【Joe’s華爾街脈動】專題:您是理性投資者,還是賭徒心態?

您的投資行為是基於經過計算的風險,還是僅僅在滿足一種衝動?

摘要

- 投機性交易會劫持大腦的多巴胺獎勵系統,使其在神經化學層面上,與賭博或毒品一樣令人上癮。

- 市場不可預測的回報以及「差點就贏」的效應,創造了一種強大的衝動,促使人為了追求是快感而加劇風險。

- 當多巴胺主導時,投資者的投資組合就成了賭博行為的反映,例如追逐虧損和放棄風險管理。

- 唯一有效的解決方案,是以一個系統性的、基於規則的流程,來取代情緒化的反應,並以此主導所有的交易決策。

- 這需要實施系統性的方法,例如嚴格的風險限制、自動化的停損,以及一個獎勵嚴守紀律的執行而非幸運結果的回饋循環。

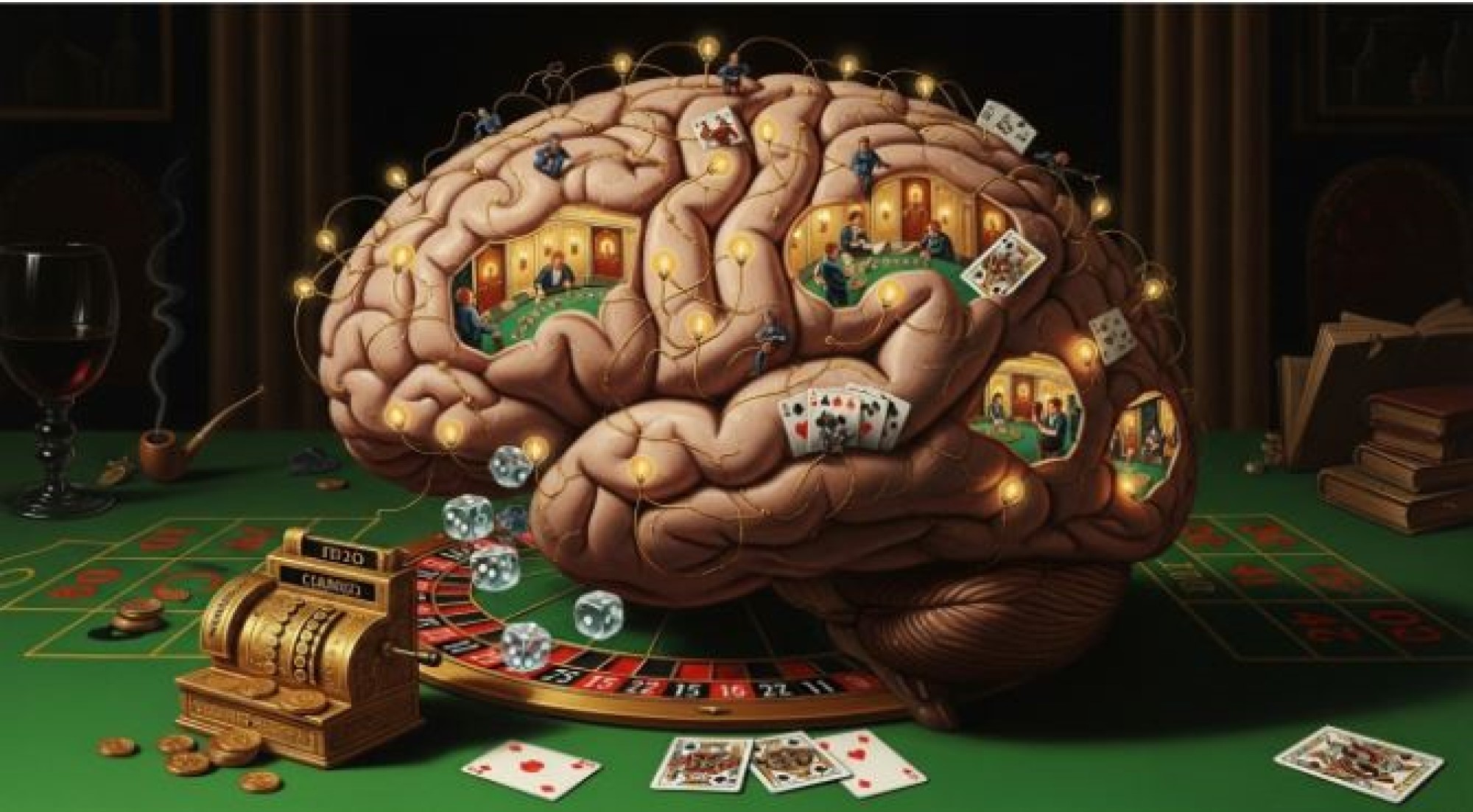

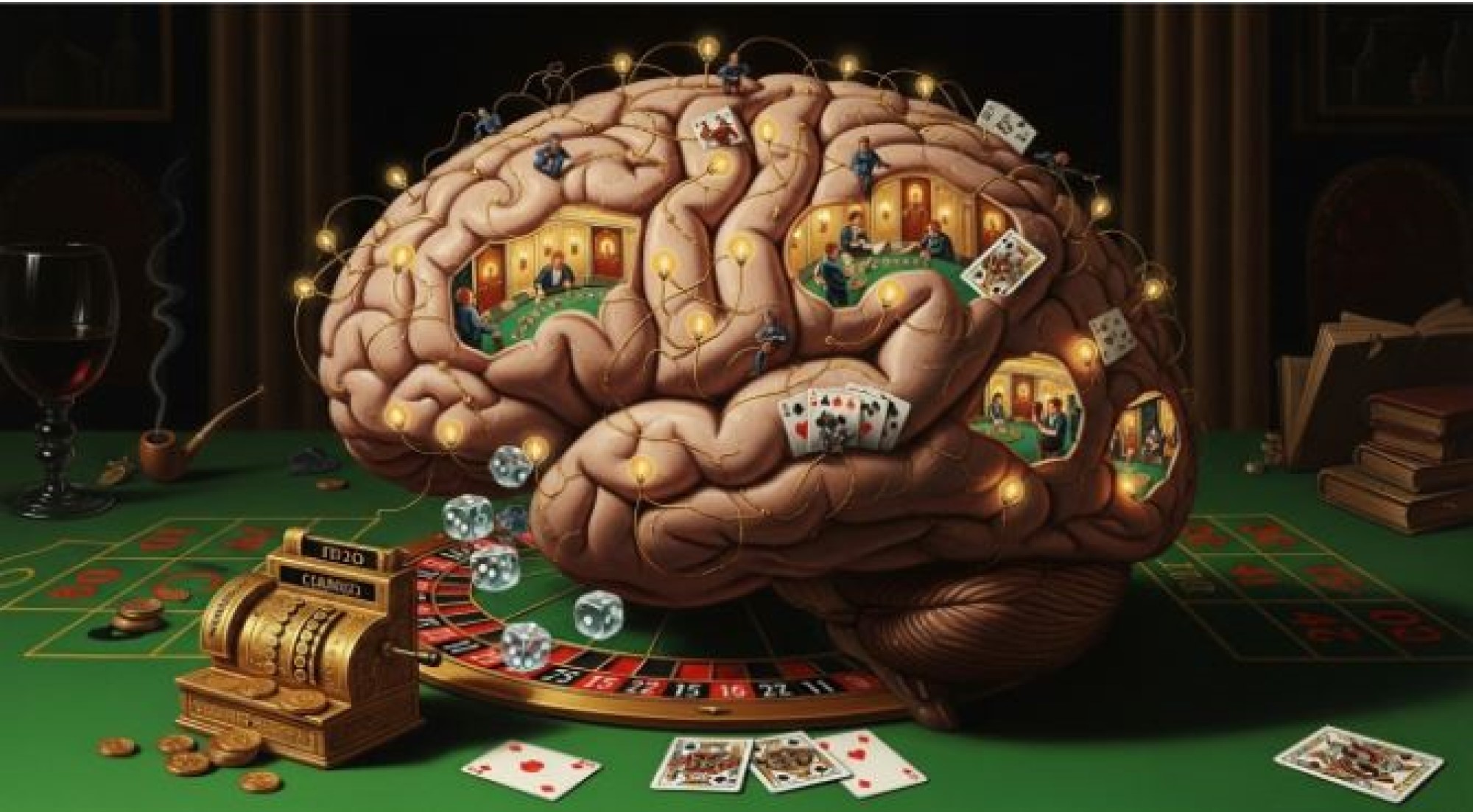

在一個狂飆的牛市中,證券交易所給人的感覺可能不像是一個商業場所,更像是一個高風險的賭場。如果您曾感受過那股拉力——那種強迫性地查看價格的需求、那種投機性押注帶來的觸電般的快感——您正在體驗神經化學的作用。

