【Joe’s華爾街脈動】川普揭示英美貿易協議,股市上漲;對聯準會的批評持續

關稅暫停後首個協議提振市場,但細節不明且整體貿易疑慮猶存

Joe Lu, CFA 2025年5月8日 美東時間

市場概況

美國股市週四上揚,受美英兩國宣布達成新貿易協議的消息激勵。這是自政府於四月初啟動為期90天、暫停更廣泛「互惠」關稅以來,首度達成的的此類協議。川普總統在白宮橢圓形辦公室舉行活動,並與英國首相Keir Starmer遠端連線,概述了該協議。據報導,該協議維持美國對英國商品10%的基線關稅,但針對汽車進口做出部分調整,並納入擴大美國農產品輸入的條款,旨在為美國農民創造50億美元的機會。儘管該協議被稱為「全面且完整」的協議,但具體細節有限,川普總統指出最終細節仍在敲定中。

此正面頭條消息足以提振盤中市場情緒。標普500指數上漲+0.70%。道瓊工業平均指數上漲+0.69%,而以科技股為主的那斯達克綜合指數上揚+1.03%。以羅素2000指數為代表的小型股強勁上漲+1.90%。儘管一些專家評論淡化了該協議的整體重要性,指出美國對英國已存在貿易順差,暗示此協議可能不易作為與存在巨大逆差國家談判的可複製範本,市場仍作出正面反應。

延續當日市場關注焦點,川普總統在昨日央行決定維持利率不變後,持續公開批評美國聯準會及主席鮑爾。川普重申其降息的願望,並形容較低的利率將如同「噴射燃料」為市場與經濟注入動能,並再度指責鮑爾在政策寬鬆方面「動作太慢」。他同時重申政府對關稅的立場,指出適用於英美協議的10%基線是一個「低數字」,並暗示對於與美國存在巨大貿易順差的國家,稅率可能「高得多」。此番言論突顯了白宮推動貨幣政策寬鬆,與聯準會聲稱在貿易政策不確定性中專注管理通膨和就業相關風險之間的持續緊張關係。

重點摘要

- 主要美股指數週四上漲,因政府宣布自關稅暫停以來的首個貿易協議,與英國達成協議:標普500指數 (+0.70%),道瓊工業平均指數 (+0.69%),那斯達克綜合指數 (+1.03%)。

- 英美協議維持美國10%的基線關稅,但調整汽車關稅並給予部分美國農產品出口准入;具體細節仍然有限。

- 儘管市場反應正面,根據分析,潛在的近期市場特性普遍仍屬不利。

- 科技類股 (+1.18%) 和非必需消費品類股 (+1.18%) 領漲各類股;必需消費品類股 (-0.12%) 和醫療保健類股 (-0.90%) 則表現落後。公債價格下跌。

- 川普總統重申對聯準會的批評,呼籲降息,同時維持對基線關稅的堅定立場,暗示更廣泛的貿易解決方案依然複雜。

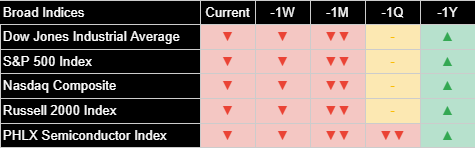

主要市場指數

受美英貿易協議宣布的提振,主要市場指數週四穩健收高。標普500指數 (+0.70%)、道瓊工業平均指數 (+0.69%) 和那斯達克綜合指數 (+1.03%) 均錄得健康漲幅。小型股表現顯著優於大盤,羅素2000指數飆升+1.90%。市場的正面反應顯示,自關稅暫停以來首次見到實質性的貿易談判成果,市場情緒有所寬慰。

費城半導體指數上漲+0.93%,參與了整體科技股的反彈,但表現略遜於那斯達克綜合指數。根據底層分析,儘管當日走勢正面,該族群在多個時間區間內仍持續呈現不利狀況。

從分析角度來看,儘管今日漲幅普遍且受投資者歡迎,但根據我們基於近期趨勢比較的分析,主要指數的潛在近期市場特性普遍仍屬不利。今日的價格上漲建立在近期的波動之上,但在我們的指標框架內,尚未確認前幾週觀察到的負面訊號出現持久的逆轉。若要改善潛在的技術面,仍需後續持續的正向走勢配合。

