【Joe’s華爾街脈動】道瓊指數上揚,那斯達克指數中止連漲;關稅現實與聯準會的平衡成焦點

市場消化零售疲弱與通膨數據;持續的經濟風險下,浮現防禦性傾向

Joe Lu, CFA 2025年5月15日 美東時間

市場概況

美國股市週四呈現漲跌互見,本週稍早因美中貿易休兵引發的初步樂觀情緒,已讓位給對經濟現實和政策複雜性更為審慎的評估。道瓊工業平均指數上揚,標普500指數溫和收高,而以科技股為主的那斯達克綜合指數則結束了連續六天的漲勢。此表現反映出市場正在努力應對關稅的實際衝擊(零售巨擘沃爾瑪的警告即為證明),同時消化好壞參半的經濟數據訊號,以及美國聯準會在避免經濟衰退與管理持續通膨壓力之間微妙的平衡。

標普500指數上漲+0.49%。道瓊工業平均指數上漲+0.70%。相較之下,那斯達克綜合指數下跌-0.11%。代表小型股的羅素2000指數上漲+0.65%。儘管川普總統持續強調貿易談判取得進展,並提及印度可能提供零關稅,但美國企業界已開始列出實際成本。沃爾瑪股價下跌-0.50%,因該公司明確表示無法吸收所有增加的成本,物價將因關稅上漲。無。這種直接轉嫁給消費者的情況,預計很快將衝擊民眾荷包,對支出構成重大風險。

四月份的零售銷售數據突顯了企業的此種謹慎態度,該數據急劇放緩(總體月增0.1%,控制組月減-0.2%),與三月份關稅實施前的激增形成鮮明對比。鑑於市場普遍認為經濟正處於衰退邊緣,此消費者活動的趨緩是一個關鍵的發展,而美國聯準會正試圖透過向金融體系提供潛在流動性的措施,來防止此情景發生。儘管此類行動可能為風險資產帶來支撐,但也同時助長試圖控制通膨的風險,尤其是在關稅導致成本壓力加劇的情況下。看似較為正面的消息是,四月份生產者物價指數(PPI)意外地月減-0.5%。然而,美國聯準會主席鮑爾週四對於美國可能進入一個「供給衝擊」更頻繁且通膨更波動時期的言論,突顯了持續存在的挑戰。這些因素——聯準會的流動性、來自關稅和政策的持續通膨風險、實際的消費者行為,以及近期顯示資本回流美國的跡象——之間的相互作用,將成為決定市場走向的關鍵。

重點摘要

美國股市週四表現分歧:道瓊工業平均指數(+0.70%)上漲,標普500指數(+0.49%)溫和收高,那斯達克綜合指數(-0.11%)則中止連續六天的漲勢,反映潛在的市場緊張情緒。

- 沃爾瑪(-0.50%)警告稱,儘管批發通膨(PPI月減-0.5%)有所趨緩(PPI月減-0.5%),但關稅將導致物價上漲,且四月份零售銷售急劇放緩,突顯了消費者面臨的實質困難,。這突顯了關稅對聯準會擺脫衰退的努力所構成的持續風險。

- 公用事業(+2.13%)和必需消費品(+2.05%)等防禦型類股表現突出,顯示投資者潛在的謹慎態度,即使聯準會似乎正在提供市場流動性。

- 分析顯示近期市場特性依然好壞參半。投資存續期間仍極為不利,儘管消費者信心和通膨指標走強——後者可能同時受到關稅和聯準會流動性的推動,構成重大挑戰。

- 投資者關注焦點:監控聯準會在支撐市場的同時,能否避免加劇持續的通膨;關稅對消費者支出的真實影響;以及若衰退風險具體化,資本流入美國的趨勢能否持續。

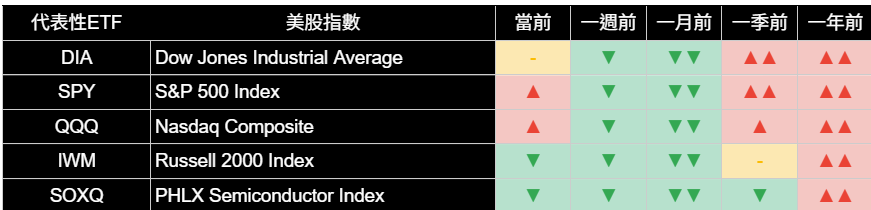

主要市場指數

主要市場指數週四收盤漲跌互見,投資者一方面消化企業對關稅的警告,另一方面評估參差不齊的經濟數據。道瓊工業平均指數上漲+0.70%,標普500指數上漲+0.49%。然而,那斯達克綜合指數中止連續六天的漲勢,下跌-0.11%。代表小型股的羅素2000指數穩步上漲+0.65%。此種分歧指向投資者的選擇性,以及在當前經濟多空交錯下,對價值所在的持續評估。