使成癮如此強大的相同生物機制,正被市場的劇烈波動所觸發。事實證明,大腦無法區分角子老虎機和飆漲的股票。當價格的跳動成為您的「催化劑」時,理性的投資很快就會退化為一種強迫性的行為。

為何大腦將交易變成了成癮行為

在此危險循環的核心,是多巴胺——一種主導預期與獎勵的神經傳導物質。它的作用不僅僅是在您獲勝後讓您感覺良好,更是在勝利發生前就讓您渴望勝利。此一模式也出現在生活的許多其他領域,並且是從社群媒體、電玩到毒品等眾多成癮行為的核心。

以下是它如何劫持您的決策過程:

- 多巴胺強化的是押注行為,而非邏輯: 您的大腦在預期潛在獎勵時會釋放多巴胺。在市場中,巨額收益的可能性,會以與興奮劑相同的方式,點燃您大腦的獎勵迴路。潛在的利潤越大、越快,多巴胺的衝擊就越大。這強化了押注的行為,無論其底層的分析是否健全。

- 不確定性是終極的鉤子: 最強效的多巴胺觸發器,是一個可變的、不可預測的獎勵系統。這就是「角子老虎機排程」——一種混合了勝利、失敗和「差點就贏」的組合,讓您緊盯螢幕。如果您每次都贏,新奇感就會消失,而不確定性才是使其令人上癮的原因。

- 「差點就贏」的效應是個陷阱: 您是否曾有過一支股票在反轉前,幾乎觸及您的目標價?那種「差點就贏」的經驗,可以觸發一次幾乎與實際獲勝一樣強大的多巴胺飆升。這種令人沮喪的經驗並不會使您氣餒,反而會強烈地激勵您「再試一次」,通常會促使更大的部位或更高的風險交易。

- 耐受性導致行為升級: 第一次小而快的勝利感覺不可思議,但隨著時間的推移,您的大腦會適應。小勝利再也無法帶來同樣的快感。為了重現最初的興奮感,許多交易者發現自己會升級其行為——使用更多的槓桿、進行高度集中的押注,或交易波動劇烈的迷因股。

- 您的手機成了藥頭: 很快地,環境中的線索會與多巴胺獎勵連結起來。觀察清單、價格提醒和社群媒體的通知,都變成了「成癮日日線索」,觸發一股不可抗拒的行動衝動,即使您的理性計畫告訴您什麼都不要做。

成癮如何顯現在您的投資組合中

當多巴胺佔據主導地位時,您的投資組合就成了衝動的反映,而非策略。跡象通常很明顯:

