投資者密切關注關稅情勢變化,美國市場表現不一

Joe Lu, CFA 2025年4月15日 美東時間

市場概況

投資者面對著不斷變動的關稅政策發展,同時消化第一季度財報,周二美國市場表現不一。相對平靜的股市表現與上周極端波動狀況形成鮮明對比,顯示在關稅宣布的初始衝擊後逐漸站穩腳步,但對經濟狀況的潛在擔憂仍持續影響著市場情緒。

道瓊斯工業平均指數下跌-0.42%,收盤接近40,369點,標普500指數下跌-0.28%至5,397點。那斯達克綜合指數展現韌性,小幅上漲+0.11%,而羅素2000小型股指數上升+0.12%。這一表現代表市場波動性較近期顯著降低,芝加哥期權交易所波動率指數從上周的高位回至約30。

今日交易焦點集中在金融類股財報,尤其美國銀行獲利成長10%,帶動該類股上揚。然而,美國銀行執行長Brian Moynihan對「經濟環境正在改變」的謹慎言論抑制了市場的熱情。市場好壞參半的表現反映了對關稅情勢最終如何發展的不確定性,投資者尤其關注對科技供應鏈潛在的影響。儘管美國海關與邊境保護局 (CBP) 公告豁免了智慧型手機和半導體等電子科技產品的「互惠」關稅,川普總統和商務部長Howard Lutnick周末的評論暗示這些豁免可能僅是暫時性的,留下了市場再度波動的可能性。

重點摘要

- 市場表現不一,道瓊斯指數下跌0.42%,標普500指數下跌0.28%,那斯達克指數上漲0.11%,羅素2000指數上漲0.12%

- 美國國債價格上漲,10年期美債殖利率下降

- 銀行業獲利提供亮點,金融類股上漲0.25%

- 儘管市場趨於穩定,但基本經濟指標持續顯示疲弱

- 國際市場表現分歧,歐洲上漲1.00%,中國下跌0.77%

經濟指標

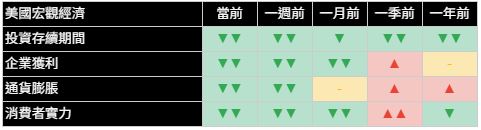

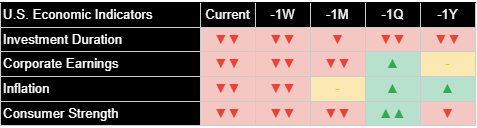

多項經濟指標持續顯示令人擔憂的惡化趨勢,所有主要專有經濟指標都呈現負面讀數。這種持續疲弱與今日市場相對穩定形成鮮明對比,暗示投資者可能低估了近期貿易緊張局勢的潛在經濟影響。

投資存續期間指標顯示嚴重負面趨勢,表明市場轉向短期決策和規避風險。這反映了對長期經濟前景的高度不確定性。

消費者實力尤為令人擔憂,呈現強烈負面讀數。這表明美國消費者正在迅速減少支出,可能是對持續通膨壓力和貿易政策不確定性的反應。雖然通膨指標呈現部分改善,但顯著的價格壓力繼續影響消費者行為和企業投資決策。這些綜合經濟指標顯示,儘管市場近期趨於穩定,經濟萎縮風險正在上升,這引發疑問:今日相對溫和的市場變動是否充分反映了惡化中的經濟基本面。

美國十大公司

周二美國十大公司表現多元,五家上漲,五家下跌。這種表現分化突顯了即使是市場領導者也面臨著不確定的環境。

輝達(NVIDIA)領漲,上漲+1.35%,即使在普遍的市場擔憂下仍表現相對強勢。特斯拉(Tesla)以+0.70%的漲幅緊隨其後,延續其近期動能。博通(Broadcom)上漲+0.33%和蘋果(Apple)小幅上漲+0.19%。波克夏海瑟威(Berkshire Hathaway)以+0.25%的微幅上漲收盤。

跌幅方面,Meta Platforms領跌,顯著下滑-1.87%,其次是Alphabet下跌-1.74%。亞馬遜(Amazon)下跌-1.39%,摩根大通(JPMorgan Chase)下跌-0.68%,微軟(Microsoft)下滑-0.54%。這些市場領導者好壞參半的表現反映了市場環境的不確定性,投資者似乎正在重新評估,在關稅擔憂和經濟指標放緩背景下的成長前景。這種分化突顯了市場參與者正努力確定在科技和金融服務領域中最穩固成熟的商業模式經營下,關稅政策將造成的影響。

