【Joe’s華爾街脈動】專題:對大銀行的信任:台灣的信心 vs. 美國的懷疑

信任金融機構的文化差異

Joe 盧, CFA | 2025年11月1日

摘要

- 多數台灣民眾傾向信任大型銀行,因為文化規範和嚴格的監管,培養了對老牌金融機構的信心。

- 相較之下,多數美國人對各大銀行抱持懷疑態度,尤其在2008年後,利益衝突和不當銷售有毒抵押貸款證券的事件,暴露了銀行激勵機制與客戶利益的不一致。

- 此反彈促使多數美國人轉向獨立、具備信託責任、以費用為基礎的註冊投資顧問(RIA),這類顧問強調透明度和客戶利益一致。

- 台灣的銀行主導了基金分銷和零售投資管理。儘管金管會有嚴格的規定和必要的揭露要求,但過去的案例顯示利益衝突仍可能發生。

- 對台灣散戶投資者的啟示是「信任,但要驗證」:確認您顧問的信託責任和薪酬結構、避免過於複雜的產品、尋求第二意見,並積極參與財務決策。

超過700人已在我們的LINE上追蹤。加入我們,即可獲得我們的趨勢指標矩陣™ 市場監察員!

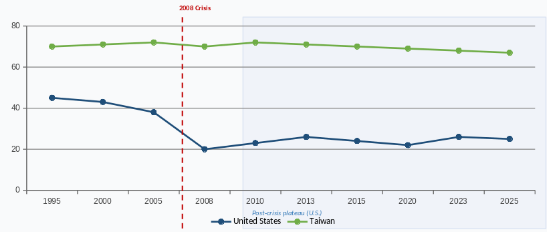

當我與台灣一般投資者交談時,我注意到一個顯著的差異,那就是他們對金融機構的信任程度。在台灣,大型銀行和知名金融品牌享有很高的聲譽和公眾信心。許多台灣投資者本能地相信大型銀行能安全地管理他們的資金並提供建議,這與美國形成鮮明對比。在2008年金融危機後,美國民眾對大型銀行的信任度急劇下降,至今仍相對較低。舉例來說,世界經濟論壇在2015年的一項調查中,美國公民對其銀行體系的信心僅排名第49位(英國則為第89位)——這反映了美國人在2008年後如何對銀行失去信任[1]。事實上,到2008年底,只有約20%的美國人對美國銀行抱有高度信心[2],這與過去幾十年相比是急劇的下降。

公眾對銀行信任度隨時間的變化(美國 vs. 台灣)

從文化上講,美國人通常為「小人物」喝采,並對大型機構抱持懷疑,特別是當他們懷疑這些機構可能將利潤置於民眾之上時。相較之下,在台灣,社會規範傾向於尊重權威和老牌機構。集體主義和較高的權力距離等文化因素,可能會促使人們對知名銀行產生更大的信任。關於東亞金融行為的研究發現,「信任」是消費者的一個關鍵因素,並受到集體主義文化的顯著影響[3]。一項針對台灣和南韓銀行保險業務銷售的研究表明,消費者從其銀行購買金融產品的意願,受到感知價值、形象、滿意度和信任的驅動——且值得注意的是,高度集體主義的文化背景增強了這些銀行關係中的信任和滿意度[3][4]。

簡言之,台灣投資者往往對大型金融品牌抱持「姑且相信」的態度,假設它們會正當行事。台灣穩定的銀行業環境強化了這種對老牌銀行的信心;本地銀行受到嚴格監管,且普遍未經歷過西方那種規模的倒閉事件。因此,許多台灣人將大銀行視為安全、信譽卓越且標準高的機構,值得他們的信賴。

然而,文化上的信任可能是一把雙面刃。盲目地聽從大型機構,可能會使投資者較不傾向於質疑建議或注意到利益衝突。在美國,慘痛的經驗教會了投資者要更加謹慎。美國人清楚地記得,華爾街的巨頭們並非總是能對得起人們賦予他們的信任——這個教訓值得台灣投資者客觀地審視。

