【Joe’s華爾街脈動】道瓊指數大跌近400點,標普500指數連兩黑,貿易協議前景不明

關稅協議希望降溫,股市下跌;聯準會政策決策在即

Joe Lu, CFA 2025年5月6日 美東時間

市場概況

美國股市週二延續跌勢,主要指數連續第二個交易日下跌,因投資者對貿易爭端迅速解決的樂觀情緒降溫。川普總統在與加拿大總理Mark Carney會晤時的言論指出,美國「不必簽署協議」且他將「自行制定協議」,此番言論與財政部長Bessent等政府官員早先較為樂觀的表態形成對比。貿易政策立場反覆,粉碎了對即時突破的希望,並為市場注入了新的不確定性,導致普遍性的拋售。標普500指數和那斯達克綜合指數在盤中跌幅均一度超過收盤數字,隨後才略有緩和。

主要美股指數反映出市場情緒再度轉趨保守。道瓊工業平均指數大跌-0.98%。標普500指數下跌-0.84%,而以科技股為主的那斯達克綜合指數下滑-0.93%。以羅素2000指數為代表的小型股亦下跌,跌幅為-1.09%。負面情緒全面蔓延,標普500指數所有十一大類股全數收黑。

市場參與者亦密切關注美國聯準會為期兩天政策會議的結果,該會議於今日開始,決策及主席鮑爾隨後的記者會定於週三舉行。儘管市場普遍預期央行將維持利率不變,但投資者將仔細審視鮑爾的評論,以獲取聯準會對經濟前景的看法,特別是關於通膨以及持續貿易爭端的潛在衝擊。近期數據,例如週一優於預期但也突顯物價壓力上升和關稅擔憂的ISM服務業PMI,加上上週負面的第一季GDP數據以及今日創紀錄的三月份貿易逆差(1405億美元,受關稅前進口激增推動),為決策者描繪了一幅複雜的景象。對此,億萬富豪對沖基金經理Paul Tudor Jones等評論員表示擔憂,即使縮減對中國的關稅,仍可能相當於大幅增稅,可能對經濟成長構成壓力。

重點摘要

- 主要美股指數連續第二個交易日下跌,因貿易協議的轉變論述重燃投資者謹慎情緒:標普500指數 (-0.84%),道瓊工業平均指數 (-0.98%),那斯達克綜合指數 (-0.93%)。

- 儘管週一公布的ISM服務業報告優於預期,市場仍出現回檔,突顯貿易政策情緒的主導地位。

- 根據分析,潛在的近期市場特性普遍仍屬不利,今日的跌勢強化了近期多數指數和類股的負面訊號。

- 標普500指數所有十一大類股全數收低,由醫療保健 (-2.76%) 和工業 (-0.88%) 領跌。公債價格上漲。

- 市場焦點加劇集中在美國聯準會明日的政策決策,主席鮑爾關於通膨、成長及貿易衝擊的評論備受期待。

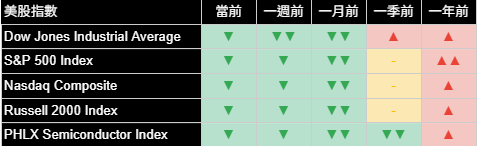

主要市場指數

主要市場指數週二全面下跌,延續本週初以來的回檔走勢。道瓊工業平均指數下跌-0.98%,標普500指數下跌-0.84%,那斯達克綜合指數下跌-0.93%,羅素2000指數回檔-1.09%。再起的賣壓歸因於市場對潛在貿易協議時程與性質的不確定性升高,以及在美國聯準會政策宣布前的謹慎態度。

費城半導體指數當日亦下跌,跌幅為-1.02%。根據底層分析,該族群在多個時間區間內持續呈現明顯偏弱格局,仍是整體科技領域內的主要弱勢區域。

從分析角度來看,今日盤面的全面下跌進一步強化了我們分析所顯示的不利近期市場特性。市場未能維持前一週的反彈,並迅速重回賣壓,這與近期趨勢比較中觀察到的負面訊號一致。這突顯了一個脆弱的市場環境,需要積極的催化劑才能轉變普遍的謹慎情緒。

