losses experienced since early April. The S&P 500 rose 0.71%, approaching levels seen before President Trump's tariff announcements. The Dow Jones Industrial Average advanced more modestly, up 0.27%, reflecting the concentrated nature of today's tech-driven rally.

Small-cap stocks also participated in the positive sentiment, with the Russell 2000 gaining 0.62%. The PHLX Semiconductor Index added 0.45%, showing some spillover benefit from large-cap tech earnings.

Despite today's strong price action, underlying market conditions suggest caution. The rally appears concentrated in specific sectors rather than showing broad market strength, indicating this may be more of an earnings-driven bounce than a fundamental shift in market direction.

TOP 10 U.S. COMPANIES

Performance among America's largest companies was strongly positive today, particularly within the technology sector following earnings reports.

Microsoft surged 7.63% after beating expectations and providing an optimistic outlook on AI investments. Meta Platforms gained 4.23% following strong results that calmed fears about advertising spending. Amazon rose 3.13% ahead of its own earnings report due after today's close. Other notable performers included Nvidia (+2.47%) and Broadcom (+2.53%), both benefiting from renewed AI optimism.

Not all mega-caps participated equally in today's rally. Tesla declined 0.58% and Berkshire Hathaway fell 0.57%, highlighting the selective nature of today's advance. These divergences suggest investors are making careful distinctions rather than buying the market broadly.

Despite today's impressive gains, the longer-term picture for many of these companies remains mixed. Market conditions continue to show stress signals that could impact future performance, particularly if economic data continues to disappoint.

ECONOMIC INDICATORS

Today's economic data added complexity to the market narrative. Weekly jobless claims rose to 241,000, exceeding expectations and pointing to potential softening in the labor market. This follows yesterday's negative GDP print, raising questions about economic strength.

The labor market's health has taken on added significance as policy discussions evolve. A G30 report recommended the Federal Reserve adopt a stricter inflation focus and drop its broader employment mandate. Treasury Secretary Bessent noted that bond markets are signaling expectations for rate cuts, adding another dimension to the policy outlook.

Consumer strength appears particularly weak based on market signals, with spending patterns showing stress. Corporate earnings outlook remains cautious outside of select technology companies. These conflicting signals - strong tech earnings versus broader economic concerns - create a complex environment for investors heading into tomorrow's important jobs report.

SECTOR OVERVIEW

Sector performance today was dominated by Information Technology (+1.77%), significantly outpacing all other sectors thanks to strong earnings from Microsoft and Meta.

Communication Services (+0.51%) also gained, benefiting from Meta's results. Other sectors showing moderate advances included Industrials (+0.75%) and Consumer Discretionary (+0.55%). Energy managed a modest gain of 0.37%, while Real Estate and Utilities both rose 0.29%.

Defensive sectors generally underperformed, with Consumer Staples falling 0.87%. Healthcare was the worst performer, dropping sharply by 2.73%, likely impacted by Eli Lilly's 11% decline following reduced guidance. Financials finished essentially flat (-0.02%), while Materials declined 0.44%.

Today's sector rotation shows a clear preference for growth over value and suggests investors are selectively pursuing opportunities rather than making broad market bets. This pattern of specific sector leadership rather than broad market strength often occurs during periods of uncertainty.

INTERNATIONAL MARKETS

International markets showed mixed performance today, not fully participating in the US tech-led rally. The US Dollar Index weakened 0.52%, which typically supports international assets.

Despite this currency advantage, developed markets struggled, with European equities falling 0.36% and Japanese stocks also declining 0.36%. This divergence from US markets suggests international investors remain cautious about global growth prospects.

Emerging markets displayed varied results. Emerging Markets Asia managed a slight gain of 0.05%, while India was nearly flat at -0.06%. Latin American markets fell 0.48%, and Chinese equities declined 0.14%.

These mixed international results highlight the selective nature of today's rally, which appears primarily driven by US tech earnings rather than a global improvement in sentiment. Regional economic conditions and trade concerns continue to weigh on markets outside the US.

OTHER ASSETS

Activity across other asset classes reflected the improved risk appetite seen in equities, with traditional safe havens generally weaker.

Treasury prices broadly declined as yields rose amid the equity rally. Short-term Treasury prices fell 0.52%, intermediate Treasury prices declined 0.76%, and long-term Treasury prices dropped 0.87%. The broad US Aggregate Bond index fell 0.60%. This suggests investors moved away from safe-haven assets as equity sentiment improved.

Commodity performance was mixed. WTI Crude Oil gained 1.51%, aligning with the risk-on sentiment. Gold prices fell sharply, declining 2.08%, consistent with reduced safe-haven demand. Agricultural commodities dropped 0.71%, while base metals gained 1.12%, reflecting mixed industrial demand signals.

Digital assets joined the risk-on move, with Bitcoin prices surging 2.69%. This cross-asset picture suggests investors are becoming more selective in their positioning rather than making broad directional bets across all markets.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)