2008年危機:利益衝突侵蝕了美國的信任

2008年的次貸危機是一個分水嶺,粉碎了美國大眾對大型銀行的信任。主要的銀行和投資機構被發現從事損害其客戶利益的自我交易和利益衝突行為。一個明顯的例子是,一些銀行明知抵押貸款支持證券及相關產品品質低劣,卻仍將其產品化並出售給投資者——包括它們自己的財富管理客戶。在美國司法部的和解協議中,高盛(Goldman Sachs)承認在2000年代中期出售的證券存在誤導性,背後包含了有毒抵押貸款[5]。聯邦調查人員指出,銀行業在銷售這些產品時普遍存在「欺詐行為」[6]。本質上,幾家大型銀行正在承銷高風險的抵押貸款債券,同時又將其作為安全的投資品,向信任它們的客戶推銷。當這些證券價值崩潰時,不僅造成了巨大的損失,也摧毀了公眾對銀行諮詢服務誠信的信心。正如一份報告總結的那樣,美國的銀行揮霍了信任,它們向客戶保證有瑕疵的抵押貸款債券是穩健的——而與此同時,銀行卻從銷售中獲利[5][6]。

次貸危機的慘敗使美國人敏銳地意識到,大型銀行的利益可能與個人投資者的利益產生衝突。美國投資者逐漸意識到,大銀行或券商的「理財顧問」,不過是穿著體面西裝的銷售代表——通常靠佣金來推銷銀行的產品或達成業績目標。這種利益衝突在許多傳統的財富管理模式中是固有的。正如世界經濟論壇指出的,「銷售金融產品的佣金激勵制度,會產生不利於投資者的利益衝突。」[7] 受僱於銀行的顧問可能會傾向於推薦能最大化其費用或其雇主利潤的產品,而非真正適合客戶的選擇。一種常見的做法是「雙重收費」(double-dipping),即公司的內部顧問銷售公司自家的基金或結構型產品;不出所料,這種設置構成了「固有的利益衝突」,因為如果銀行能引導客戶購買其自家的高利潤產品,它就能賺取更多利潤[8]。在2008年之前的幾年裡,此類衝突猖獗——而許多美國客戶為此付出了代價。

RIA成長 vs. 銀行體系券商市佔率 (2008–2025)

這些揭露所引發的反彈,深刻地改變了美國的財富管理格局。投資者開始尋求與華爾街大型企業無關的獨立顧問和替代方案。一個很好的例子是獨立的註冊投資顧問(RIA)和只收費(fee-only)的理財規劃師的崛起。與銀行的傳統經紀人不同,美國的RIA以信託人(fiduciaries)的身份運作,在法律上有義務將客戶的利益置於首位。這種模式通常向客戶收取固定或基於資產的費用,而非佣金,對那些被大銀行具衝突性的建議所傷害的美國人很有吸引力。事實上,RIA通路已見到爆炸性的增長。到2023年,獨立RIA管理的資產已翻倍至近20兆美元,成為美國財富管理中增長最快的部分[9]。投資者正優先考慮「費用透明度和信託責任建議」,並獎勵那些與其利益一致的顧問[10]。簡言之,美國對「大公司」的信任在2008年受到重創,許多投資者的反應是給予新進者和獨立顧問一個贏得他們信任的機會。「信任,但要驗證」的健康懷疑精神,現已深植於許多美國人選擇理財顧問的方式中。

美國理財顧問模式比較

台灣對大型銀行的信任 – 標準高,但須提防利益衝突

在台灣,環境則大不相同。本地銀行在2008年並未引發本土的金融危機,且它們普遍保持著穩健的紀錄。台灣的監管機構對銀行實施嚴格的監督,整體金融體系也保持穩定和韌性[11][12]。這種強力的監督,無疑有助於民眾與主要銀行打交道時的安心感。台灣的財富管理市場主要由大型銀行主導——這是信任的一個明顯指標。在台灣,超過80%的共同基金投資是透過銀行的分銷通路銷售的,遠遠超過任何獨立的理財顧問或券商[13]。對許多台灣投資者而言,他們尋求投資產品或建議的第一站(且往往是唯一一站)就是他們的銀行。依賴銀行的客戶關係經理或理財顧問,來指導從保險到共同基金等一切事務是很常見的。人們的假設是,一家大型、知名的銀行會提供穩健的建議,並保障個人的利益。