美國前十大公司

美國大型企業週二表現普遍疲弱,反映出因貿易不確定性再起所引發的廣泛市場拋售。其中,科技股和成長導向型股票跌勢尤為明顯。

觀察個股當日表現:特斯拉 (Tesla Inc) 股價下跌-1.75%。據報導,高盛(Goldman Sachs,非前十大,但為道瓊成分股)下跌,對道瓊指數的下跌有所影響。在前十大公司中,輝達 (NVIDIA Corp) 下跌-0.25%,Meta Platforms Inc 下跌-2.00%。微軟 (Microsoft Corp) 下跌-0.66%,蘋果 (Apple Inc) 回檔-0.19%,亞馬遜 (Amazon.com Inc) 下跌-0.72%。Alphabet Inc A股 (Alphabet Inc Class A) 下跌-0.60%,博通 (Broadcom Inc) 亦下跌-0.31%。摩根大通 (JPMorgan Chase & Co) 下跌-1.31%。波克夏海瑟威B股 (Berkshire Hathaway Inc Class B) 微幅上漲+0.04%。

從底層分析訊號來看,我們的分析指標表示,多數領先企業的近期市場特性仍偏向疲弱或中性。這些個股價格今日普遍走弱,與市場整體謹慎氛圍相符。市場正靜待貿易與貨幣政策進一步明朗化,以及後續財報公布,以決定這些具影響力股票的下一步走向。

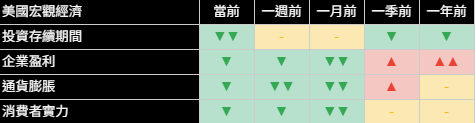

經濟指標

市場今日的焦點較少放在新的經濟數據發布上,而更多地是在變動的貿易局勢和即將到來的美國聯準會政策決策背景下,解讀現有數據。三月份貿易逆差因進口激增而達到創紀錄的1405億美元,突顯出預期關稅所造成的扭曲效應,並導致上週第一季GDP數據呈現負成長。週一優於預期的ISM服務業PMI,雖顯示出韌性,但也反應出物價壓力上升,這對聯準會而言是一項潛在隱憂。

我們整套經濟指標持續反映出市場潛在環境偏向保守。分析仍顯示,關於投資存續期間的訊號極為不利,反映出市場強烈偏好最短投資期限,並伴隨加劇的不確定性。消費者信心訊號依然疲弱,與近期官方數據揭示的消費者信心下滑一致。同樣地,從市場分析推估出的企業獲利前景亦持續不利。目前通膨訊號顯示,價格壓力較先前有所緩和,接近中性區間。但ISM的支付價格分項表明上游壓力可能持續存在;根據我們的分析,通膨訊號較前一日並未進一步緩和。這種好壞參半的官方數據以及我們專有指標持續謹慎的背景,突顯了聯準會在其明日溝通中必須達成的微妙平衡。