廣泛市場指數

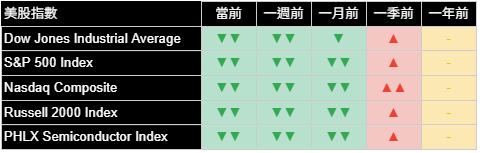

周二主要美國指數表現不一,那斯達克綜合指數和羅素2000小幅上漲,而道瓊斯和標普500指數下跌。這一表現顯示,儘管市場普遍存在擔憂,成長型和小型股類股仍展現出一定韌性。

標普500指數下跌-0.28%,道瓊斯工業平均指數下跌-0.42%。那斯達克綜合指數呈現韌性,小幅上漲+0.11%,羅素2000小型股指數上漲+0.12%。費城半導體指數表現強勁,上漲+0.48%,顯示近期關於科技產品豁免關稅的初步公告後,為這一關鍵類股提供了一些緩解。

小型股的表現雖然溫和,但與大型股指數疲弱相比,仍存在顯著差異。然而,那斯達克和羅素2000的漲幅均微乎其微,表明雖然投資者可能在科技和小型公司中尋找選擇性機會,但仍然謹慎。儘管供應鏈中斷的潛在擔憂仍然存在,費城半導體指數強勁的表現顯示,最近關稅豁免科技產品的公告為這一關鍵類股提供了部分緩解。

類股概況

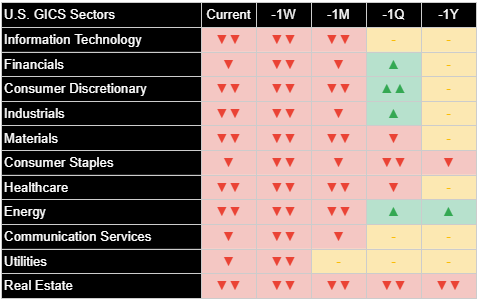

周二市場類股表現分歧,五個類股上漲,六個類股下跌。儘管金融和科技類股呈現一些亮點,但整體類股模式顯示出在持續經濟擔憂下的防禦性定位。

資訊科技類股領漲,上升+0.38%,其次是通訊服務和金融類股,均上漲+0.25%。房地產上漲+0.27%,而非必需消費品顯示疲弱,下跌-0.72%。表現最差的類股包括必需消費品下跌-0.84%,原材料下跌-0.79%,醫療保健下跌-0.61%,工業下跌-0.50%,能源下滑-0.15%。公用事業基本持平,為-0.01%。

國際市場

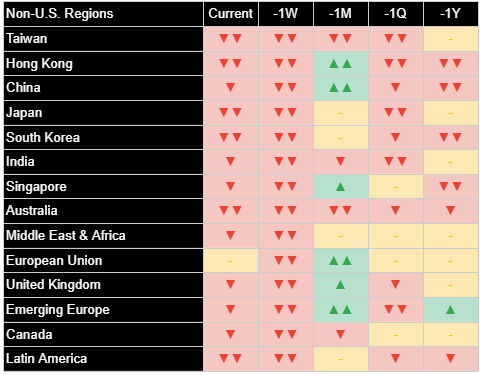

周二全球市場表現顯著分化,歐洲市場走強,而亞洲市場普遍下跌。這一模式顯示各地區對近期貿易發展及其潛在經濟影響的解讀不同。

歐洲市場表現相對強勁,歐洲指數上漲+1.00%。這一積極走勢似乎反映了對美國與歐洲之間可能避免一些極端關稅情境的緩解,這可能歸功於近期的外交接觸。日本也顯示強勢,上漲+0.81%。

亞洲市場呈現更為多元的局面,中國下跌-0.77%,反映了對美貿易關係的嚴重擔憂。印度小幅上漲+0.20%,而新興亞洲下跌-0.27%。拉丁美洲小幅上漲+0.04%。

其他資產

周二跨資產表現反映了溫和的避險情緒,美國國債價格上漲,美元兌大多數主要貨幣走強。這一模式表明,儘管市場波動性近期有所緩和,仍須保持謹慎。

美國國債價格全線上漲,20年期國債上漲+0.35%,7-10年期國債上漲+0.30%,1-3年期國債持平為0.00%。殖利率曲線平坦化顯示,儘管短期市場趨於穩定,投資者仍對長期經濟前景感到擔憂。