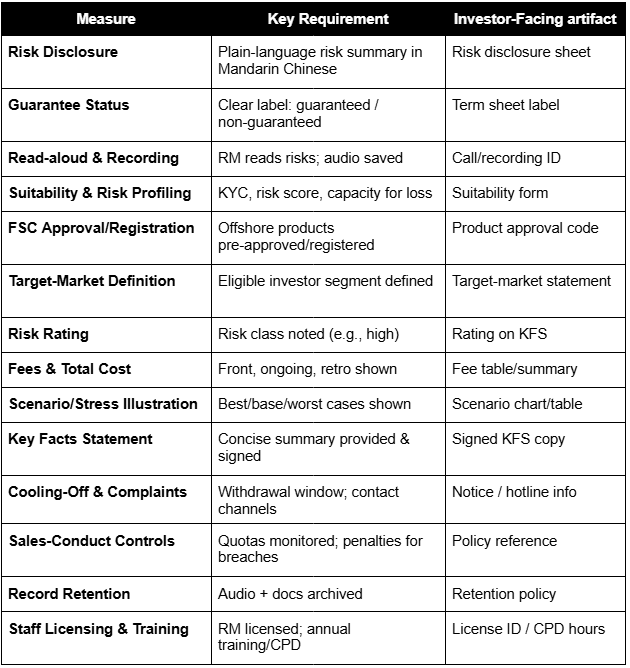

台灣2008年後金管會監管查核清單

這種信任關係,加上嚴格的監管,至今為止防止了像華爾街崩盤那樣規模的重大醜聞。台灣的金融監督管理委員會(金管會)在許多方面對銀行實施了「更高的標準」。值得注意的是,在2008年後,金管會為財富管理引入了新的消費者保護規則。例如,頒布了《境外結構型商品管理規則》,以遏制複雜產品的不當銷售。現在,台灣的銀行必須以中文提供完整的風險揭露,明確告知投資者產品是否保本,甚至必須在錄音的情況下,向客戶大聲朗讀風險揭露文件[14]。這些措施突顯了監管機構理解濫用的可能性,並已採取行動,透過增加透明度和問責制來鞏固信任。本質上,銀行受到良好監督:銀行的任何私人財富顧問或信託經理,都被期望遵循嚴格的規程,這有助於維持公眾的信念,即「這家大銀行正為我做正確的事。」

然而,高標準並不意味著零利益衝突。即使在台灣較為保守的銀行文化中,根本的激勵問題仍可能潛伏在表面之下。在2008年後的改革之前,台灣的銀行曾透過信託帳戶,在沒有太多監督的情況下,自由地向零售客戶銷售各式各樣的境外結構型票據和衍生性金融商品[15]。許多一般投資者從其銀行的財富管理部門購買了複雜的產品(如信用連結票據或結構型票據),卻未完全理解其風險。當全球危機來襲時,這些產品的價值暴跌,導致了重大的損失和爭議。事實上,在2000年至2013年間,台灣投資者就結構型票據的疑似不當銷售,提起了超過300件訴訟[16]。這波法律行動顯示,即使在台灣,一些銀行顧問也曾推銷客戶不理解或真正不需要的產品。此事件的後續影響促使監管機構收緊規則,如上所述,但它是一個警世故事:利益衝突確實存在——只是在壓力揭示它們之前,它們較不為人所見。此外,台灣主要銀行的私人銀行理專,通常仍是領取薪資並有銷售目標的員工,他們經常因分銷銀行核准的金融產品而獲得獎金或佣金。存在著一種推銷產品和達成銷售目標的內在壓力,這可能會使您收到的建議產生偏見。顧問或許並非公然欺詐,但他們可能會利用銀行享有盛譽的品牌來贏得您的信任——然後巧妙地引導您購買銀行想要銷售的投資產品,而偏離了您的最佳利益。當一位顧問將自己定位為由知名機構支持的專家時,心理上的影響力可能很強。