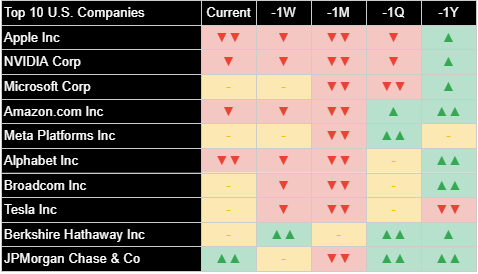

美國前十大公司

美國大型企業週四表現普遍強勁正面,科技股和成長型股票在整體市場反彈的帶動下領漲。

觀察個股當日表現:特斯拉 (Tesla Inc) 飆升+3.11%。亞馬遜 (Amazon.com Inc) 在其財報公布後上漲+1.79%。輝達 (NVIDIA Corp) 上漲+0.26%。微軟 (Microsoft Corp) 上漲+1.11%。博通 (Broadcom Inc) 上揚+1.45%。Alphabet Inc A股 (Alphabet Inc Class A) 上漲+1.92%。蘋果 (Apple Inc) 上漲+0.63%。Meta Platforms Inc 上漲+0.20%。摩根大通 (JPMorgan Chase & Co) 上漲+1.64%。唯一顯著的例外是波克夏海瑟威B股 (Berkshire Hathaway Inc Class B),下跌-0.96%。

從底層分析訊號來看,儘管今日價格走勢強勁正面,但我們的分析指標表示,多數領先企業的近期市場特性仍偏向疲弱或中性。這種持續的分歧表明,雖然市場情緒因貿易消息而有所改善,但先前分析所識別的潛在弱點目前依然存在。根據分析,波克夏海瑟威仍是個例外,顯示出較為穩定的潛在特性。

經濟指標

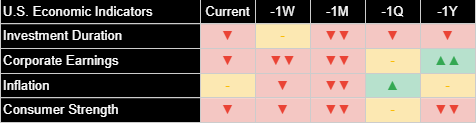

今日市場局勢主要受貿易政策消息(英美協議)和總統對貨幣政策的評論所主導,而非重大的新經濟數據發布。川普總統明確呼籲美國聯準會降息,同時為其關稅政策辯護,突顯了財政/貿易政策與貨幣政策目標之間的持續張力。他聲稱「幾乎沒有通膨」的說法,與聯準會昨日聲明中承認通膨和失業雙雙面臨風險上升的情況形成對比,並且可能與某些市場基礎指標所反映的通膨壓力仍偏正面的長期訊號相衝突,即使我們近期的通膨經濟指標讀數今日已轉為中性。

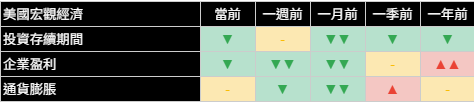

我們整套經濟指標反映出,與前一日相比,一些潛在狀況略有改善,但仍需保持謹慎。分析顯示,投資存續期間的訊號從極為不利改善至中度不利,表明即時不確定性略有減輕,但仍偏好較短的投資期限。企業獲利前景依然不利,而消費者信心訊號亦持續疲弱。如前所述,通膨訊號從不利(趨緩)轉為中性,表明根據今日的市場訊號,物價壓力並未進一步下降。總體而言,這些指標描繪出一個即時風險可能略有消退,但潛在弱點和不確定性依然存在的經濟體,尤其是在企業獲利和消費者方面。