商品方面,黃金表現突出,上漲+0.52%。農產品下跌-0.53%,工業金屬下跌-0.78%,原油下滑-0.27%。美元指數上漲+0.55%,儘管美國國內政策不確定性,仍反映其作為相對避險資產的地位。加密貨幣市場表現疲弱,比特幣下跌-1.12%。

這種多元的跨資產表現表明,儘管劇烈的市場恐慌已經緩解,投資者繼續在多項資產類別中採取防禦性定位。黃金的強勁表現表明對傳統避險資產的持續需求,暗示在股市表面平靜之下,對經濟前景和政策不確定性的重大擔憂仍然存在。

關於《Joe’s 華爾街脈動》

鉅亨網特別邀請到擁有逾 22 年美國投資圈資歷、CFA 認證的機構操盤人 Joseph Lu 擔任專欄主筆。

Joe 為台裔美國人,曾管理超過百億美元規模的基金資產,並為總資產高達數千億美元的多家頂級金融機構提供資產配置優化建議。

Joe 目前帶領著由美國頂尖大學教授與博士組成的精英團隊,透過獨家開發的 "趨勢脈動 TrendFolios® 指標",為台灣投資人深度解析全球市場脈動,提供美股市場第一手專業觀點,協助投資人掌握先機。

Market Stability Returns as Tariff Concerns Ease, But Underlying Economic Weakness Persists

U.S. markets show mixed performance as investors monitor evolving tariff situation

Joe Lu, CFA April 15, 2025

MARKET OVERVIEW

U.S. markets showed mixed performance on Tuesday as investors processed the evolving tariff landscape and digested first-quarter earnings reports. The relative calm contrasted sharply with last week's extreme volatility, suggesting a market finding its footing after the initial shock of tariff announcements, though underlying concerns about economic conditions continue to weigh on sentiment.

The Dow Jones Industrial Average fell -0.42%, closing near 40,369, while the S&P 500 declined -0.28% to 5,397. The Nasdaq Composite showed resilience with a modest gain of +0.11%, while the Russell 2000 small-cap index advanced +0.12%. This performance represents a significant reduction in volatility compared to recent sessions, with the CBOE Volatility Index retreating to around 30 from much higher levels last week.

The day's trading was anchored by financial sector earnings, with Bank of America reporting a 10% profit jump that helped lift the sector. However, cautionary comments from CEO Brian Moynihan about "a changing economy" kept enthusiasm in check. The market's mixed performance reflects lingering uncertainty about how the tariff situation will ultimately unfold, with investors particularly focused on potential impacts to technology supply chains. Despite recent guidance from U.S. Customs and Border Protection that exempted electronics like smartphones and semiconductors from "reciprocal" tariffs, weekend comments from President Trump and Commerce Secretary Howard Lutnick suggested these exemptions might be temporary, leaving the door open for renewed volatility.

Executive Summary

- Markets showed mixed performance with the Dow falling 0.42%, S&P 500 down 0.28%, Nasdaq gaining 0.11%, and Russell 2000 up 0.12%

- Treasury prices rose across the curve with the 10-year yield dropping

- Bank earnings provided a bright spot with financial stocks gaining 0.25%

- Underlying economic indicators show persistent weakness despite market stabilization

- International markets displayed divergent performance with Europe rising 1.00% while China fell 0.77%

ECONOMIC INDICATORS

Economic measures continue to show concerning deterioration across multiple fronts, with negative readings in all major proprietary economic measures. This persistent weakness stands in contrast to the relative market stability seen today, suggesting investors may be underestimating the potential economic impact of recent trade tensions.

Investment duration shows severe negative trends, indicating a significant shift toward short-term decision making and risk aversion. This reflects heightened uncertainty about long-term economic prospects.

Consumer strength is particularly concerning, with strong negative readings. This suggests American consumers are rapidly pulling back on spending, likely in response to persistent inflation concerns and uncertainty about trade policy. While inflation measures show some improvement, significant price pressures continue to impact consumer behavior and business investment decisions. These combined economic readings point to increasing risks of economic contraction despite the market's recent stability, raising questions about whether today's relatively modest market moves adequately reflect the deteriorating economic fundamentals.

TOP 10 U.S. COMPANIES

The ten largest U.S. companies showed mixed performance on Tuesday, with five posting gains and five declining. The performance split highlights the uncertain environment for even the market's leaders.