簡言之,台灣的銀行享有良好的信譽與信任,且通常依法運作。然而,投資者應記住,銀行也是企業。一家大銀行的優先考量是其股東利益和實現獲利,這有時可能與客戶的最佳利益相衝突。具衝突性的建議——例如在一個更便宜的指數基金就能滿足需求的情況下,被推銷一個高費用的基金,或者被慫恿頻繁交易——如果投資者從不質疑其銀行的建議,就可能發生。從美國以及一些本地的經驗中學到的教訓是,健康的懷疑和盡職調查是必要的,即使是與一家信譽良好的銀行打交道時也一樣。信任,但要驗證。

給台灣投資者的建議

保持一種正式、分析性的態度,意味著在信任與謹慎之間取得平衡。以下是一些值得考慮的建議:

- 驗證資格與信託責任: 確保您的理財顧問具備良好資格(尋找證照或執照),並詢問他們是否對您負有信託責任。在美國,RIA依法必須將客戶利益置於首位;在台灣,詢問顧問是獨立的,還是與銷售業績掛鉤。與真正合格的專業人士合作,意味著與一位將您的目標置於推銷產品之上的人合作。

- 了解您的顧問如何獲得報酬: 務必釐清其激勵結構。如果您與銀行的財富管理部門打交道,他們是否因銷售某些基金或保險而賺取佣金或獎金?佣金制度本身就會造成利益衝突——正如一份全球分析所言,這種「激勵分銷商銷售對其自身有利的產品」而不是對投資者有利的產品[17]。盡可能考慮採用只收費模式的顧問(只需支付透明的費用)。此類顧問費用只由您支付報酬,而非由產品提供者支付,這促使他們以您的最佳利益為出發點行事[18]。

- 警惕「好到不真實」的產品: 如果一位銀行顧問推薦一個承諾高報酬的複雜產品(例如結構型票據、奇異的衍生性金融商品,或任何您難以理解的投資),請暫停並仔細審視。低風險高報酬的產品並不存在;總有蹊蹺。要求以書面形式提供所有費用和風險。請記住,在2008年之前,許多投資者(包括在台灣)被推銷了表面上「安全」的高收益產品,而這些產品後來都崩盤了。不要猶豫提出尖銳的問題——如果解釋充滿專業術語,或者顧問對風險輕描淡寫,那就是一個警訊。

- 分散您的建議來源: 正如您分散投資一樣,考慮分散您獲取建議的來源。您不必放棄您的銀行——但尋求獨立理財規劃師的第二意見,或自己做研究是明智之舉。外部顧問可能會提供不同的觀點,相互比較可以揭示您銀行的建議是否真的具有競爭力。在美國,獨立顧問之所以增長,是因為他們通常提供更客製化、以客戶為中心的建議[10][9]。在台灣,獨立顧問服務仍在興起,但您仍然可以諮詢那些不與銷售單一銀行產品掛鉤的持牌理財顧問。即使只是閱讀中立的研究報告(來自信譽良好的財經出版物或投資者教育材料),也能幫助您做出更明智的決定,而非僅僅依賴銀行的說詞。

- 保持資訊靈通並積極參與: 說到底,這是您的錢。培養對您投資計畫和投資組合的基本理解。不要將所有思考都外包給顧問。監控您的帳戶和績效,如果發現任何不對勁之處(例如頻繁交易,或您不記得同意過的產品),應立即提出。一位值得信賴的顧問會歡迎您的參與和提問。俗話說,「信任是每天贏得的。」讓您的顧問透過透明和迅速的回應來贏得那份信任。如果您覺得他們在迴避問題或將銀行的利益置於您的利益之上,請準備好離開或將疑慮上報。

透過遵循這些步驟,台灣投資者可以兼得兩全——利用主要銀行的強大金融基礎設施和專業知識,同時也保護自己免受潛在的利益衝突。對機構的健康信任是寶貴的,但它絕不應是盲目的。美國的經驗顯示了盲目信任的代價有多高,而一種平衡的方法——信任並驗證——則能帶來更好的結果。