類股概況

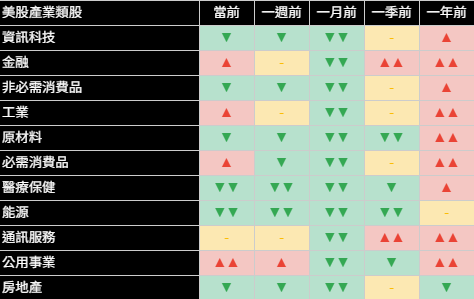

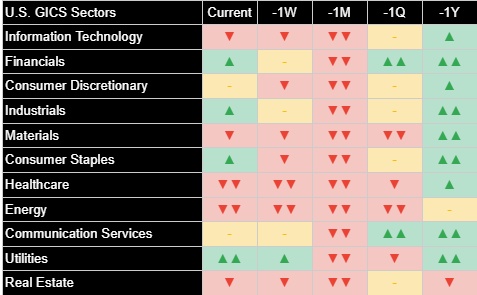

在英美貿易協議宣布後市場情緒改善的推動下,標準普爾500指數各類股週四普遍表現正面。漲勢由成長導向型和週期性類股領軍。

資訊科技類股 (+1.18%) 和非必需消費品類股 (+1.18%) 是表現最佳的類股,顯示市場對成長股的偏好重燃。工業類股 (+1.38%) 和原物料類股 (+1.35%) 亦錄得強勁漲幅,或許受惠於對貿易關係趨於平順的期望。金融類股 (+0.83%) 穩健上揚。通訊服務類股 (+0.24%)、能源類股 (+1.32%) 和房地產類股 (-0.25%) 則呈現較溫和的走勢或微幅下跌。防禦型類股在此波反彈中表現落後,必需消費品類股 (-0.12%) 和醫療保健類股 (-0.90%) 收低,而公用事業類股 (-0.80%) 亦回檔。

從分析角度來看,儘管今日普遍上漲,但我們分析所顯示的多數類股潛在近期狀況仍為不利或中性。雖然週期性和成長型領域的強勁表現令人鼓舞,但此一走勢發生於先前分析建議保持謹慎的背景下。今日的正面價格走勢尚未在我們的框架內,為多數類股帶來明確的正面分析訊號轉變。

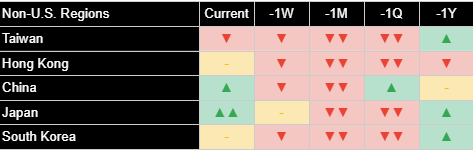

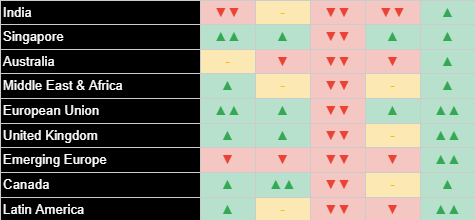

國際市場

國際市場週四對美英貿易協議的宣布以及普遍改善的風險情緒作出正面反應,儘管反應溫和。美元走強,當日上漲+0.84%。

儘管有此消息,已開發市場大多收低:歐洲股市下跌-0.37%,日本股市下跌-0.21%。相對平淡的反應和收黑表明市場對此特定英美協議的更廣泛影響持懷疑態度,或受到區域性因素的壓制。然而,分析持續顯示,從較長的時間區間來看,這些地區的潛在正向特徵正在增強。

新興市場表現亦好壞參半:新興亞洲市場收盤近乎持平 (-0.04%),印度大跌 (-3.16%),而拉丁美洲則上漲+1.98%。中國股市上漲+1.44%。印度市場的顯著下跌與其他地區普遍穩定至正面的背景形成對比。

其他資產

週四其他資產類別的活動反映了股市風險偏好的改善以及貿易公告中具體細節(或缺乏細節)的影響。債券遭拋售,殖利率隨之上揚,美元走強,大宗商品則表現好壞參半。

固定收益方面,美國公債價格下跌,殖利率隨之走高,逆轉了前一日的走勢。短期公債價格下跌-0.21%,中期公債價格下跌-0.78%,長期公債價格下滑-1.09%。整體美國綜合債券價格下跌-0.52%。此次拋售顯示,在股市對貿易消息作出正面反應的情況下,對避險資產的需求減少。

大宗商品表現好壞參半。WTI原油上漲+3.29%。黃金價格下跌-1.97%,可能受到美元走強和避險需求減少的壓力。基本金屬上漲+1.00%。農產品微幅上漲+0.15%。美元指數顯著走強,上漲+0.84%。在數位資產方面,比特幣價格飆升+5.38%,與股市的風險偏好情緒呈現強勁的正相關。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。 Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。 Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Stocks Rise as Trump Unveils UK Trade Deal; Fed Criticism Continues

Market Gains on First Post-Tariff Pause Deal, But Details Scant and Broader Trade Doubts Linger

Joe Lu, CFA May 8, 2025

MARKET OVERVIEW

U.S. equity markets advanced on Thursday, finding support from the announcement of a new trade agreement between the United States and the United Kingdom. This marks the first such deal unveiled since the administration initiated a 90-day pause on broader "reciprocal" tariffs in early April. President Trump, in an Oval Office event joined remotely by UK Prime Minister Keir Starmer, outlined the deal which reportedly keeps the baseline 10% U.S. tariff on UK goods but includes adjustments for auto imports and provisions for increased U.S. agricultural access, aiming for a $5 billion opportunity for American farmers. While presented as a "full and comprehensive" agreement, specifics were limited, with President Trump noting final details were still being finalized.