費城半導體指數當日下跌-0.59%,回吐了部分近期的強勁漲幅。儘管出現回檔,底層分析顯示短期特性最近有所改善,但長期的不利條件依然存在,反映出AI樂觀情緒與整體經濟及關稅擔憂之間波動的拉鋸。

從分析角度來看,儘管今日市場表現分歧,根據我們的指標,標普500指數和那斯達克綜合指數的近期市場特性仍維持有利;不過,這些訊號的有效性仍將面臨關稅不確定性和即將公布的經濟數據的考驗。道瓊工業平均指數和羅素2000指數則雙雙維持中度不利的評估。這種好壞參半的分析景象突顯了市場當前的變動狀態。

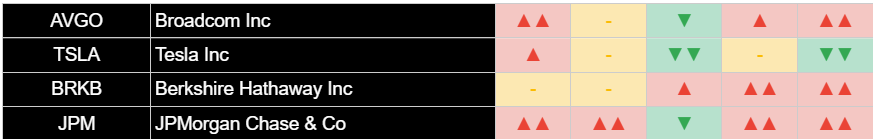

美國前十大公司

美國大型企業週四表現好壞參半,在近期強勁上漲後,「七巨頭」中部分個股出現顯著下跌,反映出整體市場謹慎和輪動的情緒。

觀察個股當日表現:亞馬遜(Amazon.com Inc)下跌-2.42%,據報導與其裝置部門傳出裁員消息有關。Meta Platforms Inc 亦下跌,跌幅為-2.35%,有報導稱其旗艦AI模型可能延遲推出。蘋果(Apple Inc)下滑-0.41%,輝達(NVIDIA Corp)則下跌-0.38%。特斯拉(Tesla Inc)亦下跌-1.40%。相較之下,微軟(Microsoft Corp)(+0.04%)和Alphabet Inc A股(Alphabet Inc Class A)(-0.85%)的波動較為溫和。博通(Broadcom Inc)(+0.22%)則設法上漲。金融股表現好壞參半,摩根大通(JPMorgan Chase & Co)上漲+0.70%,而波克夏海瑟威B股(Berkshire Hathaway Inc Class B)則上漲+0.78%。

從底層分析面來看,多檔領先科技企業中的近期市場特性出現一些緩和或仍屬不利。分析顯示,微軟(Microsoft Corp)和亞馬遜(Amazon.com Inc)的狀況有利。Meta Platforms Inc和特斯拉(Tesla Inc)亦維持有利的近期評估。博通(Broadcom Inc)持續呈現極為有利的特性。輝達(NVIDIA Corp)的狀況維持中性。然而,蘋果(Apple Inc)的狀況仍極為不利,Alphabet Inc A股(Alphabet Inc Class A)亦維持極為不利。摩根大通(JPMorgan Chase & Co)維持其極為有利的評估,而波克夏海瑟威B股(Berkshire Hathaway Inc Class B)則維持中性。部分大型科技股的回檔顯示,即便聯準會提供顯著的流動性支持,若公司特定或更廣泛的經濟擔憂普遍存在,也未必能一致性地提振所有成長導向型股票。