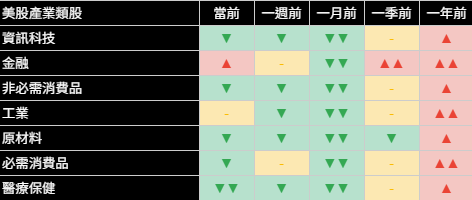

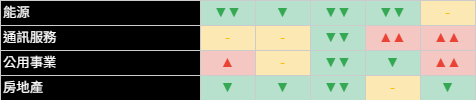

類股概況

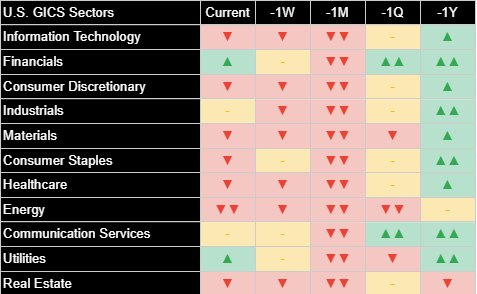

隨著貿易協議不確定性重燃以及在美國聯準會政策決策前的謹慎態度,引發市場普遍回檔,標準普爾500指數各類股週二表現一致為負。十一個標準普爾500類股一致收黑。

週期性和成長導向型類股受創最重。醫療保健類股 (-2.76%) 急劇下跌。工業類股 (-0.88%) 和非必需消費品類股 (-0.87%) 亦見顯著跌幅。資訊科技類股 (-0.85%) 下跌,輝達和Meta等指標股對其疲弱表現有所影響。原物料類股 (-0.72%) 和金融類股 (-0.57%) 亦回檔。防禦型類股雖亦下跌,但表現各異:公用事業類股 (+1.22%) 在市場普遍下跌的情況下,相對表現突出,而必需消費品類股 (-0.17%) 跌幅較小。房地產類股 (-0.73%) 和通訊服務類股 (-0.02%) 亦收低。能源類股 (+0.02%) 收盤近乎持平。

從分析角度來看,今日各類股普遍下跌,進一步強化了我們對多數市場領域近期狀況不利或中性的看法。各類股整體缺乏明確的強勁表現,突顯了今日普遍的謹慎情緒,並與我們底層分析所呈現的負面訊號一致。

國際市場

隨著對即時貿易協議的希望因新的評論而降溫,國際市場週二亦普遍下跌,與美國市場的負面情緒相呼應。美元走弱,當日下跌-0.62%。

已開發市場回檔:歐洲股市下跌-0.26%,而日本股市則上漲+0.06%。這些市場對全球貿易相關訊息及來自美國的政策變動仍然高度敏感。

新興市場表現好壞參半:新興亞洲市場下跌-0.47%,印度下跌-1.18%,而拉丁美洲則上漲+0.85%,中國股市上漲+1.03%。這種好壞參半的表現,突顯了在某些地區貿易不確定性下全球風險趨避情緒升高,而其他地區則展現出韌性。

其他資產

週二其他資產類別的活動普遍反映了避險情緒,債券吸引了一些避險買盤(價格上漲,殖利率下降),大宗商品表現好壞參半,美元走弱。

固定收益方面,在股市拋售和聯準會決策前,投資者尋求避險,美國公債價格上漲。短期公債價格上漲+0.08%,中期公債價格上漲+0.25%,長期公債價格上漲+0.33%。整體美國綜合債券價格亦上漲+0.25%,殖利率曲線全面下降。

大宗商品表現各異。WTI原油上漲+3.58%。黃金價格上漲+2.80%。農產品上漲+0.64%。基本金屬亦上漲+0.33%。美元指數走弱,下跌-0.62%。在數位資產方面,比特幣價格上漲+0.63%。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。 Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。 Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Dow Slides Nearly 400 Points, S&P 500 Books Back-to-Back Losses as Path on Trade Deals Remains Unclear

Stocks Fall as Tariff Deal Hopes Fade; Fed Policy Decision Looms

Joe Lu, CFA May 6, 2025

MARKET OVERVIEW

U.S. equity markets extended losses on Tuesday, with major indices posting their second consecutive day of declines as investor optimism regarding swift resolutions to trade disputes faded. President Trump's comments during a meeting with Canadian Prime Minister Mark Carney, suggesting the U.S. doesn't "have to sign deals" and that he would "set my own deals," appeared to contradict earlier, more hopeful statements from administration officials, including Treasury Secretary Bessent. This wavering stance on trade policy dashed hopes for imminent breakthroughs and injected fresh uncertainty into the market, leading to a broad-based sell-off. The S&P 500 and Nasdaq Composite both saw losses exceed their final reported figures during intraday trading before a slight moderation.

The major U.S. stock indices reflected this renewed caution. The Dow Jones Industrial Average fell sharply by -0.98%. The S&P 500 Index shed -0.84%, and the technology-heavy Nasdaq Composite Index dipped -0.93%. Small-capitalization stocks, represented by the Russell 2000 Index, also declined, losing -1.09%. The negative sentiment was pervasive, with all eleven S&P 500 sectors closing in negative territory.