- 衝動凌駕計畫: 您發現自己是為了緩解無聊、焦慮或錯失恐懼症(FOMO)而進場交易,而非因為您精心定義的交易設定已出現。

- 追逐虧損: 在一次重大虧損後,您立即「加倍下注以求回本」,這是典型的賭徒心態。情緒化的交易用以抹去虧損的痛苦,而非接受其為過程的一部分。

- 過度集中: 您投資組合的曝險悄悄地集中到單一的熱門股或題材上。當巨大獲利的潛力壓倒所有邏輯時,風險控制被拋棄。

- 情緒戒斷: 當市場上沒有活躍的交易時,您會感到煩躁或焦慮。唯一的解脫來自於進行下一次押注,重新投入行動。

建立一個系統來駕馭您的化學反應

您無法消除多巴胺,但您可以管理其影響。情緒性賭博的解藥不是更強的意志力,而是一個系統性的流程。一個基於規則的方法,能將決策從您衝動的、由多巴胺驅動的大腦,外包給一個理性的、預先承諾的計畫。

1. 預先承諾您的整個流程

在您考慮下單之前,用簡單的術語寫下您的計畫。

- 進場規則: 「如果股票X在成交量高於平均水平的情況下,收盤價高於其50日移動平均線,我將買入。」

- 出場規則(獲利): 「如果股票上漲20%,我將賣出一半的部位。」

- 出場規則(虧損): 「如果股票收盤價低於$50美元,我將賣出全部部位,沒有例外。」

這創造了一個「如果-那麼」的結構,使決策變得自動化,而非情緒化。

2. 設計您的環境以減少線索

像戒掉壞習慣一樣對待您的交易環境。

- 關閉推播通知: 關掉所有價格提醒和即時新聞通知。安排固定的時間來查看市場(例如,開盤後一小時一次,收盤一次,甚至一週一次)。不斷的更新是長期思維的敵人。

- 精選您的觀察清單: 維護一個單一、乾淨的觀察清單,只包含符合您嚴格標準的資產,將其他所有東西都存檔。雜亂的螢幕等於雜亂的心靈。

3. 系統化您的風險(限制「劑量」)

這是最關鍵的規則。專業投資者在思考回報前,會先思考風險。

- 1%規則: 在任何單一的點子上,所冒的風險絕不超過您總交易資本的1%。這意味著,您的進場價和停損價之間的距離,所導致的虧損不應超過您投資組合的1%。

- 絕不攤平: 加碼一個虧損的部位是在追逐虧損。只有當一個新的進場訊號,滿足您所有原始的標準時,才是加碼的正當理由。

4. 自動化您的出場

在極度貪婪或恐懼的時刻,不要依賴意志力來賣出。在那些時刻,您的大腦是受限制的。

- 使用硬性停損單: 在您進場交易的那一刻,就在系統中設定一個實體的停損單。這是不可協商的。

- 使用移動停損或獲利目標: 為防止興奮感導致您「讓獲利繼續奔馳」直到反轉,應使用自動化的訂單,在部位對您有利時逐步減碼。

5. 創造一個專注於流程,而非利潤的回饋循環

您的大腦想要獎勵結果(損益表),您必須重新訓練它去獎勵行為。

- 追蹤您的遵守情況: 在每週末,不要只看您的利潤,而要為您遵守規則的情況打分數。您是否抓住了每個有效的訊號?您是否遵守了每個停損?

- 慶祝紀律: 一次完美遵循計畫的小虧損,是比一次衝動押注下幸運的大勝更大的勝利。您所獎勵的行為,就是您將會重複的行為。

6. 實施冷卻儀式

在事件與您的下一個決策之間,創造一個緩衝。

- 交易後日誌: 在每筆交易後(無論輸贏),寫下三行字:設定是什麼?我是否遵守了我的規則?我可以改進什麼?這能強迫您進行反思。

- 24小時規則: 在一次非常大的勝利或一次痛苦的虧損後,承諾自己從市場休息24小時。這能防止由快感驅動的「瘋狂交易binge trading」或由憤怒驅動的「報復性交易」。

結論:賭徒心態是其神經化學的奴隸,永遠在追逐下一次的多巴胺衝擊。理性投資者則了解自身的神經化學,並建立系統來管理它。他們用流程取代衝動,創造了一個能在任何市場環境中存活的持久優勢。