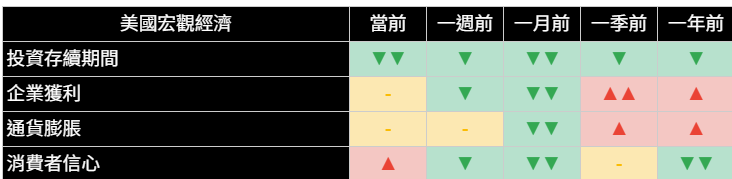

經濟指標

今日的經濟數據發布進一步證明了美國經濟當前所面臨的挑戰。四月份零售銷售數據僅呈現0.1%的總體增長,控制組則下滑-0.2%,顯示在關稅實施前的支出後,整體消費活動明顯趨緩。這是一個關鍵的訊號,與對消費者信心的持續擔憂一致,即使我們特定的該項指標今日略微走強至中度正向。四月份生產者物價指數(PPI)出乎意料地月減-0.5%,儘管對總體通膨而言看似好消息,但也可能反映需求疲弱。關鍵問題在於,此PPI的疲弱是否會轉嫁至消費者物價,或者被關稅衝擊所抵銷。

我們整套經濟指標突顯了此種複雜性。投資存續期間的訊號仍極為不利,顯示儘管有任何可察覺的聯準會流動性措施,市場對長期風險仍存在根深蒂固的謹慎態度和規避心理。企業獲利前景維持中性。如前所述,消費者信心指標為中度正向,但其韌性將受到物價上漲的考驗。我們的通膨指標今日維持中性,但潛在的關稅轉嫁和聯準會的寬鬆立場相結合,表明通膨可能持續存在,這是聯準會在防止經濟衰退的同時試圖管理的一個重大風險。市場顯然正在努力應對這些相互矛盾的訊號。

類股概況

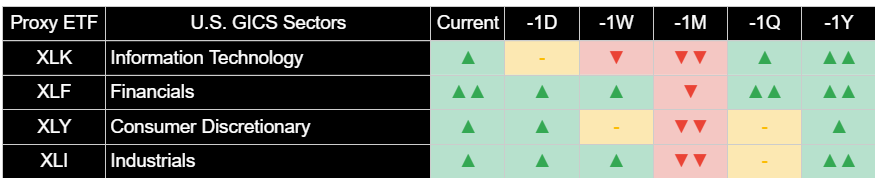

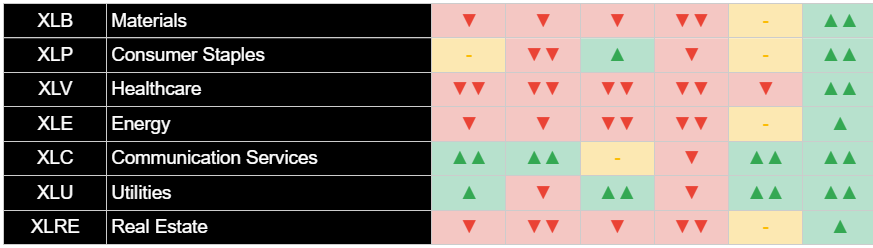

標普500指數各類股週四呈現明顯的防禦性傾向,因投資者對好壞參半的經濟數據和企業對關稅衝擊的警告作出反應,表明儘管存在對「聯準會賣權」的預期,整體保守情緒仍未消散。

防禦型類股領漲,公用事業類股(+2.13%)和必需消費品類股(+2.05%)錄得最強勁的漲幅。房地產類股(+1.66%)亦表現良好。這種向避險資產的輪動顯示,對美國瀕臨衰退邊緣的擔憂正影響著資產配置決策。工業類股(+1.11%)、原物料類股(+1.02%)和能源類股(+0.42%)設法上漲。金融類股(+0.67%)亦上揚。相較之下,資訊科技類股(-0.05%)收盤近乎持平,中止了近期的優異表現。通訊服務類股(+0.40%)小幅上漲。醫療保健類股(+1.31%)亦上漲,但年初以來表現持續落後。非必需消費品類股(-0.22%)下滑,反映了疲弱的零售銷售數據和沃爾瑪的謹慎基調。

從分析角度來看,公用事業和必需消費品類股的近期特性維持有利或有所改善,與其強勁表現和市場的防禦性輪動一致。資訊科技、金融、非必需消費品與工業類股儘管當日表現各異,仍維持有利評估。然而,能源、原物料、醫療保健和房地產等多數其他類股的狀況仍為不利或中性。此防禦性領漲是典型的循環後期訊號,表明即使聯準會的流動性為整體市場提供一些下檔保護,投資者對經濟前景的擔憂日益加劇。