Market participants are also keenly awaiting the outcome of the Federal Reserve's two-day policy meeting, which began today with a decision and subsequent press conference by Chair Jerome Powell scheduled for Wednesday. While the central bank is widely expected to keep interest rates unchanged, investors will scrutinize Powell's commentary for insights into the Fed's economic outlook, particularly concerning inflation and the potential impacts of the ongoing trade disputes. Recent data, such as Monday's stronger-than-expected ISM Services PMI which also highlighted rising price pressures and tariff concerns, coupled with last week's negative Q1 GDP print and today's record March trade deficit ($140.5 billion, driven by a surge in imports pre-tariffs), paints a complex picture for policymakers. Commentators like billionaire hedge fund manager Paul Tudor Jones expressed concerns that even a dialing back of China tariffs could still equate to a significant tax increase, potentially dragging on economic growth.

EXECUTIVE SUMMARY

- Major U.S. indices declined for a second consecutive session as shifting commentary on trade deals renewed investor caution: S&P 500 Index (-0.84%), Dow Jones Industrial Average (-0.98%), Nasdaq Composite Index (-0.93%).

- The market pullback occurred despite a stronger-than-expected ISM Services report on Monday, underscoring the dominance of trade policy sentiment.

- Underlying near-term market character remained broadly unfavorable according to analysis, with today's declines reinforcing recent negative signals across most indices and sectors.

- All eleven S&P 500 sectors finished lower, led by Healthcare (-2.76%) and Industrials (-0.88%). Treasury prices gained.

- Focus intensifies on the Federal Reserve's policy decision tomorrow, with Chair Powell's commentary on inflation, growth, and trade impacts highly anticipated.

BROAD MARKET INDICES

Broad market indices declined across the board on Tuesday, continuing the pullback that began the week. The Dow Jones Industrial Average fell -0.98%, the S&P 500 Index lost -0.84%, the Nasdaq Composite Index dropped -0.93%, and the Russell 2000 Index retreated -1.09%. The renewed selling pressure was attributed to increased uncertainty surrounding the timeline and nature of potential trade deals, as well as caution ahead of the Federal Reserve's policy announcement.

The PHLX Semiconductor Index also declined, falling -1.02% on the day. This group continues to exhibit pronouncedly unfavorable conditions across multiple timeframes according to underlying analysis, remaining a key area of weakness within the broader technology space.

From an analytical perspective, today's broad declines further reinforce the unfavorable near-term market character suggested by our analysis. The inability of the market to sustain the prior week's rally and the quick return to selling pressure align with the negative signals observed in recent trend comparisons. This underscores a fragile market environment where positive catalysts are needed to shift the prevailing cautious sentiment.

TOP 10 U.S. COMPANIES

Performance among the largest U.S. companies was predominantly negative on Tuesday, reflecting the broad market sell-off driven by renewed trade uncertainties. Technology and growth-oriented names were particularly affected.

Looking at individual stock performance for the day: Tesla Inc shares shed -1.75%. Goldman Sachs (not in top 10, but a Dow component) reportedly dipped, contributing to the Dow's decline. Among the top 10, NVIDIA Corp fell -0.25% and Meta Platforms Inc declined -2.00%. Microsoft Corp lost -0.66%, Apple Inc retreated -0.19%, and Amazon.com Inc was down -0.72%. Alphabet Inc Class A fell -0.60%, and Broadcom Inc also declined -0.31%. JPMorgan Chase & Co fell -1.31%. Berkshire Hathaway Inc Class B managed a slight gain of +0.04%.

Interpreting the underlying analytical signals, the near-term market character for most of these leading companies remained unfavorable or neutral according to our indicators. Today's negative price action for the majority of these stocks is consistent with this underlying caution. The market awaits further clarity on trade and monetary policy, as well as ongoing earnings reports, to determine the next directional move for these influential names.

