【Joe’s華爾街脈動】專題:趨勢分歧訊號浮現,潛在波動風險增溫

儘管處於強勁上升趨勢,信貸與外匯市場不同的訊號,為股市及黃金帶來警訊。

Joe 盧, CFA | 2025年10月9日 美東時間

摘要

- 美國科技股上漲與信貸市場落後的背離,為高度相關的台股加權指數(TAIEX)帶來警訊。

- 黃金的上升趨勢面臨美元潛在反轉的風險;基於兩者的負相關性,美元走強將構成逆風。

- 美國政府潛在的關門風險,加上歐洲和拉丁美洲的地緣政治緊張局勢,為市場帶來顯著的短期波動風險。

- 全球央行政策持續支撐風險性資產和黃金的長期上升趨勢,目前數據並未指向趨勢將發生重大反轉。

- 主要意涵是,在現有上升趨勢中波動性將加劇,而非市場將出現重大反轉。

美股持續創下新高,但信貸市場並未以同等力道確認此一強勢。我們的企業獲利指標,同時考量了股市和信貸市場的活動,其走勢並未跟上股市強勁的上升軌跡。此一分歧顯示,少數大型科技股的漲幅不成比例地推動了主要指數,可能掩蓋了更廣泛的市場疲態。對台灣投資者而言,台股加權指數(TAIEX)與那斯達克(Nasdaq)的高度相關性,使得此一分歧對科技及半導體類股的曝險尤其重要。

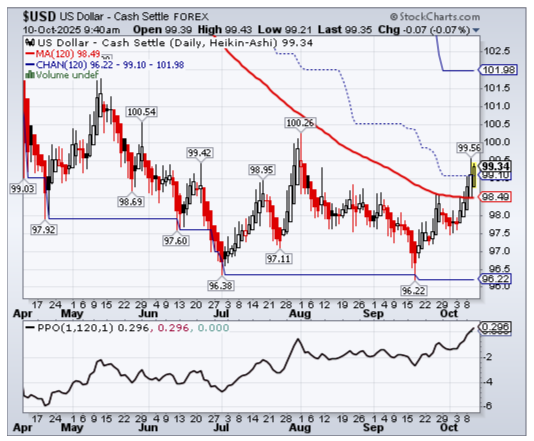

黃金是另一項價格高漲的資產,同樣面臨潛在逆風,因為美元在今年稍早的強勁下跌後,已顯現反轉跡象。黃金與美元之間典型的負相關性意味著,美元走強可能會抑制黃金的漲勢。

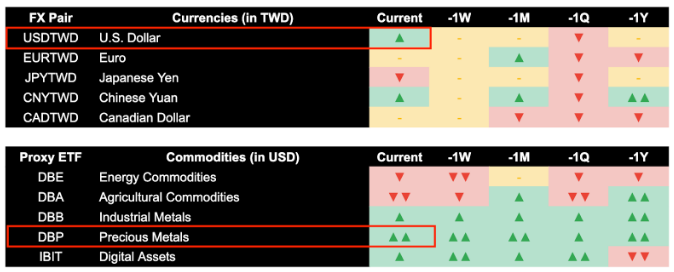

截至2025年10月9日,貨幣與大宗商品之趨勢信念矩陣指標報告

與此同時,地緣政治的不確定性也在增加。儘管歷史經驗顯示美國政府關門最終都能解決且影響不大,但一次長期的關門可能會帶來顯著的短期波動,並擾亂市場信心。結合歐洲和拉丁美洲日益升級的地緣政治緊張局勢,這些因素為市場波動加劇創造了條件。

儘管存在這些短期風險,投資者必須認識到,許多政府和央行仍為股市和黃金市場提供了持續的支撐背景。貨幣政策仍然是關鍵影響因素,任何持續寬鬆的訊號都有助於支撐資產價格。因此,股市和黃金的廣泛上升趨勢發生實質性、長期的反轉,並非最可能的情境。

飆升的股市與其他資產類別之間的顯著分歧,加上美元潛在的反轉以及緊張的地緣政治環境,顯示當前的市場趨勢正面臨關鍵考驗。技術面過度延伸的狀況和偏高的美股估值,放大了此一警示訊號,儘管有央行政策的支持,投資者仍應採取審慎的態度。