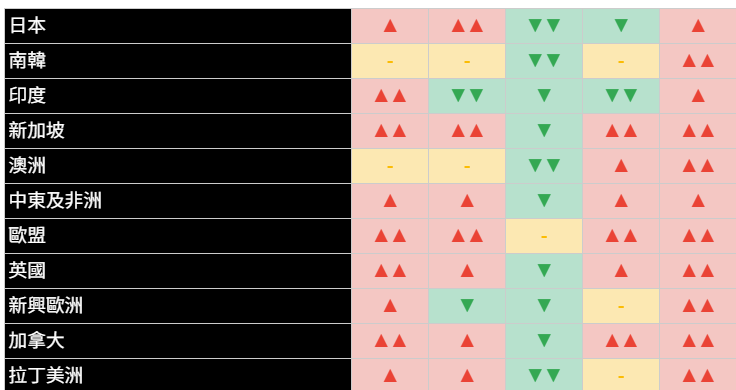

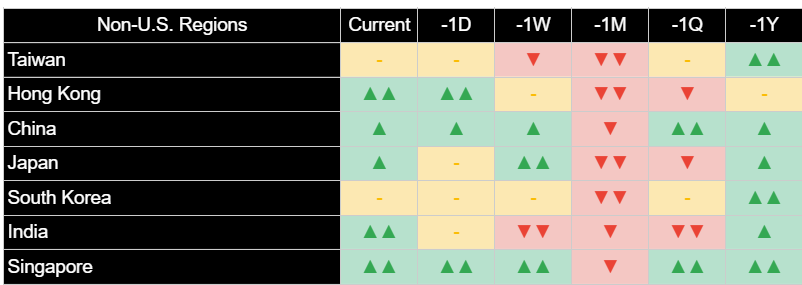

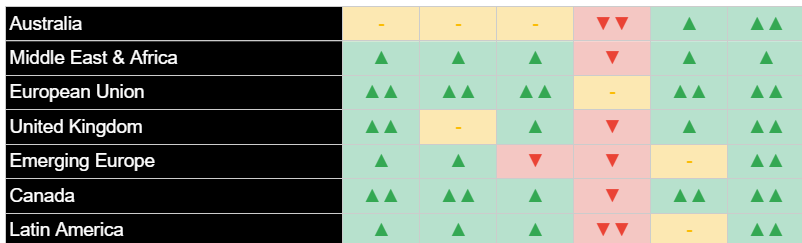

國際市場

國際市場週四表現好壞參半,全球投資者一方面消化美國零售銷售與通膨數據,另一方面關注持續的貿易評論。美元走弱,當日下跌-0.25%,這對非美國資產可能具支撐作用,並與對美元長期疲軟的預期一致,儘管近期的資本流動逆轉值得關注。

已開發市場大多為正向:歐洲股市上漲+0.99%,日本股市上漲+1.19%。分析持續顯示這些地區潛在的正向特性正在增強,可能受惠於市場認為聯準會正試圖避免美國經濟衰退的看法。

新興市場亦呈現不同結果:新興亞洲市場下跌-0.17%。印度(+1.48%)和拉丁美洲(-0.23%)則呈現顯著的反向走勢。中國股市下跌-1.85%。不同的表現突顯了這些市場對美國經濟訊號和全球貿易局勢的不同敏感度。

其他資產

週四其他資產類別的活動反映了市場對美國經濟數據、關稅擔憂和貨幣走勢的複雜反應,所有這些都必須透過美國聯準會試圖駕馭險峻經濟情勢的視角來解讀。

固定收益方面,美國公債價格上漲,殖利率隨之下跌,可能反映了疲弱的零售銷售數據,亦可能受到市場不確定性下的避險買盤推動。短期公債價格上漲+0.19%,中期公債價格上漲+0.65%,長期公債價格上揚+0.88%。整體美國綜合債券價格上漲+0.57%。此需求可能預示市場擔憂聯準會為防止經濟衰退所做的努力最終可能導致利率降低,或單純是資金流向優質資產。

大宗商品表現好壞參半。WTI原油在川普總統暗示可能與伊朗達成協議後下跌-1.66%。黃金價格 上漲+1.60%,受惠於美元走弱,且可能作為對抗因持續關稅和聯準會流動性而可能加劇的持續通膨風險的避險工具。基本金屬下跌-0.79%。農產品上漲+0.62%。美元指數走弱,下跌-0.25%。在數位資產方面,比特幣價格下跌-0.12%。黃金即使在聯準會提供流動性的情況下仍具韌性,表明投資者正仔細權衡通膨風險。