ECONOMIC INDICATORS

The market's focus today was less on new economic data releases and more on interpreting existing data in the context of shifting trade narratives and the upcoming Federal Reserve policy decision. The March trade deficit hitting a record $140.5 billion, driven by a surge in imports, highlighted the distortions caused by anticipated tariffs and contributed to last week's negative Q1 GDP reading. Monday's stronger-than-expected ISM Services PMI, while indicating resilience, also pointed to rising price pressures, a concern for the Fed.

Our suite of economic indicators continued to reflect a cautious underlying environment. Analysis still indicated a pronouncedly unfavorable signal regarding Investment Duration, reflecting a strong preference for the shortest investment horizons and heightened uncertainty. The Consumer Strength signal remained weak, consistent with recent official data showing a dip in consumer confidence. Similarly, the outlook for Corporate Earnings derived from market analysis also remained unfavorable. Inflation signals currently suggest easing price pressures relative to neutral, but the ISM's prices paid component suggests upstream pressures may persist; there was no further easing in the inflation signal day-over-day according to our analysis. This backdrop of mixed official data and consistently cautious proprietary signals underscores the delicate balance the Fed must strike in its communications tomorrow.

SECTOR OVERVIEW

Sector performance within the S&P 500 was uniformly negative on Tuesday, as renewed trade deal uncertainty and caution ahead of the Federal Reserve's policy decision prompted a broad market retreat. All eleven S&P 500 sectors finished in negative territory.

Cyclical and growth-oriented sectors were among the hardest hit. Healthcare (-2.76%) experienced a sharp drop. Industrials (-0.88%) and Consumer Discretionary (-0.87%) also saw notable declines. Information Technology (-0.85%) fell, with bellwethers like Nvidia and Meta contributing to the weakness. Materials (-0.72%) and Financials (-0.57%) also retreated. Defensive sectors, while also declining, showed varied results: Utilities (+1.22%) was a notable outperformer on a relative basis despite the negative market, while Consumer Staples (-0.17%) saw a smaller loss. Real Estate (-0.73%) and Communication Services (-0.02%) also finished lower. Energy (+0.02%) managed to close nearly flat.

From an analytical perspective, today's across-the-board sector declines reinforce the unfavorable or neutral near-term conditions indicated by our analysis for the majority of the market. The lack of any sector showing truly strong positive returns highlights the pervasive nature of today's cautious sentiment and aligns with the negative signals that have been present in our underlying analysis.

INTERNATIONAL MARKETS

International markets also broadly declined on Tuesday, mirroring the negative sentiment in the U.S. as hopes for imminent trade deals were tempered by new commentary. The U.S. Dollar weakened, falling -0.62% for the day.

Developed markets retreated: European equities fell -0.26% while Japanese equities gained +0.06%. These markets remain highly sensitive to global trade narratives and policy shifts emanating from the U.S.

Emerging markets performance was mixed: Emerging Markets Asia fell -0.47%, India declined -1.18%, while Latin America gained +0.85%, and Chinese equities rose +1.03%. The mixed performance underscores heightened global risk aversion amid trade uncertainty in some regions, while others showed resilience.

OTHER ASSETS

Activity across other asset classes on Tuesday generally reflected a risk-off sentiment, with bonds attracting some haven bids (prices higher, yields lower), commodities mixed, and the dollar weakening.

In fixed income, U.S. Treasury prices gained as investors sought safety amidst the equity market sell-off and ahead of the Fed decision. Short-term Treasury prices rose +0.08%, Intermediate Treasury prices gained +0.25%, and Long-term Treasury prices increased +0.33%. Broad U.S. Aggregate Bond prices also advanced +0.25%, as yields fell across the curve.

Commodity performance was mixed. WTI Crude Oil rose +3.58%. Gold prices gained +2.80%. Agricultural Commodities rose +0.64%. Base Metals also gained +0.33%. The US Dollar Index weakened, falling -0.62%. In digital assets, Bitcoin prices gained +0.63%.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)