The positive headline was sufficient to lift market sentiment during the session. The S&P 500 Index gained +0.70%. The Dow Jones Industrial Average rose +0.69%, and the technology-heavy Nasdaq Composite Index climbed +1.03%. Small-capitalization stocks, represented by the Russell 2000 Index, posted a strong gain of +1.90%. The positive reaction occurred despite some expert commentary downplaying the deal's broader significance, noting the U.S. already runs a trade surplus with the UK, suggesting this agreement may not be an easily repeatable template for negotiations with countries where large deficits exist.

Adding to the day's narrative, President Trump continued his public criticism of the Federal Reserve and Chair Jerome Powell following the central bank's decision to hold interest rates steady yesterday. Trump reiterated his desire for rate cuts, suggesting lower rates would act like "jet fuel" for the markets and economy, and repeated his characterization of Powell as being "too late" on policy easing. He also reinforced his administration's stance on tariffs, stating that the 10% baseline applied to the UK deal was a "low number" and implying rates could be "much higher" for countries with large trade surpluses against the U.S. This commentary underscores the ongoing tension between the White House's push for looser monetary policy and the Fed's stated focus on managing risks related to both inflation and employment amidst trade policy uncertainty.

EXECUTIVE SUMMARY

- Major U.S. indices gained Thursday as the administration announced its first trade deal since the tariff pause, reaching an agreement with the UK: S&P 500 Index (+0.70%), Dow Jones Industrial Average (+0.69%), Nasdaq Composite Index (+1.03%).

- The UK deal keeps baseline US tariffs at 10% but adjusts auto tariffs and grants access for some US agricultural exports; specifics remain limited.

- Despite the positive market reaction, underlying near-term market character remained broadly unfavorable according to analysis.

- Technology (+1.18%) and Consumer Discretionary (+1.18%) led sector gains; Consumer Staples (-0.12%) and Healthcare (-0.90%) lagged. Treasury prices fell.

- President Trump reiterated criticism of the Fed, calling for rate cuts while maintaining a firm stance on keeping baseline tariffs, suggesting broader trade resolutions remain complex.

BROAD MARKET INDICES

Broad market indices finished solidly higher on Thursday, buoyed by the announcement of the U.S.-U.K. trade agreement. The S&P 500 Index (+0.70%), Dow Jones Industrial Average (+0.69%), and Nasdaq Composite Index (+1.03%) all posted healthy gains. Small caps significantly outperformed, with the Russell 2000 Index surging +1.90%. The positive market response suggests relief at seeing the first tangible outcome of trade negotiations since the tariff pause began.

The PHLX Semiconductor Index gained +0.93%, participating in the broader technology rally but slightly underperforming the Nasdaq Composite. Underlying analysis for this group continues to indicate unfavorable conditions across multiple timeframes, despite the positive daily move.

From an analytical perspective, while today's gains were broad and welcomed by investors, the underlying near-term market character across the major indices remained predominantly unfavorable according to our analysis based on recent trend comparisons. Today's price surge builds on recent volatility but has not yet confirmed a durable reversal of the negative signals observed over the preceding weeks within our indicator framework. Continued positive follow-through would be needed to improve the underlying technical picture.

TOP 10 U.S. COMPANIES

Performance among the largest U.S. companies was overwhelmingly positive on Thursday, with technology and growth names leading the advance alongside the broader market rally.

Looking at individual stock performance for the day: Tesla Inc surged +3.11%. Amazon.com Inc gained +1.79% following its earnings report. NVIDIA Corp rose +0.26%. Microsoft Corp added +1.11%. Broadcom Inc climbed +1.45%. Alphabet Inc Class A gained +1.92%. Apple Inc rose +0.63%. Meta Platforms Inc added +0.20%. JPMorgan Chase & Co gained +1.64%. The only notable outlier was Berkshire Hathaway Inc Class B, which fell -0.96%.

Interpreting the underlying analytical signals, the near-term market character for most of these leading companies remained unfavorable or neutral according to our indicators, despite the strong positive price moves today. This continued divergence suggests that while sentiment improved on the trade news, the underlying weakness identified by analysis earlier persists for now. Berkshire Hathaway remains an exception with more stable underlying characteristics indicated by analysis.