若要持續接收我們針對美國經濟、股市和產業的深度分析與洞見,請訂閱我們的電子報。

歡迎將此分析分享給可能覺得有價值的人士。

本新聞通訊僅供參考,不構成任何投資建議或買賣任何證券或資產類別的推薦。文中所表達的觀點為作者截至發布日期為止的觀點,並可能隨時更改,恕不另行通知。所呈現的資訊係基於從據信可靠來源獲得的數據,但其準確性、完整性和及時性不作保證。過往表現不代表未來結果。投資涉及風險,包括可能損失本金。讀者在做出任何投資決定前,應諮詢自己的財務顧問。作者及相關實體可能持有本文所討論資產或資產類別的部位。

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。 Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。 Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Dow Jumps While Nasdaq Snaps Win Streak as Tariff Realities and Fed's Balancing Act Take Center Stage

Markets Digest Retail Weakness, Inflation Data; Defensive Tilt Emerges Amid Persistent Economic Risks

Joe Lu, CFA May 15, 2025

MARKET OVERVIEW

U.S. equity markets navigated a mixed session on Thursday, as the initial euphoria from the U.S.-China trade truce earlier in the week gave way to a more sober assessment of ongoing economic realities and policy complexities. While the Dow Jones Industrial Average advanced, the S&P 500 posted a modest gain, and the technology-heavy Nasdaq Composite saw its six-day winning streak end. This performance reflects a market grappling with the tangible impacts of tariffs, evidenced by warnings from retail giant Walmart, alongside mixed signals from economic data and the Federal Reserve's delicate balancing act to stave off a recession while managing persistent inflationary pressures.

The S&P 500 Index rose +0.49%. The Dow Jones Industrial Average gained +0.70%. In contrast, the Nasdaq Composite Index fell -0.11%. Small-capitalization stocks, represented by the Russell 2000 Index, gained +0.65%. While President Trump continued to tout progress on trade, mentioning potential for India to offer zero tariffs, corporate America is starting to outline the real costs. Walmart shares fell -0.50% after explicitly stating that prices will rise due to tariffs, as the company cannot absorb all the increased costs. This direct pass-through to consumers, expected to hit wallets soon, poses a significant risk to spending.

This corporate caution was underscored by April's retail sales data, which slowed sharply (0.1% MoM headline, -0.2% control group), a stark reversal from March's pre-tariff surge. This softening consumer activity is a critical development, given the economy is perceived to be teetering on the edge of a recession, a scenario the Federal Reserve is actively trying to prevent, likely through measures that provide underlying liquidity to the financial system. While such Fed actions might place a floor under risk assets, they also carry the risk of fueling the very inflation the Fed aims to control, especially when combined with tariff-induced cost pressures. On a seemingly more positive note, the Producer Price Index (PPI) for April unexpectedly fell -0.5% month-over-month. However, Federal Reserve Chair Jerome Powell's remarks Thursday about the U.S. potentially entering a period of more frequent "supply shocks" and volatile inflation highlight the ongoing challenges. The interplay between these forces – Fed liquidity, persistent inflation risk from tariffs and policy, actual consumer behavior, and capital flow dynamics which have recently shown signs of reversing back towards the U.S. – will be crucial in shaping the market's trajectory.

EXECUTIVE SUMMARY

U.S. stocks showed divergence Thursday: the Dow Jones Industrial Average (+0.70%) gained, while the S&P 500 Index (+0.49%) rose modestly and the Nasdaq Composite (-0.11%) snapped its six-day winning streak, reflecting underlying market tensions.

- Walmart's (-0.50%) warning of tariff-driven price hikes and a sharp slowdown in April retail sales highlighted tangible consumer headwinds, despite softer wholesale inflation (PPI -0.5% MoM). This underscores the persistent risk tariffs pose to the Fed's efforts to navigate away from a recession.

- Defensive sectors like Utilities (+2.13%) and Consumer Staples (+2.05%) outperformed, signaling underlying investor caution, even as the Federal Reserve appears to be providing market liquidity.