NVIDIA led the gainers with an increase of +1.35%, continuing to demonstrate relative strength even amid broader market concerns. Tesla followed with a gain of +0.70%, building on its recent momentum. Broadcom added +0.33% and Apple gained a modest +0.19%. Berkshire Hathaway rounded out the gainers with a slight increase of +0.25%.

On the negative side, Meta Platforms led decliners with a significant drop of -1.87%, followed by Alphabet falling -1.74%. Amazon lost -1.39%, JPMorgan Chase declined -0.68%, and Microsoft slipped -0.54%. These mixed results among market leaders reflect the uncertain environment, with investors seemingly reassessing growth prospects amid tariff concerns and slowing economic indicators. This divergence highlights how market participants are struggling to determine how tariff policies will impact even the most established business models in technology and financial services.

BROAD MARKET INDICES

Major U.S. indices displayed mixed performance Tuesday, with the Nasdaq Composite and Russell 2000 posting slight gains while the Dow and S&P 500 declined. This performance suggests some resilience in growth and small-cap segments despite broader market concerns.

The S&P 500 declined -0.28%, with the Dow Jones Industrial Average falling -0.42%. The Nasdaq Composite showed resilience with a modest gain of +0.11%, while the Russell 2000 small-cap index advanced +0.12%. The Philadelphia Semiconductor Index showed strength with a gain of +0.48%, suggesting relief following recent clarification about technology product exemptions from initial tariff announcements.

The small-cap outperformance, though modest, represents a notable divergence from the weakness in large-cap indices. However, both the Nasdaq and Russell 2000 gains were minimal, indicating that while investors may be finding selective opportunities in technology and smaller companies, confidence remains tentative. The Philadelphia Semiconductor Index's stronger performance suggests that recent clarifications regarding technology exemptions from tariffs have provided some relief to this critical sector, though underlying concerns about supply chain disruptions persist.

SECTOR OVERVIEW

Market sectors displayed divergent performance Tuesday, with five sectors advancing and six declining. The overall sector pattern reveals defensive positioning amid ongoing economic concerns, though with some bright spots in financial and technology segments.

Information Technology led advancers with a gain of +0.38%, followed by Communication Services and Financials, both adding +0.25%. Real Estate advanced +0.27%, while Consumer Discretionary showed weakness with a decline of -0.72%. The worst performing sectors were Consumer Staples falling -0.84%, Materials dropping -0.79%, Healthcare declining -0.61%, Industrials losing -0.50%, and Energy slipping -0.15%. Utilities ended essentially flat at -0.01%.

INTERNATIONAL MARKETS

Global markets displayed significant divergence on Tuesday, with European markets strengthening while Asian markets broadly declined. This pattern suggests differing regional interpretations of recent trade developments and their potential economic impacts.

European markets showed relative strength, with the Europe Index rising +1.00%. This positive momentum appears to reflect relief that some of the most extreme tariff scenarios between the U.S. and Europe may be avoided following recent diplomatic engagements. Japan also showed strength with a gain of +0.81%.

Asian markets presented a more mixed picture, with China falling -0.77%, reflecting acute concerns about the trade relationship with the United States. India managed a modest gain of +0.20%, while Emerging Asia declined -0.27%. Latin America edged up slightly by +0.04%.

OTHER ASSETS

Cross-asset performance on Tuesday reflected a modest risk-off sentiment, with Treasury prices rising and the U.S. dollar strengthening against most major currencies. This pattern suggests continued caution despite the recent easing in market volatility.

Treasury prices rose across the curve, with the 20-Year Treasury gaining +0.35%, the 7-10 Year Treasury increasing +0.30%, and the 1-3 Year Treasury flat at 0.00%. This flattening yield curve indicates investors remain concerned about longer-term economic prospects despite the short-term market stabilization.

In commodities, Gold was a standout performer with a gain of +0.52%. Agricultural Commodities fell -0.53%, Industrial Metals declined -0.78%, and Crude Oil slipped -0.27%. The U.S. Dollar Index strengthened +0.55%, reflecting its status as a relative safe haven despite domestic policy uncertainty. Cryptocurrency markets showed weakness, with Bitcoin falling -1.12%.

This mixed cross-asset performance suggests that while acute market panic has subsided, investors continue to position defensively across multiple asset classes. The strong performance in gold indicates ongoing demand for traditional safe havens, suggesting that beneath the surface calm in equity markets, significant concerns about economic prospects and policy uncertainty persist.