ECONOMIC INDICATORS

Today's market narrative was dominated by trade policy news (the UK deal) and presidential commentary on monetary policy, rather than significant new economic data releases. President Trump's explicit call for the Federal Reserve to cut interest rates, juxtaposed with his simultaneous defense of tariffs, highlights the ongoing tension between fiscal/trade policy and monetary policy objectives. His assertion of "virtually NO INFLATION" contrasts with the Fed's own statement yesterday acknowledging rising risks to both inflation and unemployment, and potentially conflicts with the still-positive longer-term signals for inflation pressures reflected in some market-based indicators, even as our near-term Inflation economic indicator reading moved to neutral today.

Our suite of economic indicators reflected a slight improvement in some underlying conditions compared to the previous day, though caution remains warranted. Analysis indicated the signal for Investment Duration improved from pronouncedly unfavorable to moderately unfavorable, suggesting a marginal lessening of immediate uncertainty, but still favoring shorter horizons. The outlook for Corporate Earnings remained unfavorable, while the Consumer Strength signal also stayed weak. As mentioned, the Inflation signal shifted from unfavorable (easing) to neutral, suggesting price pressures are not actively falling further according to market signals today. Overall, the indicators portray an economy where immediate risks may have slightly receded, but underlying weaknesses and uncertainties persist, particularly concerning earnings and the consumer.

SECTOR OVERVIEW

Sector performance within the S&P 500 was broadly positive on Thursday, driven by the improved sentiment following the UK trade deal announcement. Gains were led by growth-oriented and cyclical sectors.

Information Technology (+1.18%) and Consumer Discretionary (+1.18%) were the top-performing sectors, indicating renewed appetite for growth stocks. Industrials (+1.38%) and Materials (+1.35%) also posted strong gains, perhaps benefiting from hopes of smoother trade relations. Financials (+0.83%) advanced solidly. Communication Services (+0.24%), Energy (+1.32%), and Real Estate (-0.25%) saw more modest moves or slight declines. Defensive sectors lagged the rally, with Consumer Staples (-0.12%) and Healthcare (-0.90%) finishing lower, while Utilities (-0.80%) also retreated.

From an analytical perspective, despite the broad gains today, the underlying near-term conditions indicated by our analysis remained unfavorable or neutral for most sectors. While the strong performance in cyclical and growth areas is encouraging, it occurred against a backdrop where analysis previously suggested caution. Today's positive price action has not yet generated a confirmed positive shift in the underlying analytical signals for most sectors within our framework.

INTERNATIONAL MARKETS

International markets reacted positively, albeit modestly, to the announcement of the U.S.-U.K. trade deal and the generally improved risk sentiment on Thursday. The U.S. Dollar strengthened, rising +0.84% for the day.

Developed markets were mostly lower despite the news: European equities fell -0.37% and Japanese equities declined -0.21%. The relatively muted reaction and negative close suggest skepticism about the broader implications of the specific UK deal or overriding regional factors. Analysis, however, continues to indicate underlying strengthening positive characteristics for these regions over longer horizons.

Emerging markets performance was also mixed: Emerging Markets Asia finished nearly flat (-0.04%), India fell sharply (-3.16%), while Latin America gained +1.98%. Chinese equities advanced +1.44%. The significant drop in India stands out against the generally stable-to-positive backdrop elsewhere.

OTHER ASSETS

Activity across other asset classes on Thursday reflected the improved risk appetite in equities and the specific details or lack thereof in the trade announcement. Bonds sold off as yields rose, while the dollar strengthened, and commodities were mixed.

In fixed income, U.S. Treasury prices declined as yields moved higher, reversing the previous day's move. Short-term Treasury prices fell -0.21%, Intermediate Treasury prices dropped -0.78%, and Long-term Treasury prices slid -1.09%. Broad U.S. Aggregate Bond prices decreased -0.52%. The sell-off indicates reduced demand for safe-haven assets amid the positive equity market reaction to the trade news.

Commodity performance was mixed. WTI Crude Oil gained +3.29%. Gold prices fell -1.97%, likely pressured by the stronger dollar and reduced haven demand. Base Metals rose +1.00%. Agricultural Commodities edged up +0.15%. The US Dollar Index strengthened notably, rising +0.84%. In digital assets, Bitcoin prices surged +5.38%, showing strong positive correlation with the risk-on sentiment in equities.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)