- Analysis shows near-term market character remains mixed. Investment Duration is still pronouncedly unfavorable, though Consumer Strength and Inflation indicators firmed – the latter potentially fueled by both tariffs and Fed liquidity, posing a significant challenge.

- Key for investors: monitoring the Fed’s ability to support markets without exacerbating persistent inflation, the true impact of tariffs on consumer spending, and whether capital inflows into the U.S. can be sustained if recessionary risks crystallize.

BROAD MARKET INDICES

Broad market indices finished mixed on Thursday as investors digested corporate warnings on tariffs and mixed economic data. The Dow Jones Industrial Average gained +0.70%, and the S&P 500 Index rose +0.49%. However, the Nasdaq Composite Index snapped its six-day winning streak, falling -0.11%. The Russell 2000 Index, representing small-cap stocks, managed a gain of +0.65%. The divergence points to investor selectivity and an ongoing assessment of where value lies amidst the current economic crosscurrents.

The PHLX Semiconductor Index declined -0.59% on the day, giving back some of its recent strong gains. Despite the pullback, underlying analysis for this group has shown some recent improvement in its near-term character, though longer-term unfavorable conditions persist, reflecting the volatile push-pull of AI optimism versus broader economic and tariff concerns.

From an analytical perspective, today's mixed performance left the near-term market character for the S&P 500 and Nasdaq Composite in a favorable state according to our indicators, though the conviction of these signals will be tested by ongoing tariff uncertainty and upcoming economic data. The Dow Jones Industrial Average and the Russell 2000 Index both maintained their moderately unfavorable assessments. This mixed analytical picture underscores the current state of flux in the market.

TOP 10 U.S. COMPANIES

Performance among the largest U.S. companies was mixed on Thursday, with some notable decliners among the "Magnificent Seven" after recent strong runs, reflecting the broader market's cautious and rotational mood.

Looking at individual stock performance for the day: Amazon.com Inc fell -2.42%, reportedly following news of job cuts in its devices division. Meta Platforms Inc also declined, losing -2.35%, with reports citing a potential delay in a flagship AI model. Apple Inc slipped -0.41%, and NVIDIA Corp was down -0.38%. Tesla Inc also fell, by -1.40%. In contrast, Microsoft Corp (+0.04%) and Alphabet Inc Class A (-0.85%) saw more modest moves. Broadcom Inc (+0.22%) managed a gain. Financials were mixed, with JPMorgan Chase & Co up +0.70%, while Berkshire Hathaway Inc Class B gained +0.78%.

Interpreting the underlying analytical picture, the near-term market character for several of these leading tech companies showed some moderation or remained unfavorable. Analysis shows favorable conditions for Microsoft Corp and Amazon.com Inc. Meta Platforms Inc and Tesla Inc also maintained favorable near-term assessments. Broadcom Inc continued to show pronouncedly favorable characteristics. NVIDIA Corp's condition remained neutral. However, conditions for Apple Inc stayed pronouncedly unfavorable, and Alphabet Inc Class A also remained pronouncedly unfavorable. JPMorgan Chase & Co maintained its pronouncedly favorable assessment, while Berkshire Hathaway Inc Class B stayed neutral. The pullback in some mega-cap tech names underscores that even significant liquidity support from the Fed may not uniformly lift all growth-oriented stocks if company-specific or broader economic concerns prevail.

ECONOMIC INDICATORS

Today's economic releases provided further evidence of the challenging environment the U.S. economy is navigating. April's retail sales data, showing a mere 0.1% headline increase and a -0.2% fall in the control group, points to a significant consumer slowdown after any pre-tariff spending. This is a crucial signal, aligning with ongoing concerns about Consumer Strength, even if our specific indicator for it firmed slightly today to moderately positive. The unexpected -0.5% month-over-month decline in the April Producer Price Index (PPI), while seemingly good news for headline inflation, may also reflect weakening demand. The key question is whether this PPI softness will translate to consumer prices or be offset by tariff impacts.

Our suite of economic indicators underscores this complexity. The Investment Duration signal remained pronouncedly unfavorable, highlighting persistent deep-seated caution and an aversion to long-term risk, despite any perceived Fed liquidity measures. The Corporate Earnings outlook stayed neutral. As noted, the Consumer Strength indicator is moderately positive, but its resilience will be tested by rising prices. Our Inflation indicator remained neutral today, but the combination of potential tariff pass-through and an accommodative Fed stance suggests inflation is likely to be persistent, a significant risk the Fed is trying to manage alongside preventing a recession. The market is clearly grappling with these conflicting signals.