總而言之,在管理您的財富時,請保持正式和分析的態度:尊重專業人士的建議,但務必確保該建議真正與您自己的目標一致。憑藉審慎的懷疑和知識,您可以繼續從台灣信譽良好的銀行中受益,而不會成為其他市場中因銷售技巧勝過託管責任而出現的陷阱的受害者。務必確保您合作的對象是一位將您置於首位的合格專業人士,如此您才能在長期的財務道路上取得成功。

資料來源:

- 世界經濟論壇與Baker Tilly關於對銀行信任度的調查數據[1]; 蓋洛普關於美國對銀行信心的民意調查[2]。

- 關於集體主義與東亞金融行為中信任度的研究[3][4]。

- 美國司法部關於銀行對抵押貸款證券不實陳述的調查結果(高盛和解案)[5][6]。

- 世界經濟論壇關於財富管理中利益衝突以及只收費顧問模式益處的報告[7][8][18][9]。

- 高盛資產管理關於美國獨立RIA顧問崛起的洞察[10]。

- 台灣金融產業報告:銀行在基金分銷中的主導地位[13],金管會2008年後對結構型產品的監管措施[14],以及台灣不當銷售案例的分析[15][16]。

📲加入我們的專屬頻道,即可獲取我們的跨資產趨勢指標矩陣,以及專家嚴選的投資內容。

如果您覺得這份研究有價值:

👍為這篇文章按讚。

➡️分享給其他關注美股和台股市場的投資者。

本電子報僅供參考,不構成任何證券或資產類別的投資建議或買賣推薦。文中所表達的觀點為作者截至發布日期的觀點,如有變動,恕不另行通知。所呈現的資訊乃基於從相信可靠的來源所獲取的數據,但其準確性、完整性和及時性不作保證。過往表現並非未來結果的指標。投資涉及風險,包括可能損失本金。讀者在做出任何投資決策前,應諮詢其財務顧問。作者及相關實體可能持有本文所討論的資產或資產類別的部位。

Trust in Big Banks: Taiwan’s Confidence vs. U.S. Skepticism

Cultural Differences in Trusting Financial Institutions

By Joe 盧, CFA | 2025-11-01

Executive Summary

- Most Taiwanese tend to trust big banks because cultural norms and strong regulation foster confidence in established institutions.

- In contrast, most Americans are skeptical of large banks, particularly after 2008, when conflicts of interest and the mis-selling of toxic mortgage securities laid bare incentive misalignment.

- The backlash drove most Americans toward independent, fiduciary, fee-based RIAs that emphasize transparency and client alignment.

- Taiwan’s banks dominate fund distribution and retail investment management. The FSC has strict rules and required disclosures, but past cases show that conflicts can still arise.

- The takeaway for retail investors in Taiwan is “trust but verify”: confirm the fiduciary duty and compensation of your advisor, avoid overly complicated products, seek second opinions, and stay actively involved in financial decisions.

One of the striking differences I notice when I talk to the average Taiwanese investor is the amount of trust they have in their financial institutions. In Taiwan, major banks and big-name financial brands enjoy a strong reputation and public confidence. Many Taiwanese investors instinctively trust big banks as safe stewards of their money and advice. This contrasts starkly with the U.S., where public trust in big banks plummeted after the 2008 financial crisis and remains relatively low. For example, a World Economic Forum survey in 2015 ranked the United States just 49th (and the UK 89th) in citizens’ confidence in their banking system – a reflection of how Americans lost trust in banks after 2008[1]. In fact, by late 2008 only about 20% of Americans had high confidence in U.S. banks[2], a drastic drop from prior decades.

% of Public That Trust Banks Over Time (U.S. vs. Taiwan)

Culturally, Americans often cheer the “little guy” and harbor skepticism toward large institutions, especially if they suspect those institutions might put profits over people. In Taiwan, by contrast, societal norms tend to respect authority and established institutions. Cultural factors like collectivism and higher power distance may encourage greater trust in well-known banks. Research on East Asian financial behavior finds that “trust” is a key factor for consumers and is significantly influenced by collectivist culture[3]. In a study of banks selling insurance in Taiwan and South Korea, consumers’ willingness to buy financial products from their bank was driven by perceived value, image, satisfaction and trust – and notably, the high collectivist cultural context boosted trust and satisfaction in those banking relationships[3][4].