如果您已準備好做出那樣的轉變——最終將「賭場大腦」趕出您的投資組合——那麼,是時候建立您的系統了。

👍若您覺得這份研究有價值,請對本文按讚。

📲加入並追蹤鉅亨號,與我們互動,即可獲取更多趨勢指標和市場資訊。

📰追蹤此部落格。

💬LINE好友。

➡️將此分析分享給您的親朋好友,一同獲取最新投資觀點。

本電子報僅供參考,不構成任何證券或資產類別的投資建議或買賣推薦。文中所表達的觀點為作者截至發布日期的觀點,如有變動,恕不另行通知。所呈現的資訊乃基於從相信可靠的來源所獲取的數據,但其準確性、完整性和及時性不作保證。過往表現並非未來結果的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其財務顧問。作者及相關實體可能持有本文所討論的資產或資產類別的部位。

Are You an Investor—or Just a Gambler?

Are you making calculated risks, or just feeding a compulsion?

Executive Summary

- Speculative trading hijacks the brain's dopamine reward system, making it neurochemically as addictive as gambling or drugs.

- The market's unpredictable rewards and the "near-miss" effect create a powerful compulsion to escalate risk in pursuit of a euphoric high.

- When dopamine is in control, an investor's portfolio becomes a reflection of gambling behaviors like chasing losses and abandoning risk management.

- The only effective solution is to replace emotional reactions with a systematic, rules-based process that governs all trading decisions.

- This requires implementing systematic approaches, like strict risk limits, automated stop-losses, and a feedback loop that rewards disciplined execution over lucky outcomes.

In a raging bull market, the stock exchange can feel less like a place of business and more like a high-stakes casino. If you've ever felt that pull—the compulsive need to check prices, the electric thrill of a speculative bet—you're experiencing neurochemistry in action.

The same biological machinery that makes addiction so powerful is triggered by the volatile swings of the market. The brain, it turns out, can’t distinguish between a slot machine and a soaring stock. When price ticks become your dose, rational investing quickly degrades into a compulsive behavior.

Why Your Brain Turns Trading into a Drug

At the center of this dangerous loop is dopamine, the neurotransmitter of anticipation and reward. Its role is not just to make you feel good after a win, but to make you crave the win before it even happens. This same pattern occurs in many other areas in life and is the core of numerous additions, from social media, video games to drugs. This recurring pattern is central to many addictions, including social media, video games, and drugs, and is observed in various aspects of life.

Here’s how it hijacks your decision-making:

- Dopamine Reinforces the Bet, Not the Logic: Your brain releases dopamine in anticipation of a potential reward. In the market, the possibility of a huge gain lights up your brain’s reward circuits in the same way a stimulant does. The bigger and faster the potential profit, the bigger the dopamine hit. This reinforces the act of betting, regardless of whether the underlying analysis was sound.

- Uncertainty is the Ultimate Hook: The most potent dopamine trigger is a system of variable, unpredictable rewards. This is the "slot machine schedule"—a mix of wins, losses, and near-misses that keeps you glued to the screen. If you won every time, the novelty would wear off. The uncertainty is what makes it addictive.

- The "Near-Miss" Effect Is a Trap: Have you ever had a stock almost hit your price target before reversing? That "almost win" can trigger a dopamine spike nearly as powerful as an actual win. This frustrating experience doesn't discourage you; it powerfully motivates you to "try again," often with a larger position or more risk.

- Tolerance Leads to Escalation: The first small, quick win feels incredible. But over time, your brain adapts. Small wins no longer deliver the same euphoric rush. To recreate that initial high, many traders find themselves escalating their behavior—using more leverage, making highly concentrated bets, or trading volatile meme stocks.

- Your Phone Becomes the Dealer: Soon, environmental cues become linked to the dopamine reward. Watchlists, price alerts, and social media pings become "drug cues." They trigger an irresistible urge to act, even when your rational plan says to do nothing.

How Addiction Shows Up in Your Portfolio

When dopamine is in the driver's seat, your portfolio becomes a reflection of impulse, not strategy. The signs are often clear:

- Compulsion Over Planning: You find yourself entering trades to relieve boredom, anxiety, or the fear of missing out (FOMO), not because your carefully defined trading setup has appeared.