📲加入我們的專屬頻道,即可獲取我們的跨資產趨勢信念矩陣,以及專家嚴選的投資內容。

💬透過LINE與我們聯繫,即可加入社群。

👥在Facebook上私訊我們,即可加入社群。

如果您覺得這份研究有價值:

👍為這篇文章按讚。

📰追蹤此部落格,獲取最新的市場動態。

➡️分享給其他關注美股和台股市場的投資者。

Trend Divergences Signals Potential Volatility

Differing signals in credit and FX markets signal caution for stocks and gold, despite strong uptrend.

Joe 盧, CFA | 2025年10月09日 美東時間

Executive Summary

- A divergence between rallying U.S. tech stocks and lagging credit markets signals caution for the highly correlated TAIEX.

- Gold's uptrend is at risk from a potential U.S. dollar reversal, which would act as a headwind due to their inverse correlation.

- The potential for a U.S. government shutdown with European and Latin America geopolitical tensions introduces a risk of significant short-term market volatility.

- Long-term uptrends in risk assets and gold remain supported by global central bank policies, with current data not pointing to a major trend reversal.

- The primary implication is a period of increased volatility within existing uptrends, not a major market reversal.

U.S. equities continue making new highs, but credit markets aren't confirming this strength with equal conviction. Our corporate earnings economic indicator, which takes into account both equity and credit market activity, hasn't matched the strong upward trajectory in equities. This bifurcation suggests a few mega-cap stocks are driving disproportionate gains in the headline indices, potentially masking broader market weakness. For Taiwan investors, the TAIEX's high correlation with the Nasdaq makes this divergence particularly relevant for technology and semiconductor sector exposure.

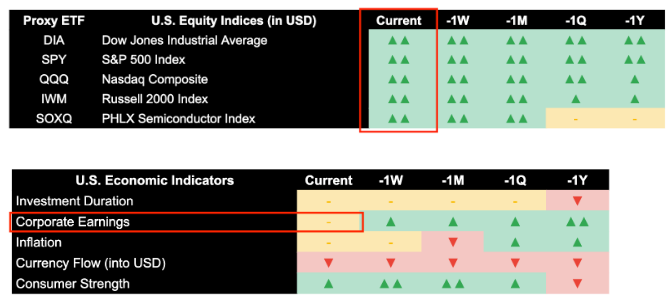

Trend Conviction Matrix Indicator Report for U.S. Indices and U.S. Economic Indicators as of: 2025/10/09

Gold, another high-flying asset, also faces potential headwinds as the U.S. dollar shows signs of reversing after its strong downtrend earlier this year. The typical inverse correlation between gold and the dollar suggests a strengthening dollar could put a brake on gold's rally.

Trend Conviction Matrix Indicator Report for Currencies and Commodities as of: 2025/10/09

This all comes at a time of increasing geopolitical uncertainty as well. While history has shown that U.S. government shutdowns ultimately are resolved and are benign, a protracted one could introduce significant short-term volatility and disrupt confidence in the market. Combined with escalating geopolitical tensions in Europe and Latin America, these factors create conditions for increased market volatility.

Despite these near-term risks, it's important to recognize the continued supportive backdrop from many governments and central banks for both equity and gold markets. Monetary policy remains a key influence, and any signals of continued accommodation could help to underpin asset prices. Therefore, a material, long-term reversal in the broader uptrends for equities and gold is not the most likely scenario.

A notable divergence between surging equities and other asset classes, coupled with a potential U.S. dollar reversal and a charged geopolitical environment, indicates a crucial test for current market trends. This cautionary signal is amplified by technically overextended conditions and high U.S. equity valuations, warranting a prudent approach despite supportive central bank policy.

📲Join our private channels to gain access to our cross-asset Trend Conviction Matrix and expert-curated investment content.

💬Connect with us on LINE to join the group.

👥Message us on Facebook to join the group.

if you found this research valuable:

👍'Like' this post.

📰Follow this blog for new market updates.

➡️Share it with others who track U.S. and Taiwan markets.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。