In short, Taiwanese investors often give the benefit of the doubt to big financial brands, assuming they will act properly. This faith in established banks is reinforced by Taiwan’s stable banking environment; local banks are closely regulated and generally did not experience failures on the scale seen in the West. Many Taiwanese therefore see big banks as safe, reputable and held to high standards, deserving of their confidence.

However, cultural trust can be a double-edged sword. Blindly deferring to large institutions may leave investors less inclined to question advice or notice conflicts of interest. In the U.S., painful experiences have taught investors to be more wary. Americans vividly remember that Wall Street giants did not always justify the trust placed in them – a lesson that Taiwanese investors would do well to examine objectively.

The 2008 Crisis: Conflicts of Interest Erode U.S. Trust

The 2008 subprime mortgage crisis was a watershed moment that shattered public trust in big banks in America. Major banks and investment houses were found to have engaged in self-dealing and conflicts of interest that harmed their clients. A glaring example was how some banks packaged and sold mortgage-backed securities and related products to investors – including their own wealth management clients – despite knowing those loans were of poor quality. In a U.S. Justice Department settlement, Goldman Sachs admitted to misleading investors about the toxic mortgages backing securities it sold in the mid-2000s[5]. Federal investigators noted the “pervasiveness of the banking industry’s fraudulent practices in selling” these products[6]. In essence, several big banks were underwriting risky mortgage bonds and simultaneously marketing them as safe investments to trusting customers. When those securities collapsed in value, it not only inflicted huge losses but also destroyed public confidence in the integrity of banks’ advice. As one report summarized, banks in the U.S. squandered trust by assuring clients that flawed mortgage bonds were sound – all while the banks profited from the sales[5][6].

The subprime fiasco made Americans acutely aware of how the interests of large banks can diverge from the interests of individual investors. U.S. investors learned that a “financial advisor” at a big bank or brokerage was little more than a sales representative in a nice suit – often paid on commission to push the bank’s own products or meet quotas. This conflict of interest is inherent in many traditional wealth management models. As the World Economic Forum notes, “Commission-based incentives for selling financial products create conflicts of interest that work against investors.”[7] Advisors employed by banks may be tempted to recommend products that maximize their fees or their employer’s profits, rather than truly suitable choices for the client. One common practice is “double-dipping,” where a firm’s in-house advisers sell the firm’s proprietary funds or structured products; unsurprisingly, this setup poses an “inherent conflict of interest,” since the bank earns more if it can steer clients into its own high-margin products[8]. In the years leading up to 2008, such conflicts were rampant – and many U.S. clients paid the price.

RIA Growth vs. Bank Wirehouse Share (2008–2025)

The backlash from these revelations has profoundly altered the U.S. wealth management landscape. Investors began seeking out independent advisers and alternative approaches not tied to the big Wall Street firms. A great example is the rise of independent Registered Investment Advisors (RIAs) and fee-only financial planners. Unlike traditional brokers at banks, RIAs in the U.S. operate as fiduciaries, legally obliged to put clients’ interests first. This model, often charging clients flat or asset-based fees instead of commissions, appealed to Americans burnt by conflicted advice from large U.S. banks. In fact, the RIA channel has seen explosive growth. By 2023, independent RIAs had doubled their assets under management to nearly $20 trillion, becoming the fastest-growing segment of U.S. wealth management[9]. Investors are prioritizing “fee transparency and fiduciary advice” and rewarding advisors who align with their interests[10]. In short, America’s trust in “the big guys” was badly damaged in 2008, and many investors responded by giving newcomers and independent advisors a chance to earn their trust instead. The cultural ethos of healthy skepticism—“trust, but verify”—is now ingrained in how many Americans choose financial advisers.

U.S. Financial Advisor Model Comparison

Taiwan’s Trust in Big Banks – High Standards, but Beware Conflicts

In Taiwan, the environment is quite different. Local banks did not produce a home-grown financial crisis in 2008, and they generally maintain a solid track record. Taiwan’s regulatory authorities enforce rigorous oversight on banks, and the overall financial system has remained stable and resilient[11][12]. This strong oversight no doubt contributes to the public’s comfort in dealing with major banks. Wealth management in Taiwan is largely dominated by big banks – a telling indicator of trust. Over 80% of mutual fund investments in Taiwan are sold through banks’ distribution channels, far outpacing any independent financial advisors or brokers[13]. For many Taiwanese investors, their first (and often only) stop for investment products or advice is their bank. It’s common to rely on a bank’s relationship manager or financial consultant for guidance on everything from insurance to mutual funds. The assumption is that a large, well-known bank will offer sound advice and safeguard one’s interests.