- Chasing Losses: After a significant loss, you immediately "double down to get even." This is the classic gambler's ruin, trading emotionally to erase the pain of a loss rather than accepting it as a part of the process.

- Over-Concentration: Your portfolio's exposure quietly creeps into a single hot stock or theme. Risk controls are abandoned as the potential for a massive win overrides all logic.

- Emotional Withdrawal: You feel irritable or anxious when you don't have an active trade in the market. The only relief comes from placing another bet and re-entering the action.

Building a System to Master Your Chemistry

You cannot eliminate dopamine, but you can manage its influence. The antidote to emotional gambling is not more willpower—it's a systematic process. A rules-based approach outsources decision-making from your impulsive, dopamine-driven brain to a rational, pre-committed plan.

1. Pre-Commit Your Entire Process

Before you even think about placing an order, write down your plan in simple terms.

- Entry Rule: "I will buy Stock X if it closes above its 50-day moving average on higher-than-average volume."

- Exit Rule (Profit): "I will sell half my position if the stock gains 20%."

- Exit Rule (Loss): "I will sell my entire position if the stock closes below $50, no exceptions."

This creates an "if-then" structure that makes decisions automatic, not emotional.

2. Engineer Your Environment to Reduce Cues

Treat your trading environment like you're quitting a bad habit.

- Kill Push Notifications: Turn off all price alerts and breaking news notifications. Schedule fixed times to check the market (e.g., once at midday, once at the close). Constant updates are the enemy of long-term thinking.

- Curate Your Watchlist: Maintain a single, clean watchlist of only the assets that meet your strict criteria. Archive everything else. A cluttered screen is a cluttered mind.

3. Systematize Your Risk (Cap the "Dose")

This is the most critical rule. Professional investors think about risk before they think about returns.

- The 1% Rule: Never risk more than 1% of your total trading capital on a single idea. This means the distance between your entry price and your stop-loss price should not result in a loss greater than 1% of your portfolio.

- Never Average Down: Adding to a losing position is chasing. A fresh entry signal that meets all your original criteria is the only justification to add capital.

4. Automate Your Exits

Do not rely on willpower to sell during a moment of intense greed or fear. Your brain is compromised in those moments.

- Use Hard Stop-Losses: The moment you enter a trade, place a physical stop-loss order in the system. This is non-negotiable.

- Use Trailing Stops or Profit Targets: To prevent euphoria from causing you to "let it ride" into a reversal, use automated orders to trim your position as it moves in your favor.

5. Create a Feedback Loop Focused on Process, Not Profit

Your brain wants to reward outcomes (the P&L). You must retrain it to reward behavior.

- Track Your Adherence: At the end of each week, don't just look at your profits. Score yourself on how well you followed your rules. Did you take every valid signal? Did you honor every stop-loss?

- Celebrate Discipline: A small loss where you followed your plan perfectly is a greater victory than a large, lucky win from an impulsive bet. The behavior you reward is the behavior you will repeat.

6. Implement Cooling-Down Rituals

Create a buffer between the event and your next decision.

- Post-Trade Journal: After every trade (win or lose), write down three lines: What was the setup? Did I follow my rules? What can I improve? This forces reflection.

- The 24-Hour Rule: After a very large win or a painful loss, commit to taking a 24-hour break from the market. This prevents euphoria-driven "binge trading" or anger-driven "revenge trading."

The Bottom Line: Gamblers are slaves to their neurochemistry, forever chasing the next dopamine hit. Investors understand their neurochemistry and build systems to manage it. They swap impulse for process, creating a durable edge that survives any market environment.

If you're ready to make that shift—to finally keep the "casino brain" out of your portfolio—then it's time to build your system.

👍'Like' this article if you found this research valuable.

📲 Join our private channels to get more trend indicators and market information delivered directly to you. Choose your preferred channel to stay informed.

➡️Share this analysis to someone in your network who appreciates a data-driven perspective.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。