SECTOR OVERVIEW

Sector performance within the S&P 500 on Thursday showed a clear defensive tilt, as investors reacted to mixed economic data and corporate warnings about tariff impacts, suggesting that underlying caution persists despite any "Fed put" expectations.

Defensive sectors led the way, with Utilities (+2.13%) and Consumer Staples (+2.05%) posting the strongest gains. Real Estate (+1.66%) also performed well. This rotation into safety indicates that concerns about the U.S. teetering on a recessionary edge are influencing allocation decisions. Industrials (+1.11%), Materials (+1.02%), and Energy (+0.42%) managed gains. Financials (+0.67%) also advanced. In contrast, Information Technology (-0.05%) finished nearly flat, snapping its recent outperformance. Communication Services (+0.40%) saw a modest gain. Healthcare (+1.31%) also rose, but its year-to-date underperformance remains a theme. Consumer Discretionary (-0.22%) slipped, reflecting the weak retail sales data and Walmart's cautious tone.

From an analytical perspective, the near-term character for Utilities and Consumer Staples remains favorable or has improved, aligning with their strong performance and the market's defensive rotation. Information Technology, Financials, Consumer Discretionary, and Industrials maintained favorable assessments despite varied daily performance. However, conditions for most other sectors like Energy, Materials, Healthcare, and Real Estate remained unfavorable or neutral. This defensive leadership is a classic late-cycle signal, suggesting investors are increasingly concerned about the economic outlook, even if Fed liquidity provides some downside protection to the broader market.

INTERNATIONAL MARKETS

International markets displayed mixed performance on Thursday as global investors digested U.S. retail sales and inflation data alongside ongoing trade commentary. The U.S. Dollar weakened, falling -0.25% for the day, which can be supportive for non-U.S. assets and aligns with longer-term expectations of dollar softness, though recent capital flow reversals bear watching.

Developed markets were mostly positive: European equities gained +0.99% and Japanese equities rose +1.19%. Analysis continues to indicate underlying strengthening positive characteristics for these regions, potentially benefiting from perceptions of a Fed trying to avert a U.S. downturn.

Emerging markets also showed varied results: Emerging Markets Asia fell -0.17%. India (+1.48%) and Latin America (-0.23%) posted notable moves in opposite directions. Chinese equities declined -1.85%. The varied performance underscores the differing sensitivities of these markets to U.S. economic signals and global trade narratives.

OTHER ASSETS

Activity across other asset classes on Thursday reflected a complex interplay of reactions to U.S. economic data, tariff concerns, and currency movements, all viewed through the lens of a Federal Reserve attempting to navigate a precarious economic situation.

In fixed income, U.S. Treasury prices registered gains as yields fell, likely reflecting the disappointing retail sales data and perhaps some safe-haven buying amidst market uncertainty. Short-term Treasury prices rose +0.19%, Intermediate Treasury prices gained +0.65%, and Long-term Treasury prices advanced +0.88%. Broad U.S. Aggregate Bond prices increased +0.57%. This demand could signal concerns that the Fed's efforts to prevent a recession might eventually lead to lower rates, or simply a flight to quality.

Commodity performance was mixed. WTI Crude Oil fell -1.66% after President Trump hinted at a potential deal with Iran. Gold prices gained +1.60%, benefiting from the weaker dollar and potentially as a hedge against persistent inflation risks that could be exacerbated by ongoing tariffs and Fed liquidity. Base Metals fell -0.79%. Agricultural Commodities rose +0.62%. The US Dollar Index weakened, falling -0.25%. In digital assets, Bitcoin prices declined -0.12%. The resilience in gold, even as the Fed provides liquidity, suggests investors are weighing inflation risks carefully.

To continue receiving our in-depth analysis and insights focused on the U.S. economy, stocks and sectors, please subscribe to our newsletter.

Consider sharing this analysis with others who might find it valuable.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

Join the official LINE account of "Joe’s Wall Street Pulse" now to receive the latest column updates (click here to join)