Taiwan Post-2008 FSC Regulation Checklist

This trusting relationship, combined with strict regulation, has so far prevented major scandals on the scale of Wall Street’s meltdown. Taiwan’s Financial Supervisory Commission (FSC) holds banks to a “higher standard” in many respects. Notably, after 2008 the FSC introduced new consumer protection rules for wealth management. For instance, the Regulations Governing Offshore Structured Products were enacted to curb mis-selling of complex products. Banks in Taiwan must now provide full risk disclosure in Mandarin Chinese, explicitly inform investors whether a product is principal-guaranteed, and even read the risk disclosure documents out loud to the client while recording the conversation[14]. These measures underscore that regulators understand the potential for abuse and have moved to fortify trust by increasing transparency and accountability. In essence, the banks are well-policed: any private wealth advisor or trust manager in a bank is expected to follow stringent protocols, which helps maintain the public’s faith that “this large bank is doing right by me.”

However, high standards don’t mean zero conflicts of interest. Even in Taiwan’s more conservative banking culture, the fundamental incentive problems can still lurk beneath the surface. Before the post-2008 reforms, Taiwanese banks freely sold a wide array of offshore structured notes and derivatives to retail clients without much oversight, often via trust accounts[15]. Many regular investors bought complex products (such as credit-linked notes or structured notes) from their banks’ wealth managers, not fully understanding the risks. When the global crisis hit, those products tanked in value, leading to significant losses and disputes. In fact, over 300 lawsuits were filed by Taiwanese investors between 2000 and 2013 over alleged mis-selling of structured notes[16]. This wave of legal action suggests that even in Taiwan, some bank advisors had been salespeople pushing products that customers didn’t understand or truly need. The fallout prompted regulators to tighten rules, as noted above, but it serves as a cautionary tale: the conflicts of interest did exist – they were just less visible until stress revealed them. Additionally, a private banking officer in a major Taiwanese bank is still typically a salaried employee with sales targets, often receiving bonuses or commissions for distributing the bank’s approved financial products. There is an inherent pressure to move product and meet sales goals, which can bias the advice you receive. The advisor may not be outright fraudulent, but they may leverage the bank’s prestigious brand to earn your trust – and then subtly steer you toward investments the bank wants to sell, and away from your best interests. Psychological influence can be strong when an advisor positions themselves as the expert backed by a big-name institution.

In short, Taiwanese banks enjoy a reservoir of goodwill and trust, and generally they operate ethically within the law. Yet investors should remember that banks are also businesses. A large bank’s priority is to its shareholders and its bottom line, which can at times conflict with a client’s best interest. Conflicted advice – such as being sold a high-fee fund when a cheaper index fund would do, or being urged to trade frequently – can happen if an investor never questions their bank’s recommendations. The lesson from both American and some local experiences is that healthy skepticism and due diligence are necessary, even when dealing with a reputable bank. Trust, but verify.

Recommendations for Taiwanese Investors

Maintaining a formal, analytical approach to your finances means balancing trust with caution. Here are some recommendations to consider:

- Verify Qualifications and Fiduciary Duty: Ensure your financial advisor is well qualified (look for certifications or licenses) and ask whether they have a fiduciary responsibility to you. In the U.S., RIAs must by law put client interests first; in Taiwan, ask if the advisor is independent or tied to sales quotas. Working with a truly qualified professional means someone who prioritizes your goals over pushing products.

- Understand How Your Advisor Gets Paid: Always clarify the incentive structure. If you deal with a bank wealth manager, are they earning commissions or bonuses for selling certain funds or insurance? Commission-based models inherently create conflicts – as one global analysis put it, they “incentivize distributors to sell products that benefit them financially” rather than the investor[17]. Whenever possible, consider advisers who use a fee-only model (you pay a transparent fee for advice). Such fee-based advisors are only paid by you, not by product providers, which encourages them to truly act in your best interest[18].

- Be Wary of “Too Good to Be True” Products: If a bank advisor recommends a complex product (e.g. a structured note, exotic derivative, or any investment you struggle to understand) promising high returns, pause and scrutinize it. High returns with low risk do not exist; there’s always a catch. Ask for all fees and risks in writing. Remember that before 2008, many investors (including in Taiwan) were sold ostensibly “safe” high-yield products that later collapsed. Don’t hesitate to ask tough questions – if the explanation is full of jargon or the advisor brushes off risks, that’s a red flag.

- Diversify Your Advice: Just as you diversify investments, consider diversifying where you get advice. You need not abandon your bank – but it can be wise to seek a second opinion from an independent financial planner or do your own research. An external advisor might offer a different perspective, and a bit of comparison can reveal if your bank’s recommendations are truly competitive. In the U.S., independent advisors have grown because they often provide more customized, client-centric advice[10][9]. In Taiwan, independent advisory services are still emerging, but you can still consult licensed financial consultants who aren’t tied to selling one bank’s products. Even reading up on neutral research (from reputable financial publications or investor education materials) can empower you to make more informed decisions rather than relying solely on a bank’s word.

- Stay Informed and Involved: Ultimately, it’s your money. Cultivate a basic understanding of your investment plan and portfolio. Don’t outsource all thinking to the adviser. Monitor your accounts and performance, and if something seems off (e.g. frequent trading, or products you don’t recall agreeing to), speak up immediately. A trustworthy advisor will welcome your involvement and questions. As the saying goes, “trust is earned daily.” Make your advisor earn that trust by being transparent and responsive. If you ever feel they are evading questions or prioritizing the bank’s interest over yours, be ready to walk away or escalate the concern.

By following these steps, Taiwanese investors can enjoy the best of both worlds – leveraging the strong financial infrastructure and expertise of major banks, while also protecting themselves from potential conflicts of interest. Healthy trust in institutions is valuable, but it should never be blind. The U.S. experience shows how costly blind trust can be, whereas a balanced approach – trusting and verifying – leads to better outcomes.

In summary, remain formal and analytical in managing your wealth: respect the advice of professionals, but always make sure that advice truly aligns with your own goals. With prudent skepticism and knowledge, you can continue to benefit from Taiwan’s reputable banks without falling victim to the pitfalls that come when salesmanship trumped stewardship in other markets. Always make sure you’re working with a qualified professional who puts you first, and you will be well-positioned to succeed financially in the long run.

Sources:

- World Economic Forum & Baker Tilly survey data on trust in banks[1]; Gallup polling on U.S. confidence in banks[2].

- Research on collectivism and trust in East Asian financial behavior[3][4].

- U.S. Department of Justice findings on bank misrepresentation of mortgage securities (Goldman Sachs settlement)[5][6].

- World Economic Forum report on conflicts of interest in wealth management and the benefits of fee-only advisory models[7][8][18][9].

- Goldman Sachs Asset Management insights on the rise of independent RIA advisers in the U.S.[10].

- Taiwan financial industry reports: dominance of banks in fund distribution[13], FSC regulatory measures on structured products after 2008[14], and analysis of mis-selling cases in Taiwan[15][16].

📲Join our private channels to gain access to our cross-asset Trend Conviction Matrix and expert-curated investment content.

💬Connect with us on LINE to join the group.

if you found this research valuable:

👍'Like' this post.

📰Follow this blog for new market updates.

➡️Share it with others who track U.S. and Taiwan markets.

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any security or asset class. The views expressed are those of the author as of the date of publication and are subject to change without notice. Information presented is based on data obtained from sources believed to be reliable, but its accuracy, completeness, and timeliness are not guaranteed. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. Readers should consult with their own financial advisors before making any investment decisions. The author and associated entities may hold positions in the assets or asset classes discussed herein.

立即加入《Joe’s 華爾街脈動》LINE@官方帳號,獲得最新專欄資訊(點此加入)

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。